March 21, 2023

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to provide an exploration update on the Everleigh Target Area.

Highlights

- Quartz reef veining has been discovered that is returning high grade gold results in rock chip samples.

- Gold in specimen stone has been found very close to source.

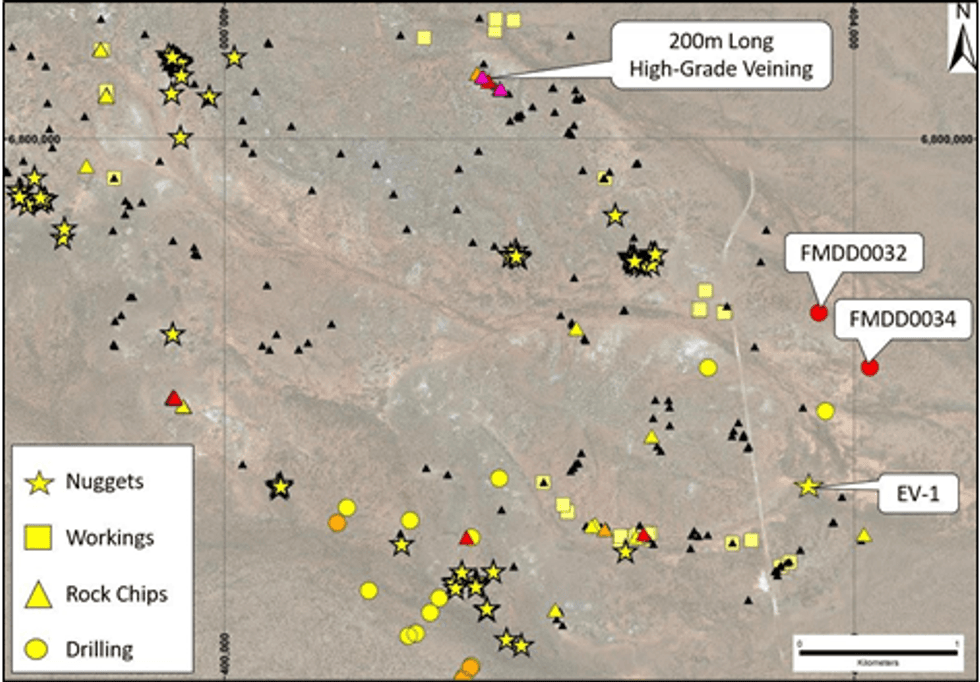

- Gold nuggets discovered across the Everleigh target area.

- Fieldwork remains focused in the Everleigh and Guyer target areas, defining targets for follow up.

Technical Director Dave Nixon commented:

“The high-grade gold in quartz veining and the gold bearing specimen stone discovered at Everleigh are strong indicators for the presence of reef gold mineralisation”.

“The 200m long gold bearing quartz vein is in-situ and the specimen stone with visible gold is very close to source, indicating that these locations have an increased probability for the discovery of quartz reef gold mineralisation”.

“The gold in the Everleigh specimen EV-1 is now confirmed to have a lower gold fineness that is more characteristic of an epizonal style of gold mineralisation more akin to the deposits of the Golden Mile in Kalgoorlie”.

“The combined data for the gold nuggets, specimen stone, gold in drilling and rock chip geochemistry forms a compelling focus for Iceni within the Everleigh target area”.

“Geological fieldwork is continuing at the Everleigh and Guyer target areas to define drill targets for follow-up exploration work.”

Specimen Stone from Everleigh Well

Gold in specimen stone has been recovered from the Everleigh target area. This is a significant result because the specimen stone is coarse and angular indicating it has not been transported far from source. Searching in the general area of the finds has located outcropping rock that is similar to the host material within the specimen stone. Further sampling is planned in this area.

Specimen stone EV-1 was previously found near diamond drillholes FMDD0032 and FMDD0034. The specimen was analysed to identify any characteristics that can assist the search for mineralisation.

Analysis by Orexplore involved the x-ray imaging of EV-1 to identify the internal distribution of gold within the specimen. The analysis identified two types of gold. The first type has a fine disseminated texture throughout the quartz. The second type is confined to the outer surface and along penetrative fractures through the specimen.

Analysis by Portable Spectral Services involved surface scanning of the specimen to identify the composition of the gold. The first type of gold has a low gold-silver ratio that is consistent with the known early epizonal styles of mineralisation within the Yilgarn. The second type of gold has a high gold-silver ratio, which is consistent with expected supergene modification of existing gold.

Click here for the full ASX Release

This article includes content from Icenic Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00