March 03, 2025

A royalty company fully diversified in clean energy metals, Electric Royalties (TSXV:ELEC,OTCQB:ELECF) holds 42 total royalties with 18 additional optioned properties that could be converted into future royalties. The company focuses on on properties with near-term production potential in safe jurisdictions (primarily, the US and Canada). Its current royalty portfolio consists of assets that are either in production, advanced stage projects or exploration assets, ensuring cash flow generation and future growth potential.

The recent acquisition of the Punitaqui Copper Mine royalty provides immediate exposure to production, while assets like Authier Lithium and Battery Hill Manganese are expected to enter production in the near term.

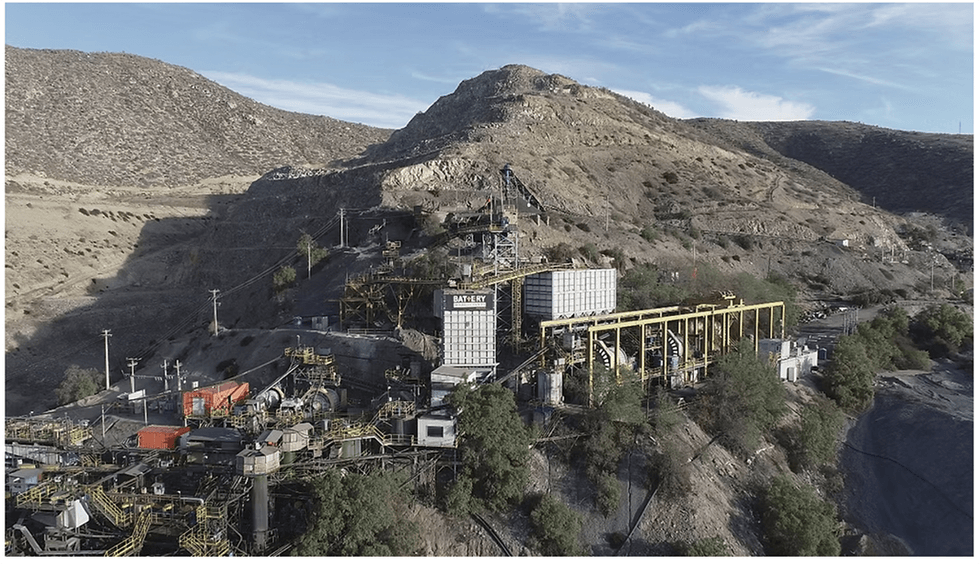

The Punitaqui Mining Complex includes the copper processing plant that is currently permitted for 100,000 tonnes per month. (Source: Battery Mineral Resources Corp.)

The Punitaqui Mining Complex includes the copper processing plant that is currently permitted for 100,000 tonnes per month. (Source: Battery Mineral Resources Corp.)The Punitaqui copper mine is permitted for 100,000 tonnes per month of processing capacity, with regional exploration potential that could further extend its operational life and increase production.

Company Highlights

- Electric Royalties is the only royalty company that is fully diversified in clean energy metals, with royalties on nine different metals, including copper, lithium, manganese, nickel and vanadium.

- Electric Royalties currently holds 42 total royalties across clean energy metals, with 18 additional optioned properties that could be converted into future royalties.

- The company’s portfolio includes assets that are in production or near-term production, ensuring cash flow generation and future growth potential. The recent acquisition of the Punitaqui copper mine royalty provides immediate exposure to production, while assets like Authier Lithium and Battery Hill Manganese are expected to enter production in the near term.

- The company prioritizes low-risk mining jurisdictions, with most of its assets located in Canada and the United States.

- Led by CEO Brendan Yurik, the leadership team brings extensive expertise in royalty acquisitions, mine financing and strategic growth.

This Electric Royalties profile is part of a paid investor education campaign.*

vanadium-investingmanganese-investingtantalum-investingtsxv-eleczinc-investingtin-investingcobalt-investingnickel-investinglithium-investinggraphite-investingcopper-investing

ELEC:CA

Sign up to get your FREE

Electric Royalties Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

03 September 2025

Electric Royalties

Royalty company exclusively focused on clean energy metals, offering investors diversified exposure to the sector

Royalty company exclusively focused on clean energy metals, offering investors diversified exposure to the sector Keep Reading...

20 January

Top 3 ASX Cobalt Stocks (Updated January 2026)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to demand for EVs. The EV market may be facing headwinds now, but the... Keep Reading...

19 January

Cobalt Market Forecast: Top Trends for Cobalt in 2026

Cobalt metal prices have trended steadily higher since September of last year, entering 2026 at US$56,414 per metric ton and touching highs unseen since July 2022. The cobalt market's dramatic reversal began in 2025, when it shifted from deep oversupply to structural tightness after a decisive... Keep Reading...

19 January

Top 5 Canadian Cobalt Stocks (Updated January 2026)

The cobalt market staged a dramatic turnaround in 2025, lifting sentiment across equity markets after years of oversupply and near-record price lows. Early in the year, the Democratic Republic of Congo’s (DRC) decision to suspend cobalt exports sparked a major price rebound, with benchmark metal... Keep Reading...

13 January

Cobalt Market 2025 Year-End Review

The cobalt market entered 2025 under pressure from a prolonged supply glut, but the balance shifted sharply as the year unfolded, due almost entirely to intervention from the Democratic Republic of Congo (DRC).After starting the year near nine year lows of US$24,343.40 per metric ton, cobalt... Keep Reading...

31 October 2025

Top 5 Canadian Cobalt Stocks (Updated October 2025)

Cobalt prices regained momentum in the third quarter of 2025 as tighter export controls from the Democratic Republic of Congo (DRC) fueled expectations of a market rebound. After languishing near multi-year lows early in the year, the metal surged to US$47,110 per metric ton in late October, its... Keep Reading...

27 October 2025

Top 3 ASX Cobalt Stocks (Updated October 2025)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to EVs. While EV demand may be facing headwinds now, the long-term... Keep Reading...

Latest News

Sign up to get your FREE

Electric Royalties Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00