QuickBooks Get Paid Upfront Allows Eligible Small Businesses to Access up to $30,000 in Unpaid Invoice Funds;

QuickBooks Early Pay Provides Small Business Employees Access to Money Before Payday

Intuit QuickBooks today announced two new products that provide small businesses and their employees with faster access to their money in an effort to give them greater cash flow flexibility so they can succeed and prosper. With QuickBooks Get Paid Upfront , eligible QuickBooks Online customers can eliminate the wait to be paid on outstanding invoices and put their earned money to work faster. QuickBooks Early Pay will provide eligible employees paid through QuickBooks Online Payroll with the option of instant 1 access to money between paydays. Both new products are the latest innovative fintech offerings from INTUit (Nasdaq: INTU), the global technology platform that makes TurboTax , QuickBooks , Mint , Credit Karma , and Mailchimp .

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220127005272/en/

(Photo: Business Wire)

"Faster access to money is a universal need among small businesses and the people they employ," said Alex Chriss, EVP and General Manager of Intuit QuickBooks Small Business and Self-Employed Group. "By making financial services available across the QuickBooks platform when and how small business owners and their employees need them most, we unlock even more benefit and value for our customers and greater opportunities for them to achieve prosperity."

QuickBooks Get Paid Upfront

Get Paid Upfront is fast, seamless and works on a business owner's schedule. Small businesses still wait an average of 29 days to get paid and 64% have outstanding unpaid invoices after 60 days.

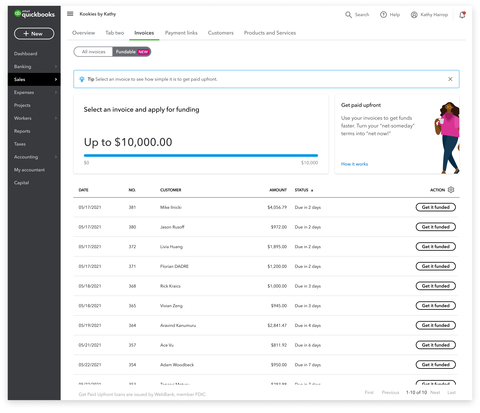

With Get Paid Upfront, small businesses now have the ability to apply for upfront advance of funds from one or more qualifying invoices, up to a total of $30,000, in just a few clicks. Customers pay one flat fee of 3% per financed invoice and invoices are financed interest free for the first 30 days. 2 There are no additional ACH or credit card transaction fees charged to the small business owner when a customer pays the invoice through QuickBooks Payments within the first 30 days. 3

Get Paid Upfront is designed with simplicity and speed in mind. The customer experience is integrated end-to-end, with eligibility, funding, and repayment all happening directly through the QuickBooks platform. Get Paid Upfront delivers faster access to funds while eliminating burdensome processes small businesses typically face with third-party invoice financing solutions. Invoice proceeds are funded directly to the small business owner while their customer sees nothing different and pays as they usually would through QuickBooks Payments.

QuickBooks Early Pay

QuickBooks Early Pay is the newest feature within QuickBooks Online Payroll designed to meet the needs of small business employees by making access to money available between paydays. Nearly 40 percent of Americans say they would struggle to pay an unexpected $400 emergency expense. But with Early Pay, in just a few steps, an eligible employee will be able to apply for funds personalized for them based on their pay history to help offset unexpected expenses or ease financial stress. Employees can choose to receive those funds instantly 1 or within 1-2 business days. Early Pay will be included in QuickBooks Online Payroll at no additional cost to employers, with no impact on their books or payroll.

Early Pay, available soon, reflects QuickBooks' commitment to not only meet the needs of small business owners with access to full-service payroll capabilities but to also provide employee benefits that positively impact their financial health and well-being.

Both Get Paid Upfront and Early Pay leverage QuickBooks' expansive financial services expertise, including in payments, payroll, and access to capital:

- Last year, QuickBooks processed $91 billion in payments volume, and $1.5 trillion of invoices are created in QuickBooks every year.

- One in 5 small businesses use QuickBooks Payroll, with a total volume of $232 billion.

- QuickBooks Capital has facilitated more than $1 billion in loans to small businesses since 2017.

By integrating critical offerings across the QuickBooks platform, QuickBooks is able to unlock faster and more seamless access to earnings for small businesses and their employees.

Intuit QuickBooks has partnered with WebBank, the lender of both the Early Pay and Get Paid Upfront products, to offer Early Pay in the coming months and launch Get Paid Upfront, 4 which is currently available to eligible QuickBooks small business customers nationwide. This partnership will help QuickBooks expand the reach of both these capital-focused fintech solutions, combining WebBank's expertise in innovative lending solutions with Intuit's legacy of money movement leadership.

More information on QuickBooks Get Paid Upfront is available here .

About Intuit:

Intuit is the global technology platform that helps consumers and small businesses overcome their most important financial challenges. Serving more than 100 million customers worldwide with TurboTax , QuickBooks , Mint , Credit Karma , and Mailchimp , we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us for the latest information about Intuit, our products and services, and find us on social .

Disclaimers:

1 QuickBooks Early Pay loans funded via instant transfer are typically deposited within 30 minutes.

2 Interest will begin to accrue on any outstanding QuickBooks Get Paid Upfront loan balance after the first 30 days.

3 Not available for customer invoice payments made through GoPayment, Pay links, or QBO Receive Payment experience.

4 QuickBooks Get Paid Upfront loans and QuickBooks Early Pay loans are issued by WebBank. Application and approval required.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220127005272/en/

Intuit QuickBooks:

Dan Mahoney

dan_mahoney@intuit.com

Jennifer Garcia

jeng@theaccessagency.com