May 01, 2023

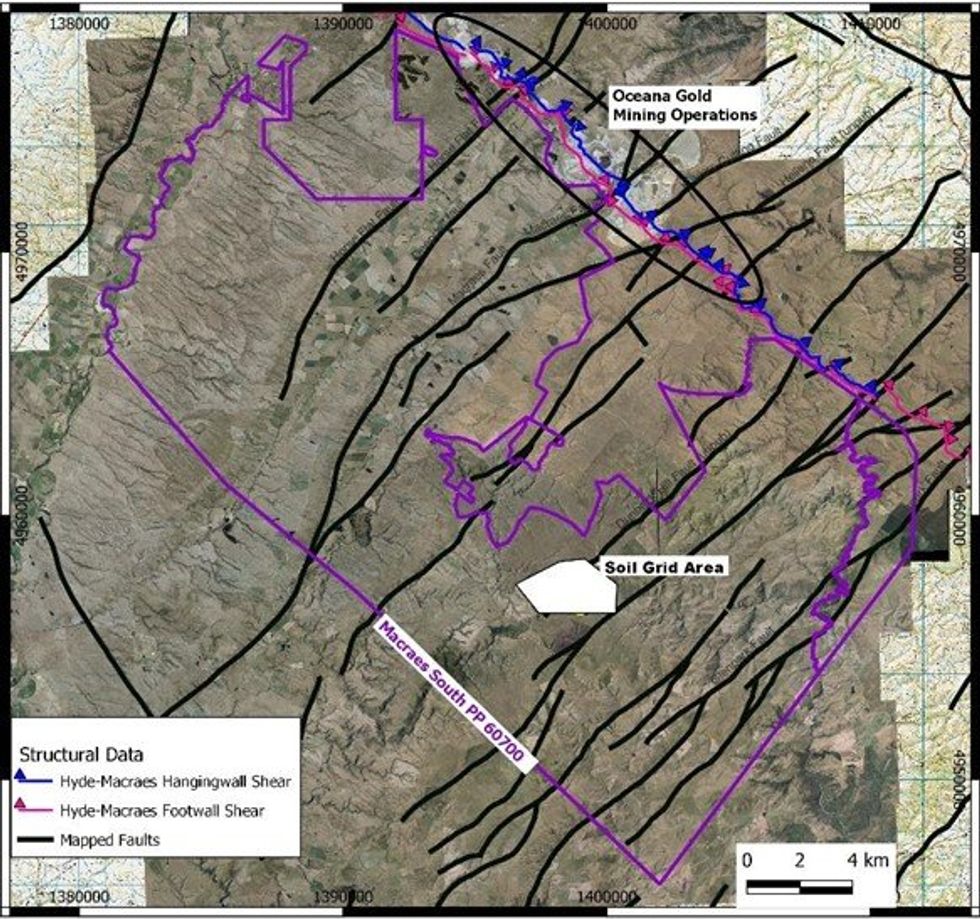

Cyclone Metals Limited (ASX: CLE) (Cyclone or the Company) is pleased to announce that soil geochemical sampling has successfully identified a series of gold anomalies within the Macraes South PP 60700, located 40km north of Dunedin in the Otago Province of New Zealand (Figure 1). Cyclone applied the Ionic LeachTM technique following the success of an orientation sampling program announced to the ASX on 2 May 2022.

Highlights

- Strong coherent and continuous geochemical responses over projected structural positions of gold lode zones at Macraes South

- Anomalous responses up to 350m wide in orientation sampling line 4 resolved into 3 parallel lode systems

- Potentially >5 mineralised lodes for drill testing identified at the Swampy Hill Prospect within the Macraes South project

- Rock chip sampling of lodes up to 3.47g/t Au

- Identified lode dipping 50o to northeast subparallel to Hyde-Macraes shear system

- Anomalism open to Northwest, Southeast and northeast

Commenting on the results of exploration in New Zealand, Cyclone Metals Chairman Tony Sage said:

“The results from the soil sampling program have generated highly prospective drill targets over multiple lodes, located only 15km from the Macraes Gold Mine, operated by Oceania Gold Limited. The Swampy Hill Prospect area with limited previous exploration, is being applied for to convert to an Exploration Permit and has significant upside if drill testing later in the year is successful. The remainder of the Macraes South project is being applied for to remain as a Prospecting Permit, and will have further soil sampling programs to identify drill targets.”

Geochemical Sampling Discussion

Following on from the Ionic leach trial soil sampling (ASX release 2 May 2022 and 1 June 2022) within Macraes South, an expanded program was designed and completed in December 2022. The slow return of results was in part due to slow shipping during the Christmas period and lab backlogs.

A soil grid program was planned and executed around the significant results returned from orientation traverse line 4, at the Swampy Hill prospect, within the Macraes South tenement. The planned program was for approximately 500 samples to be collected on a 200m north-south line spacing with a 50m samples spacing. The original orientation line was orientated north-northeast so the grid lines crossed the orientation line 3 times providing a detailed cross-check on both sets of results.

Naturally, the prospect is now called Swampy Hill.

The anomalies are defined both on raw geochemical values or on a times background basis usually used to express Ionic LeachTm results. The anomalies tend to be narrow and lenticular in nature consistent with the probable style of mineralisation being in relatively narrow elongate shear zones.

Anomalous zones (Figure 2) defined using Ionic LeachTM which show >25x background values have empirically been found in proximity to mineralisation; using this rationale there is potentially >2,000m of mineralised strike in the Swampy Hill prospect area. Table 1 lists the sample locations, the raw Au ppb values and the calculated ratio to background value (Response Ratio – RR).

The Figure 3 photograph shows the nature of the mineralised zone in a small gouging; this zone assayed 3.47g/t over 0.6m and consists of weathered sulphidic siliceous shear zone material dipping at 45o northeast and striking northwest-southeast (140o-320o). This is very similar to the Lot’s Wife area also in the footwall of the Hyde-Macraes Shear and are probably best described as moderate angle reverse faults rather than thrust faults such as in the Macraes low angle system.

Their origin and character are assumed to be due to the same thrust regime which generated the Hyde- Macraes Shear with the change in dip angle being due to rotation of the fault planes occurring in the footwall zone.

The southernmost anomaly adjacent to the Swampy Hill Trig station strikes 110o-290o, the same as the subvertical quartz hosted Nenthorn gold mineralisation.

An application for an extension of term has been lodged for the Macraes South PP 60700; it is proposed a small EP area covering Swampy Hill and surrounding area be lodged; once granted and an access agreement signed with the landowners a drilling program will be undertaken to test the defined anomalies.

Click here for the full ASX Release

This article includes content from Cyclone Metals Ltd., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CLE:AU

The Conversation (0)

11 April 2024

Cyclone Metals

Focused on Developing a World-class Iron Ore Asset in Canada, project Iron Bear

Focused on Developing a World-class Iron Ore Asset in Canada, project Iron Bear Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00