May 01, 2023

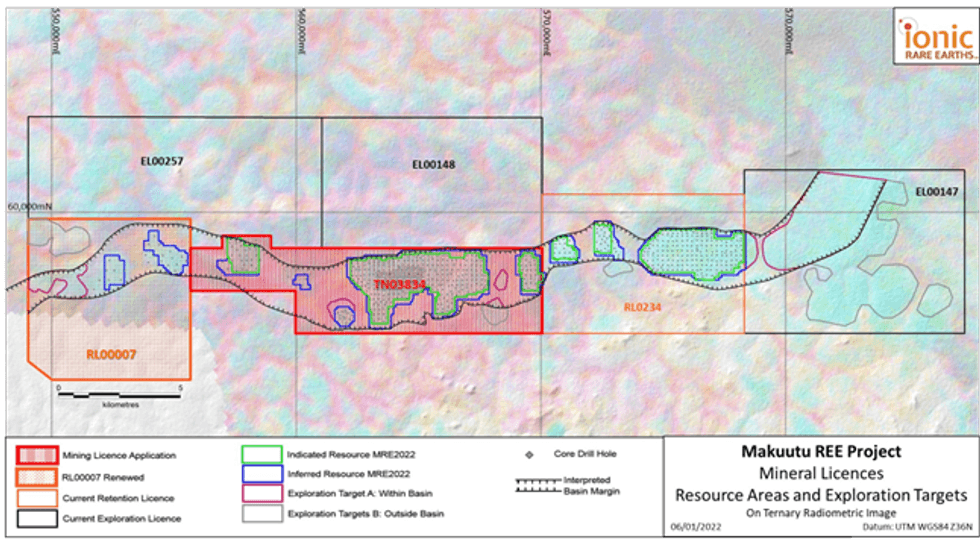

The Board of Ionic Rare Earths Limited (“IonicRE” or “The Company”) (ASX: IXR) is pleased to provide an update on the next phase of drilling at its 60% owned Makuutu Rare Earths Project (“Makuutu” or “the Project”). The drill program will aim at increasing the Inferred Resources on Retention Licence (RL) 00007 to an Indicated Resource category, plus also providing further confidence through reconnaissance drilling at exploration targets identified at both Exploration Licences (EL) 00147 and 00257 (refer Figure 1).

- Approval received from National Environment Management Authority (NEMA) to re-commence infill drilling at RL00007, plus drilling at Makuutu exploration targets on EL00147 and EL00257;

- Drill rigs secured and drilling expected to begin in May;

- Phase 5 exploration program to target areas for further resource growth;

- Infill drilling at RL00007 to support Mineral Resource Estimate update and increased classification of Inferred Resources to Indicated Resources to support next MLA;

- Program to evaluate areas with known REE mineralisation and untested geophysical anomaly target areas.

Makuutu currently ranks amongst the world’s largest ionic adsorption clay (IAC) deposits, and as such, a globally strategic resource for near term, low capital development and long-term security of magnet and heavy rare earth (HREO) supply.

Makuutu is made up of six tenements, with the Makuutu central tenement, RL 1693, the only tenement used to support the recently announced positive Makuutu Stage 1 Definitive Feasibility Study (DFS), which showed that Makuutu would have an initial 35-year mine life with EBITDA of A$2.29 billion and an IRR of 32.7% (ASX: 20 March 2023).

With the addition of the other tenements at Makuutu, the larger consolidated Project has substantial scope for future growth, and increasing geopolitical importance, to underpin the establishment of western sources for new magnet and heavy rare earths supply chains.

Ionic Rare Earths Managing Director Mr. Tim Harrison commented:

“The long-term exploration potential is immense. Given the positive Stage 1 DFS at Makuutu, the progress now on the demonstration plant at Makuutu, and the pending mining licence award at Makuutu on RL 1693, the Company has an eye to further growth to support the next MLA on the Makuutu western zone due to be submitted later in 2024.”

“This new exploration program will help us support the next MLA plus also refine our potential growth targets to the east at the massive EL00147 target, and the new north-western target at EL00257.”

Phase 5 Drill Program

Drilling is planned to commence in May, with both a diamond rig and RAB (Rotary Air Blast) rig secured. The Phase 5 drill program will include approximately 4,380m of core drilling used for resource upgrade on RL00007 plus 2,230m of RAB drilling used for evaluation of exploration targets on EL00147 and EL00257.In addition, the Company has a stated exploration target outside of the estimated resources of (ASX: 1 June 2022):

216 – 535 million tonnes grading 400 – 600 ppm TREO*

*This Exploration Target is conceptual in nature but is based on reasonable grounds and assumptions. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

Infill Drill Program

IonicRE will prioritise infill drilling to areas located on RL00007 to increase resource classification from Inferred Resources to Indicated Resources, supporting the Stage 2 DFS and the next MLA expected to be completed on RL00007 in November 2024.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00