Investor Insight

Triumph Gold offers investors exposure to a multi-million ounce gold resource base with established deposits, significant expansion potential, and new discovery opportunities across a true district-scale land package, all strategically positioned in the mining-friendly Yukon.

Overview

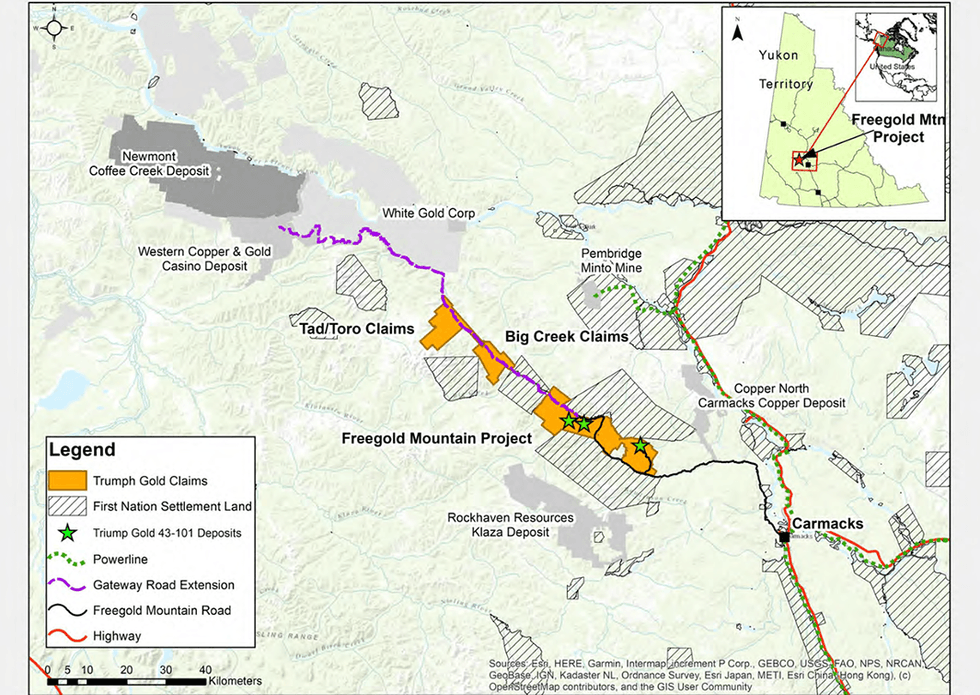

Triumph Gold (TSXV:TIG,OTC:TIGCF) is a Canadian gold exploration company strategically positioned to capitalize on the rising gold market. The company is primarily focused on advancing its 100 percent owned Freegold Mountain project, a district-scale property located in the Yukon Territory's prolific Dawson Range gold-copper belt.

Founded with a vision to discover and develop significant precious metal resources, Triumph Gold has assembled a portfolio centered around its flagship Freegold Mountain project. With over 20 mineralized zones identified along a 34 km stretch of the Big Creek Fault system, the company possesses significant exploration upside with established resources across multiple deposits. The project benefits from excellent infrastructure, being accessible via all-weather government roads, which provides cost advantages compared to more remote exploration projects.

The Yukon Territory has a storied history as one of the world's most famous gold jurisdictions, dating back to the legendary Klondike Gold Rush of the late 1890s that drew over 100,000 prospectors to the region. Today, the territory continues to be recognized as one of the world's premier exploration destinations, hosting world-class deposits like Victoria Gold's Eagle mine (3.3 million ounces), Western Copper's Casino project (8.9 million ounces gold, 4.5 billion pounds copper), and Newmont's Coffee project (4 million ounces).

The Yukon government has consistently demonstrated strong support for responsible mining development. The territory offers a stable regulatory environment, clear permitting processes, and collaborative relationships with First Nations, making it an attractive jurisdiction for resource development. Additionally, the Yukon Resource Gateway Project, a $360 million infrastructure initiative, continues to improve access to mineral-rich areas throughout the territory.

With geopolitical tensions, inflationary pressures, and currency devaluation concerns driving investor interest in safe-haven assets, gold exploration companies with substantial resource potential like Triumph Gold are well-positioned to benefit from this strengthening market cycle.

Company Highlights

- Resource Base: Combined indicated resources of 1 million ounces and inferred resources of 1.08 million ounces gold equivalent across the Freegold Mountain project

- Strategic Location: Positioned in the mineral-rich Dawson Range, home to major deposits including Newmont's Coffee, Western Copper's Casino, and Pembridge's Minto mine

- Multiple Deposit Types: Mineralization found in various forms (porphyry, epithermal, skarn) providing diversified exploration targets

- Expansion Potential: All deposits remain open in multiple directions with numerous untested satellite targets

- Fully Permitted: Exploration permits in place until 2025-2026 allowing for extensive drilling programs

- Experienced Leadership: Management team with proven track records in mineral exploration, mine development and capital markets

Key Projects

Freegold Mountain Project

The Freegold Mountain project represents Triumph Gold's flagship asset – a district-scale property that spans 34 kilometers along the prolific Big Creek Fault mineralization system in the Yukon. What makes this project particularly compelling is the presence of mineralization in every rock type across the property, including Paleozoic metamorphics, Jurassic intrusives and Cretaceous intrusives, each hosting different styles of precious and base metal deposits.

The project currently hosts three defined deposits – Nucleus, Revenue and Tinta Hill – with a combined resource of more than 2 million ounces of gold equivalent. What's particularly exciting about Freegold Mountain is that these deposits represent just a fraction of the more than 20 mineralized zones identified across the property. With extensive permitted exploration programs, ongoing geological work, and vast untested areas, Freegold Mountain exemplifies true district-scale potential where new discoveries could substantially increase the overall resource base.

Nucleus Deposit

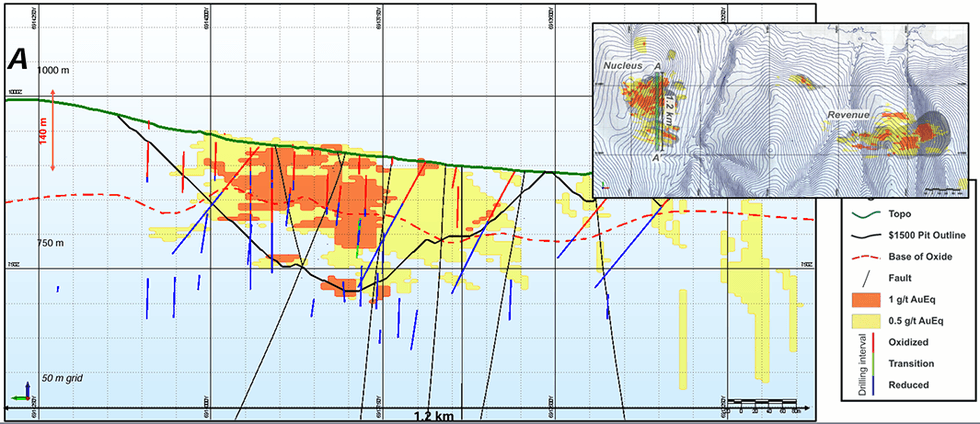

The Nucleus deposit represents a compelling bulk tonnage oxide gold opportunity with similarities to Victoria Gold's Eagle mine. With indicated resources of 748,000 ounces gold equivalent and inferred resources of 189,000 ounces gold equivalent, the deposit features favorable metallurgy with approximately 77 percent cyanide recoverable gold based on preliminary testing. Recent drilling has expanded the resource by 50 to 100 meters both laterally and vertically, with mineralization remaining open in all directions. Drilling has also confirmed significant oxide mineralization extending up to 150 meters vertically, enhancing the potential for heap leach processing.

Revenue Deposit

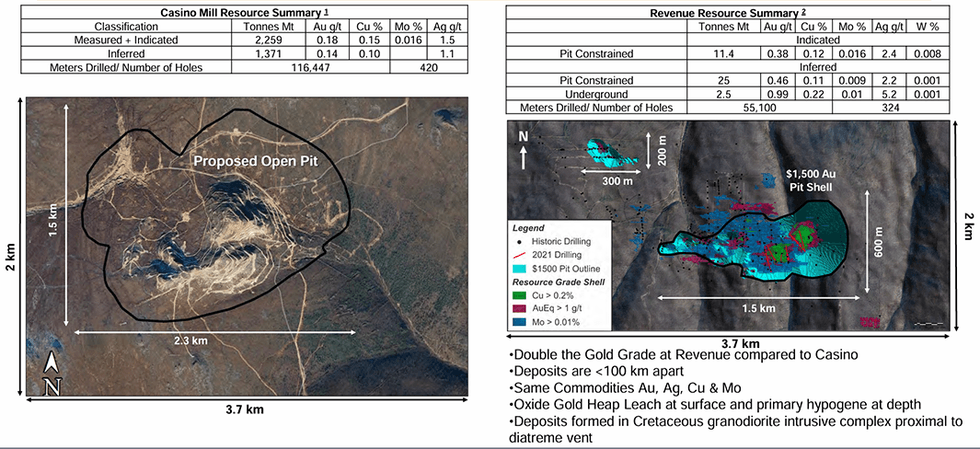

The Revenue deposit is a substantial porphyry system with indicated resources of 252,000 ounces and inferred resources of 677,000 ounces gold equivalent. It shows similarities to Western Copper's Casino deposit but with double the gold grade. The deposit contains multiple high-grade zones including the Blue Sky and WAu zones, which were expanded through recent drilling programs. The company has identified a more than 5 km structural trend connecting various mineralized zones, suggesting significant resource expansion potential. Geophysical and geochemical surveys have identified numerous untested anomalies worth exploring.

Revenue - Casino deposits comparison

Tinta Hill Deposit

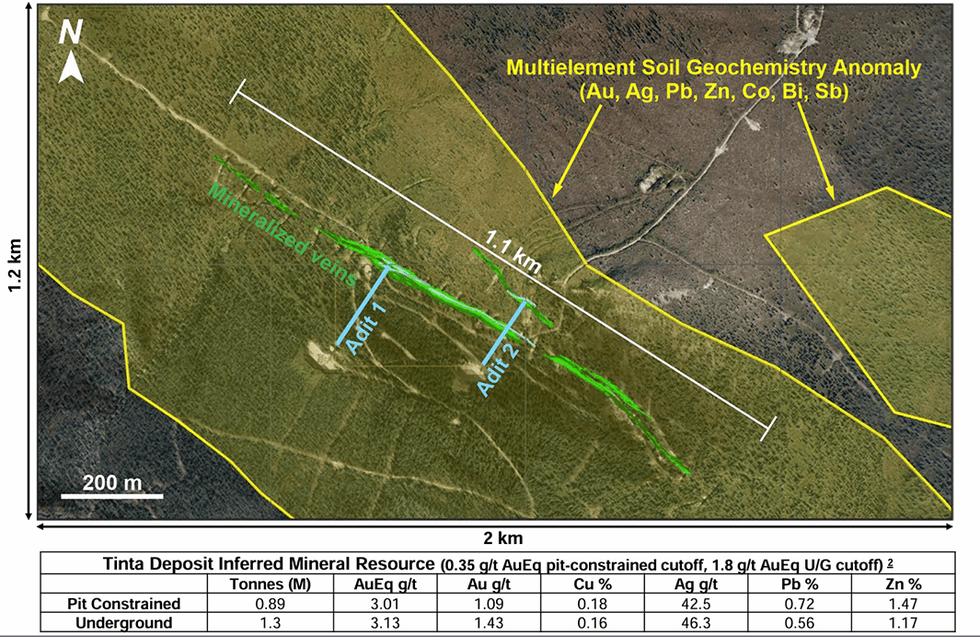

With inferred resources of 216,000 ounces gold equivalent, Tinta Hill is a polymetallic deposit with substantial gold, silver, copper, lead and zinc values. The property has historical underground development including two adits with extensive drifting completed in 1980-1981. There's a 25,000-ton stockpile from previous mining operations that could represent near-term cash flow potential. The deposit remains open along strike and at depth, with opportunities to extend mineralization through additional IP and ground magnetic surveys.

Exploration Properties

Beyond the three established deposits, Triumph Gold holds several promising early-stage exploration targets across the Freegold Mountain Project and beyond, including:

- Melissa Zone: A drill-ready target with similarities to the Nucleus deposit, featuring anomalous gold in rock samples and coincident multi-element soil and geophysical anomalies

- Tad/Toro-Big Creek: Located approximately 50 km southeast of the Casino deposit, showing intermediate sulfidation epithermal and porphyry-style mineralization across multiple zones

- Andalusite Peak: A copper-gold-silver porphyry target with three separate mineralized zones showing high-grade rock samples up to 68 percent copper, 2.77 grams per ton (g/t) gold, and 526 g/t silver

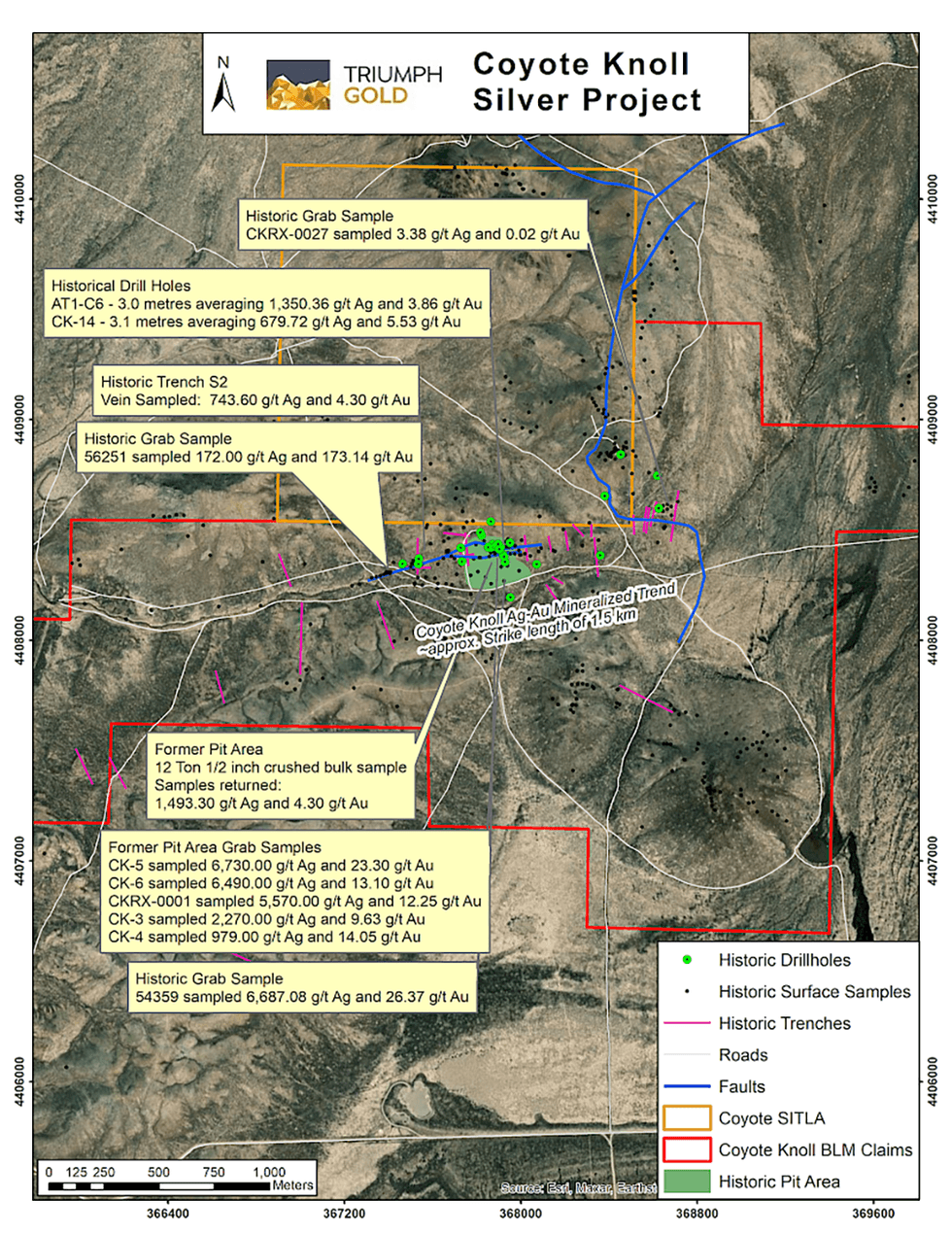

Coyote Knoll Silver-Gold Project

Located in central Utah, Coyote-Knoll is Triumph Gold’s most recent acquisition. It is approximately 40 km southwest of the prolific Tintic mining district, known for its rich mining history, with gold, silver, lead and zinc from both epithermal and carbonate replacement deposits. The Bingham Canyon copper-molybdenim-gold porphyry deposit is about 85 km away.

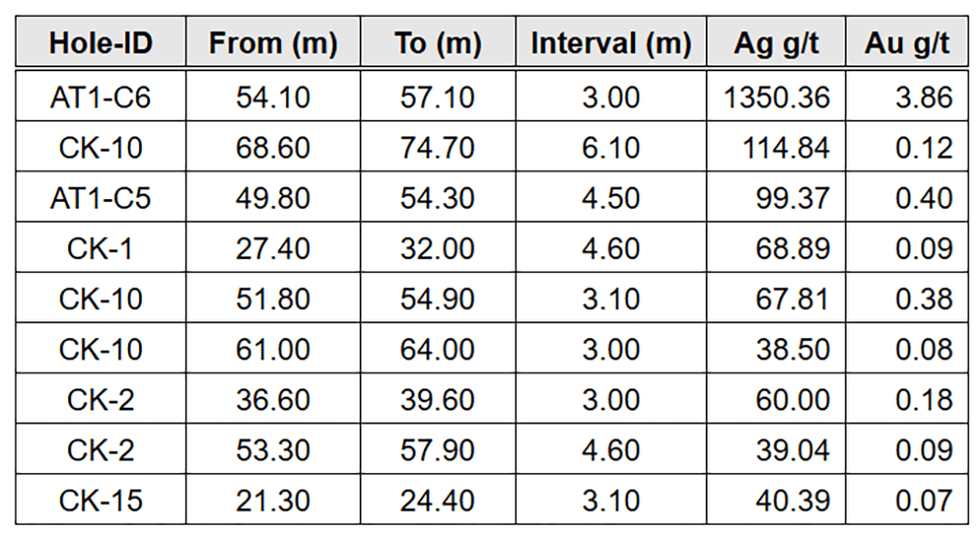

Following its discovery in 1988, Coyote Knoll underwent exploration work, including mapping, trenching, rock sampling, and induced polarization and magnetic geophysical surveys. Approximately 2,600 metres of RC drilling have been completed at the property to date, with compelling results including 1,350.36 g/t silver and 3.86 g/t gold over 3 metres. Historical rock samples returned high-grade silver and gold values, up to 6,730 g/t silver and 23.30 g/t gold, and 6,687.08 g/t silver and 26.37 g/t gold.

Historic drilling highlights at Coyote Knoll

A 12-ton representative bulk sample was also mined from a shallow open pit, centered over the east-west trending mineralized structure. Silver and gold epithermal mineralization was exposed over approximately 60 metres within the open pit and has been delineated for 1.5 km through surface trenching, sampling and shallow RC drilling.

Management Team

John Anderson – Interim CEO and Chairman

With over 20 years of experience in resource sector capital marketing, John Anderson brings strategic vision to company growth and management. His extensive background in capital formation and corporate development provides Triumph Gold with strong leadership as it advances its portfolio of projects.

Brian Bower – Lead Director

Brian Bower contributes 30 years of experience in exploration and mining to the Triumph Gold team. He has been a key member in the development of several significant mining projects including New Afton, Kemess South, Blackwater, Mount Milligan mines and the Casino deposit, bringing valuable technical and operational insights to the company's development strategies.

Jesse Halle – VP Exploration

With more than 25 years of experience in mineral exploration, Jesse Halle has specialized in advancing multiple porphyry copper-gold deposits in Yukon and British Columbia. His extensive work with similar deposits, including the Casino and Copper Mountain deposits, brings critical technical expertise to Triumph's exploration programs.

Marty Henning – Principal Geologist

Marty Henning contributes over 15 years of mineral exploration and mining experience to the team. His background includes focused work on construction, production and exploration at the New Afton block cave mine, providing valuable operational perspective to Triumph's exploration approach.

Graeme Hopkins – Chief Technical Officer

With 20 years of experience in data management and GIS, Graeme Hopkins has been involved with the Freegold Mountain project since 2008. His long-term knowledge of the project and technical expertise provides valuable continuity and insight to Triumph's exploration and development activities.

Emily Halle – Project Manager

Emily Halle brings over 15 years of experience in exploration and project management to the team. Her focus on porphyry copper-gold systems in British Columbia and Yukon, combined with additional experience in South Africa, Alaska and Eastern Canada, ensures efficient and effective management of Triumph's exploration programs.