July 11, 2023

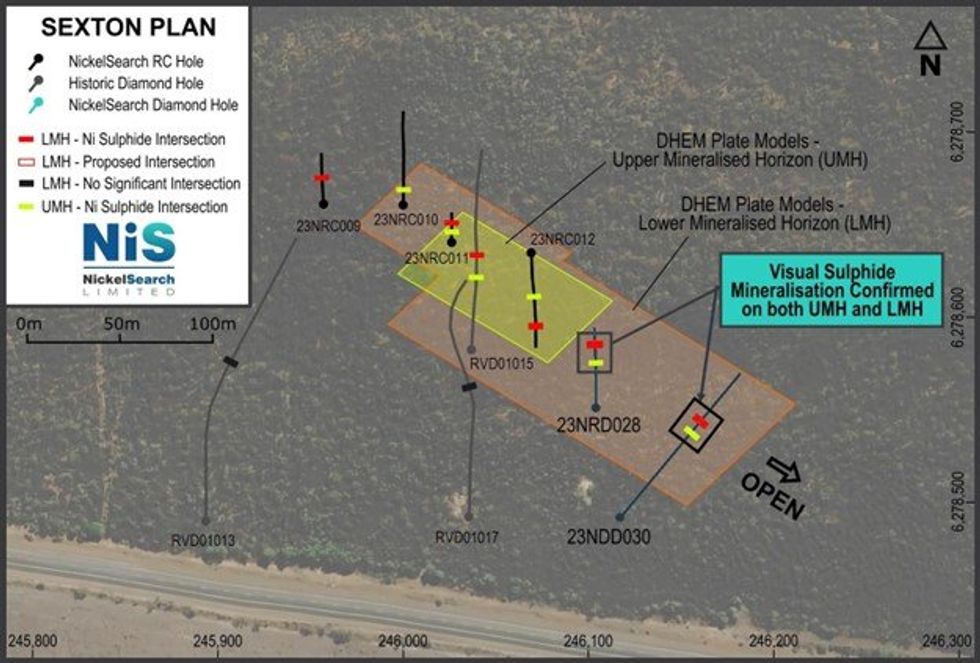

NickelSearch Limited (ASX: NIS) (NiS or Company) is pleased to provide an update on diamond drilling completed at the Sexton Prospect at its Carlingup Nickel Sulphide Project (Carlingup) near Ravensthorpe in Western Australia. Both diamond drillholes (DD) at Sexton intersected visual sulphides1 in the UMH and LMH, with both horizons intersected at shallower depths than expected in the second DD.

KEY HIGHLIGHTS

- Massive sulphide mineralisation intersected in both the Upper Mineralised Horizon (UMH) and Lower Mineralised Horizon (LMH) in two diamond drillholes at the Sexton Prospect.

- Multiple sulphide intersections previously reported over a 9.85 metre interval in diamond drill hole 23NRD028.

- Diamond drill hole 23NDD030 intersected massive sulphides in the same horizon, which demonstrates the nickel mineralisation continues 60m further along strike, extending the total strike length to 250m.

- Assays from the two diamond holes at Sexton expected in early August, and follow-up downhole electromagnetic (DHEM) surveys are now planned for these diamond holes to further test the extent of the sulphide mineralisation, which exhibits a strong DHEM anomaly response.

- Diamond drilling underway at the high priority B1 Prospect, where recent reverse-circulation (RC) drilling intersected nickel sulphides (see announcement 25 May 2023).

NickelSearch’s Managing Director, Nicole Duncan, commented:

“We are delighted to report that we have once again intersected visual sulphides, including massive sulphide mineralisation, in our diamond drilling program at Sexton, one of our highly prospective targets at Carlingup.

“The hole confirmed the presence of nickel sulphide mineralisation sitting in a structure located at relatively shallow depths of ~145m and starting quite close to surface at ~40m, which is particularly pleasing. This mineralisation was intersected shallower than anticipated, and our planned DHEM surveys in the DD will allow for more constrained models and show where the intersections are in respect of the new models. We eagerly look forward to assay results in the coming weeks.”

SEXTON DIAMOND DRILLING

The drilling program at Sexton targeted two distinct bodies of mineralisation encountered in earlier RC drilling and corroborated by DHEM surveys. The primary aim for the drilling was to identify the massive sulphides associated with the LMH, with the holes also designed to test the potential for further nickel sulphide mineralisation within the UMH.

Analysis following completion of the drilling confirms the overall strike length of Sexton mineralisation to extend to 250m and remains open both up- and down-plunge. To date, the drilling has shown there are multiple horizons of nickeliferous sulphide, shallowly plunging to the southeast, with the up- and down- dip extents undefined and open along strike. The mineralisation intersected is at the upper and lower contact of a banded iron formation (BIF) unit, within the ultramafic. In addition to sulphides on the BIF contacts, there are sulphides internal to the ultramafics. The amount and thickness of sulphide that has been intersected in each hole is variable, which is not uncommon in nickel sulphide systems that can pinch and swell.

The two holes successfully intersected sources of the DHEM plates modelled from the previous RC drilling. The intersections were shallower than anticipated, with multiple sulphide intersections. The planned DHEM surveys will now be completed to allow for more constrained models and in conjunction with assay results allow for the generation of follow up drill targets to extend mineralisation and vector in on higher grade zones.

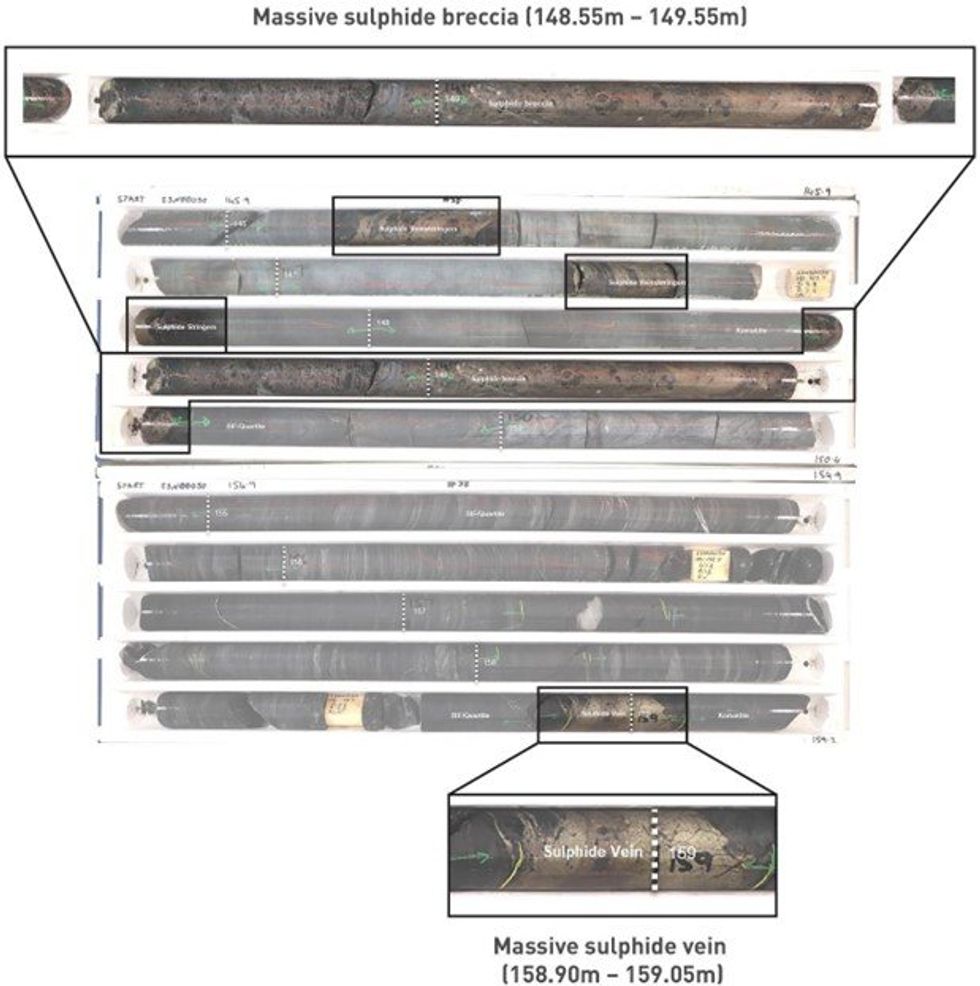

LOGGING RESULTS

In the first diamond hole at Sexton (23NRD028), the mineralisation is spread over nine metres and includes a number of intervals of various thickness of net textured/matrix to semi-massive/ massive sulphides. The sulphides are predominantly pyrrhotite +/- pentlandite and pyrite, with minor chalcopyrite. For full details of this logging, please refer to ASX Announcement dated 14 June 2023 – “Massive visual sulphide intersected at Sexton”.

Click here for the full ASX Release

This article includes content from NickelSearch Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00