April 21, 2024

Odessa Minerals Limited (ASX:ODE) (“Odessa” or the “Company”) is pleased to provide an update on its Lyndon Project (“Project”), located approximately 200km northeast of Carnarvon in Western Australia.

Highlights:

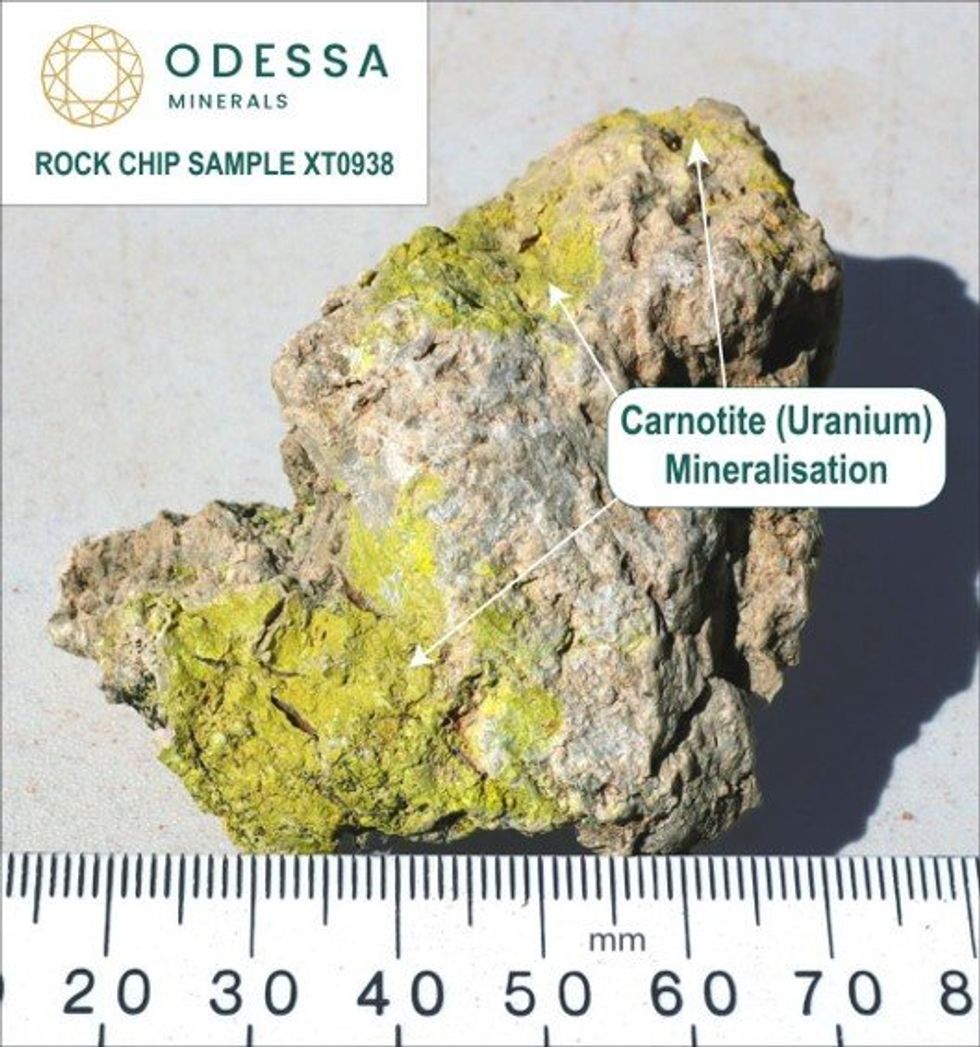

- Rock chip assay results up to 6,612ppm U3O8 at the Baltic Bore and Jailor Bore prospects

- 12 rock chips returned assays >1,000ppm U3O8

- 5 rock chips returned assays >1,000ppm V2O5

- Uranium anomalism spans strike lengths of 2.6km at Baltic Bore and 2km at Jailor Bore

- Lyndon Project Immediately adjoins Paladin Energy’s Carley Bore Uranium Project (15.6MLbs U3O8)

David Lenigas, Executive Director of Odessa, said:

“Results of our preliminary field work have returned outstanding uranium and vanadium results, confirming the presence of calcrete-type mineralisation across multiple prospects at the Lyndon Project. The results of this campaign have exceeded expectations through the discovery of the highest-grade uranium and vanadium results at the Project to date. Odessa is now focussed on assessing the extent of high-grade uranium mineralisation through follow-up field campaigns that will involve ground-based radiometric mapping and further sampling to generate drill-ready targets for sub-surface testing during Q3, in conjunction with the palaeochannel roll-front uranium drilling at the Relief Well prospect. With multiple radiometric targets outside of the Jailor Bore and Baltic Bore prospects remaining untested, the Company is excited to undertake further field programs to expand on this round of assay results.”

Click here for the full ASX Release

This article includes content from Odessa Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ODE:AU

The Conversation (0)

11 October 2023

Odessa Minerals

Uranium exploration in the Gascoyne Region of Western Australia

Uranium exploration in the Gascoyne Region of Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00