November 12, 2023

Comet Vale groundwork begins while the Menzies area experiences thriving gold and lithium exploration

Labyrinth Resources Limited (ASX: LRL) (‘Labyrinth’ or ‘the Company’) has completed preliminary mapping and sampling at its Comet Vale gold project in Western Australia (‘the Project’).

- Reconnaissance trip a solid start to Comet Vale ground exploration program

- 35 rock chip samples of prospective mafic/ultramafic rocks and pegmatites were taken from Comet Vale tenements

- Samples are being assayed with results expected in 2-3 weeks

- Historic magnetics and radiometric data has been acquired and reprocessed to aid in mapping gold bearing structures and prospective geology

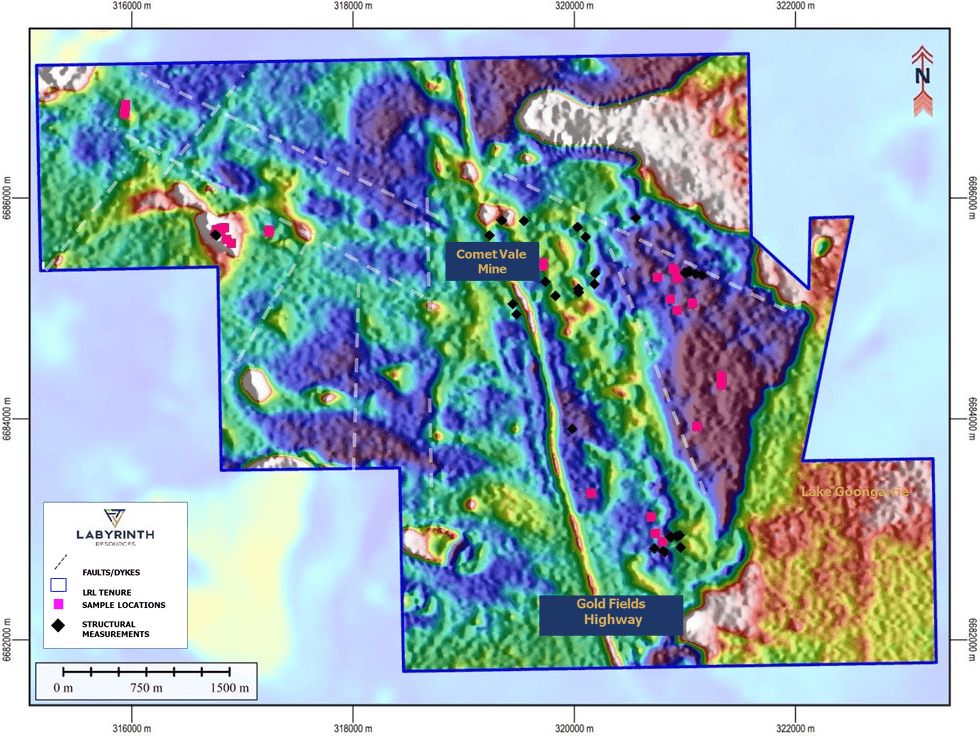

- Radiometric data (TC) showed several anomalies and previously unknown structures

- Soil sampling program has started on western side of tenement package

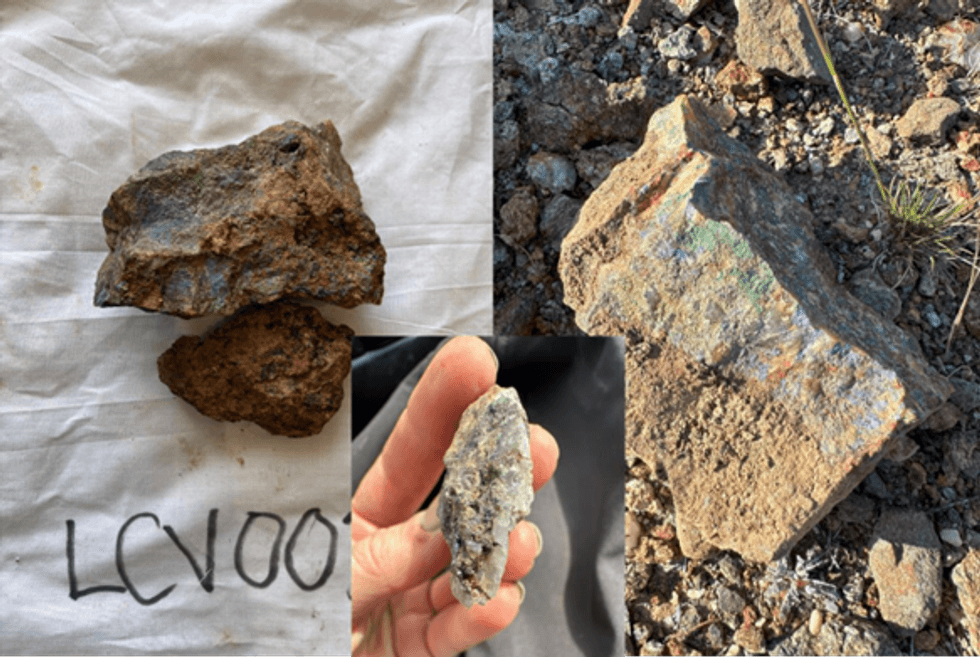

The reconnaissance program has renewed interest in the historically overlooked multi- commodity prospectivity of the Comet Vale project. Reconnaissance samples are at the laboratory undergoing analysis and results are expected in 2-3 weeks (samples shown in Figure 1 and Figure 2). Recently acquired radiometric data (U, Th and Total Count or “TC”) showed numerous unexplained anomalies (Figure 3). Pegmatite samples collected were coincident with these anomalies, though the radiometrics could be indicating alteration, variation in intrusives (more specifically fractionation) and faults.

These findings initiated a gridded soil sampling program. The soils will be assayed for Lithium (Li), Caesium (Cs), Tantalum (Ta) and other Rare Earth Elements whereas historical programs have focused on gold and some indicator elements for base metals. The soil samples will help to explain the geophysical anomalies.

CEO Jennifer Neild explained, “We’re fortunate at Comet Vale to have such a richly prospective tenement package for multiple commodities.

This does mean going back to basics and soil sampling programs are a great way to vector in on prospective intrusions, structures and in the best case, mineralisation.

With the recent joint venture activity proximal to Comet Vale focused on lithium, Labyrinth has been identified as highly prospective tenure both internally and externally.”

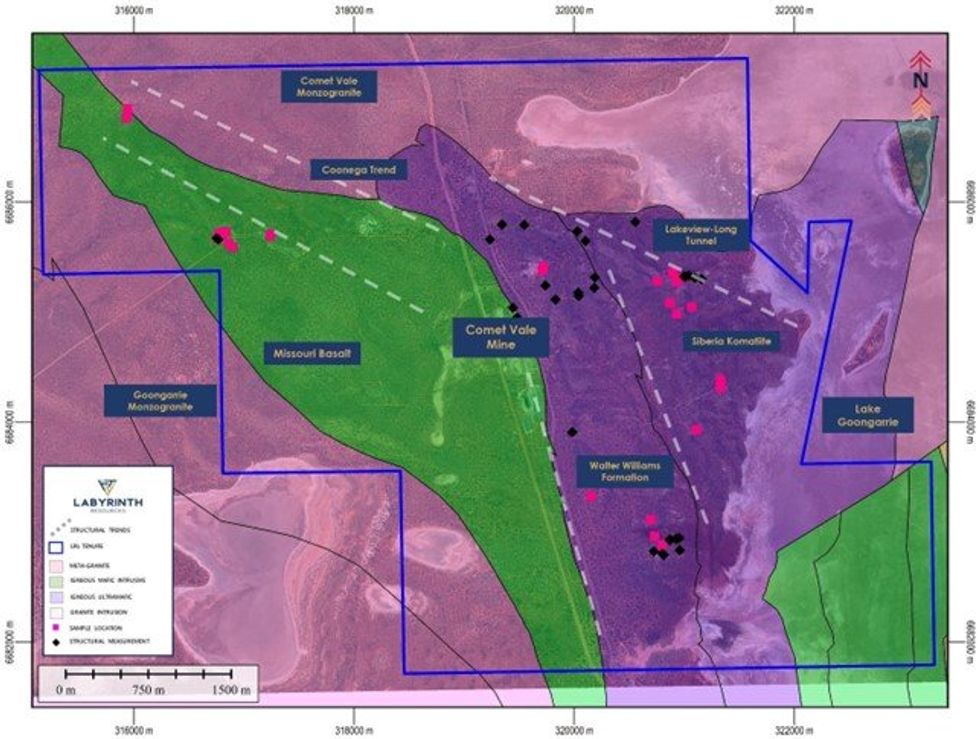

The reconnaissance work also confirms historic positions of copper (Cu) (Figure 2) and nickel (Ni) laterite mineralisation and prospective geology. The work noted more detailed variation in ultramafic intrusions, possibly explaining some anomalism seen in geophysical data. Finding evidence to explain geochemical and geophysical variance narrows is key to narrowing down targets.

Soil sampling was already in the planning stages when Ora Banda Mining Ltd (‘OBM’) signed a Joint Venture agreement with Wesfarmers Limited’s (‘WesCEF’) exploration subsidiary Brenahan Exploration Pty Ltd (‘BEPL’)1 lending credence to Labyrinth’s interpretation of the regional lithology (Figure 5). The recent exploration activity has involved thoroughly assessing the complete mineral potential through targeting exercises of Comet Vale.

Indicator elements will assist in understanding the fractionation of intrusives and make sense of the radiometric anomalies. Radiometric surveys can detect the intensity of gamma rays of particular elements like K, Th and U. The TC refers to the total gamma rays emitted and might indicate the partitioning of elements within granitic melts, potentially a helpful tool in detecting compositional changes in intrusions.

Background

Gold occurrences across the ground produced many ounces of gold in small scale operations over the last 120 years. Long Tunnel-Lake View and Coonega trends (ENE-WSW) have been thought to be minor trends, but the structure can be delineated across the region in the magnetics. Other N-S trends such as the Rambo Trend, east of Comet Vale also remain interesting with historic drillholes now digitised and confirm mineralisation (Figure 4).

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

19h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

19h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

20h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

20h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00