November 05, 2024

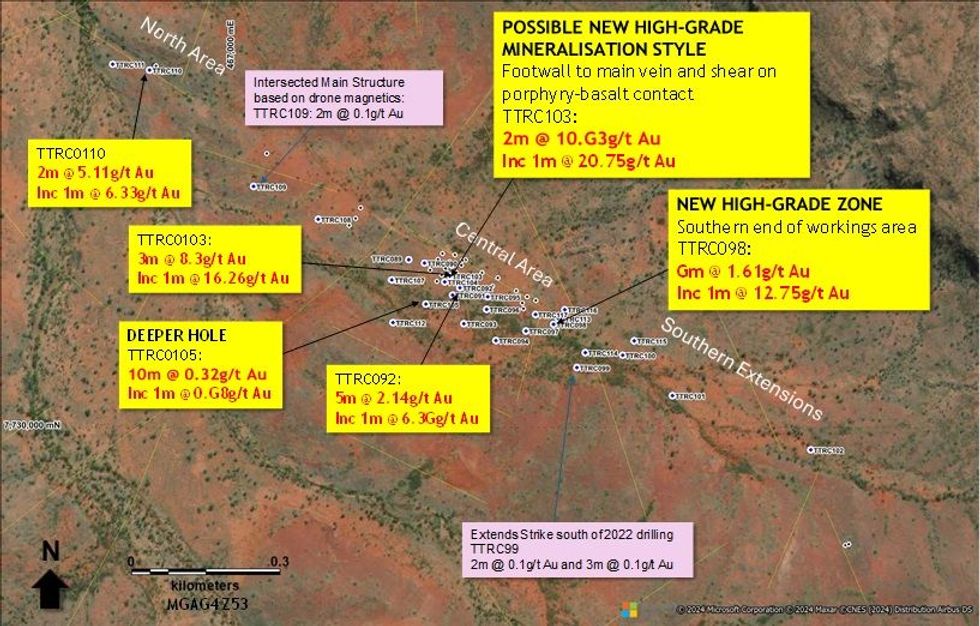

King River Resources Ltd (ASX: KRR) is pleased to provide the following update on results for the 2024 drilling at Kurundi Main prospect. Drilling focused on extending previously discovered high grade gold mineralisation (reported in 2022) and testing alternative structural positions identified in detailed drone magnetics completed in 2023 (KRR ASX: 28 June 2024). Significant results have been returned (Figure 1) including the discovery of a new high grade gold zone 250m south of the central main workings with best result of:

- TTRC098: 9m @ 1.62g/t Au from 49m including 1m @ 12.75g/t Au from 53m.

Other high-grade results include:

- TTRC103: 3m @ 8.3g/t Au from 35m including 1m @ 16.25/t Au from 36m at the central main zone.

- TTRC092: 5m @ 2.14g/t Au from 38m including 1m @ 6.39g/t Au from 40m at the central main zone.

- TTRC110: 2m @ 5.11g/t Au from 44m including 1m @ 6.33g/t Au from 45m at the northern workings

Also, a possible new style of mineralisation on a porphyry-basalt contact, footwall to the central main mineralized zone has been identified (requires further investigation - see Central Target Area section below) with an intersection of:

- TTRC103: 2m @ 10.93g/t Au from 51m including 1m @ 20.75g/t Au from 51m.

All intersections are stated as down hole widths which are close to true width for the Kurundi Main structure. A second phase of drilling has commenced to test the new southern high-grade zone and continue exploring the other Kurundi Main targets.

A total of 28 RC holes for 1,986m have been completed (results listed in Table 2) testing 3 main targets: (1) northern and southern extensions of the Kurundi structure up to 1km from the central main workings, (2) testing the plunge of the central high-grade shoot intersected in 2022 drilling, (3) testing mineralisation deeper under the central main workings.

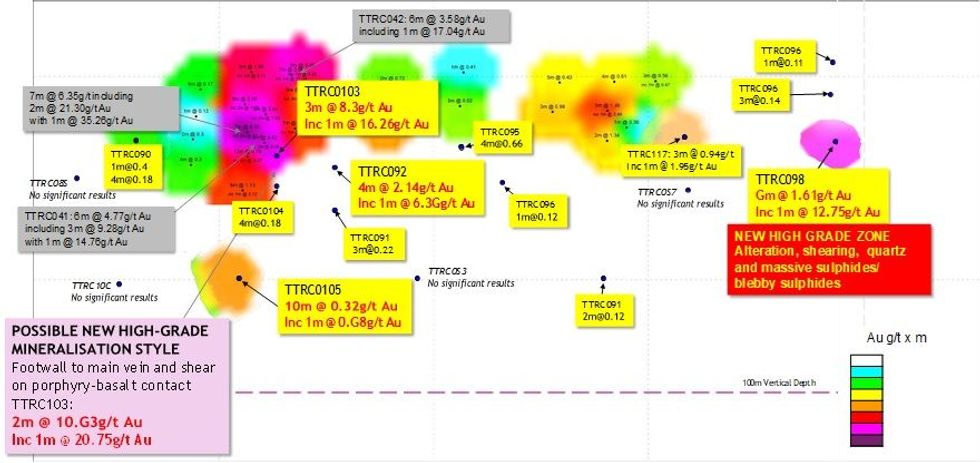

Central Target Area:

Drilling has confirmed a southerly plunge to the central main high grade gold mineralisation identified in 2022 drilling with TTRC0103 and TTRC092 intersecting high grade gold mineralisation (Figure 2). Also, TTRC103 intersected an unexpected high grade gold zone of mineralisation footwall to the central main zone, on the contact between the basalt host rock and a porphyry intrusive unit (cross section in Figure 3). Due to the lack of structure and alteration being visible in the drill chips the result was initially perceived as a sampling error (2 composite samples from this interval returned anomalous results). However, re-assaying of the pulps followed by resampling at 1m intervals confirmed the presence of gold mineralization and eliminated possible sampling and laboratory errors. This possible new style of mineralisation will be investigated thoroughly with reinterpretation, drill hole relogging, multi element analysis, petrography and drilling to understand possible orientations, further targeting and to eliminate the possibility of down hole contamination of samples during the drilling of TTRC103.

In the Central Target Area KRR’s previous 2022 drilling only tested to a vertical depth of 40m. Four new holes have now been drilled to test a vertical depth of 65m. All holes intersected strong structure, alteration and veining confirming the continuation of the central target zone at depth. TTRC105 intersected a broad zone of veining and alteration and returned 10m @ 0.32g/t Au including 1m @ 0.98g/t Au from 68m with mineralisation open at depth and to the south, shown in the long projection below (Figure 2). The presence of strong veining and shearing at depth across the strike of the central zone is very encouraging for further, deeper drilling.

TTRC112 was drilled to test a resistivity anomaly identified by 2023 DDIP survey (KRR ASX: 28 June 2024) however no cause for the resistivity anomaly was identified.

Click here for the full ASX Release

This article includes content from King River Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00