May 01, 2023

World’s Highest Grade Ionic Adsorption Clay REE Deposit 409Mt @ 2,626 ppm TREO at a 1000ppm cut off

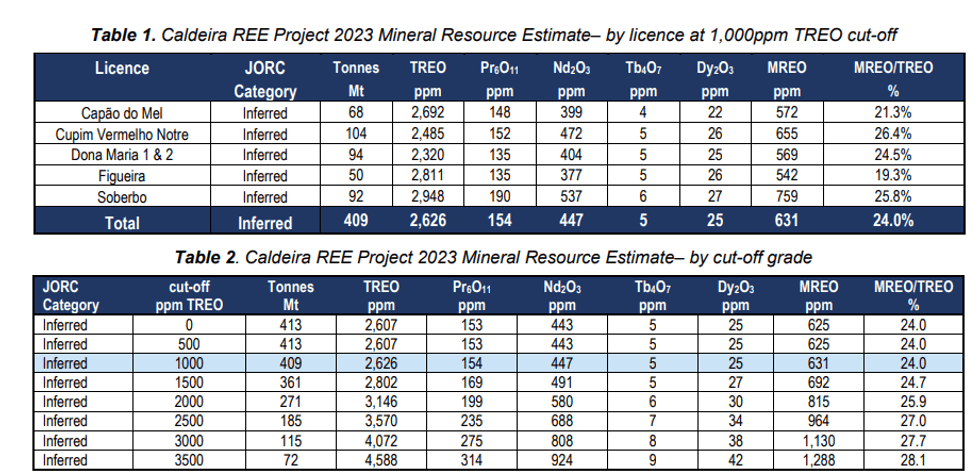

Meteoric Resources NL (ASX: MEI) (Meteoric or the Company) is pleased to announce the maiden Mineral Resource Estimate for the Caldeira REE Project in Minas Gerais Brazil. The mineral resource has been estimated using the results from 1,379 holes and 12,299 samples. At a 1000 ppm TREO cut-off the Mineral Resource stands at 409Mt @ 2,626 ppm TREO and contains Magnet REO grades of 631ppm comprising 24% of TREO (Table 2).

Highlights

- Global Mineral Resource Estimate (MRE) for Caldeira REE Project reported against the guidelines of JORC 2012 stands at 409Mt @ 2,626 ppm TREO1 at a 1000ppm cut off.

- Magnet REO (MREO2 ) grades are 631ppm, comprising 24% of the TREO basket.

- At a 2,000ppm TREO cut-off, the MRE is 271Mt @ 3,146ppm TREO, applying a higher-grade cut-off allows for evaluation of high-grade zones forming priority targets for future drilling.

- At the higher cut-off (TREO 2,000ppm) MREO grades are 815 ppm, comprising 26% of the TREO basket.

- Average drill depth used in the maiden resource is 6.9m and 85% of all holes finish in TREO grades above 1,000 ppm – deposit is completely open at depth.

- An expanded diamond drilling program is currently testing depth extensions of the clay zone below the maiden resource model.

- MRE comes from just 24% of the Caldeira REE Project area, and only 20% of the combined area in the proposed acquisition announced in late April.

- 100,000m air core and diamond drilling program scheduled to commence mid-year to increase confidence in the resource estimate.

- Scoping/Prefeasibility studies are planned to commence in Q4 2023

Executive Chairman, Dr Andrew Tunks said:

“What a beautiful set of numbers, this is indeed a world class, Tier 1 Project.

Since first encountering the Caldeira REE Project in October 2022, we have come a long way in our understanding of the geology and the distribution of rare earth mineralisation within the clay zone of the regolith profile.

Our maiden Mineral Resource Estimate marks another major milestone for Meteoric Resources and a crucial component of our plans to develop this project. There are several key take aways from today’s MRE announcement:

First is the enormous size of the resource. Over four hundred million tonnes have been defined in our maiden resource, yet less than twenty percent of the holding has been drilled with an average hole depth of 6.9m and 85 % of holes terminating in grades above 1,000ppm TREO.

The second key point to note is the remarkable grade, for a true IONIC Clay Rare Earth project, the highgrade resource above a cut off 3,000ppm equates to 115Mt at a grade of 4,072 ppm TRE. This is literally off the charts and makes this the highest-grade deposit yet discovered globally.

A quick analysis of the grade tonnage curve and block-model maps and sections will show that within drilled areas there are several large ultra high-grade zones. These zones of exceptional TREO grades are the immediate focus of our exploration and development teams. We will soon commence a 100,000m drilling program, designed to convert portions of todays inferred resource into higher confidence categories of Measured and Indicated Resources.”

Chief Executive Officer, Nick Holthouse added:

“The Meteoric Team and consultants in Brazil have done an exceptional job in getting the Maiden Caldeira Resource to market.

The remarkable characteristics of the maiden resource provide for Meteoric to accelerate its development plans. The grade and tonnages have exceeded expectations and when coupled with the projects initial ammonia sulphate leach results, promote this true Ionic Clay Resource as an outlier amongst its peers. The work rate now will start to build and the focus will be assembling the right team to take the Caldeira REE Project forward.”

Click here for the full ASX Release

This article includes content from Meteoric Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MEI:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00