February 05, 2024

Elixir Energy Limited (Elixir or the Company) is pleased to provide an update on preliminary laboratory results recently received in connection with its Daydream-2 appraisal well in its 100% owned Grandis Gas Project (ATP 2044), located in the Taroom Trough of the Bowen Basin, Queensland.

HIGHLIGHTS

- Preliminary petrgraphical results on samples from deep permeable zone completed

- Clay rims identified that have preserved porosity in highly pressured deep zone

- Analogies with high productivity deep Permian section of the Perth Basin

On 18 January 2024, Elixir announced petrophysical log information detailing the permeable sands in Daydream-2 intersected between 4,200 and 4,220 metres, from which gas flowed without stimulation. Elixir is pleased to provide further laboratory derived information about these permeable zones.

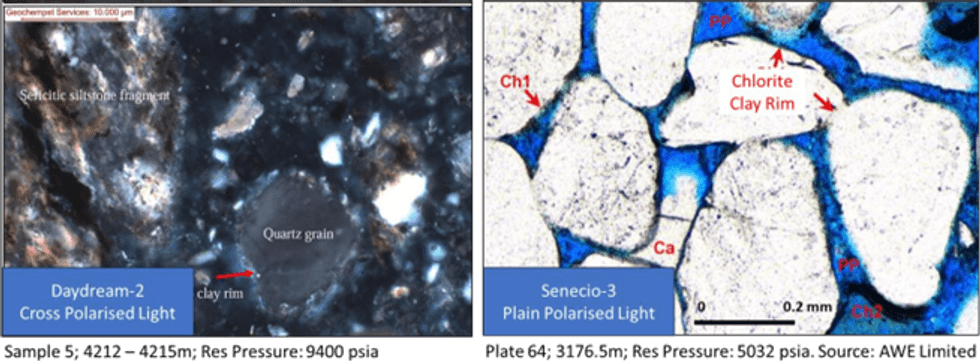

Petrographical analysis of cuttings samples from the sand interval shown on the log below have identified clay coatings (rims) around individual quartz grains. It is interpreted that these clay rims assist in the preservation of primary porosity at these depths by reducing the post depositional cementation. Without such features, sandstones at such depths typically cannot flow without stimulation, which results in higher costs and reduced recoveries per well.

It is Elixir’s understanding that this is the first time that these clay rims, which are also recognised in the relatively recently discovered highly productive deep Permian sections of the Perth Basin, have been identified in Queensland at depths below 4,200 metres where primary porosities are preserved above 12%. Again, this has great significance for the Grandis Gas Project, where previous low-side cut-offs of the gas contingent resource were limited to 4,200 metres.

It is Elixir’s preliminary geological theory that this clay rim coating affect arises due to the location of the sandstones on a transient marine/shoreline border in Permian times.

Below is a photomicrograph of a quartz grain interpreted to be from Sand 3 in the Daydream-2 permeable zone. The clay rim coating is clearly shown encapsulating the quartz grain and inhibiting the post depositional cementation. For comparison, an AWE published photomicrograph on Senecio- 3 (the Waitsia discovery well) is also shown. Whilst the grainsize is larger in scale, the similar clay rim is clearly noted. This sand grain at Senecio-3 is at a depth 3,177 metres.

Whilst the depth of the Waitsia reservoir at the Senecio-3 location is more than 1,000 metres shallower than the permeable zone in Daydream-2, the reservoir pressure in the latter has now been determined to be 9,400 psia - which is 80% higher than the former. All things being equal, higher pressures mean a materially higher ultimate gas recovery per well and hence more favourable economics.

Diagnostic Fracture Injection Testing (DFIT) and stimulation simulation of the deep permeable zone, in addition to the overlying coals and tighter sand zones, will commence fairly soon. The extent of the Daydream-2 permeable zone in ATP 2044 – and across the broader Taroom Trough – is currently unknown. Evaluating this possible extent will be a key feature of Elixir’s - and likely other Operators’ – programs in the future. This will be in addition to de-risking the thick pervasive, gas-charged and over-pressured tight sandstone and coal formations.

The DFTI and stimulation program will follow once a coil tubing unit has cleaned out the Daydream-2 cased hole and replaced the heavy suspension fluid mud with a clean completion fluid.

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

06 March

Syntholene Energy Corp. Announces Completion of Conceptual Design Report and Technoeconomic Analysis

Report Validates Pathway to Industrial Scale Synthetic Fuel Production Targeting Cost Competitiveness with Fossil FuelsSyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) ("Syntholene" or the "Company") announces the completion of its Conceptual Design Report ("CDR") and integrated... Keep Reading...

06 March

Angkor Resources Announces Closing of Evesham Oil and Gas Sale

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 6, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of all final payments and closing of the sale of its 40% participating interest (the "Assets") in the Evesham Macklin oil and gas... Keep Reading...

05 March

Oil Prices Surge as Iran Conflict Halts Tanker Traffic Through Hormuz

Oil and gas prices extended their sharp climb this week as the escalating conflict between the US, Israel and Iran disrupts shipping through one of the world’s most critical energy chokepoints.Crude oil futures surged again on Thursday (March 5), with the US benchmark climbing roughly 3.5... Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00