May 14, 2023

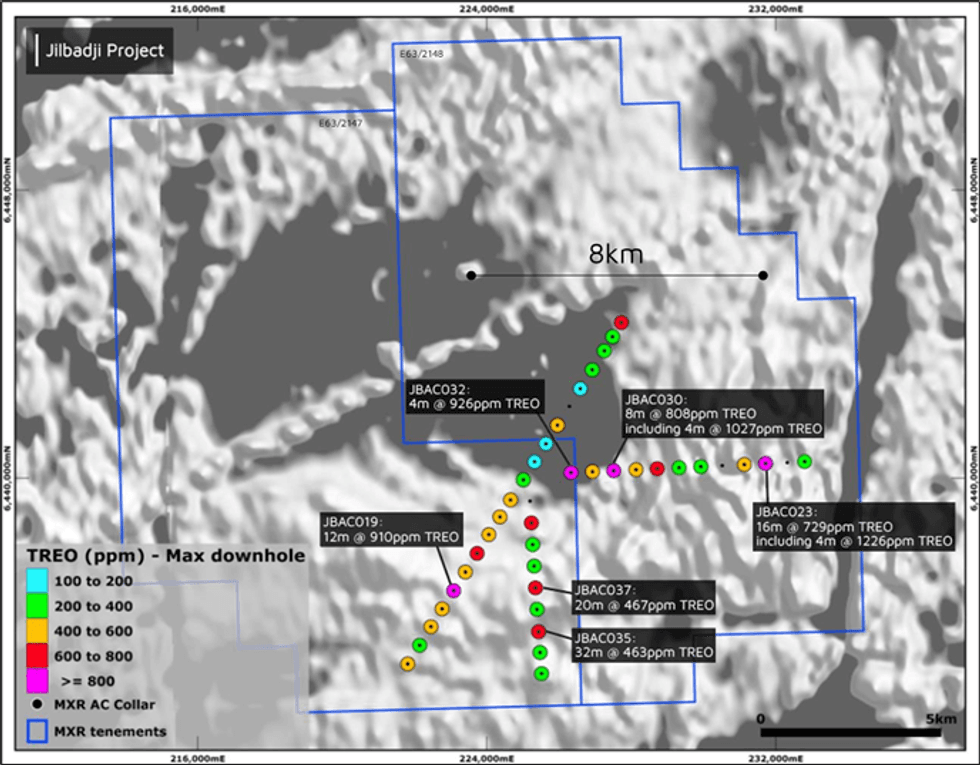

Maximus Resources Limited (‘Maximus’ or the ‘Company’, ASX:MXR) is pleased to provide an update on the completed aircore drill programme at the 311 km2 Jilbadji prospect (100% MXR) located ~25km east of Mt Holland, Western Australia.

- 600m-spaced reconnaissance aircore drill programme identifies widespread Rare Earth Element (REE) saprolite enrichment up to 1,296ppm Total Rare Earth Element Oxides (TREO)1.

- Extensive presence of elevated REEs over a vast area highlights the potential of discovering substantial rare earth elements across the Jilbadji prospect at Mt Holland, Western Australia.

- Significant drill intersections include:

- 16m @ 729ppm TREO from 20m, incl. 4m @ 1,226ppm TREO from 28m (JBAC023)

- 8m @ 808ppm TREO from 16m, incl. 4m @ 1,027ppm TREO from 16m (JBAC030)

- 12m @ 910ppm TREO from 12m (JBAC019)

- 32m @ 463ppm TREO from 12m (JBAC035)

- 4m @ 926ppm TREO from 12m and 4m @ 719ppm TREO from 24m (JBAC032)

- 20m @ 467ppm TREO from 8m (JBAC037)

- Mineralised intervals exhibit an average of 21 % Magnetic Rare Earth Oxides (MREO)2 and very low levels of penalty radionuclides elements - Uranium (1.9ppm UO2) and Thorium (18ppm ThO2).

Maximus’ Managing Director, Tim Wither commented “Our objective of the reconnaissance drill programme was to gain a better geological understanding of the magnetic and gravity features across the Jilbadji prospect.

It is encouraging to intersect elevated REE mineralisation in 37 of 41 completed aircore holes, across a broad saprolite zone, with a very large area still waiting to be explored. Following these results, we have started further analytical testing to understand the potential of the Jilbadji prospect.”

Jilbadji Prospect

Located within the Archaean Southern Cross Province of the Yilgarn Craton, the Jilbadji prospect encompasses a 20 km long arcuate magnetic trend. A 41-hole drill program (Figure 1) was completed to investigate the geological setting by drilling below the shallow transported cover and to gain an understanding of the magnetic and gravity anomalies.

The program involved drilling utilising existing vehicle tracks for 1,060 metres, at 600m drillhole spacing, along traverses intersecting the areas of maximum magnetic and gravity responses. Co-funding for the drill program, up to $90,000, was provided by the Western Australia Government Exploration Incentive Scheme (EIS).

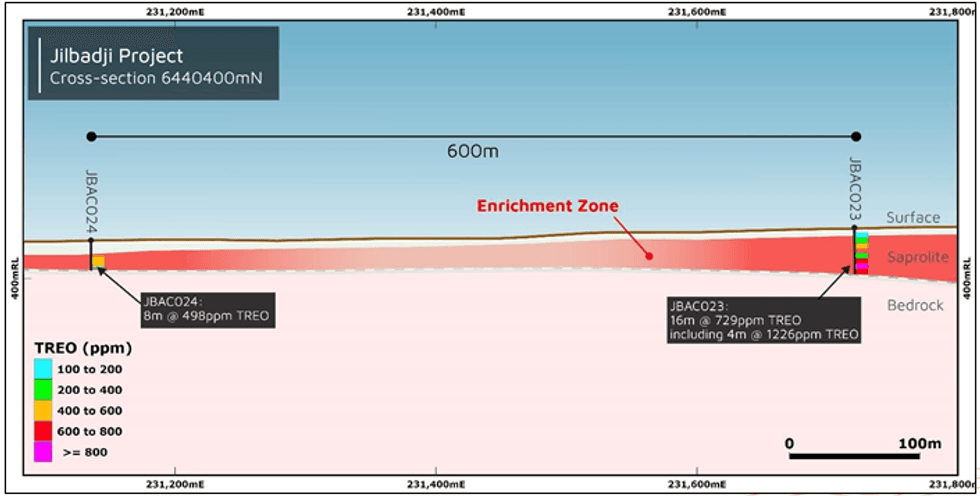

The drilling program revealed the presence of a regolith profile that includes a thin layer of transported cover (1-4 metres) and a thick saprolite layer with a vertical thickness ranging from 20 to 30 metres (Figure 2). The bedrock in the area is composed of metamorphosed granitic intrusions. The saprolite layer above the bedrock contains anomalous levels of REE (Table 1) displaying residual enrichment of REE.

The Company's next phase exploration effort will focus on the identification of residual clays within the preserved regolith profile.

To further the understanding of the REE mineralisation, the Company has submitted mineralised saprolite samples for analytical metallurgical tests to ascertain ionic clay composition. In addition, the Company intends to carry out petrographic and Scanning Electron Microscopy analysis (SEM), which aims to identify the REE mineral phases and assess the clay REE deportment.

Our next steps to perform mineralogical and geochemical testing will help us determine potential soluble REEs, which are typical of high-value clay-hosted ionic REE deposits and inform our decision-making going forward.

MXR:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00