October 17, 2023

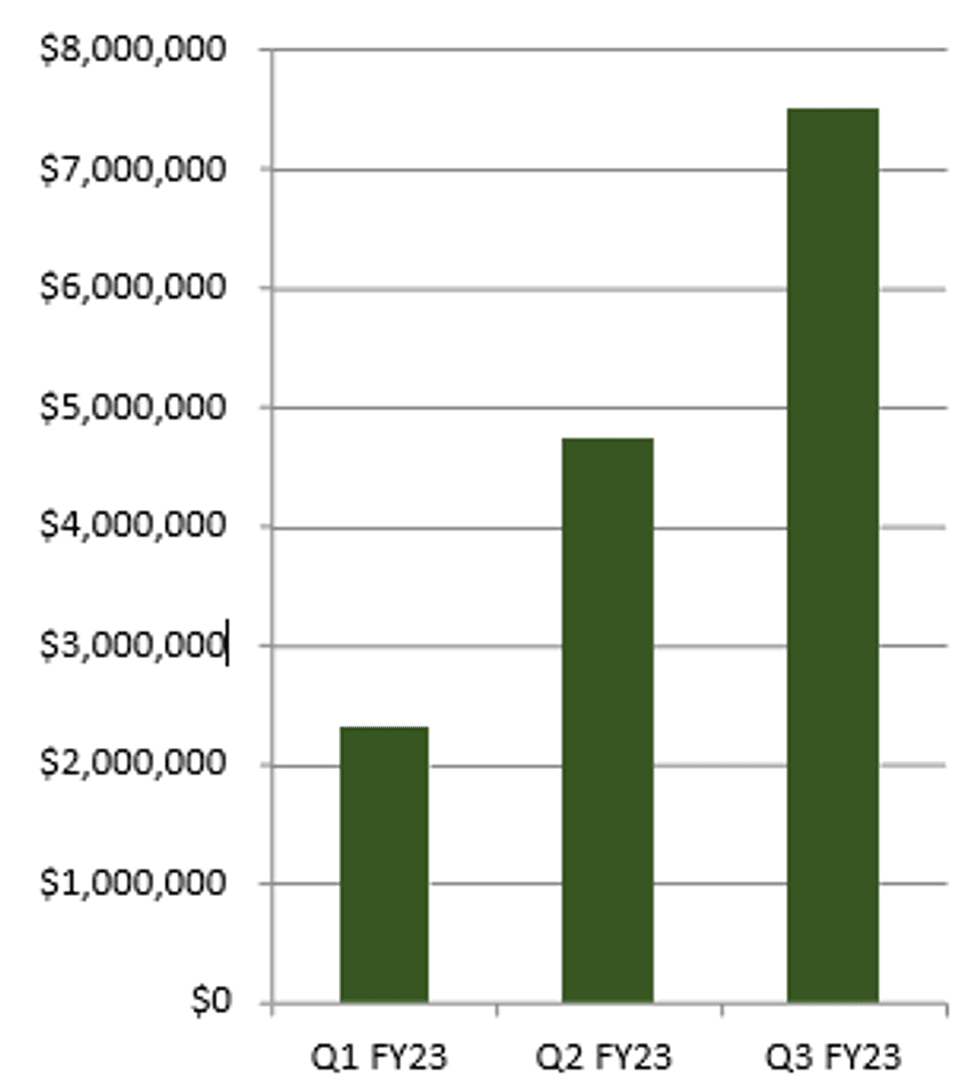

Melodiol Global Health Limited (ASX:ME1, FRA:1X8) (‘Melodiol’ or ‘the Company’) is pleased to advise that it has achieved another record quarter of growth, delivering ~$7,497,891 in unaudited net revenue for the quarter ended 30 September 2023 (‘Q3 FY23’).

Highlights:

- Circa $7.5m in unaudited revenue achieved across the Melodiol Group of companies in Q3 FY23 – a 265% increase on the PCP (Q3 FY22: $2.05m), and a 58% rise on last quarter (Q2 FY23: $4.74m)

- Q3 FY23 revenue growth takes total FY23 unaudited net revenue to date to $14.54m

- Strong growth underpinned by contributions from wholly-owned subsidiaries, including $1.85m in revenue from Mernova Medicinal Inc.

- Health House International also delivered unaudited revenue of $4.851m, which included $2.99m in net revenue from the division’s Australian operations

- Health House International’s Australian operations also generated an unaudited net profit of $312,548 during Q3 FY23 - +10% profit margin reflects well-established operating procedures on COGS (cost of goods sold) and a strong sales network across several leading Australian pharmacies

- Company remains focused on its stated strategy of delivering high revenue growth, while maintaining a stringent control on costs to reach profitability

The Q3 FY23 result represents a 265% increase on the previous corresponding period (‘PCP’) (Q3 FY22: $2.05m), and a 58% rise on last quarter net revenue (Q2 FY23: $4.74m).

Recent revenue growth also takes total unaudited net revenue for FY23 to date to $14.54m, highlighting Melodiol’s ability to streamline operations and focus on high growth revenue generating opportunities in key international markets.

Growth has been underpinned by the Company’s wholly-owned Canadian subsidiary, Mernova Medicinal Inc. (‘Mernova’), which generated $1.85m in revenue during Q3 FY23 (refer ASX announcement: 9 October 2023). Mernova’s revenue growth during the period marked a 20% increase on last quarter (Q2 FY2023 sales: A$1.547m) and a 104% rise on the PCP (Q3 FY22: A$907,042).

Further, 100%-owned subsidiary, Health House International (‘HHI’ or ‘HHI International’) also generated strong unaudited revenue of $4.871m, which included $2.99m in net revenue from the division’s Australian operations.

Pleasingly, adjusted for Cost of Goods Sold (COGS) and operating expenses, HHI Australia was also profitable with quarterly net profit before tax of $312,548, representing a net-profit-to-sales margin of 10.4% (refer ASX announcement: 16 October 2023).

During Q4 FY23, the Company remains increasingly focused on its stated strategy of maintaining high revenue growth across the group, with an emphasis on cost management to achieve a cash-flow breakeven position.

Management commentary:

CEO and Managing Director, Mr William Lay said: “We are very pleased to report these unaudited results for the Melodiol Group of companies, which has highlighted a record quarter of growth. Pleasingly, results are underpinned by very strong growth through wholly-owned subsdiary, Health House International which demonstrates the Company’s strategic priority to generate growth through strategic M&A and the acquisition of HHI marks successful execution in that regard.

“As we enter Q4, the Company remains focused on continuing its growth trajectory, while maintaining stringent on costs. We look forward to providing additional updates in the coming weeks.”

Click here for the full ASX Release

This article includes content from Melodial Global Health, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ME1:AU

The Conversation (0)

05 October 2023

Melodiol Global Health

Global Portfolio of Strategic Cannabis and Plant-based Businesses

Global Portfolio of Strategic Cannabis and Plant-based Businesses Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00