Founders Metals Inc. (TSXV: FDR,OTC:FDMIF) (OTCQX: FDMIF) (FSE: 9DL0) ("Founders" or the "Company") announces drill results from the Lower Antino Target at the Antino Gold Project ("Antino" or the "Project") in southeastern Suriname. Hole LA041 returned 90.0 metres (m) of 1.02 grams per tonne (gt) gold (Au), including 1.0 m of 28.44 gt Au - the highest-grade single drill intercept at Lower Antino to date. The results suggest gold mineralization at Lower Antino occurs over multiple 15-90+ metre wide, sub-parallel gold zones along ~1.9 kilometres of strike with opportunity to grow.

Lower Antino Highlights

- Large-scale gold system confirmed: Intrusion-hosted orogenic gold system comprising several broad gold zones along ~1,900 m of strike and to 350 m depth

- Consistent grade over wide intercepts: 90.0 m of 1.02 g/t Au (LA041) and 30.9 m of 1.56 g/t Au (LA032) are excellent examples of broad mineralized intervals at Lower Antino; other previously released intervals include 81.9 m of 1.01 g/t Au (LA003) and 50.0 m of 1.02 g/t Au (LA024)

- High-grade zones present: LA041 includes 1.0 m of 28.44 g/t Au, supporting potential for higher-grade shoots within the broader mineralized system; historical grab samples up to 340 g/t Au and channel samples up to 21 g/t Au have been reported

- Significant oxide opportunity: Average saprolite/oxide thickness of 50 m across the target area provides meaningful potential for scalable oxide gold mineralization

- Open for expansion in all directions: Trench results 800 m south of current drilling returned 29.0 m of 0.51 g/t Au and 10.0 m of 0.68 g/t Au, demonstrating significant southward growth potential. Pending drill results confirm an additional 100 m expansion to the south of the mineralized body.

Founders President & CEO, Colin Padget, commented, "The 90-metre intercept in LA041 is our strongest result to date at Lower Antino and reinforces our view that this is a large-scale gold system. The 28 g/t high-grade interval within this intercept is equally significant — it confirms the potential for higher-grade zones that we first identified from surface sampling. With 50 metres of oxide cover and mineralization open to the south, Lower Antino offers both near-surface bulk tonnage potential and high-grade upside. We are ramping up 2026 operations with three rigs now turning and expect to release our 2026 exploration plans in the near future, along with additional results from 2025 drilling."

Geological Discussion

Gold mineralization at Lower Antino occurs within altered and sheared tonalite, a type of intrusive rock that is a common host for gold deposits in the Guiana Shield. The gold is associated with abundant disseminated pyrite (up to 15%) and quartz veining, with gold concentrations often consistently distributed across broad intercepts. The drill-defined system aligns with a greater than 2 km geophysical anomaly identified from IP surveys and similar scale gold geochemical anomaly, indicating the potential footprint extends well beyond current drilling.

Mineralized intervals appear to be generally increasing in width as we continue to drill further south, and the system remains open for expansion. Trenching 800 m beyond current drill extents returned 29.0 m of 0.51 g/t Au and 10.0 m of 0.68 g/t Au, and recent drilling 100 m further south shows similar mineralization to the holes in this release with assays pending. The system continues to expand with drilling, reinforcing Lower Antino's emergence as a significant gold target and potential companion to Upper Antino's high-grade shear hosted vein mineralization.

Importantly, high-grade zones exist within the broader system. LA041 includes 1.0 m of 28.44 g/t Au, and historical sampling has returned grades up to 340 g/t Au in grab samples and 21 g/t Au in channel samples. These results indicate potential for higher-grade targets that could enhance future potential economics of the bulk tonnage system. Additionally, the weathered surface layer (saprolite) averages 50 m thick across the target, presenting a near-surface oxide gold opportunity amenable to lower-cost extraction methods.

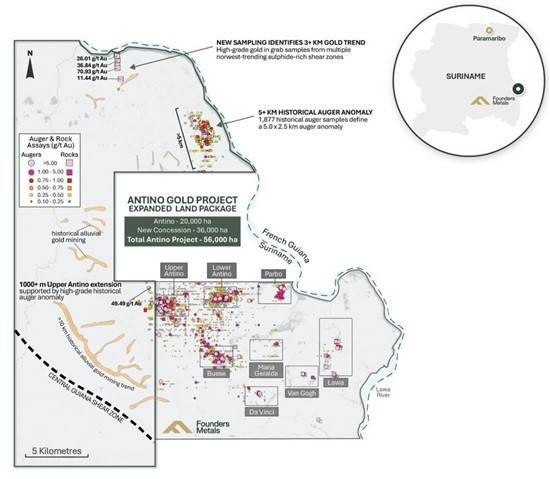

Figure 1: Antino Gold Project Property Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7574/281234_foundersfig1.jpg

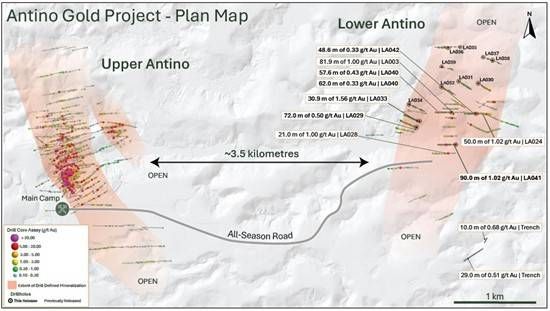

Figure 2: Lower Antino Plan Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7574/281234_foundersfig2.jpg

Table 1: Drill Hole Assay Results

| Drillhole | From (m) | To (m) | Interval (m) | Au (g/t) |

| 25LADD042 | 0.00 | 48.60 | 48.60 | 0.33 |

| and | 103.00 | 109.00 | 6.00 | 0.62 |

| 25LADD041 | 156.00 | 246.00 | 90.00 | 1.02 |

| and | 256.00 | 280.00 | 24.00 | 0.42 |

| 25LADD040 | 0.00 | 57.60 | 57.60 | 0.43 |

| and | 109.00 | 149.00 | 40.00 | 0.33 |

| and | 187.00 | 199.00 | 12.00 | 0.30 |

| and | 208.00 | 270.00 | 62.00 | 0.33 |

| 25LADD039 | 230.00 | 232.00 | 2.00 | 2.65 |

| 25LADD038 | 122.00 | 127.00 | 5.00 | 0.57 |

| 25LADD037 | NSA | |||

| 25LADD036 | 112.00 | 118.00 | 6.00 | 0.37 |

| 25LADD035 | NSA | |||

| 25LADD034 | 110.00 | 136.00 | 26.00 | 0.35 |

| 25LADD033 | 0.00 | 8.10 | 8.10 | 0.85 |

| and | 29.10 | 60.00 | 30.90 | 1.56 |

| 25LADD032 | 89.00 | 103.00 | 14.00 | 0.46 |

| and | 155.00 | 163.00 | 8.00 | 0.30 |

| 25LADD031 | NSA | |||

| 25LADD030 | 237.00 | 239.00 | 2.00 | 3.19 |

| 25LADD029 | 138.00 | 210.00 | 72.00 | 0.50 |

| and | 247.00 | 275.00 | 28.00 | 0.56 |

*Intervals are down-hole depths. True widths of mineralization are estimated to be approximately 85% of the down-hole interval based on currently available results and observations. All are diamond drill holes. Interval average grades are calculated with un-capped gold assays, as insufficient drilling has been completed to determine capping levels for higher grade gold intercepts. Average widths are calculated using a 0.10 g/t gold cut-off grade with <5.0 m of internal dilution of zero grade, and a minimum composite length of 2.0 m. Intervals below 1.0 gram-metre or with average grade below 0.2 g/t Au are not reported.

Table 2: Drill Hole Locations

| Hole ID | Easting (m) | Northing (m) | Elevation (m) | Azimuth (°) | Dip (°) | Depth (m) |

| LA042 | 821858.04 | 401731.51 | 125.23 | 270.00 | -50.10 | 200.00 |

| LA041 | 821619.38 | 401365.37 | 171.11 | 270.10 | -50.20 | 330.56 |

| LA040 | 821568.72 | 401747.58 | 147.49 | 270.20 | -45.30 | 272.00 |

| LA039 | 821454.51 | 402292.11 | 168.56 | 110.10 | -50.30 | 233.09 |

| LA038 | 822056.55 | 402366.44 | 168.96 | 110.00 | -50.00 | 199.72 |

| LA037 | 821944.45 | 402404.97 | 158.84 | 110.00 | -50.20 | 211.86 |

| LA036 | 821530.21 | 402514.81 | 140.28 | 269.90 | -50.20 | 253.88 |

| LA035 | 821671.26 | 402526.41 | 127.10 | 270.10 | -50.20 | 280.96 |

| LA034 | 821069.23 | 401845.17 | 176.14 | 110.00 | -49.90 | 311.12 |

| LA033 | 821194.74 | 401644.14 | 128.66 | 290.00 | -50.00 | 290.19 |

| LA032 | 821451.92 | 402050.23 | 133.85 | 120.10 | -50.30 | 308.18 |

| LA031 | 821656.00 | 402112.55 | 125.87 | 120.00 | -50.00 | 278.00 |

| LA030 | 821887.71 | 402089.22 | 131.956 | 120.40 | -50.00 | 250.78 |

| LA029 | 821156.87 | 401572.83 | 129.21 | 290.10 | -50.00 | 301.84 |

*The coordinate reference system is WGS 84, UTM zone 21N (EPSG 32621)

About Founders Metals Inc.

Founders Metals is a Canadian-based exploration company focused on advancing the Antino Gold Project located in Suriname, South America, in the heart of the Guiana Shield. Antino is 56,000 hectares and has produced over 500,000 ounces of gold from historical surface and alluvial mining to date1. The Company is systematically advancing one of Suriname's most promising gold exploration and development opportunities with drill-confirmed, district-scale potential. Founders is committed to responsible exploration, community engagement, and delivering long-term value to shareholders through technical excellence and strategic growth in the Guiana Shield.

12022 Technical Report - Antino Project; Suriname, South America. K. Raffle, BSc, P. Geo & Rock Lefrançois, BSc, P.Geo.

ON BEHALF OF THE BOARD OF DIRECTORS,

Per: "Colin Padget"

Colin Padget

President, Chief Executive Officer, and Director

Contact Information

Katie MacKenzie, Vice President, Corporate Development

Tel: 306 537 8903 | katiem@fdrmetals.com

Harp Gosal, Director, Investor Relations

Tel: 236 301 4211 | harpg@fdrmetals.com

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation, including statements regarding long term value creation and Company's prospects. Forward-looking information can generally be identified by words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", or variations indicating that certain actions, events or results "may", "could", "would", "might" or "will" occur or be achieved.

Forward-looking statements are based on management's current expectations and reasonable assumptions but are subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results to differ materially from those expressed or implied, including: general business and economic uncertainties; exploration results; mining industry risks; and other factors described in the Company's most recent annual management discussion and analysis. Although the Company has attempted to identify important factors that could cause actual results to differ materially, other factors may cause results not to be as anticipated. There can be no assurance that forward-looking information will prove accurate, as actual results and future events could differ materially from those anticipated. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information except in accordance with applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

All material information on Founders Metals can be found at www.sedarplus.ca.

Qualified Persons

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc., P.Geol., P.Geo., an independent qualified person as defined by National Instrument 43-101.

Quality Assurance and Control

Samples were analyzed at FILAB Suriname, a Bureau Veritas Certified Laboratory in Paramaribo, Suriname (a commercial certified laboratory under ISO 9001:2015). Samples are crushed to 75% passing 2.35 mm screen, riffle split (700 g) and pulverized to 85% passing 88 µm. Samples were analyzed using a 50 g fire assay (50 g aliquot) with an Atomic Absorption (AA) finish. For samples that return assay values over 5.0 grams per tonne (g/t) Au, another cut was taken from the original pulp and fire assayed with a gravimetric finish. Founders Metals inserts blanks and certified reference standards in the sample sequence for quality control. External QA-QC checks are performed at ALS Global Laboratories (Geochemistry Division) in Lima, Peru (an ISO/IEC 17025:2017 accredited facility). A secure chain of custody is maintained in transporting and storing of all samples. Drill intervals with visible gold are assayed using metallic screening. Rock chip samples from outcrop/bedrock are selective by nature and may not be representative of the mineralization hosted on the project.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281234