Aluminum Outlook 2020: Experts Call for Surplus in Years to Come

What’s the aluminum outlook for 2020? Read on to find out experts’ thoughts about the market next year in this overview.

Click here to read the latest aluminum outlook.

The US-China trade war continued to be a key catalyst for the aluminum market in 2019.

As political tensions escalated during the year, aluminum demand was hurt more than expected, with demand slowing down in China, the largest producer and consumer of the metal.

Read on for a more detailed overview of the main factors that impacted the market in 2019, plus analysts’ aluminum outlook for 2020.

Aluminum trends 2019: The year in review

Looking back at the main trends in the aluminum space in 2019, Wood Mackenzie Senior Analyst Ami Shivkar pointed to global primary aluminum demand, which was at its lowest level in a decade.

“Demand was impacted by the weakness in the automotive and construction sectors in key markets,” she said. “Higher scrap availability also constrained primary aluminum demand.”

With the continued uncertainty surrounding the US-China trade war, demand took a much bigger hit than Wood Mackenzie had expected at the end of last year.

“We still forecast a global metal deficit for 2019 to the tune of 900,000 tonnes, but China and ex-China market trends have now reversed,” Shivkar added.

For the expert, one of the biggest news items in the space this past year was the unanticipated smelter disruptions in China, as participants speculated on how much capacity was affected.

“For the first time since 2009, we estimate that the Chinese primary aluminum market will register a deficit of 600,000 tonnes — despite a sharp slowdown in demand growth,” Shikvar said.

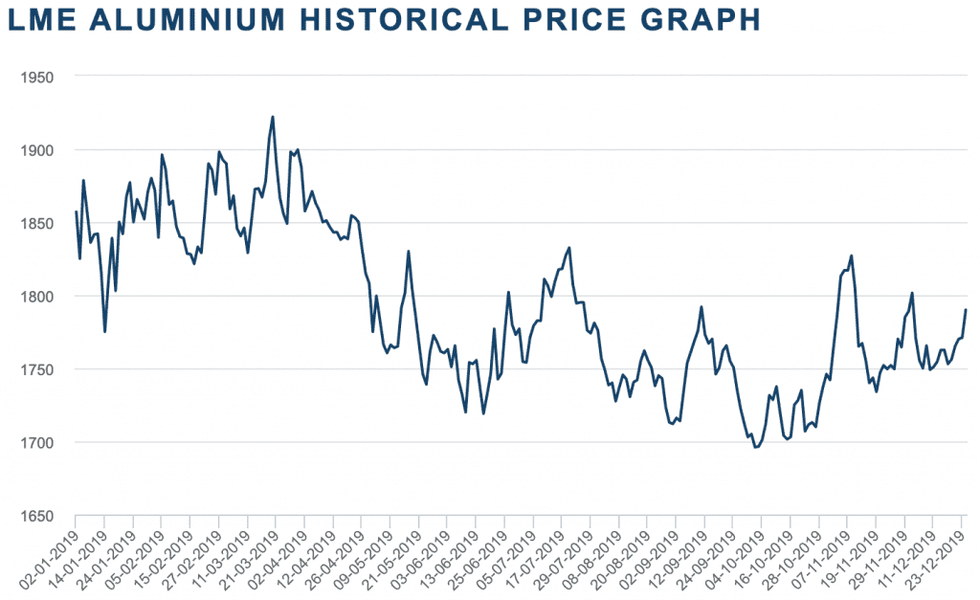

Looking over to prices, the end of September and start of October saw aluminum touch a two year low on the back of escalating US-China trade tensions and a slowdown in global growth.

“Intensifying concerns about demand in China, coupled with slowing factory production in other major industrial nations and a downturn in the global automotive sector, put firm downward pressure on global aluminum prices,” FocusEconomics analysts said in their October report. “Weaker supply and falling inventories — aluminum stocks in LME warehouses dived to over-one-decade low in September — cushioned the downturn in prices.”

Chart via London Metal Exchange.

Aluminum outlook 2020: Global growth a key risk

As 2019 comes to a close, investors might be wondering what’s next for the aluminum outlook.

“We forecast the world ex-China market to move into surplus over the next few years. In the absence of a supply response, we project an uninspiring price outlook,” Shikvar said.

Wood Mackenzie forecasts an average annual London Metal Exchange (LME) aluminum price of US$1,752 per tonne next year.

Restarts in Canada and Brazil, expansion in Bahrain and the commissioning of SALCO’S 300,000 tonne greenfield project will move the market — excluding China — to a surplus of 700,000 tonnes.

“One could argue that it’s not that the ex-China producers are adding too much capacity, but simply that the demand outlook has deteriorated too much, too quickly to give producers a chance to assess their expansion plans,” Shikvar said.

According to Wood Mackenzie, the global demand picture continues to dampen.

“We estimate global demand to be flat this year followed by a tepid recovery at 2 percent in 2020,” Shikvar said.

Meanwhile, FocusEconomics analysts expect aluminum prices to rise slightly from current levels, largely thanks to healthy global demand.

“That said, an upturn in global supply — including the removal of an operational embargo on Alunorte in Brazil, the planned construction of a ‘green aluminum’ industrial park in Yunnan and the restart of Xinfa capacity in China — will restrain price increases,” states the firm in its report.

Furthermore, a sharper-than-expected downturn in global growth remains the key risk to the outlook, the analysts added.

FocusEconomics panelists see prices averaging US$1,795 in the last quarter of 2020. For Q4 2021, prices are seen averaging US$1,836.

For Shikvar, one of the key factors to watch for in 2020 is a potential resurgence in stock financing.

“The poor macroeconomic background has set the stage for lower interest rates,” she said. “That, coupled with the LME warehousing rule change from 50 days to 80 days, means we could see an uptick in stock financing activity.”

Investor confidence is also on the rise after, early in December, the US and China said they have reached a phase one trade pact. The more than one and a half year trade war has hurt global economic growth and demand for many metals.

According to Shikvar, one of the key events to watch out for is Rio Tinto’s (ASX:RIO,LSE:RIO,NYSE:RIO) review of the 350,000 tonne per year Tiwai Point smelter in Q1 2020.

“Alcoa has also announced a multi-year capacity review and potential asset sales,” Shikvar said. “We also expect high-cost smelters in Africa and Europe to curtail output.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.