February 23, 2025

Accelerate Resources Limited (“AX8”, “Accelerate” or the “Company”) is pleased to announce the commencement of a gold prospectivity review and reinterpretation at its Comet Gold Project (“Comet”) inspired by the recent exploration success by Caprice Resources at their Island Gold Project located 10km to the south-west in Western Australia’s Murchison Goldfield.

Key Points

- Accelerate commences comprehensive review of its Comet Gold Project in the Murchison region following the recent high-grade gold discovery at Caprice Resource’s (ASX: CRS) Island Gold Project, just 10km to the south-west.

- The 100% owned Comet Gold Project hosts significant gold mineralisation within Banded Iron Formation (BIF) lithologies, similar to those at The Island Gold Project.

- Notable previous drill intercepts at Comet include 9m at 3.89 g/t Au, 4m at 7.08 g/t Au and 6m at 2.29 g/t Au (see details in main body text).

- Accelerate’s 100% ground holding represents 73km2 with over 26km of prospective strike, strategically situated 19 km from Westgold Resources 1.2 million tonne per annum Tuckabianna gold mill in the +20Moz Murchison Goldfields of WA

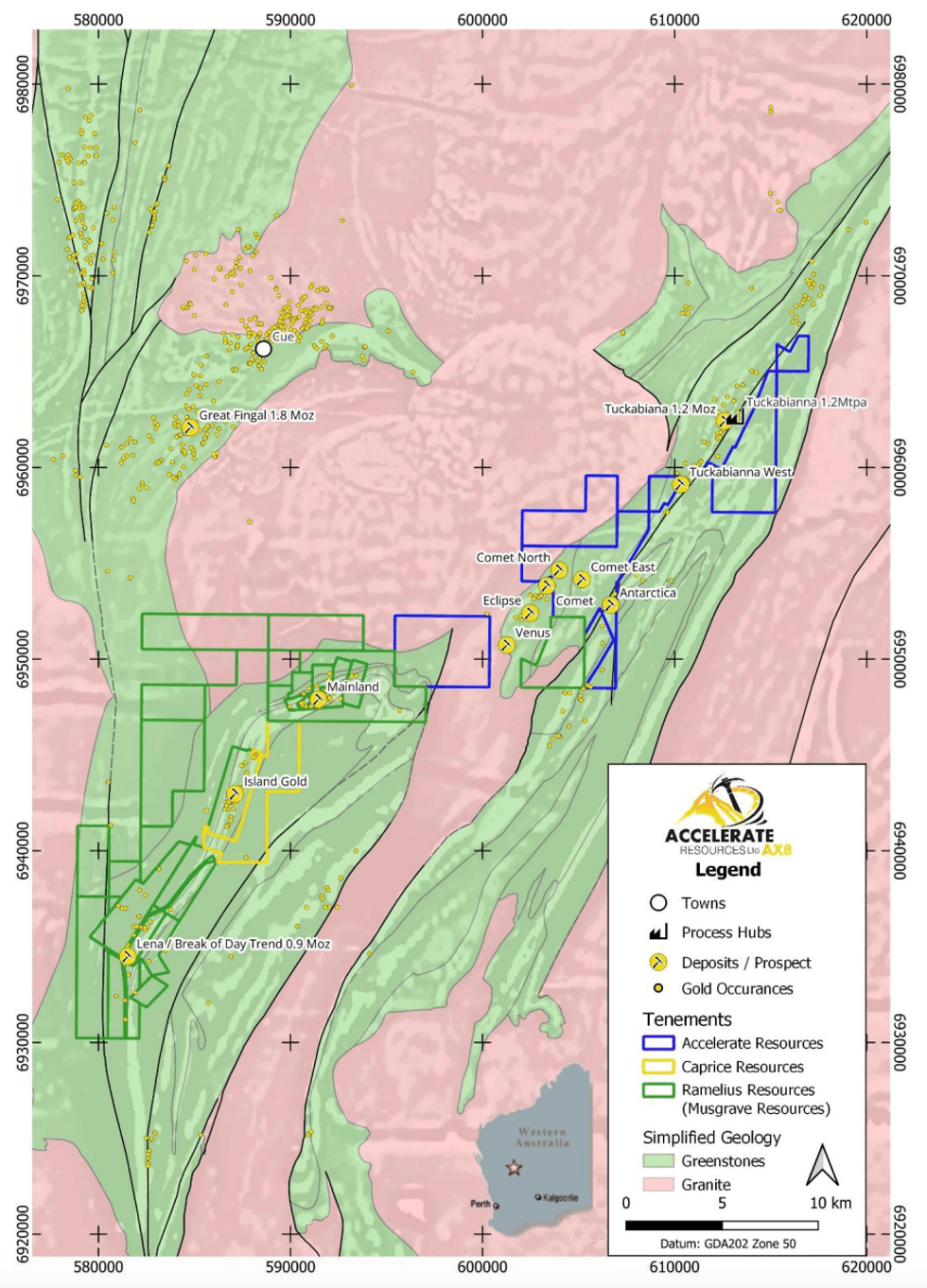

Building on the Caprice high-grade gold discovery and the historic success of former ASX- listed Musgrave Minerals (now Ramelius Resources ASX: RMS) along the Break of Day trend, Accelerate is advancing its investigation of Comet by prioritising Banded Iron Formation (BIF) mineralisation at the Comet East, Comet North and the Antarctica Prospects (Figure 1). The review is expected to be complete by end of the Quarter and results will guide next steps in exploration including drill testing of BIF-hosted mineralisation targets along strike of the Caprice discoveries and the Break of Day trend.

Gold Targets

Drilling campaigns by Accelerate and historic explorers, including Silverlake Resources, have delivered significant assay results across three prospects at Comet, with the most recent program completed in 2020 during the peak of the COVID-19 pandemic.

The Comet East Prospect (Figure 2) is situated approximately 1 km east of the former Comet-Eclipse Gold Mine of Westgold Resources (ASX: WGX), where wide-spaced shallow drilling during the 1990’s intersected significant gold mineralisation including 4m at 7.08 g/t Au from 27m (PRB305), and 3m at 4.53 g/t Au from 60m (PRC269)1.

Figure 1: Comet Gold Project in relation to the Island Gold and Break of Day Projects

Figure 1: Comet Gold Project in relation to the Island Gold and Break of Day ProjectsClick here for the full ASX Release

This article includes content from Accelerate Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AX8:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00