- WORLD EDITIONAustraliaNorth AmericaWorld

April 30, 2023

Charger Metals NL (ASX: CHR, ‘Charger’ or ‘the Company’) is pleased to announce it has contracted a drilling company for its maiden drill programme at the Bynoe Lithium Project, Northern Territory.

- Contract signed with Geodrilling Pty Ltd for maiden reverse circulation (RC) programme at the Bynoe Lithium Project, NT

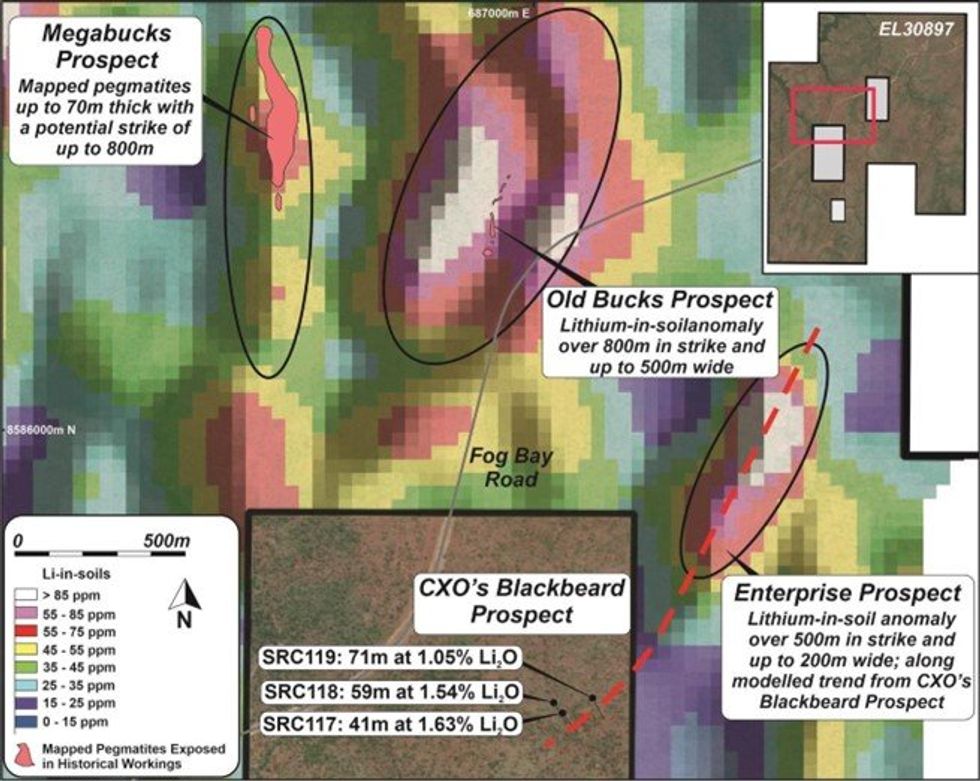

- 2,000m programme has been designed as a first-pass test of high priority targets including the Old Bucks and Megabucks prospects

- A third high priority target called the Enterprise Prospect will also be tested with this first pass programme. Enterprise is located along strike from Core Lithium Limited’s (ASX:CXO) Blackbeard Prospect, which includes the following recently-announced significant drill intersections:

- 41m @ 1.63% Li2O from 137m (SRC117)

- 59m @ 1.54% Li2O from 158m (SRC118) and

- 71m @ 1.05% Li2O from 101m (SRC119) 1

- Drill programme scheduled to commence in the second week of May

Charger’s Managing Director, Aidan Platel, commented:

“We are excited to lock in a drilling contractor for our maiden drill programme at Bynoe. The first- pass programme will drill test priority targets including Old Bucks, Megabucks and Enterprise, where surface geochemical anomalies, historic workings and nearby drill-holes all suggest a high potential for these prospects to host significant lithium mineralisation.

We have all our required permits in place, and contracting a local drilling company in Geodrilling completed the final critical item. As the region’s “wet season” draws to a close we look forward to building momentum as we commence our maiden drill programme in the coming weeks.”

Charger has signed a drilling contract with Geodrilling Pty Ltd (“Geodrilling”), a well-respected local drilling company, for a first-pass RC programme comprising approximately 2,000m.

The drill programme has been designed to test three priority target areas that the Company believes have high prospectivity for significant pegmatite-hosted lithium mineralisation. The Old Bucks Prospect comprises a strong lithium anomaly at surface that extends over 800m in strike and up to 500m wide, with pegmatites visible in historic artisanal tin workings.

The Megabucks Prospect also comprises a lithium-in-soils anomaly up to 800m long, with a significant pegmatite up to 70m thick defined by historical deep trenching across the strike.

A third high priority target called the Enterprise Prospect will also be tested with this first pass programme. Enterprise is also delineated by a large lithium anomaly at surface, and is located along strike from Core Lithium Limited’s (ASX:CXO) Blackbeard Prospect, which includes the following recently-announced significant drill intersections:

- 41m @ 1.63% Li2O from 137m (SRC117)

- 59m @ 1.54% Li2O from 158m (SRC118) and

- 71m @ 1.05% Li2O from 101m (SRC119). 2

Earthworks will commence shortly with the drill programme scheduled to commence in the second week of May.

About Charger Metals NL

Charger Metals NL is a well-funded exploration company targeting battery metals and precious metals in three emerging battery minerals provinces in Australia.

Bynoe Lithium and Gold Project, NT (Charger 70%)

The Bynoe Project occurs within the Litchfield Pegmatite Field, approximately 35 km southwest of Darwin, Northern Territory, with nearby infrastructure and excellent all-weather access. Charger’s Project is enclosed by Core Lithium Limited’s (ASX: CXO) Finniss Lithium Project, which has a mineral resource of 30.6Mt at 1.31% Li2O.3 Core Lithium, which has a $1.9B market capitalisation, has opened its mine just 7 km north of Charger’s Bynoe Lithium Project.

Geochemistry, aeromagnetic programmes and open file research completed by Charger suggests multiple swarms of LCT pegmatites that extend from the adjacent Finniss Lithium Project into the Bynoe Project. Geochemistry results highlight two large LCT pegmatite target zones, with significant strike lengths of 8km at Megabucks and 3.5km at 7-Up. Numerous drill-ready lithium targets have been identified within each pegmatite zone.

Planning and permitting for the maiden drill programme at Bynoe are complete.

Click here for the full ASX Release

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CHR:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00