Highlights

- Assay results from 16 drillholes continue to confirm high-grade near-surface mineralization

- Nine drillholes with intersections of higher-grade (above 1% nickel) mineralization

- Hole TEX23-26 intersected 3 metres of 1.47% nickel within 13.5 metres of 0.82% nickel within 52.5 metres of 0.5% nickel

- Hole TEX23-19 intersected 7 metres of 1.03% nickel within 40.0 metres of 0.69% nickel

- High grade mineralization intersected in northern lens 470 metres from original high grade lens in the south area

- Hole TXT23-32 intersected 10.5 metres of 0.95% nickel within 43.5 metres of 0.59% nickel within 292 metres of 0.31% nickel

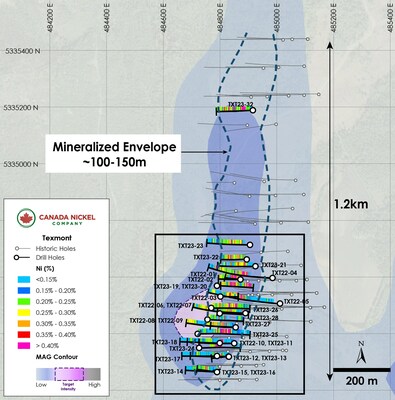

Canada Nickel Company Inc. (" Canada Nickel " or the " Company ") (TSXV: CNC) (OTCQX: CNIKF) today announced assay results that indicate an expansion of high grade, near-surface nickel mineralization at the Texmont property located 36 kilometres south of Timmins, Ontario .

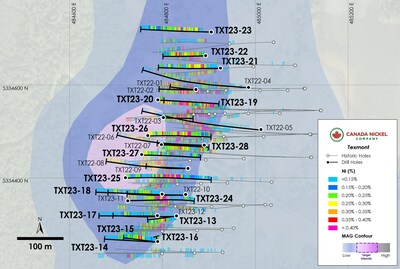

This release contains assay results from 16 additional holes with assays pending from eleven holes. The Company has drilled 39 holes totaling 9,696 metres as part of an exploration program to support the development of a resource. The mineralization has been drilled over a footprint of 1 kilometre along strike to a maximum depth of 444 metres where it remains open (Figures 1 and 2).

Mark Selby , CEO of Canada Nickel Company, said, "The latest assay results continue to confirm our thesis of near-surface high grade intervals within thick mineralized sections which support the potential for near-term, smaller scale, open pit production. Of particular note, we are excited by the near-surface higher grade interval in hole TEX23-32 in the northern lens which is nearly half a kilometre from the southern high-grade lens. We have now planned additional drilling at the northern lens. We are looking forward to delivering an initial resource and Preliminary Economic Analysis ("PEA") on Texmont this year as its near-term production potential is highly complementary to our large-scale Crawford and regional nickel sulphide project potential."

Current Drill Results

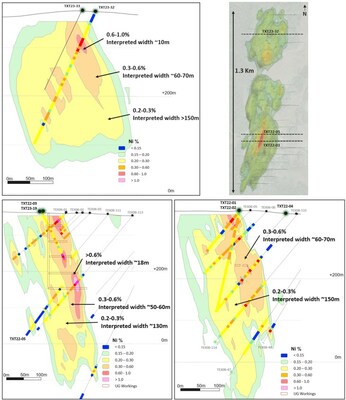

All 39 drillholes intersected mineralized peridotite to varying degrees, with the drill program confirming Canada Nickel's interpretation of the Texmont deposit, as displaying zoning in its mineralization, with a higher-grade core >1.0% ranging between 2 to 8 metres thickness (and being the main target of previous mining), grading into an outer shell of moderate-high mineralization 0.6-1.0% of up to 20 to 30 metres in thickness and followed by further outward shells of moderate and lower grades (Table 1. Figure 3). Overburden in the area varied between 2 and 18 metres in downhole length (average 7.5 metres).

Table 1: Texmont exploration drilling results - high grade highlights

| Hole ID | From | To | Length* | Ni | Co | Pd | Pt | Cr | Fe | S |

| | (m) | (m) | (m) | ( %) | ( %) | (g/t) | (g/t) | ( %) | ( %) | ( %) |

| TXT22-13 | 153.0 | 174.0 | 21.0 | 0.52 | 0.02 | 0.036 | 0.030 | 0.15 | 5.68 | 0.63 |

| and | 183.0 | 192.0 | 9.0 | 0.49 | 0.02 | 0.027 | 0.023 | 0.12 | 5.42 | 0.58 |

| Including | 184 | 185.5 | 1.5 | 1.02 | 0.035 | 0.053 | 0.044 | 0.13 | 6.01 | 1.27 |

| TXT23-15 | 85.5 | 104.5 | 19.0 | 0.57 | 0.02 | 0.034 | 0.024 | 0.16 | 6.00 | 0.66 |

| including | 85.5 | 93.5 | 8.0 | 0.88 | 0.03 | 0.061 | 0.041 | 0.17 | 6.55 | 1.00 |

| Including | 91.5 | 93.5 | 2 | 1.24 | 0.05 | 0.068 | 0.049 | 0.15 | 6.50 | 1.70 |

| TXT23-16 | 202.5 | 223.5 | 21.0 | 0.48 | 0.02 | 0.035 | 0.023 | 0.13 | 5.57 | 0.59 |

| Including | 217.5 | 223.5 | 6.0 | 0.72 | 0.02 | 0.060 | 0.040 | 0.14 | 5.65 | 1.09 |

| Including | 219 | 221 | 2 | 1.03 | 1.03 | 0.03 | 0.094 | 0.060 | 0.13 | 5.82 |

| TXT23-19 | 63 | 184 | 121 | 0.52 | 0.02 | 0.038 | 0.029 | 0.15 | 5.56 | 0.48 |

| TXT23-19 | 63.0 | 98.7 | 35.7 | 0.70 | 0.02 | 0.060 | 0.045 | 0.14 | 5.27 | 0.70 |

| and | 144.0 | 184.0 | 40.0 | 0.69 | 0.02 | 0.054 | 0.042 | 0.16 | 5.99 | 0.55 |

| Including | 145.0 | 148.3 | 3.3 | 1.24 | 0.02 | 0.124 | 0.087 | 0.15 | 5.12 | 1.06 |

| and | 156.5 | 160.0 | 3.5 | 1.20 | 0.03 | 0.100 | 0.071 | 0.15 | 5.75 | 0.94 |

| including | 170.0 | 177.0 | 7.0 | 1.03 | 0.03 | 0.083 | 0.069 | 0.16 | 6.73 | 0.81 |

| TXT23-21 | 64.5 | 70.5 | 6.0 | 0.90 | 0.02 | 0.082 | 0.072 | 0.15 | 5.65 | 0.42 |

| including | 64.5 | 69.0 | 4.05 | 1.06 | 0.02 | 0.102 | 0.089 | 0.15 | 5.79 | 0.50 |

| TXT23-22 | 153.0 | 193.5 | 40.5 | 0.34 | 0.01 | 0.017 | 0.015 | 0.17 | 5.83 | 0.50 |

| TXT23-25 | 154.5 | 222.0 | 67.5 | 0.58 | 0.02 | 0.043 | 0.034 | 0.16 | 6.44 | 0.83 |

| including | 156.0 | 164.0 | 8.0 | 0.85 | 0.03 | 0.074 | 0.054 | 0.15 | 7.43 | 1.27 |

| including | 157.5 | 159.0 | 1.5 | 1.02 | 0.031 | 0.092 | 0.064 | 0.14 | 8.03 | 1.8 |

| TXT23-26 | 112.5 | 165 | 52.5 | 0.50 | 0.01 | 0.047 | 0.044 | 0.14 | 5.48 | 0.53 |

| Including | 151.5 | 165.0 | 13.5 | 0.82 | 0.02 | 0.125 | 0.079 | 0.15 | 5.53 | 0.94 |

| Including | 151.5 | 156.0 | 4.5 | 1.13 | 0.02 | 0.159 | 0.102 | 0.15 | 6.04 | 1.29 |

| TXT23-27 | 74.8 | 78.0 | 3.2 | 0.51 | 0.02 | 0.048 | 0.036 | 0.14 | 5.11 | 0.49 |

| TXT23-28 | 103.5 | 130.5 | 27.0 | 0.52 | 0.02 | 0.033 | 0.042 | 0.14 | 5.47 | 0.62 |

| Including | 123.0 | 124.5 | 1.5 | 1.29 | 0.038 | 0.147 | 0.046 | 0.13 | 7.02 | 2.01 |

| Including | 129.0 | 130.5 | 1.5 | 1.43 | 0.045 | 0.156 | 0.519 | 0.14 | 6.37 | 1.91 |

| and | 225.0 | 261.0 | 36.0 | 0.42 | 0.01 | 0.039 | 0.032 | 0.15 | 5.59 | 0.46 |

| including | 258.0 | 261 | 3 | 1.15 | 0.04 | 0.235 | 0.177 | 0.13 | 5.63 | 1.62 |

| TXT23-32 | 63.0 | 106.5 | 43.5 | 0.59 | 0.02 | 0.038 | 0.029 | 0.15 | 5.34 | 0.52 |

| including | 63.0 | 73.5 | 10.5 | 0.95 | 0.02 | 0.071 | 0.047 | 0.14 | 5.08 | 0.79 |

| including | 63 | 66 | 3 | 1.22 | 0.01 | 0.130 | 0.077 | 0.14 | 4.90 | 1.00 |

| *Specified drillhole length, note that true widths are uncertain. Initial interpretation by the Company is that the nickel mineralization is hosted in steeply dipping zones, implying true widths in the range of 70% to 95% of reported intervals |

Table 2: Texmont exploration drilling results – downhole average

| Hole ID | From | To | Length* | Ni | Co | Pd | Pt | Cr | Fe | S |

| | (m) | (m) | (m) | ( %) | ( %) | (g/t) | (g/t) | ( %) | ( %) | ( %) |

| TXT22-13 | 5.0 | 387.0 | 382.0 | 0.21 | 0.01 | 0.008 | 0.009 | 0.17 | 6.33 | 0.33 |

| including | 111.0 | 297.2 | 186.2 | 0.29 | 0.01 | 0.010 | 0.010 | 0.14 | 5.23 | 0.30 |

| and | 317.8 | 387.0 | 69.2 | 0.21 | 0.01 | 0.008 | 0.009 | 0.27 | 6.17 | 0.28 |

| TXT23-14 | 47.0 | 129.9 | 82.9 | 0.20 | 0.01 | 0.006 | 0.006 | 0.18 | 5.48 | 0.21 |

| TXT23-15 | 47.5 | 169.8 | 122.3 | 0.27 | 0.01 | 0.010 | 0.011 | 0.19 | 6.08 | 0.35 |

| TXT23-16 | 114.5 | 444 | 329.5 | 0.25 | 0.01 | 0.009 | 0.007 | 0.16 | 5.45 | 0.23 |

| including | 192.0 | 285.0 | 93.0 | 0.30 | 0.01 | 0.016 | 0.011 | 0.15 | 5.37 | 0.28 |

| TXT23-17 | 81.0 | 109.1 | 28.1 | 0.21 | 0.01 | 0.004 | 0.006 | 0.17 | 5.39 | 0.18 |

| TXT23-18 | 40.5 | 109.7 | 69.2 | 0.21 | 0.01 | 0.008 | 0.007 | 0.15 | 4.90 | 0.15 |

| and | 123.0 | 158.0 | 35.0 | 0.19 | 0.01 | 0.007 | 0.006 | 0.18 | 6.09 | 0.56 |

| TXT23-19 | 10.0 | 193.7 | 183.7 | 0.43 | 0.01 | 0.027 | 0.022 | 0.14 | 5.45 | 0.44 |

| TXT23-20 | 84.0 | 243.0 | 159.0 | 0.23 | 0.01 | 0.008 | 0.008 | 0.12 | 5.45 | 0.34 |

| TXT23-21 | 51.3 | 135.7 | 84.4 | 0.28 | 0.01 | 0.014 | 0.014 | 0.14 | 5.39 | 0.19 |

| and | 148.1 | 163.5 | 15.4 | 0.26 | 0.01 | 0.016 | 0.015 | 0.12 | 4.59 | 0.25 |

| TXT23-22 | 12.0 | 260.8 | 248.8 | 0.26 | 0.01 | 0.011 | 0.009 | 0.16 | 5.44 | 0.24 |

| TXT23-23 | 37.6 | 219.5 | 181.9 | 0.24 | 0.01 | 0.009 | 0.008 | 0.14 | 5.38 | 0.10 |

| including | 82.5 | 120.0 | 37.5 | 0.30 | 0.01 | 0.012 | 0.009 | 0.15 | 5.03 | 0.12 |

| TXT23-25 | 3.0 | 311.8 | 308.8 | 0.24 | 0.01 | 0.013 | 0.013 | 0.13 | 6.19 | 0.35 |

| including | 125.0 | 240.0 | 115.0 | 0.44 | 0.01 | 0.029 | 0.024 | 0.15 | 5.84 | 0.58 |

| TXT23-26 | 5.0 | 240.0 | 235.0 | 0.29 | 0.01 | 0.015 | 0.016 | 0.15 | 5.42 | 0.31 |

| including | 52.5 | 165.0 | 102.5 | 0.37 | 0.01 | 0.026 | 0.026 | 0.15 | 5.54 | 0.42 |

| TXT23-27 | 4.0 | 124.6 | 120.6 | 0.21 | 0.01 | 0.007 | 0.010 | 0.12 | 5.70 | 0.29 |

| and | 191.2 | 231.0 | 39.8 | 0.20 | 0.01 | 0.007 | 0.014 | 0.19 | 5.88 | 0.14 |

| TXT23-28 | 14.4 | 174.1 | 159.7 | 0.30 | 0.01 | 0.009 | 0.014 | 0.13 | 4.95 | 0.31 |

| and | 222.6 | 291.0 | 68.4 | 0.33 | 0.01 | 0.022 | 0.021 | 0.15 | 5.52 | 0.32 |

| TXT23-32 | 8.2 | 300.0 | 291.8 | 0.31 | 0.01 | 0.016 | 0.015 | 0.15 | 5.11 | 0.27 |

| *Specified drillhole length, note that true widths are uncertain. Initial interpretation by the Company is that the nickel mineralization is hosted in steeply dipping zones, implying true widths in the range of 70% to 95% of reported intervals |

Table 3: Texmont Drillhole Orientation

| Hole ID | Easting (mE) | Northing (mN) | Azimuth (⁰) | Dip (⁰) | Length (m) |

| TXT23-13 | 484830 | 5334318 | 270 | -82 | 387 |

| TXT23-14 | 484790 | 5334263 | 270 | -45 | 162 |

| TXT23-15 | 484790 | 5334263 | 270 | -65 | 180 |

| TXT23-16 | 484790 | 5334263 | 270 | -90 | 444 |

| TXT23-17 | 484789 | 5334319 | 270 | -45 | 171 |

| TXT23-18 | 484799 | 5334365 | 270 | -45 | 201 |

| TXT23-19 | 484790 | 5334568 | 90 | -48 | 201 |

| TXT23-20 | 484790 | 5334568 | 90 | -86 | 243 |

| TXT23-21 | 484925 | 5334636 | 270 | -57 | 234 |

| TXT23-22 | 484893 | 5334663 | 270 | -70 | 264 |

| TXT23-23 | 484905 | 5334714 | 270 | -52 | 246 |

| TXT23-25 | 484720 | 5334400 | 90 | -58 | 351 |

| TXT23-26 | 484768 | 5334491 | 90 | -55 | 240 |

| TXT23-27 | 484755 | 5334450 | 90 | -55 | 231 |

| TXT23-28 | 484798 | 5334471 | 90 | -70 | 291 |

| TXT23-32 | 484915 | 5335188 | 265 | -65 | 300 |

TXT23-13 was collared in komatiite, and intersected a thick sequence of mineralized peridotite, with minor dykes encountered near surface. The hole averaged 0.21% nickel over 382.0 metres, including a higher-grade section of 0.52% nickel over 21.0 metres (see Table 1 for higher grade composites, and Table 2 for entire mineralized composites).

TXT23-14 was collared 70 metres southwest of TXT23-13 and intersected weakly mineralized komatiite 4.7 metres below surface, intersecting mineralized peridotite for a length of 82.9 metres until encountering volcanics at the lower contact. The peridotite section averaged 0.20% nickel.

TXTX23-15 was collared in the same setup as TXT23-14 drilling steeper, intersected komatiite followed by well mineralized peridotite for 122.3 metres. The hole averaged 0.27% nickel, including 0.88% nickel and 0.10g/t Pt+Pd over 8.0 metres.

TXT23-16 was collared on komatiite at 3 metres followed by well mineralized peridotite to end of hole. The mineralized peridotite averaged 0.25% nickel over 329.5 metres, including 0.48% nickel over 21.0 metres.

TXT23-17 was collared in hanging wall mafic intrusive and followed a succession of komatiite and mafic volcanics before intersecting mineralized peridotite at 81 metres. The hole intersected 28.1 metres of peridotite averaging 0.21% nickel.

TXT23-18 was drilled 55 metres northwest of TXT23-13 in komatiite and intersected mineralized peridotite, interrupted by a section of metasediments. The top peridotite averaged 0.21% nickel over 69.2 metres, while the bottom peridotite averaged 0.19% nickel over 35.0 metres.

TEX23-19 was collared 55 metres northwest of the shaft, intersecting well mineralized peridotite at 10 metres below surface, interrupted by minor diabase dykes. The hole averaged 0.43% nickel over 183.7 metres including 0.69% nickel over 40.0 metres and 1.03% nickel over 7.0 metres.

TXT23-20 was collared and ended in mineralized peridotite. The bottom of the hole averaged 0.23% nickel over 159.0 metres including 0.31% nickel over 100.2 metres. Top of hole assays are still pending.

TXT23-21 was collared in komatiite with minor dykes, followed by mineralized peridotite. The top peridotite averaged 0.28% nickel over 84.4 metres, including 0.90% nickel over 6.0 metres and 0.35% nickel over 49.3 metres. The bottom peridotite averaged 0.26% nickel over 15.4 metres.

TXT23-22 was collared in mineralized peridotite at 12 metres below surface. The hole averaged 0.26% nickel over 248.8 metres including 0.34% nickel over 40.5 metres.

TXT23-23 was collared approximately 220 metres northeast of the shaft. The hole intersected 0.24% nickel over 181.9 metres, including 0.30% nickel over 37.5 metres.

TXT23-24 was collared at the hanging wall mafic volcanics and intersected well mineralized peridotite starting at 13.8 metres. The hole has 0.71% nickel over 21.0 metres. Top and bottom of hole assays are still pending.

TXT23-25 was collared on komatiite at 3 metres followed by diabase and a well mineralized peridotite to end of hole. The hole averaged 0.24% nickel over 308.8 metres, including a section of well mineralized peridotite averaging 0.58% nickel over 64.8 metres, including 0.85% nickel over 8.0 metres.

TXT23-26 was collared in mineralized peridotite at 5.0 metres below surface. The hole averaged 0.29% nickel over 235.0 metres including 0.50% nickel over 52.5 metres.

TXT23-27 collared on peridotite at 4 metres below surface and ended in peridotite except for a gabbro section near the bottom of the hole. The top peridotite averaged 0.21% nickel over 120.6 metres, while the bottom peridotite averaged 0.20% nickel over 39.8 metres.

TXT23-28 collared in mafic volcanics at 5.5 metres, followed by well mineralized peridotite starting at 14.4 metres. This section of the peridotite averaged 0.30% nickel over 159.7 metres and included a section of 0.52% nickel over 27.0 metres. The hole is interrupted by a section of a later intrusion but continues on well mineralized peridotite averaging 0.33% nickel over 68.4 metres and includes 0.42% nickel over 36.0 metres.

TXT23-32 is collared in the north zone approximately 650 metres from the shaft. The hole starts on komatiite and remains in mineralized peridotite to the end of the hole. The hole averaged 0.31% nickel over 291.8 metres and includes 0.59% nickel over 43.5 metres with 10.5 metres of 0.95% nickel.

Share Issuances

Canada Nickel also announces that it has agreed to issue 43,924 common shares of the Company (" Common Shares ") in satisfaction of $60,000 due to a service provider for advisory services provided to the Company. In addition, the Company has entered into an agreement to acquire a 100% interest in certain mining claims located in the Timmins, Ontario nickel-sulphide mining district in exchange for 54,000 Common Shares. Canada Nickel has also entered into an agreement with the holder of certain expired mining claims located in the area under which the Company has been provided with the right to re-stake these claims in exchange for consideration of 10,000 Common Shares. Each of the foregoing issuances of Common Shares are subject to the prior approval of the TSX Venture Exchange and will be subject to a four-month hold period under Canadian securities laws.

Assays, Quality Assurance/Quality Control and Drilling and Assay

Edwin Escarraga , MSc, P.Geo., a "qualified person" as defined by National Instrument 43-101, is responsible for the on-going drilling and sampling program, including quality assurance (QA) and quality control (QC). The core is collected from the drill in sealed core trays and transported to the core logging facility. The core is marked and sampled at 1.5 metre lengths and cut with a diamond blade saw. One set of samples is transported in secured bags directly from the Canada Nickel core shack to Actlabs Timmins, while a second set of samples is securely shipped to SGS Lakefield for preparation, with analysis performed at SGS Burnaby or SGS Callao ( Peru ). All are ISO/IEC 17025 accredited labs. Analysis for precious metals (gold, platinum, and palladium) are completed by Fire Assay while analysis for nickel, cobalt, sulphur and other elements are performed using a peroxide fusion and ICP-OES analysis. Certified standards and blanks are inserted at a rate of 3 QA/QC samples per 20 core samples making a batch of 60 samples that are submitted for analysis.

Qualified Person and Data Verification

Stephen J. Balch P.Geo . (ON), VP Exploration of Canada Nickel and a "qualified person" as is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc.

The magnetic images shown in this press release were created from Canada Nickel's interpretation of datasets provided by the Ontario Geological Survey.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless-steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero Nickel TM , NetZero Cobalt TM , NetZero Iron TM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins-Cochrane mining camp. For more information, please visit www.canadanickel.com.

For further information, please contact:

Mark Selby

CEO

Phone: 647-256-1954

Email: info@canadanickel.com

Cautionary Statement Concerning Forward-Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, the carbon capture approach could allow production of Net Zero nickel and generation of an additional tonnes of CO2 credits per tonne of nickel produced after offsetting all emissions, the potential to turn nickel mine into a generator of carbon credits rather than generator of carbon emissions, the production of estimated average of 710,000 tonnes of carbon credits annually and 18 million total tonnes of CO2 of credits over expected life of mine at Crawford, the ability to monetize carbon credits, the ability to quantify carbon capture, emission estimates, the brucite content of the deposit, the scalability of the process, the metallurgical results, the timing and results of the feasibility study including the viability of the inclusion of the IPT Carbonation Process and related facilities as part of the project, the results of Crawford's PEA, including statements relating to net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs, timing for permitting and environmental assessments, realization of mineral resource estimates, capital and operating cost estimates, project and life of mine estimates, ability to obtain permitting by the time targeted, size and ranking of project upon achieving production, 5 economic return estimates, the timing and amount of estimated future production and capital, operating and exploration expenditures and potential upside and alternatives. Readers should not place undue reliance on forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Canada Nickel to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The PEA results are estimates only and are based on a number of assumptions, any of which, if incorrect, could materially change the projected outcome. There are no assurances that Crawford will be placed into production. Factors that could affect the outcome include, among others: the actual results of development activities; project delays; inability to raise the funds necessary to complete development; general business, economic, competitive, political and social uncertainties; future prices of metals or project costs could differ substantially and make any commercialization uneconomic; availability of alternative nickel sources or substitutes; actual nickel recovery; conclusions of economic evaluations; changes in applicable laws; changes in project parameters as plans continue to be refined; accidents, labour disputes, the availability and productivity of skilled labour and other risks of the mining industry; political instability, terrorism, insurrection or war; delays in obtaining governmental approvals, necessary permitting or in the completion of development or construction activities; mineral resource estimates relating to Crawford could prove to be inaccurate for any reason whatsoever; additional but currently unforeseen work may be required to advance to the feasibility stage; and even if Crawford goes into production, there is no assurance that operations will be profitable. Although Canada Nickel has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Canada Nickel disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-expands-high-grade-near-surface-mineralization-at-texmont-301799502.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-expands-high-grade-near-surface-mineralization-at-texmont-301799502.html

SOURCE Canada Nickel Company Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2023/18/c3926.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2023/18/c3926.html