Meridian Mining UK S (TSX: MNO,OTC:MRRDF) (OTCQX: MRRDF) (FSE: N2E) ("Meridian" or the "Company") announces the appointment of Mr. David Halkyard as Interim Chief Financial Officer ("CFO"), following the resignation of Ms. Soraia Morais as CFO. The Company is also pleased to announce the transition of Mr. Vitor Hugo de Sousa Belo to the position of Chief Development Officer ("CDO") of the Company to oversee the development and construction of the Cabaçal project.

As part of the progression of the Cabaçal project to decision to mine in 2027, the Company also announces the completion of the Definitive Feasibility Study ("DFS") drill program, and the completion of the title transfer by the Agência Nacional de Mineração ("ANM") for the Cabaçal and Santa Helena projects to Rio Cabaçal Mineração Ltda ("RCM"), the Company's Brazilian subsidiary managing the programs.

Highlights of the news release:

Mr. David Halkyard appointed as Interim Chief Financial Officer;

Mr. Vitor Hugo de Sousa Belo as Chief Development Officer;

Cabaçal DFS drill program completed;

591 holes completed for 66,487m of diamond drilling; and

Cabaçal Purchase Agreement advanced with Cabaçal and Santa Helena titles transferred.

Mr. Gilbert Clark, CEO, commented: "I have been working closely with David since he joined the Company, and his contribution has been exceptional, and I am very confident he will grow quickly into the CFO role. David has been working with Soraia to ensure a smooth CFO transition, as we continue to execute on our growth strategy. On behalf of the Board and management of the Company, I would like to thank Soraia for her dedication and many contributions to the Company. We wish Soraia all the best in her future endeavors.

"I am also very pleased to announce Vitor's increased role as the Company's Chief Development Officer. Vitor has been with the Company since 2019 and has led the Brazilian engineering team's successful completion of Cabaçal's PEA and PFS. Having him now joining Meridian's Executive team is a tremendous boost for the Cabaçal DFS1 roll out and beyond.

"The completion of the Cabaçal DFS drill program and the title transfer of the Cabaçal and Santa Helena projects, are key milestones and de-risking events for Meridian as we progress to a decision to mine in 2027."

Appointment of Chief Financial Officer

The appointment of Mr. David Halkyard as Interim Chief Financial Officer ("CFO"), following the resignation of Ms. Soraia Morais as CFO. Mr Halkyard brings over 20 years' experience in mining-focussed banking and investment management, including senior roles at Resource Capital Funds, Bank of Montreal and Société Générale. David has served as the Company's Senior Vice President – Finance2. Both changes are effective September 1, 2025. Ms. Morais served as the Company's CFO since the reorganization of the Company in 2020 and resigned from her position with the Company to pursue other business opportunities.

Appointment of Chief Development Officer

In his role as CDO, Mr. Belo will be responsible for leading the Company's Cabaçal Mine development strategy, including overseeing the completion of the definitive feasibility study of the Cabaçal VMS gold-copper project and being the principal liaison with the respective Brazilian mining and environmental authorities.

Mr. Belo, who has served as the Company's Principal Mining Consultant in Brazil since 2019, brings over 30 years' experience in the Brazilian mining industry, managing extensive mining operations and leading the engineering and construction of multiple beneficiation plants. Mr. Belo has worked for companies such as Rio Tinto, Kinross and Yamana, Rio Novo, Carpathian Gold and Brio Gold and holds a Bachelor of Mechanical Engineering from the Universidade Católica de Minas Gerais, a postgraduate degree in business management from Fundação Dom Cabral, and project management courses from Ibmec.

Cabaçal Definitive Feasibility Drill Program

The Company reports that it has concluded the DFS drilling at Cabaçal. In Cabaçal and near mine areas, the Company has drilled 591 holes (66,487m), supplementing an already large database from the prior work of BP Minerals / RTZ. Various samples have been sent to SGS Lakefield in Canada for the final phase of metallurgical testwork which includes variability testwork from the initial phase of planned production, with floatation tests having commenced, and a mini pilot plant test being scheduled. The Company is liaising with its resource and mining consultancy, GE21, in preparation for DFS modelling and mine planning. With the Cabaçal drilling campaign now finished, the rigs that had been allocated to the program will shift their focus to evaluation of regional targets in the extension of the belt to the northwest and southeast. Company staff are also active in expanding access agreements to the newly granted exploration licences where past reconnaissance work highlighted gold and base metal stream anomalies requiring ground follow-up. Geophysical programs remain in vigour to test new frontiers in an expanding campaign of exploration.

Cabaçal Purchase Agreement Update

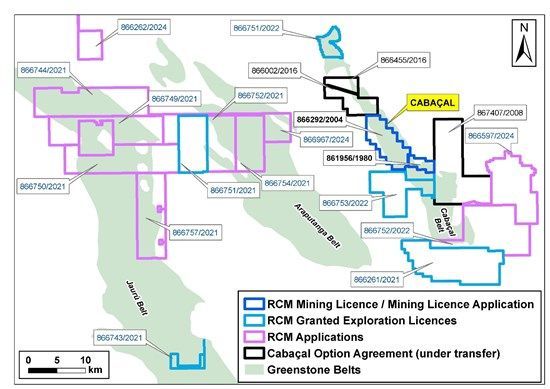

The Company signed the Cabaçal Purchase Agreement in November 20203 (the "Agreement"). As part of the Agreement's Second Instalment, it included the transfer of certain mining titles to RCM, the Company's Brazilian subsidiary managing the programs. Licences 866.292/2004 (hosting the Cabaçal mine) and 861.956/1980 (hosting the Santa Helena mine), as shown in Figure 1, have now been registered to RCM by the ANM, concluding the transfer of the key titles. Transfers for three exploration licences remain in progress. We look forward to the ongoing engagement with mining and environmental agencies in advancement of the project.

Figure 1. Licence status map, including the recently transferred Cabaçal (866292/2004) and Santa Helena (861956/1980) licence areas.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/264684_e5b858d7c4f66961_001full.jpg

ABOUT MERIDIAN

Meridian Mining is focused on:

The development and exploration of the advanced stage Cabaçal VMS gold-copper project;

The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Pre-feasibility Study technical report (the "PFS Technical Report") dated March 31, 2025, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study" outlines a base case after-tax NPV5 of USD 984 million and 61.2% IRR from a pre-production capital cost of USD 248 million, leading to capital repayment in 17 months (assuming metals price scenario of USD 2,119 per ounces of gold, USD 4.16 per pound of copper, and USD 26.89 per ounce of silver). Cabaçal has a low All-in Sustaining-Cost of USD 742 per ounce gold equivalent & production profile of 141,000 ounce gold equivalent life of mine, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.3:1, and the low operating cost environment of Brazil.

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold, 0.44% copper and 1.64g/t silver (at a 0.25 g/t gold equivalent cut-off grade).

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company's profile on SEDAR+ at www.sedarplus.ca and on the Company's website at www.meridianmining.co.

The PFS Technical Report was prepared for the Company by Tommaso Roberto Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering Canada ULC; Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering Canada ULC; John Anthony McCartney, C.Geol., Ausenco Chile Ltda.; Porfirio Cabaleiro Rodriguez (Engineer Geologist FAIG), of GE21 Consultoria Mineral; Leonardo Soares (PGeo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral; Norman Lotter (Mineral Processing Engineer; P.Eng.), of Flowsheets Metallurgical Consulting Inc.; and, Juliano Felix de Lima (Engineer Geologist MAIG), of GE21 Consultoria Mineral.

Qualified Person

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, verified, and approved the technical information in this news release.

On behalf of the Board of Directors of Meridian Mining UK S,

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

8th Floor, 4 More London Riverside

London SE1 2AU

United Kingdom

Email: info@meridianmining.co

Ph: +1 778 715-6410 (BST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/. Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

1 See Meridian news release dated May 8, 2025

2 See Meridian news release dated March 10, 2025

3 See Meridian news release dated November 9, 2020

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264684