Overview

Silver Viper Minerals Corp. (TSXV:VIPR, OTCQB:VIPRF) is a mineral exploration company focused on the acquisition and advancement of high-quality, early-stage projects. The group aims to build value through discovery and deposit definition with the goal of attracting the interest of senior resource companies looking to acquire advanced mineral properties. Silver Viper establishes strict minimum thresholds for resource target size, ensuring that they make effective use of the company’s capital and deliver as much value as possible to its shareholders.

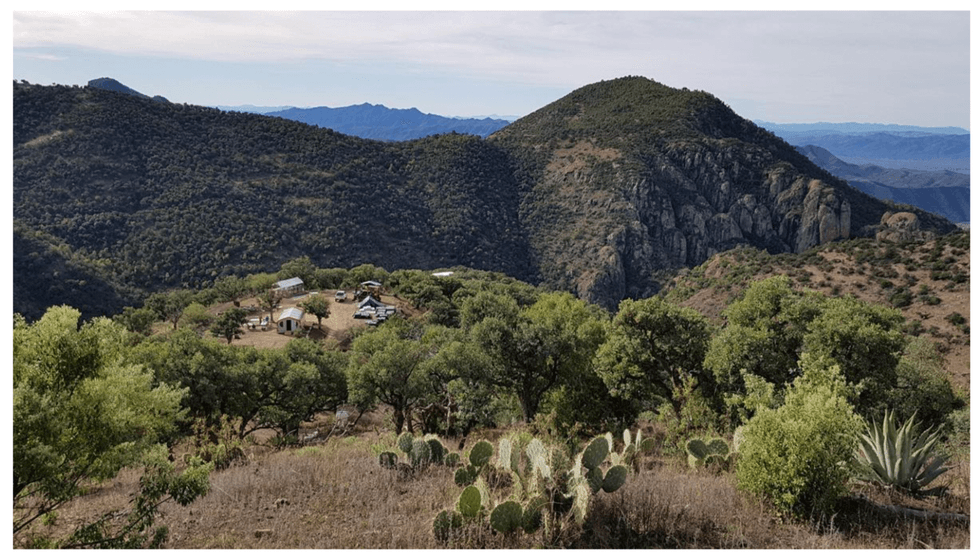

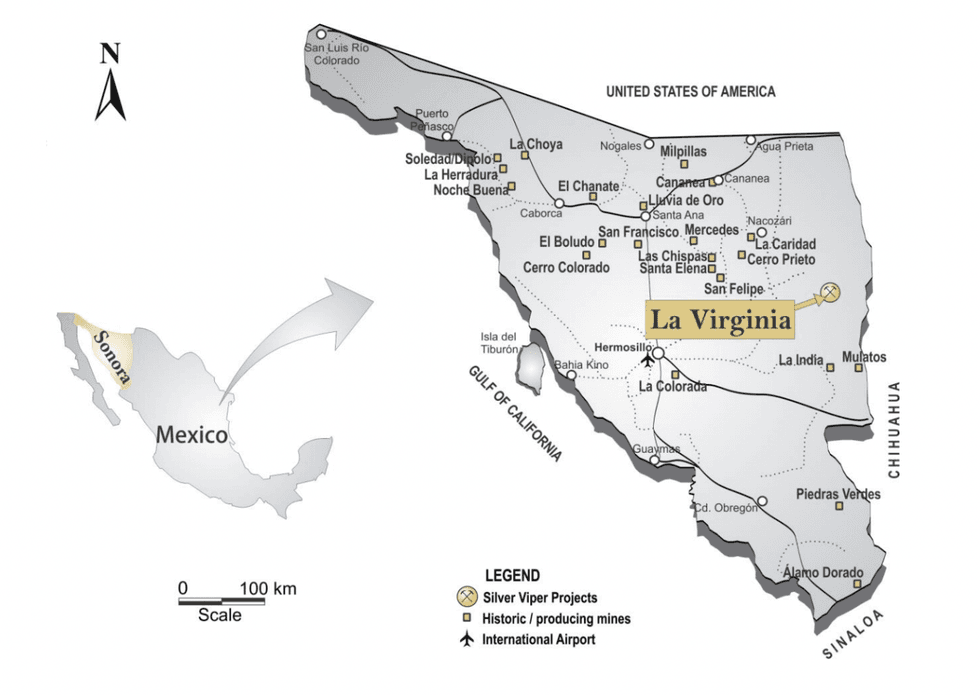

Silver Viper is currently focused on exploring and advancing the La Virginia gold-silver project in Sonora, Mexico. The project’s current form was achieved by the combination of two groups of claims acquired by the company. The first claims were acquired 100% from Pan American Silver Corp. (NASDAQ:PAAS,TSX:PAAS), which retains a royalty and right of the first offer on any deal should Silver Viper successfully define an economic deposit. The second group is internal to the Pan American claims and Silver Viper has the right to earn 100% interest by way of an option agreement. The gold-silver exploration project has seen significant work in certain parts, though much of the mineralized trend remains untested. Historically reported high-grade findings from previous work include a 23.5-meter interval grading at 13.69 g/t gold equivalent.

In April 2022, Silver Viper advanced its exploration drilling at El Rubi and expansion of mapping and sampling coverage across the project area. Recent drilling was performed at the Paredones Zone on the eastern structural mineralized trend. Quantec Geoscience contractors completed data collection for a 31 line-kilometer magnetotelluric geophysical survey covering approximately 610 hectares (1,500 acres).

The Silver Viper management team has a proven ability to discover and develop quality exploration projects with large returns for their shareholders. The management team are members of the Belcarra Group, a team of industry professionals who have technical and capital markets experience in developing projects, including those associated with Orko Silver, Orex Minerals (TSXV:REX), Dolly Varden Silver Corp. (TSXV:DV) and Barsele Minerals (TSXV:BME). They have a strong history of entering agreements with major mining companies such as Pan American Silver Corp. (TSX:PAAS), Coeur Mining (NYSE:CDE), First Majestic Silver (NYSE:AG,TSX:FR,FWB:FMV), Fresnillo (LSE:FRES), Agnico Eagle (NYSE:AEM,TSX:AEM) and Hecla Mining Company (NYSE:HL).

Company Highlights

- La Virginia is an exploration property with a recent exploration history including approximately 52,000 meters of drilling over 188 drill holes.

- Publicly-reported drill tests at La Virginia reported findings as high as 23.5 meters of 13.69 g/t gold equivalent.

- Experienced technical and management team with proven ability to unlock value by developing projects through exploration.

- Management and institutional shareholders own ~60 percent and ~20 percent of the shares, respectively.

- In 2021, Silver Viper submitted an independent technical report supporting the maiden mineral resource estimate for its La Virginia Project.

- In 2022, the company, through Quantec Geoscience, completed a TITAN MT Deep-Penetrating geophysical survey at La Virginia.

Get access to more exclusive Silver Investing Stock profiles here