October 02, 2023

Heavy Rare Earths Limited (“HRE” or “the Company”) is pleased to report a very substantial growth in Mineral Resources at its 100 per cent-owned Cowalinya rare earth project in the Norseman-Esperance region of Western Australia.

Highlights

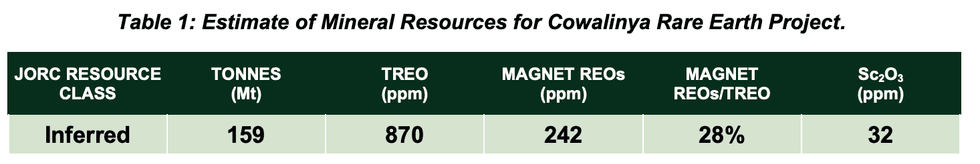

- JORC (2012 Edition) Inferred Mineral Resources for the Cowalinya rare earth project now estimated to be 159 million tonnes @ 870 ppm TREO at a cut-off grade of 400 ppm TREO-CeO2

- This result represents an increase of:

- 468% in resource tonnes

- 39% in grade

- 690% in contained rare earths

on the project’s maiden 2022 Mineral Resources of 28 million tonnes @ 625 ppm TREO at the lower cut-off grade of 300 ppm TREO-CeO2

- Total contained rare earths of 138,290 tonnes (on a TREO basis)

- Significantly, the valuable magnet rare earth component of Cowalinya has increased from 25% to 28%

- Resource upgrade achieved by grid drilling 14,438 metres in 509 holes on 19% of HRE’s total land position

- Resource excludes multiple rare earths-rich drill intercepts up to 14 kilometres from the resource

- Maiden Exploration Target for Cowalinya in advanced preparation

- Downstream metallurgical flowsheet development in progress to produce Mixed Rare Earth Carbonate (MREC) product samples for customer engagement

TREO = La2O3+CeO2+Pr6O11+Nd2O3+Sm2O3+Eu2O3+Gd2O3+Tb4O7+Dy2O3+Ho2O3+Er2O3+Tm2O3+Yb2O3+Lu2O3+Y2O3

Magnet REOs = Pr6O11+Nd2O3+Tb4O7+Dy2O3

Reported above a cut-off grade of 400 ppm TREO-CeO2

HRE Executive Director Richard Brescianini said, ”Today, we have delivered the first key milestone for our Cowalinya rare earth project just 13 months since Heavy Rare Earths listed on the ASX.

“Mineral Resources for Cowalinya now stand at 159 million tonnes, and pleasingly we have seen a 39% grade increase to 870 parts per million of rare earth oxides. This has been achieved on just 19% of our total land position. We have also intersected thick rare earth- rich horizons in drilling up to 14 kilometres from our resource zone1 and very much look forward to presenting the project’s maiden Exploration Target in the near future.

“I also note a material increase in the valuable magnet rare earth component of the resource to 28%. This is best in class amongst clay-hosted resources in Australia.

“Today’s exceptional result sets a solid foundation in demonstrating the potential for a long- life rare earth development project at Cowalinya.”

Click here for the full ASX Release

This article includes content from Heavy Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HRE:AU

The Conversation (0)

06 September 2022

Heavy Rare Earths

Rare Earth Elements in Western Australia and the Northern Territory

Rare Earth Elements in Western Australia and the Northern Territory Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00