January 01, 2024

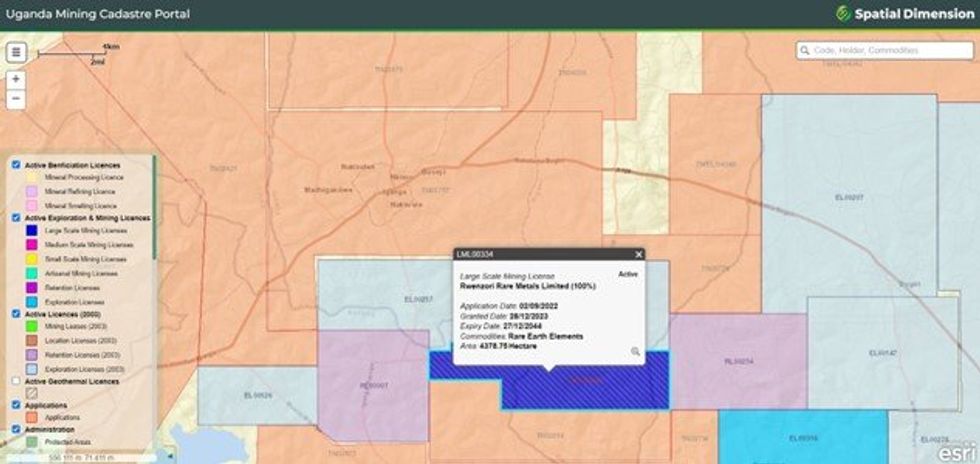

The Board of Ionic Rare Earths Limited (“IonicRE” or “the Company”) (ASX: IXR) is pleased to announce that on the 28th of December 2023, the Ugandan Directorate of Geological Survey and Mines (DGSM), have provisionally granted the Stage 1 Large scale Mining Licence (LML00334) over Retention Licence (RL) 1693 for the Makuutu Heavy Rare Earths Project.

- Makuutu Central Zone Large Scale Mining Licence (LML) 00334, has been provisionally granted over Retention Licence (RL) 1693, pending receipt of formally signed documents and gazetting in Uganda;

- Mining Licence approval will be the first large scale mining licence awarded in Uganda;

- Grant of the Mining Licence paves way for further supply chain engagement to support sustainable, secure, and traceable magnet and heavy rare earth supply to the new economy;

- Makuutu Demonstration Plant continues to advance, with first Mixed Rare Earth Carbonate (MREC) on track for Q1 2024;

- IonicRE has reached agreement with its partners in Rwenzori Rare Metals Ltd to move up to a 94 percent interest in Makuutu; and

- Makuutu remains the most advanced Ionic adsorption clay project in development today with product not committed to China, and available to supply new supply chains looking to decouple sourcing from existing sources.

This represents the first large scale mining licence to be awarded in Uganda under the Mining Act 2022, which was announced on the Ugandan Mining Cadastre portal (see Figure 1). The Ugandan Minister of Energy and Mineral Development (MEMD), the Honourable Dr Ruth Nankabirwa Ssentamu, is expected to sign the documents this week prior to gazetting.

Ionic Rare Earths Managing Director, Mr Tim Harrison, said the provisional award is part of the official commitment from the Government of the Republic of Uganda and clears the path for the Makuutu Project and the ongoing development of Uganda’s mining industry.

“This is an important step forward for Ionic Rare Earths in mining, refining, and recycling the heavy rare earths critical for the energy transition, advanced manufacturing, and defence,” Harrison said.

“This reinforces the Makuutu Heavy Rare Earth Project as one of the world’s largest and most advanced development-ready heavy rare earth element assets, and we look forward to progressing the next steps and commissioning our Demonstration Plant at Makuutu.”

The Stage 1 Mining Licence LML00334 covers the area set out in IonicRE’s mining licence application TN03834 as shown in Figure 2, which covers approximately 44 square kilometres of the Project’s near 300 square kilometres of tenements at Makuutu. Currently, the Company’s greater Makuutu Mineral Resource Estimate (MRE) (refer to Table 3 and Table 4 and ASX: 3 May 2022) is estimated at 532 million tonnes at 640 ppm Total Rare Earth Oxide (TREO) with a cut-off grade of 200 parts per million (ppm) TREO minus Cerium Oxide (CeO2).

The provisional granting of the mining licence follows the gazetting of updated Mining and Minerals (Licencing) Regulations 2023 to provide a clear framework for mineral development in Uganda, and the submission of documentation which has been reviewed and approved by Ugandan DGSM. As part of the process, the Company secured land access agreements over 95% of the LML00334 area (ASX: 29 November 2023) and completed a verification process on site led by the DGSM with strong support demonstrated from local project stakeholders and landowners.

The Company has also applied for the renewal of Exploration Licences 00147 and 00148 and expects this to be completed shortly. EL00147 has a significant Exploration Target (ASX: 01 June 2022), providing further positive reconnaissance drilling results (ASX: 4 September 2023) confirming clay- hosted rare earth element (REE) in 66 of 70 RAB holes drilled across programs in 2021 and 2023, on a broad 500 metre spacing.

The Mineral Resource Estimate and Exploration Targets are expected to be updated in Q1 2024 to incorporate results from the Phase 5 drill program completed in Q4 2023.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00