June 13, 2023

Spectacular Intersections of 28m at 2.34% Nickel & 0.109% Cobalt within the Resource Outline including intercepts of up to 4.14% Ni and 0.421% Co

Golden Mile Resources Limited (“Golden Mile”; “the Company”; ASX: “G88”) is pleased to announce that PQ diamond drilling for Stage 3 Metallurgical testwork on the 100% owned Quicksilver Nickel- Cobalt deposit “Quicksilver” has intersected very wide zones of high-grade nickel mineralisation within the existing Resource.

Highlights

- 23QDD008: 49m at 1.74% nickel (Ni), 0.071% cobalt (Co) from 30m

- Including 28m at 2.34% Ni & 0.109% Co from 32m depth, with intercepts up to 4.14% Ni and 0.421% Co; and

- 5m @ 1.6% Ni & 0.026% Co from 73m depth

Other significant intersections include:

- 23QDD006: 61m @ 0.61% Ni from 20m depth, including 1m @ 1.22% Ni from 77m depth

- 23QDD002: 47m @ 0.74% Ni from 18m depth, including 3m @ 1.15% Ni from 54m depth

- 23QDD007: 29m @ 0.65% Ni from 20m depth, including 1m @ 1.25% Ni from 36m depth

- 23QDD003: 13m @ 0.76% Ni from 21m depth, including 1m @ 1.53% Ni from 23m depth

- 23QDD001: 4m @ 1.5% Ni from 29m depth

- Potential for direct transportation and shipping of high-grade zones of the orebody without beneficiation

- High-grade cobalt in 23QDD008 exhibits good nickel-cobalt ratios (~10:1)

- High-grade nickel and cobalt in the oxide zone might be an indication of potential disseminated nickel mineralisation within the untested primary zone

- Hole 23QDD008 encountered the highest grade nickel and cobalt so far at Quicksilver

Golden Mile’s Managing Director Damon Dormer said “These are spectacular intersections and the highest nickel grade we have ever encountered at Quicksilver. The results indicate that we have a significantly higher-grade zone within the overall Resource with the potential of disseminated nickel mineralisation within the untested primary zone. This may provide an opportunity for direct transportation and shipping of high-grade zones of the orebody to provide early cash flow while constructing the beneficiation plant and accelerating project timelines.”

Quicksilver Nickel-Cobalt Project

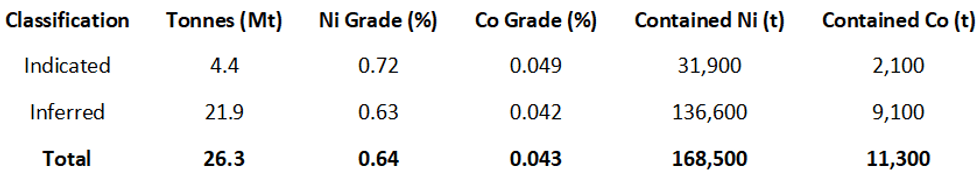

The Quicksilver Nickel-Cobalt Project (“the project”; “Quicksilver”) is located near the town of Lake Grace (approximately 300km SE of Perth) on privately owned farmland in an area with excellent local infrastructure. The project is an oxide clay hosted Nickel-Cobalt deposit with an Indicated and Inferred Resource of 1:

cut-off grade >0.5% Ni or >0.05% Co

Further to the defined Resource, Quicksilver has confirmed mineralisation of Rare Earth Elements2 (REE’s) and significant high-grade Scandium3 (Sc) within the Resource envelope.

Metallurgical Diamond Drill Programme

The metallurgical diamond drilling programme4 was conducted to deliver a bulk sample for the Stage 3 metallurgical testwork programme. The drilling programme resulted in a total of 8 holes for 548.9m of PQ size diamond core. The PQ size was selected to deliver the highest quality and most representative sample of the orebody as well as maximise the mass for the Stage 3 metallurgical testwork programme.

Assay Results

The priority 1 assays from the diamond drill programme have returned wide zones of nickel mineralisation, including high-grade nickel and cobalt, hosted within the upper and lower saprolite oxide zones. The best nickel results from the Metallurgical PQ Diamond Drilling are shown in Table 1 with the positioning of the holes relative to the resource outline in Figure 1.

Click here for the full ASX Release

This article includes content from Golden Mile Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18 February 2025

Golden Mile Resources

Multiple exploration opportunities across base and precious metals in Australia and the US

Multiple exploration opportunities across base and precious metals in Australia and the US Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00