Overview

The most promising gold mine isn’t worth much if it’s located in an unsafe or non-mining-friendly jurisdiction. Navigating obstructive laws and adapting to political instability can quickly consume a mining company’s resources. Regions with clearly stated mining laws that have demonstrated political stability are essential to the long-term success of a mining project. Even with the current geopolitical climate skyrocketing the price of gold, investors must consider the jurisdiction in which mining companies operate.

The Fraser Institute repeatedly ranks Nevada as the top jurisdiction for investment attractiveness in the entire world. Nevada’s mineral endowments, regulatory certainty and clearly stated public policy are what earned the state its top spot. Overall, North America has quickly become known as a politically stable and mining-friendly continent.

Few countries have embraced the mining industry quite like Canada. The country’s clear sustainability requirements and multiple initiatives that aim to improve the country’s economy by leveraging its natural resources are only a few of the reasons why Canada continues to be an attractive country for mining. Much like real estate, the location of mining projects is vital and investors need to take an asset’s jurisdiction into consideration when performing due diligence.

Newrange Gold (TSXV:NRG,OTC:NRGOF,FSE:X6C.F) is a Canadian-based mining exploration and development company focused on district-scale exploration of prolific assets in safe jurisdictions. The company has projects in Nevada and Ontario that benefit from pro-mining regulations, a highly-trained local workforce and district-scale historical data. Newrange Gold focuses on stable jurisdictions in order to cultivate long-term value for shareholders.

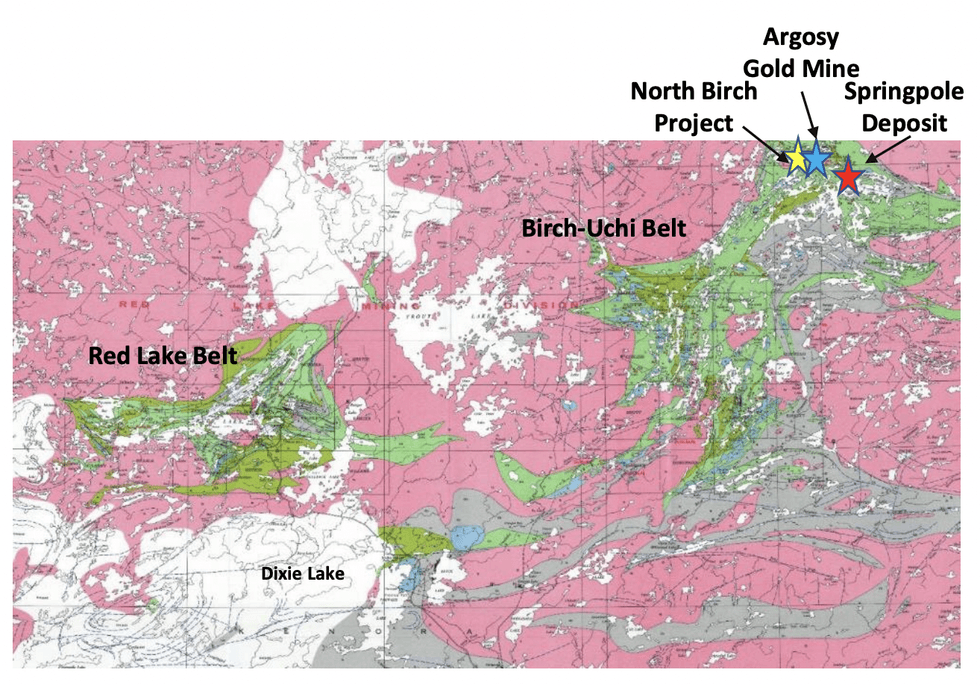

The company’s asset portfolio is rich with district scale potential projects, all located within stable and mining-friendly jurisdictions. The Argosy Gold Mine and North Birch Gold Project are both located in the Red Lake District in Ontario. To date, this district has produced 22 million ounces of gold. The projects are nearly contiguous and comprise 4,454 hectares located on the Birch-Uchi Greenstone Belt and adjacent to the prolific Red Lake Greenstone Belt which has similar geographical formations and is three times the size of the Red Lake Belt. Despite this, it is relatively underexplored.

Newrange Gold’s Pamlico Project is located in Nevada. The project is located in the famous Pamlico District, which was known as one of the highest-grade gold districts in the 1880s. However, because it’s been privately held since 1896, the district has largely gone unexplored. Fortunately, the presence of over 300 historic mines in the region has led to the creation of excellent infrastructure to facilitate future development. The project sits on the Walker Lane geographic structure, which is a large-scale multi-phase polymetallic mineralization system that contains multiple gold and copper targets across 5,700 hectares.

On October 25, 2022, the company acquired 100 percent interest in the Coricancha Gold-Silver-Copper-Lead-Zinc Mine in Central Peru. The asset is a high-grade, narrow-vein, gold-silver-copper-lead-zinc underground mine in the Central Polymetallic Belt of Peru, and located 90 kilometres east of Lima on the Central Highway and comprises a 600-tonne-per-day processing plant, dry-stack tailings storage facility and all necessary surface and underground infrastructure. The mine was in production intermittently from 1906 to 2013 and has been on care-and-maintenance since then but is in excellent shape and is fully permitted.

The management team leading Newrange Gold is equally as impressive as its asset portfolio. Robert Archer, president and CEO, has over 40 years of management experience in the mining industry within the Americas. He also possesses a strong scientific background as a professional geologist with an honors BSc. Meanwhile, David Cross, CFO, has 21 years of experience focused on corporate governance and finance. The team is rounded out by independent directors who add their specific expertise to the company, including a geologist, metallurgical engineer and corporate accountant.

Company Highlights

- Newrange Gold is a Canada-based exploration and development mining company dedicated to building long-term shareholder value with its gold-focused assets that leverage district-scale historical data to inform its decisions

- The company has built an asset portfolio that is entirely within mining-friendly jurisdictions with clear legal requirements and regulations that provide confidence in the future of each project.

- Both the Argosy Gold Mine and North Birch Project are located in the Red Lake District in Northwestern Ontario, a region famous for gold production.

- Newrange Gold’s Pamlico Project in Nevada benefits from an incredibly mining-friendly state and is located in a legendary district that has remained relatively unexplored since the late 1800s.

- The company has acquired 100 percent interest in the Coricancha Gold-Silver-Copper-Lead-Zinc Mine in Central Peru.

- The company is led by an impressive management team with decades of experience that is directly relevant to Newrange Gold’s ambitions, including experience managing mining companies that operate in the Americas

Get access to more exclusive Gold Investing Stock profiles here