FireFox Gold Corp. (TSXV:FFOX)(OTCQB:FFOXF) ("FireFox" or the "Company") is pleased to report the results from its second reconnaissance diamond drilling campaign at its 100%-held Sarvi Gold Project in Lapland, Finland

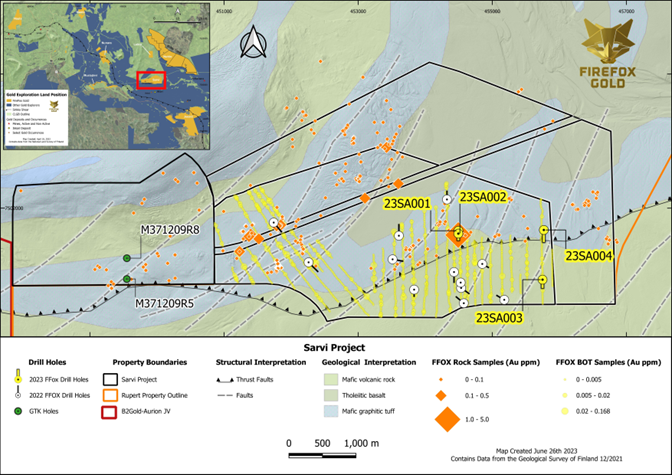

This drilling campaign included four drill holes, totalling 611 metres. These holes were designed to test a combination of geochemical anomalies (till and rock sampling) and structural/geological targets (See Figure 1). The drilling was not successful in identifying high-grade gold, but the drill holes did encounter quartz-carbonate (tourmaline) veining with sulphides, as well as sulphide-bearing carbonaceous sediments above a contact with mafic volcanic rocks.

FireFox's CEO, Carl Löfberg, commented, "We are pleased that this program, despite having been cut short due to spring snow conditions, has provided significant information to advance our understanding of this high-priority property. We have identified attractive host lithologies and low levels of mineralization, while also confirming that more till sampling is essential to our drill targeting. We are now planning our winter till sampling program to continue our systematic exploration at Sarvi. In the meantime, the team is excited to focus on the upcoming drill results from our Mustajärvi project, where we are confident that we will continue to grow our high-grade East Target."

Overall, these drill results were similar to the first phase of drilling in 2022 (see Company news release dated May 27, 2022). A few highlights from the drill hole analyses follow:

- Weakly anomalous gold in two of the four holes, with no values above 0.100 g/t;

- Widespread areas of anomalous copper, including narrow intercepts of 841, 652, and 605 ppm;

- Anomalous multielement geochemistry in all holes, generally consistent with the till results:

- Elevated silver (Ag), arsenic (As) antimony (Sb), copper (Cu), bismuth (Bi), molybdenum (Mo), tellurium (Te), zinc (Zn), and other elements; and

- Drill hole 23SA004 passed through a fault zone with polymetallic enrichment and weakly anomalous gold, including:

- 2.23 ppm Ag, 652 ppm Cu, 1,680 ppm Zn, and 0.044 g/t Au over 1.35m from 16.0m depth.

The most important finding from this phase of drilling is that the mudstones and black shales at Sarvi are likely the best hosts for gold, silver, and base metal mineralization. This is consistent with previous drilling on the property completed by the Geological Survey of Finland (GTK) in 2009. Assays from two historical holes located approximately 5km west of FireFox's Phase 2 drill holes reportedly include 1.6 metres averaging 1.1 g/t Au from 26.4 metres depth (drill hole M371209R5) and 0.5 metres averaging 3.57 g/t Au from 69.5 metres depth (drill hole M371209R8). [This drilling was carried out by previous operators and has not been independently verified by the Company's Qualified Person. Reported intervals are core lengths and true thickness has not been estimated at this time.] The FireFox team is reviewing the historical drill core from these holes. The preliminary interpretation is that these intercepts occur in similar metasedimentary rocks to those hosting low-grade gold, silver, and base metals elsewhere at Sarvi. This geological unit appears to extend across the Sarvi permits, creating target settings on which to focus future exploration where this metal rich stratigraphy is cut by late-stage faulting.

In the upcoming exploration season, FireFox intends to extend base-of-till (BoT) sampling into new areas and increase the sampling density with a focus on the metasedimentary rock package. Interpreted structures and/or magnetic anomalies that are believed to cut the black shales and mudstones will be the highest priority for more sampling and drilling.

Figure 1 - Sarvi Project: Drill Holes, BoT, and Rock Samples Over Geology

Project and Program Details

The Sarvi Project ("Sarvi") is part of the Company's large land package immediately north of Rupert Resources' Area 1 Project (Ikkari Deposit). The project is centred on the Sarvi exploration permit and includes two additional exploration permits, Sarvi-2 to the north and Keulakko to the west, for a total permitted area of 21 km2. The Sarvi permits cover a portion of the Kittilä Suite of volcanic rocks, which is cut by several interpreted faults. The project is at a very early stage; however, the geological understanding has been advanced through a compilation of detailed magnetics from both drone-based and ground surveys combined with almost 1,600 BoT samples and a total of 2938.8 metres of drilling. Much of the property is covered by glacial sediments, so outcrop is rare, but the technical team has identified a number of structures and lithologic contacts as targets based on detailed magnetics data.

Drill holes 23SA001 and 23SA002 were collared 42 metres apart and drilled in a south oriented drill fence. The holes tested a steep magnetic gradient that is coincident with a surface rock sample that yielded 1.47 g/t Au and 1.86% Cu (see Company news release dated August 24, 2021). These drill holes intersected mafic volcanic rocks including some evidence of shearing and folding with locally intense quartz-carbonate veining, including chalcopyrite, pyrite, tourmaline, and iron carbonate. Gold assays were all close to or below the detection limit, however, both holes returned multiple assays with elevated copper (>300pppm) including a high sample of 841ppm copper in 23SA002. This latter sample was accompanied by elevated cobalt (100.5ppm) and arsenic (105.5ppm).

Drill hole 23SA003 was collared approximately 1.4 kilometres southeast of 23SA001 and 23SA002. In this area, a magnetic high is apparently cut by late faulting and the BoT samples were anomalous in arsenic and copper. The drillhole was aimed to the south and passed through a thick section of mafic volcanic rocks. A two-metre interval starting at 132metres returned elevated copper with an average of 605ppm Cu.

Drill hole 23SA004 was located approximately 750 metres north from 23SA003. The target for this hole was a strong geochemical anomaly in the BoT sampling, including elevated silver, arsenic, bismuth, tellurium, and molybdenum. These elements are often enriched in Lapland gold systems. The hole intersected an interval of abundant pyrite in graphite-bearing mudstones and black shales above a gradational contact with the underlying volcanic rocks. The drill hole passes into mafic volcanic rocks (likely tholeiitic basalts) at approximately 91m downhole and continuing until final depth of 235 metres. Establishing the presence of this contact between the sulphide-bearing mudstones and the basalt is very useful for ongoing work at Sarvi.

Results from this hole correspond well with the BoT geochemistry, with anomalous gold and the associated pathfinder elements above the contact with the volcanics. There were multiple narrow intervals in the hole with elevated silver, copper, cobalt, zinc and other elements. The best interval occurred near surface at 16.0m depth: 1.35m containing 2.23 g/t Ag, 0.044 g/t Au, 652 ppm Cu, 121.5 ppm, and 1,680 ppm Zn.

Table 1. Sarvi Drill Collar Data (coordinates presented in EPSG:3067)

Drill Hole ID | Easting | Northing | Final Depth (m) | Azimuth (˚) | Plunge (˚) |

23SA001 | 454494 | 7501662 | 109 | 180 | -45 |

23SA002 | 454493 | 7501620 | 116 | 180 | -45 |

23SA003 | 455749 | 7500934 | 151 | 180 | -45 |

23SA004 | 455768 | 7501675 | 235 | 180 | -45 |

Methodology & Quality Assurance

FireFox geologists selected individual intervals of drill core for analysis based on visible mineralization and/or alteration and/or structural deformation.

FireFox team members transported rock and core samples to an ALS sample prep lab in Sodankylä. The samples were then crushed to -2 mm, split and pulverized into 1kg pulps, before being shipped to the ALS facility in Rosia Montana, Romania for gold by fire assay of 50 gm aliquots with AAS finish (method Au-AA24). Multielement results are normally reported from ALS - Ireland from a four-acid digestion followed by ICP-AES analyses (method ME-ICP61).

ALS Laboratories is a leading international provider of assay and analytical data to the mining industry. All ALS geochemical hub laboratories, including the Irish facility, are accredited to ISO/IEC 17025:2017 for specific analytical procedures. The Firefox QA/QC program consists of insertion of blind certificated standard material and blanks into the analytical batches, and results reported here did not show deviations from recommended values.

Patrick Highsmith, Certified Professional Geologist (AIPG CPG # 11702) and director of the Company, is a qualified person as defined by National Instrument 43-101. Mr. Highsmith has helped prepare, reviewed, and approved the technical information in this news release.

About FireFox Gold Corp.

FireFox Gold Corp is listed on the TSX Venture Stock Exchange under the ticker symbol FFOX. FireFox also trades on the OTCQB Venture Market Exchange in the US under the ticker symbol FFOXF. The Company has been exploring for gold in Finland since 2017 where it holds a large portfolio of prospective ground.

Finland is one of the top mining investment jurisdictions in the world as indicated by its multiple top-10 rankings in recent Fraser Institute Surveys of Mining Companies. Having a strong mining law and long mining tradition, Finland remains underexplored for gold. Recent exploration results in the country have highlighted its prospectivity, and FireFox is proud to have a Finland based CEO and technical team.

For more information, please refer to the Company's website and profile on the SEDAR website at www.sedar.com.

On behalf of the Board of Directors,

"Carl Löfberg"

Chief Executive Officer

CONTACT:

FireFox Gold Corp.

Email: info@firefoxgold.com

Telephone: +1-778-938-1994

Forward Looking Statements

The information herein contains forward looking statements that are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in our forward-looking statements. Factors that could cause such differences include changes in world commodity markets, equity markets, costs and supply of materials relevant to the mining industry, change in government and changes to regulations affecting the mining industry.

Forward-looking statements in this release may include statements regarding: the intent to conduct additional drilling; the belief as to the location of the most prospective gold targets; the location of targets for future drill programs; and the current and future work program, including the extent and nature of exploration to be conducted in 2023. Although we believe the expectations reflected in our forward-looking statements are reasonable, results may vary.

The forward-looking statements contained herein represent the expectations of FireFox as of the date of dissemination and, accordingly, are subject to change after such date. Readers should not place undue importance on forward-looking statements and should not rely upon this information as of any other date. FireFox does not undertake to update this information at any particular time except as required in accordance with applicable laws.

SOURCE: FireFox Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/764522/FireFox-Gold-Reports-Results-from-Reconnaissance-Drill-Program-at-Sarvi-Project-Lapland-Finland