Overview

Newfoundland is becoming known for more than just beautiful scenery, ocean-fresh seafood and its strategic importance in defense, transportation and communications as Canada’s easternmost province. Hundreds of millions of years ago, the area where Newfoundland is now located was host to crustal-scale tectonic activity that primed the geological terrain for orogenic style, high-grade gold mineralization.

Compared to other gold belts in Canada, Newfoundland had been relatively underexplored due to a lack of understanding of the controls on high grade gold mineralization.

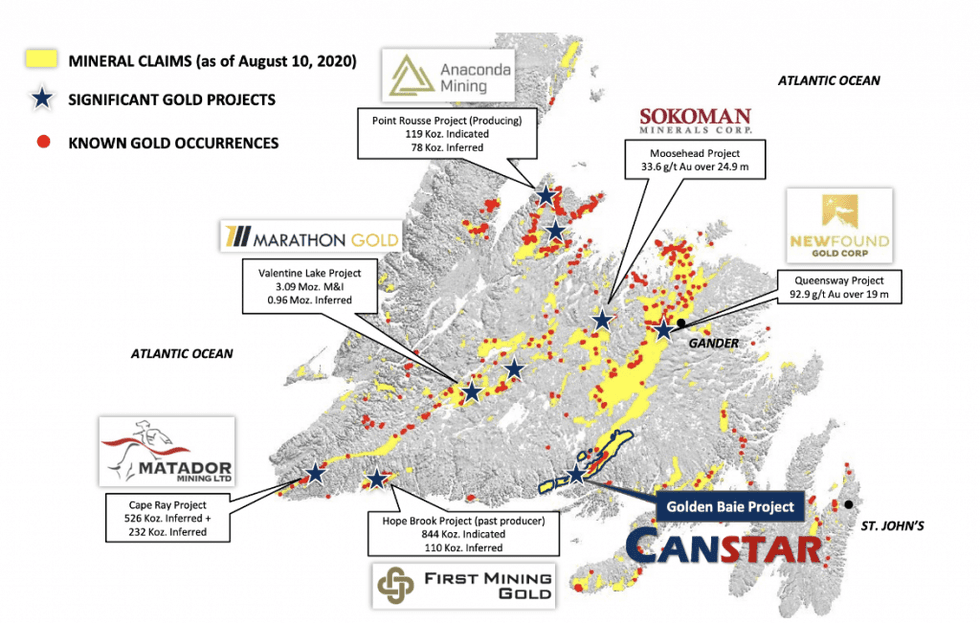

In recent years, however, this has changed. With the recognition of high-grade gold mineralization along major fault structures identified in other companies’ recent drill programs, Newfoundland is becoming one of the world’s most exciting areas for new gold discoveries. With excellent infrastructure, good road access, and a skilled workforce in a safe jurisdiction with straightforward permitting processes, Newfoundland is experiencing revitalized interest in gold exploration and mining.

Canstar Resources (TSXV:ROX,OTCQB:CSRNF) is a Canadian exploration company with two district-scale mineral exploration projects on the island of Newfoundland. The resurgence of gold exploration in the province and a company market cap of approximately C$21 million primes Canstar for tremendous upside potential for investors based on its district scale property holdings in Newfoundland.

In September 2020, Canstar Resources partnered with mining heavyweight Altius Minerals (TSX:ALS,OTCQX:ATUSF) on an option agreement to acquire 100 percent interest in 61,150 hectares of Golden Baie claims. Altius is a half-billion-dollar base metals royalty company with extensive project generation experience in Newfoundland, so this strategic relationship gives Canstar access to Altius’ technical team and adds a lot of market credibility.

With over 20 high-grade gold occurrences along 30 kilometers of strike on the company’s 620 km2 Golden Baie property, Canstar has the potential of soon mimicking the exploration successes of New Found Gold Corp (TSXV:NFG), which is in the same gold belt and currently has a market cap of C$550 million. In 2019, New Found Gold reported drill results that included 92.9 g/t gold over 19 meters in a geological setting that is very similar to that found at Golden Baie.

Canstar’s primary focus is on its flagship Golden Baie gold project situated in southcentral Newfoundland. With very limited historical drilling on the massive claim package, Canstar has an abundance of opportunity to make new discoveries at Golden Baie. This project has already shown notable visible gold occurrences, including one grab sample that assayed 4,485 grams per tonne (g/t) gold. In addition, the company owns the Buchans-Mary March and Daniel’s Harbour projects in Newfoundland, which both demonstrate the potential for high-grade base metal and precious metal mineralization in the vicinity of historical high-grade mines.

Canstar has likened the Golden Baie property’s geological structure and style of gold mineralization to other world-class orogenic gold deposits, such as Kirkland Lake Gold’s Fosterville deposit in Australia. In both cases, visible gold is found as disseminated fine specks within quartz veins and spatially associated with antimony mineralization in the form of stibnite. However, such visible gold mineralization has been found at surface on the Golden Baie project while it was not found until a depth of 800 meters at Fosterville.

Less than 10,000 meters of drilling has been done historically on the Golden Baie project, with most of that being shallow drilling done in the 1980s along a small portion of the 95 kilometers of potential strike on the property. In other words, Golden Baie has tremendous discovery potential, both along strike and at depth. Much of the property has seen little or no exploration and even a short exploration program conducted by the company in 2020 has already demonstrated the potential for new discoveries.

In December 2020, the company announced new assay results confirming high-grade gold mineralization at the Blow Out target on the Golden Baie property, located to the north of the Kendell Showing where visible gold was discovered in 2019. New grab samples from the Blow Out target contained grades up to 36.14 g/t gold and expanded the Blow Out target from 325 meters to a potential strike length of approximately 1 kilometer.

Visible gold in quartz from the Golden Baie Kendell Showing

In late December 2020, Canstar announced the closing of a C$1.3 million flow-through financing. The company intends to use this financing to incur Canadian exploration expenses in 2021 that will include drilling on multiple gold targets on the Golden Baie project.

The Canstar Resources’ management team and board of directors are seasoned veterans of the Canadian exploration sector with a history of success. Directors include Dr. David Palmer who was key in the success of Probe Mines, which was acquired by Goldcorp in 2015 for $526 million. The company’s recently hired CEO, Robert Bruggeman, played a key role in the turnaround and recapitalization of AbraPlata Resource Corp. (TSXV:ABRA), increasing the market cap from $5 million in 2019 to over $200 million today. Canstar has a good ownership structure with management and insiders controlling approximately half of the shares.

Company Highlights

- Canstar Resources is a mineral exploration and development company focused on district-scale mineral properties in Newfoundland, Canada.

- In September 2020, Canstar Resources partnered with Newfoundland-based Altius Minerals on an option agreement to acquire a 100 percent interest in approximately 62,000 hectares of Golden Baie claims. This strategic partnership solidly positions Canstar for shareholder value growth at a time when gold prices are rising and gold exploration in Newfoundland is seeing a resurgence.

- The company’s flagship Golden Baie project has widespread high-grade gold mineralization on over 30 kilometers of strike length, with much of the property yet to be explored. Gold grades discovered in the past year have been as high as 4,485 g/t gold in grab samples.

- The company currently has a market cap of C$21 million, with almost half of shares presently held by insiders and management.

- In November 2020, the company announced completion of phase one field exploration of its Golden Baie project and the identification of new gold mineralization zones. Float samples assayed up to 33 g/t gold, with additional assay results still to be announced. The company is excited about the larger exploration program planned for 2021, which will include the drilling of multiple gold targets.

Get access to more exclusive Gold Investing Stock profiles here