May 28, 2023

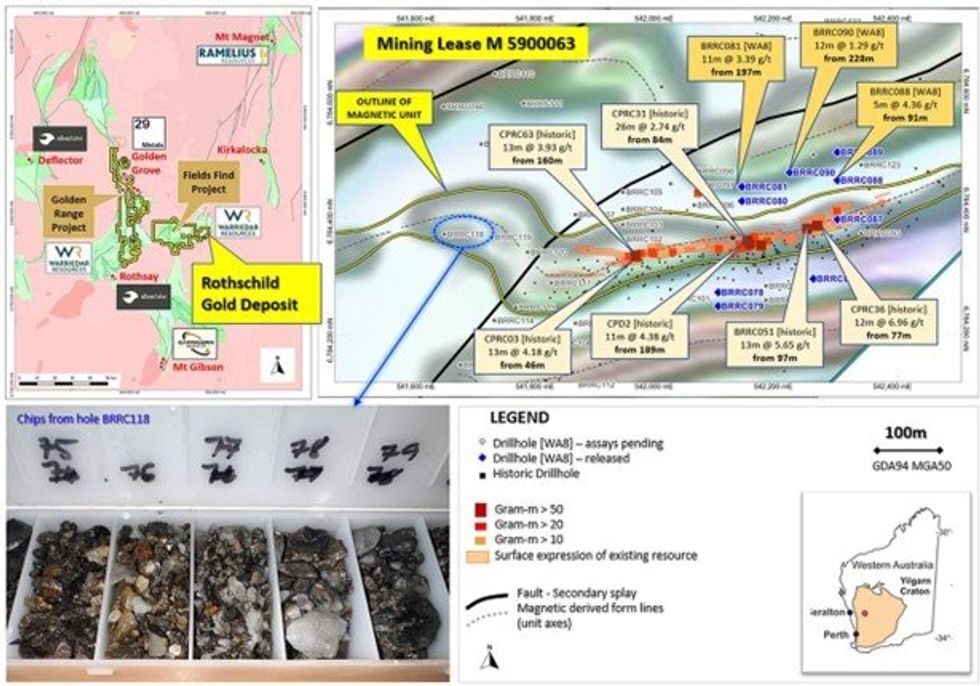

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on assay results received for a further five (5) drill holes from the Rothschild deposit, part of the ongoing Reverse Circulation (RC) drilling program at its Fields Find Project in the Murchison province of Western Australia (refer Figure 1).

HIGHLIGHTS:

- Second set of assay results comprising a further five (5) drill holes at the Rothschild deposit within the Fields Find Project.

- High-grade extensional intercepts returned including 5m @ 4.36 g/t Au from 91m, 12m @ 1.61g/t Au from 179m, and 12m @ 1.29 g/t from 228m.

- Further demonstration of substantial, multi-lode growth potential at Rothschild, both along strike and at depth; with mineralization extended to 220m below surface.

- Initial drilling program at Rothschild of 47 RC holes for 7,529m is now complete; assays for 38 holes are pending and expected to be received during the second half of June.

- Excellent results to date at Rothschild have encouraged acceleration of scout-drilling targeting ‘Rothschild analogues’, with similar or better geophysical responses, within the camp-scale setting of the ML that overlays that part of the Fields Find Project.

- Drilling of these high-potential targets is expected to commence during Q3 CY2023.

These results further demonstrate deposit extension at depth and, together with the initial assays released (see WA8 ASX announcement dated 28 April 2023), confirm Warriedar’s interpretation that the Rothschild deposit is much larger than currently defined in terms of both strike and depth extent.

Key intervals returned include (refer Table 1, and Figures 1, 4 and 5):

- 5m @ 4.36 g/t Au from 91m (BRRC088), ending in mineralisation;

- 12m @ 1.61g/t Au from 179m (BRRC089); and

- 12m @ 1.29 g/t Au from 228m (BRRC090), ending in mineralisation with assays from the last 32m pending.

The Rothschild deposit is one of several prospects within a larger camp-scale gold play, on the eastern side of the Fields Find Project (refer Figure 2). Ongoing success at Rothschild has encouraged the Company to bring forward scout-drilling of geophysically-targeted ‘Rothschild analogues’ within the wider existing Mining Lease (ML) that overlays that part of Fields Find.

Further assay results from Rothschild extensional drilling

The initial drilling program at Rothschild, which is now complete, was 47 RC holes for 7,529m. Results have now been received and released for 9 holes (the first 4 holes in WA8 ASX release dated 28 April 2023, and a further 5 holes in this release).

Figure 1: [TOP LEFT] REGIONAL SCALE: The location of Rothschild on the eastern side of the Fields Find Project, within the broader context of the operating mines and advanced exploration projects within the Murchison. [RIGHT]: DEPOSIT SCALE – plan view of the existing resource and the locations of the holes drilled this year and historically. Gold assay results coloured by gram-m value (for historic significant intervals, see ASX Announcement 28 November 2022). The resource exhibits good continuity along strike. Drilling by the company has increased the depth extent of the deposit. The magnetic data would suggest the unit hosting the gold extends west of the fault. Drillholes BRRC118-120 were designed to test this hypothesis. BRRC118 intersected strong sulphides. See photo of the chip tray BOTTOM LEFT, chips for 74 to 79m downhole shown. Assays pending will inform the scale potential of the deposit. Underlying image = semi-transparent residual RTP magnetic data (using the 50m spaced survey over the prospect, 1999, survey 60712).

Two of the holes announced in this release failed to reach target depth due to excess water (drillholes BRRC086 and BRRC087). The remaining three holes intersected the target zone and extended the known depth of gold mineralisation (BBRC088, BBRC089 and BBRC090; refer Table 1 for full results).

Figure 3 shows the coverage of the 2023 drilling program completed to date at Rothschild. The location of the five holes with assays released in this announcement are highlighted in yellow (target depth achieved) and purple (target depth not achieved). Cross sections are shown in Figures 4 and 5.

The mineralization intersected in drillhole BRRC090 is 220m below surface (vertical depth), refer to Figure 5. The final 1m sample in the hole returned 3.12 g/t (240m downhole) with assays for the final 32m of the hole still pending. This 12m interval at > 1 g/t Au at 230m below surface, more than doubles the previously understood depth extent of the mineralization.

Click here for the full ASX Release

This article includes content from Warriedar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00