May 28, 2023

Forrestania Resources Limited (ASX:FRS) (Forrestania or the Company), is undertaking an entitlement issue to eligible shareholders on the basis of two (2) new fully paid ordinary shares (shares) for every five (5) shares held on the record date, at $0.07 per share, together with 1 for 1 free option (proposed to be listed) (option) with an exercise price of $0.15 each on/or before 30 June 2026 to raise up to ~$1.94 million before expenses (Entitlement Issue or Offer).

- Fully underwritten Entitlement Issue on the basis of 2 new shares for every 5 held at $0.07 per share to raise ~$1.94 million before expenses.

- Each share subscribed in the offer will be issued with 1 free option (proposed to be listed) exercisable at $0.15 each on/before 30 June 2026.

- Offer strongly supported by Board of Directors - commitment to subscribe for entitlements and priority sub-underwriting agreements for a total of $194,000.

- Proceeds will be used to advance drilling and exploration programmes at the Company’s Forrestania and Eastern Goldfields projects in Western Australia.

- At Forrestania, priority lithium targets will be drilled at Giant, Calypso and South Iron Cap East

- In the Eastern Goldfields, the focus will be on defining drill targets on multiple known pegmatite outcrops, including at the Balarky Prospect.

- Funds will also be used to formalise and progress the recently announced Joint Venture with ALX Resources Corporation on the Hydra Lithium Project in the James Bay region of Canada, where exploration is set to commence on 31 May 2023.

Managing Director, Michael Anderson, commented:

“Having recently expanded our portfolio in WA and extended our reach into the James Bay region of Canada, the Company now has significant discovery potential in two of the world’s most fertile lithium exploration jurisdictions.

With three highly prospective projects to progress at Forrestania, Eastern Goldfields and Hydra, we are focused on working systematically and proactively, and this funding will allow us to do justice to the potential that we see.

We are excited that fieldwork will start in Canada in just a few days’ time, and when combined with our ongoing work at Forrestania and in the Eastern Goldfields, we expect to deliver substantial news flow over the coming months from all three projects”.

Offer Details

The Offer is for two (2) new shares for every five (5) shares held on the record date, at $0.07 per share, to raise up to ~$1.94 million before expenses. Shareholders will receive one (1) free option for every one (1) share subscribed and issued. Each option will have an exercise price of $0.15 each with an expiry date of 30 June 2026. The Company will apply for quotation of the options, subject to approval by ASX.

The issue price of $0.07 per share is a 9.7% discount to the 10-day VWAP of $0.078 per share and a 11.6% discount to the 30-day VWAP of $0.079.

Eligible Shareholders may also apply (in excess of their Entitlement) for new shares and options not subscribed for by other Eligible Shareholders pursuant to the Offer (Shortfall Offer), on the same terms as the Entitlement Offer.

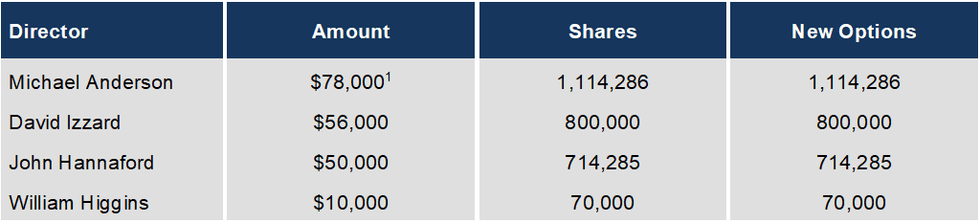

The Directors of Forrestania have indicated that they will be supporting the Offer to the following amounts:

RM Corporate Finance Pty Ltd has been appointed as Lead Manager and Underwriter to the Offer. The Offer is available to all shareholders registered at 5.00 (Perth time) on 2 June 2023 (Record Date) whose registered address is in Australia or New Zealand (Eligible Shareholders). The Entitlement Offer will close at 5.00pm (Perth time) on 21 June 2023 (unless extended).

The Company will lodge a prospectus with ASIC today, Monday 29 May 2023 which will contain all relevant details of the Offer (Prospectus).

Use of proceeds

Proceeds from the Offer will primarily be used to advance lithium focused exploration at the Company’s WA Projects (Forrestania and Eastern Goldfields). See below for further details of the planned exploration programmes.

A portion of the funds will also be used to make payment to ALX Resources Corporation as part of the consideration to formalise the proposed Joint Venture on the Hydra Lithium Project in the James Bay Region of Quebec, Canada (see announcement from 8 May 2023) with remaining proceeds used for general working capital purposes and to meet the fees and expenses of the offer.

Click here for the full ASX Release

This article includes content from Forrestania Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00