- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

Electric vehicle (EV) production is ramping up worldwide. According to the International Energy Agency, the global stock of EVs could reach 245 million units by 2030. Importantly, the EV industry is being touted as critical to the rapidly emerging green economy.

However, the environmental sustainability of the EV industry is not as clear-cut as many believe. In fact, its growth has generated many questions about how end-of-life lithium-ion batteries can be managed in ways consistent with the ethos of the green economy. Given that the volume of spent batteries from EVs and battery energy storage systems will grow sharply over the next decade, the matter is of real concern – it is predicted that the number of end-of-life lithium-ion batteries will exceed that of lead-acid batteries beyond 2040.

Currently in Australia, less than 10 percent of end-of-life lithium-ion batteries are made available for recycling. This has prompted the establishment of a battery stewardship initiative, which provides a strong financial incentive to recycle most types of spent batteries. The initiative, which is set to take effect in early 2022, encourages responsible battery management ... from design right through to end of life. Thus, Australian companies embracing environmentally sustainable lithium-ion battery supply and recycling present investors with an intriguing opportunity as they seek to leverage such financial incentives.

Lithium Australia NL (ASX: LIT) is a diversified battery materials company with strong ESG values. Led by an accomplished management team with decades of experience in the mining, mineral processing and chemical manufacturing industries, the company is committed to developing a sustainable circular economy for battery materials.

An investment in Lithium Australia provides exposure to the exponential growth of the lithium-ion battery industry worldwide and a geographic footprint with the potential to span several countries – Australia, China, the United States, India and the United Kingdom among them. The company has established an ethical, sustainable framework for lithium extraction, processing and recycling that encompasses joint-venture projects, strategic investments and a suite of proprietary technologies – underpinned by intellectual property (IP), including international patents – that creates a sustainable model for battery production.

According to company managing director Adrian Griffin, “Lithium Australia is the only ASX-listed company with a sustainable model for battery materials.”

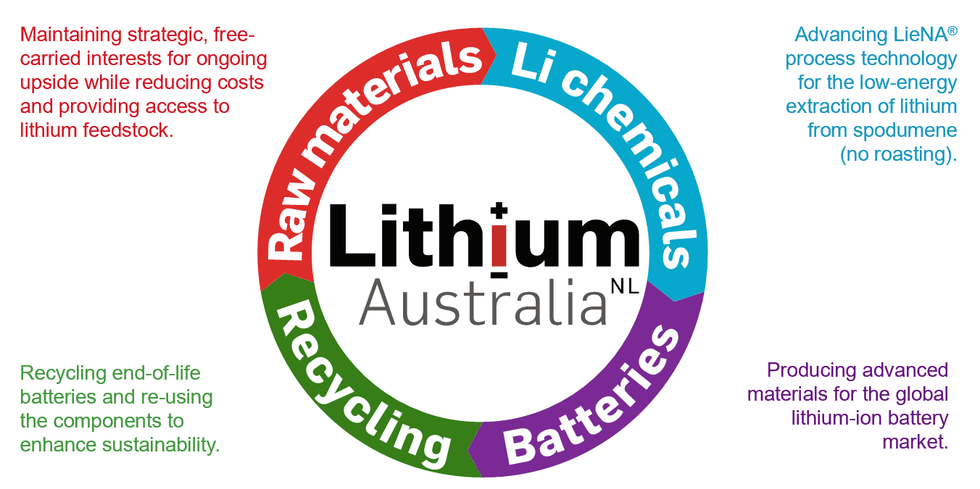

Lithium Australia has four lithium-battery related business divisions: raw materials, lithium chemicals, batteries and recycling. These can be summarised as follows.

With respect to raw materials, the company has progressively farmed out its exploration portfolio. In so doing, it has accumulated equity interests in the public companies now managing the projects. This reduces costs and enhances accessibility to lithium feedstock while providing shareholder value through potential economic returns.

Lithium Australia's lithium chemicals division has developed proprietary, energy-efficient technologies for the extraction of lithium from what is generally considered waste material by the mining industry. Foremost is LieNA®, a process that greatly improves the rate of recovery of lithium from spodumene. SiLeach®, meanwhile, recovers lithium from mine waste (specifically micas) and clays. Both technologies produce primary battery chemicals (lithium phosphate in particular) and are patented in Australia and internationally. The federal government has awarded Lithium Australia a grant to further develop its LieNA® process, and construction of a LieNA® pilot plant is underway.

The company's 100 percent owned subsidiary VSPC Ltd (VSPC) is a developer of advanced materials for lithium-ion batteries. VSPC, which has spent 20 years researching its proprietary, internationally patented nanotechnology, produces next-generation battery materials, including lithium ferro phosphate (LFP) and lithium manganese ferro phosphate (LMFP) cathode powders. VSPC's technology can harness lithium phosphate (produced by both LieNA® and SiLeach®) as a cathode powder precursor and thus has the potential to reduce the number of process steps required to convert lithium chemicals recovered from mine waste and spent batteries to materials for use in new lithium-ion batteries.

Lithium Australia's 90 percent owned recycling subsidiary Envirostream Australia Pty Ltd (Envirostream) is Australia's only authorised mixed-battery recycler and, as such, is well-positioned for the imminent roll-out of the national Battery Stewardship Scheme. Having established an Australia-wide collection network for mixed spent batteries (including at Bunnings stores in Australia and New Zealand) for recycling, Envirostream uses proprietary technology to extract higher yields (95 percent) from end-of-life lithium-ion batteries than any of its global competitors.

(For further details of each Lithium Australia business division, refer to 'Key assets' below.)

Company Highlights

- Lithium Australia’s strategic investments in ASX-listed companies and its free-carried exploration interests provide exploration upside and low-risk exposure to raw materials for the battery industry.

- The company’s patented lithium extraction technologies reduce the length of the supply chain from mining of raw materials through battery production to, ultimately, recycling.

- Lithium Australia is one of the few companies outside China that provides direct exposure to the burgeoning LFP industry – and the only investment exposure to LFP on the ASX. Increased global demand for LFP-type lithium-ion batteries (particularly for EVs and battery energy storage systems), lack of LFP production in the West and strong domestic consumption of LFP within China are placing immense pressure on the availability of this battery material worldwide.

- Lithium Australia is also one of the few companies worldwide to master the production of next-generation, higher-energy-output LMFP cathode material.

- As the only licensed mixed-battery recycler in Australia, company subsidiary Envirostream stands to benefit from the imminent Australia-wide battery stewardship scheme, particularly in light of its recent battery-collection agreement with Bunnings.

Get access to more exclusive Resource Investing Stock profiles here