March 19, 2024

Peak Rare Earths Limited (ASX: PEK) (“Peak” or the “Company”) is pleased to announce the final set of assay results from its critical minerals exploration programme, which is targeting the multi-commodity potential of the Ngualla carbonatite system.

- Critical minerals exploration programme is supporting the multi-commodity potential of the Ngualla carbonatite system

- Completion of all remaining assays from the current drilling:

- 7 RC drill holes from the Northern Zone as well as 11 RC and 2 DD drill holes from the Breccia Zone

- Assays from Breccia Zone confirm outstanding high-grade thick intercepts of fluorspar supporting the potential of a globally significant fluorspar deposit:

- NRC390: 80m at 30.8% CaF2 from surface including 10m at 53.3% CaF2 from 34m

- NRC408: 34m at 44.2% CaF2 from surface including 10m at 59.2% CaF2 from surface

- NDD048: 68m at 30.6% CaF2 from surface including 6m at 61.5% CaF2 from surface and 8m at 58.1% CaF2 from 12m

- Prospectivity of Breccia Zone further enhanced by significant high-grade rare earth mineralisation as well as elevated levels of niobium:

- NRC408: 34m at 3.77% TREO from surface including 8m at 4.87% TREO from 2m and 16m at 4.63% TREO from 14m

- Final assays from Northern Zone extend the area of high-grade phosphate mineralisation, supporting the recently identified opportunity to supply phosphate into local fertiliser sector:

- NRC384: 28m at 16.7% P2O5 from 6m and 41m at 22.9% P2O5 from 39m to end of hole

- NRC388: 40m at 20.3% P2O5 from 6m,

- Ongoing engagement with strategic parties around low-cost phosphate and fluorspar development options that could complement the delivery of the Ngualla Rare Earth Project

- Further drilling to be evaluated as part of the next phase of the exploration programme

Assay results cover a maiden drilling campaign in the Breccia Zone, comprising of 11 Reverse Circulation (“RC”) and 2 Diamond Drill (“DD”) holes. They confirm extensive high-grade and thick intercepts of fluorspar across the Breccia Zone (Figure 1) supporting the potential of a globally significant fluorspar deposit at Ngualla. High-grade rare earth mineralisation and elevated levels of niobium have also been intercepted within the Breccia Zone; further enhancing the prospectivity of the area.

The final set of assays from 7 RC holes within the Northern Zone have also been finalised. These demonstrate further high-grade intersections of phosphate, further extending the existing extent of phosphate mineralisation in the south direction.

Both fluorspar and phosphate are increasingly strategic critical minerals:

- Fluorspar is used in electrolytes within lithium batteries and to purify graphite anodes; and

- Phosphate is used in lithium iron phosphate EV batteries and fertilisers, which are critical to boosting food security and agricultural yields in Tanzania and East Africa.

Commenting on the assay results, Bardin Davis, the CEO of Peak, said:

“The results from our maiden drilling campaign in the Breccia Zone are extremely exciting and confirm a major fluorspar discovery. Fluorspar is an increasingly strategic critical mineral, and we have the potential of a globally significant deposit. The final assay results from the Northern Zone are also very pleasing and further extend the mineralisation area of high-grade phosphate.

We intend to further assess the potential for low-cost development options for these two commodities”.

Results overview

The assay results from 18 RC holes and 2 diamond holes across the Northern Zone and Breccia Zone covering a total of 1,533m are included within this latest batch of results (Figure 2). Drilling in the Breccia Zone has targeted the southern and northern extent of the area where previous trench samples identified high-grade fluorspar at surface. The final set of drill holes from the Northern Zone has focused on infill between the current mineralised area and the Bastnaesite Rare Earth Zone, which lies ~1km south of the Northern Zone.

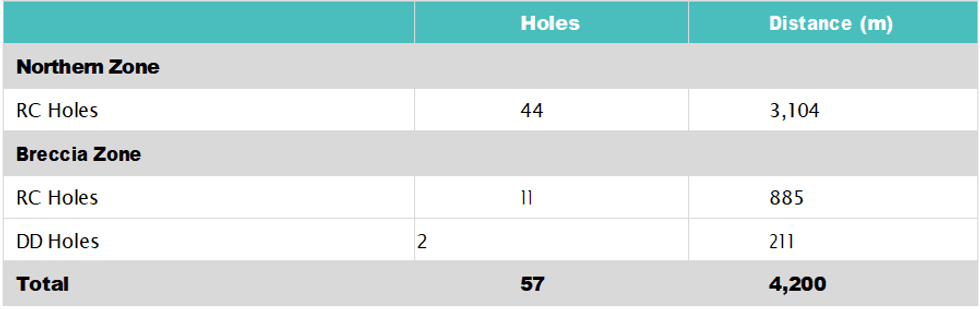

All assays pertaining to the current drilling campaign have been completed and covered a total of 57 drill holes for a total of 4,200m (Table 1).

Click here for the full ASX Release

This article includes content from Peak Rare Earths Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00