Investor Insight

Brixton Metals offers high-impact copper-gold discovery potential at its flagship Thorn Project, supported by strategic investment from BHP and partner-funded exploration on non-core assets with Ivanhoe Electric and Eldorado Gold, providing diversified upside, technical validation and non-dilutive funding.

Overview

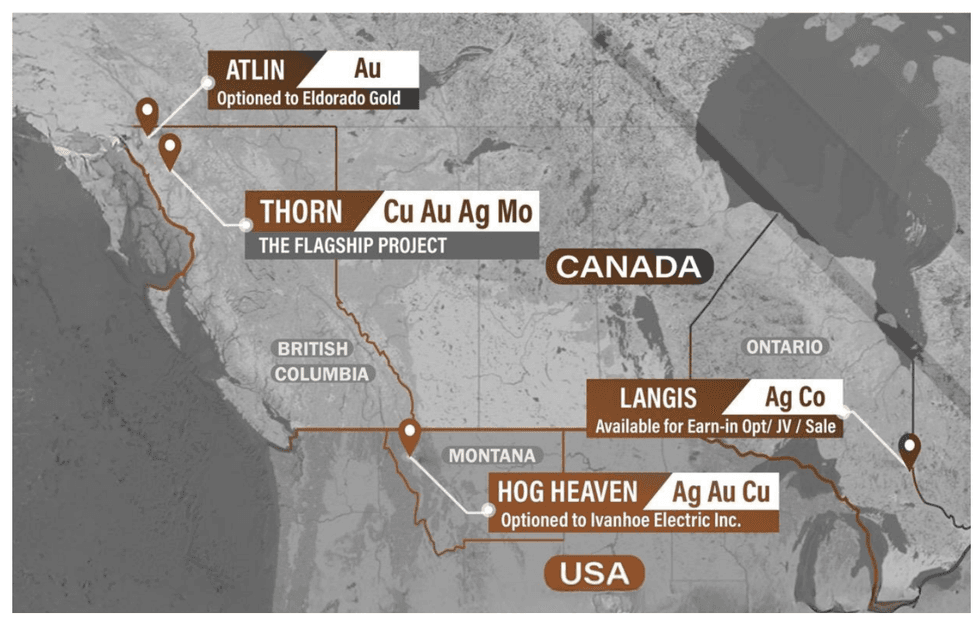

Brixton Metals (TSXV:BBB,OTCQB:BBBXF,FRA:8BX1) is a Canadian mineral exploration company focused on copper, gold, silver, and critical minerals across North America. Its flagship Thorn Project in British Columbia is a district-scale project with multiple porphyry and epithermal targets.

In addition to Thorn, Brixton Metals is strategically advancing non-core projects through partnerships and option agreements with companies such as Ivanhoe Electric (NYSE American:IE;TSX:IE) and Eldorado Gold (TSX:ELD,NYSE:EGO). These partnerships provide partner-funded exploration, allowing Brixton Metals to retain upside exposure while conserving capital and strengthening its balance sheet. This approach enables the company to focus on high-impact targets while mitigating exploration risk.

Brixton Metals’ management team, led by chairman and CEO Gary R. Thompson, brings decades of experience in resource exploration, project development, and capital markets. The team’s expertise allows the company to efficiently advance multiple projects while maintaining exposure to a diversified portfolio of metals.

With global demand for copper and critical minerals set to surge over the next 25 years—driven by renewable energy, electrification, and industrial decarbonization—Brixton Metals is well positioned to capitalize on this green revolution. By combining discovery potential at its flagship project, strategic monetization of non-core assets, and disciplined exploration, Brixton Metals is advancing toward its next growth milestones while delivering significant value for investors.

Company Highlights

- Flagship Project: Thorn Project in BC, Canada – a fully owned, district scale copper-gold porphyry project on a 2,945 sq km claim block, on trend with BC’s prolific Golden Triangle.

- Pipeline Projects: Includes Langis Project (Ontario, Canada), Hog Heaven (Montana, USA), Atlin Goldfields (BC, Canada), providing diversified exposure to copper, gold and silver

- Partnerships: Strategic option agreements with tier-one companies such as Ivanhoe Electric and Eldorado Gold provide technical validation and fund exploration on non-core projects.

- Shareholder Base: Strategic investors include, but are not limited to BHP (approx. 14.8 percent) and Crescat Capital

- Management Expertise: Led by co-founder Gary Thompson, the management team has an average tenure of nearly 15 years, showing significant stability.

- 2026 Outlook: With a recently closed $12.2 million financing, the company is fully funded for a 2026 program that includes a winter drill campaign at the Langis Silver Project (Ontario) to capitalize on record-high silver prices.

Key Projects

Thorn Project (BC, Canada)

The Thorn Project is Brixton Metals’ flagship project, covering approximately 2,945 sq km in northwestern British Columbia and located on trend of the province’s Golden Triangle, renowned for world-class porphyry and epithermal systems. The project hosts porphyry-style alteration with copper, gold, silver, and molybdenum, with significant exploration potential. The project is accessible via a 45-minute flight from Whitehorse, Yukon.

Project Highlights:

- Camp Creek Corridor: An 8-kilometer-long northeast-southwest trending corridor that hosts multiple underexplored porphyry-style prospects.

- Trapper Target: High-grade gold intercepts demonstrate multiple vein systems with near-term resource potential.

- Catalyst Target: First-ever drilling confirms copper-gold porphyry mineralization, advancing the exploration pipeline.

- Tempest Target: Initial drilling reveals a multiphase porphyry system with copper-gold-silver-molybdenum mineralization and strong hydrothermal alteration.

Langis and Hudson Bay Projects (Ontario, Canada)

The Langis and Hudson Bay projects are primary silver-cobalt-nickel brownfield opportunities located in the historic Cobalt Mining District of Ontario, which has a regional production history of over 600 million ounces of silver. Both are past-producing, high-grade mines.

Since 2016, Brixton Metals has actively explored these sites, with drilling at Langis yielding over 220 intervals exceeding 100 g/t silver, including high-grade intercepts such as 15,436 g/t silver and 1.98 percent cobalt. The projects benefit from year-round road access and proximity to existing infrastructure, including a railway and the Electra Battery Metals cobalt refinery 10 km away.

Project Highlights:

- Historic Mineralization: High-grade silver and cobalt intercepts in historical drilling.

- Strategic Opportunity: Winter drill program to unlock additional shareholder value.

- Exploration Upside: Property hosts brownfield exploration targets with known mineralization.

- Critical Minerals Exposure: Adds battery metals to Brixton Metals’ diversified portfolio.

Hog Heaven Project (Montana, USA)

Located in western Montana, Hog Heaven is a historical silver-gold-copper property with significant porphyry potential. Hog Heaven is currently under an earn-in agreement where Ivanhoe Electric can earn up to 75 percent interest through staged cash payments and exploration expenditures. This arrangement provides funding for exploration while retaining Brixton Metals’ upside exposure.

The property contains multiple mineralized zones, including historical drill targets with notable copper, gold, and silver intercepts. Ivanhoe’s initial drilling has confirmed mineralization and highlighted the project’s potential for large-scale porphyry systems. Brixton retains exposure to exploration success while de-risking development costs.

Project Highlights:

- Option Agreement: Ivanhoe Electric can earn up to 75 percent through funding exploration expenditures of US$40 million and cash payments of US$4.5 million to Brixton.

- Mineralization: Historical drilling confirms copper, gold, and silver mineralization across multiple targets.

- Exploration Focus: Targets include porphyry-style and epithermal systems.

Atlin Goldfields Project (British Columbia, Canada)

The Atlin Goldfields Project is located in northwestern British Columbia, an area historically known for placer gold production, offering strong potential for hard-rock gold discoveries. Brixton Metals has optioned the project to Eldorado Gold, which is funding exploration activities under a structured earn-in agreement.

Exploration at Atlin focused on identifying orogenic and intrusion-related gold targets, with early work confirming continuity of mineralization in key areas. The property benefits from proximity to historic mining infrastructure and geology conducive to high-grade gold zones, providing an attractive exploration and growth opportunity.

Project Highlights:

- Option Agreement: Eldorado Gold can earn 100 percent interest through staged exploration and cash payments: C$1.1 million cash and $5.35 million in work over five years. At the end of the option period, Eldorado has the right to exercise the option to acquire 100 percent ownership for a final cash payment of C$7 million.

- Historic Production: Located near areas of historic placer gold production, indicating strong geological potential.

- Exploration Targets: Focused on orogenic and intrusion-related gold deposits with high-grade potential.

- Fully Funded Program: Partner-funded exploration reduces capital requirements while advancing project knowledge.

Management Team

Gary R. Thompson - Chairman, CEO, President and Director

Gary Thompson is a co-founder of Brixton Metals with over 25 years of experience in the resources sector, spanning precious and base metals, oil and gas, and geothermal energy. He has led public companies since 2006 and has held senior roles in both junior and major mining companies, including Newmont Mining, NovaGold Resources, and Encana Corporation. Thompson took Cayley Geothermal public in 2006 through the acquisition of Sierra Geothermal Power and served as CEO until its acquisition by Ram Power in 2010.

Cale Moodie – CFO and Director

Cale Moodie, a co-founder of Brixton Metals, has over 15 years of public markets experience. A CPA and serial entrepreneur, he has served as founder, CEO, CFO, director, and audit committee chair for multiple publicly traded companies on the TSXV and CSE. Moodie holds a Bachelor of Science from UBC and earned his CPA designation while working at KPMG in Vancouver. He has been involved in over $150 million in financings for resource and technology companies.

Michael Rapsch – Vice-president, Investor Relations

Michael Rapsch has over 18 years of capital markets experience in the resource sector, including senior roles in corporate communications and corporate development. He led investor relations and marketing programs for SilverCrest Mines until its acquisition by First Majestic in 2015, and from 2015 to 2018 managed investor relations for SilverCrest Metals, owner of the Las Chispas silver-gold project in Mexico. In 2019, he founded Cologne Communications, providing investor relations consulting to publicly traded resource companies, and has been instrumental in capital raises and market communications throughout his career.