November 22, 2023

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide an update on its extensive work program being conducted on its 100% owned Horden Lake and BAGB battery metals projects in Quebec, Canada.

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide an update on its extensive work program being conducted on its 100% owned Horden Lake and BAGB battery metals projects in Quebec, Canada.

Highlights

- Exploration activities advance across the portfolio.

- 8,000 metre Horden Lake drill program on track for January 2024 mobilisation:

- Contract signed for 2 drill rigs.

- Drill pad and road access permits in place.

- Core logging and logistics for Val d’Or processing hub in place.

- Horden Lake historical core re-logging in progress:

- Over 18,000 metres of diamond core, including 2,237 of mineralised sections from the 2008 and 2012 campaigns, relocated to Val d’Or core facility.

- Samples being collected for mineralogical assessment.

- Magnetotelluric “MT” survey completed at the BAGB project:

- 44 test sites over 7.5km2 completed on schedule.

- Results expected early in 2024.

- The Company has $5.3m cash1, and consistent news-flow is expected as the Company executes its work programs across its properties.

Managing Director, Mr Fairhall said:

“I am very pleased to report on our preparations and progress as we advance the exploration program. Most importantly, drilling is on track for Horden Lake. This drilling, the first on the property in over a decade, will not only showcase the quality of the project already defined, but also begin to demonstrate the grade and tonnage potential improvements we see in the project.

Completion of the MT survey is another significant milestone. This is the first program of its kind completed on the property, specifically targeting a potential feeder system as the source for exceptional grades of Ni-Cu-PGM already discovered in shallow gabbroic intrusions that have been defined in the top 200-300 metres.

Investors have significant news-flow to look forward to as these work programs gather momentum in the weeks and months to come.

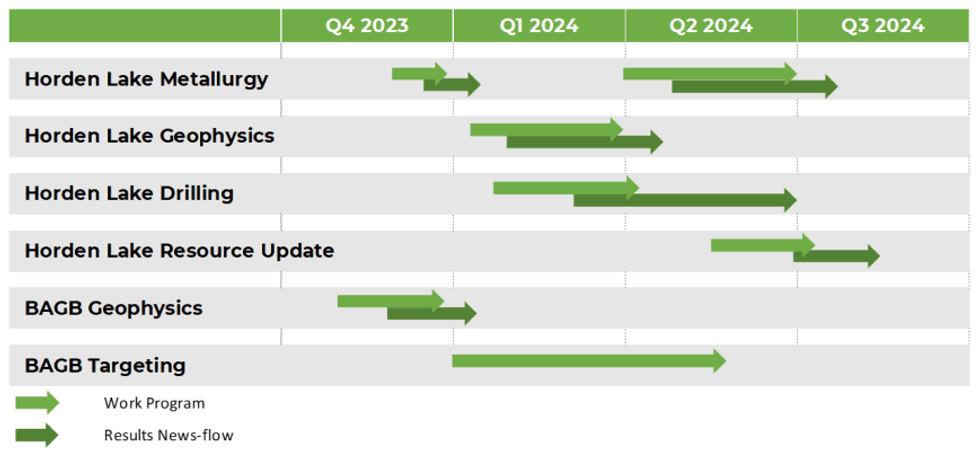

Figure 1: Pivotal Metals work program and news flow timeline

Horden Lake drill program

The Horden Lake project already hosts a 27.8Mt @ 1.49% CuEq Cu-Ni-PGM JORC compliant inferred (12.5Mt) and indicated (15.2Mt) mineral resource2 with considerable prospectivity remaining to expand and improve the deposit and de-risk its development potential.

Up to 8,000m of drilling is slated to commence in January 2024. Following a competitive tender process, the Company has contracted Orbit Garant Drilling Services “Orbit” for two diamond rigs, with the option for a third rig if required. Headquartered in Val-d’Or, Québec, Orbit is one of Canada’s largest drilling companies, with more than 217 drill rigs providing both underground and surface drilling services in Canada and internationally.

Ancillary preparations for the program are well advanced. Permits for drill pads and the access road are in place, and Pivotal has secured core storage, logging and preparation facilities in Val d’Or.

The winter program has three principal aims.

- Target increase in grade by collecting Au, Ag, Pt and Co by-product assay data for parts of the deposit that were not assayed for these metals in the past. Only the central part of the deposit has full multielement assay. The resource estimate currently constrains the gold wireframe to this area (consequently diluting grade across the entire resource). Ag, Pt and Co were assayed in the central part, but have not been domained in the model. Further assay for these metals will be collected and modelled in a future resource update.

- Target increase in tonnage by drilling open areas of limited density or open areas mineralisation that fall outside the 27.8 mt resource envelope. Downhole geophysics will be used to refine targets for further step�out drilling.

- Collect significant sample for metallurgical testwork, with the primary aim to support representative samples of the mineralised lithologies, and target collection of samples for future variability test work to support more detailed engineering studies.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00