The Conversation (0)

Dec 17, 2025

Top 5 Canadian Silver Stocks of 2025

Dec 15, 2025

Top 5 Gold News Stories of 2025

Nov 25, 2025

How Would a New BRICS Currency Affect the US Dollar?

Oct 15, 2025

7 Biggest Lithium-mining Companies

More Featured Articles and Inverviews

Overview

Latin Metals (TSXV:LMS, OTCQB:LMSQF) is an exploration company focused on precious metals and copper projects in historically resource-rich regions of South America, specifically Peru and Argentina.

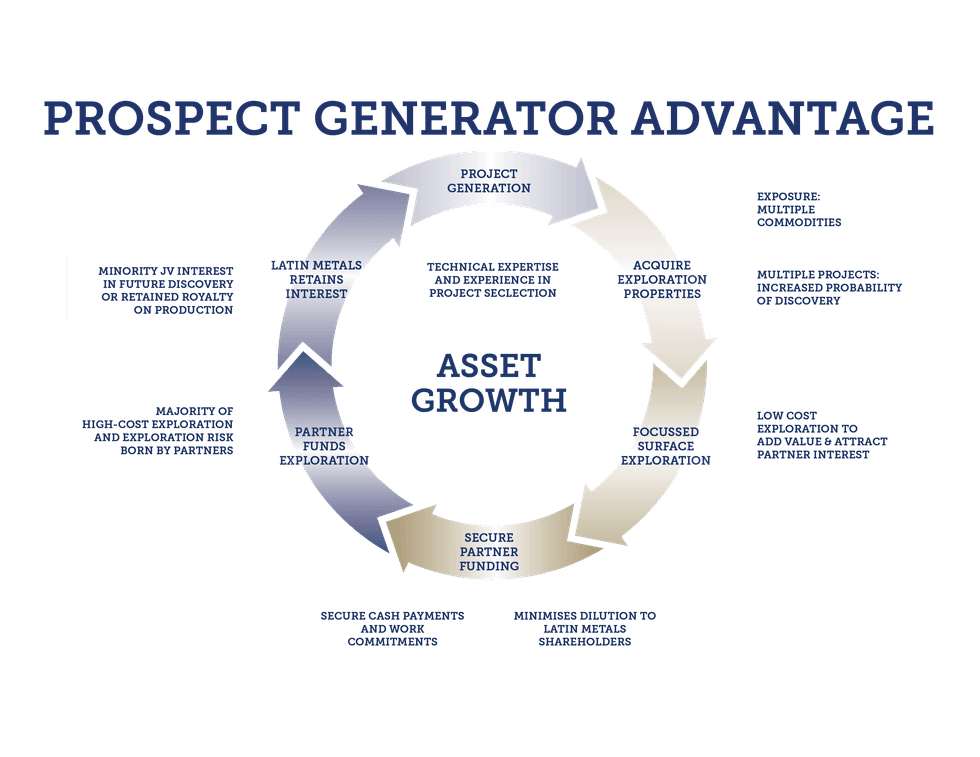

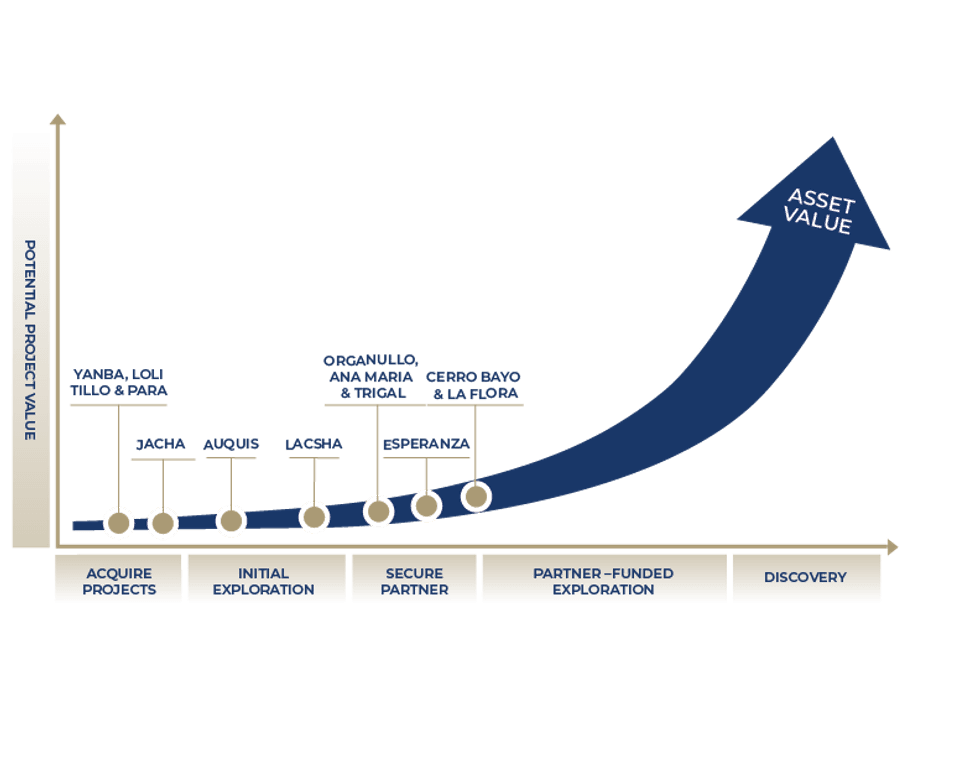

The company operates on a prospect generator model, focusing on acquiring prospective exploration properties at minimum cost, then completing initial evaluation through cost-effective exploration to establish drill targets. Latin Metals ultimately secures joint venture partners to fund drilling and advanced exploration, and in doing so, exposes shareholders to the upside of mineral discoveries while conserving capital.

Company Highlights

- Recent deals announced with AngloGold Ashanti, Barrick Gold Corporation, and Libero Copper and Gold.

- Option agreements for $34M of investment by partners, including cash payments to Latin Metals and exploration on the ground.

- Focus on high-potential projects in Latin America, including under-explored areas of Peru and Argentina

- Management and advisors have decades of experience working for major mining companies and have a comprehensive understanding of industry needs

- Portfolio of 20 projects provides commodity exposure to gold, silver, copper and battery metals

- Only 57M shares issued and almost 50% with management and board

- Latin Metals ultimately retains a minority or royalty interest in all projects providing shareholders with exposure to exploration or discovery upside

- Investment by partners is non-dilutive and preserves corporate structure. Cash payments to Latin Metals reduces the need for equity financing.

Get access to more exclusive Copper Investing Stock profiles here

Latest News

Latest News

Outlook Reports world

Featured Copper Investing Stocks

Browse Companies

MARKETS

COMMODITIES

CURRENCIES