Brunswick Exploration Inc. ( TSX-V: BRW OTCQB: BRWXF ; FRANKFURT: 1XQ ; " BRW " or the " Company ") is pleased to report the last results from the Mirage summer drilling campaign. The Mirage Project is located in the Eeyou Istchee-James Bay region of Quebec, approximately 40 kilometers south of the Trans-Taiga Road. This campaign focused on the Central Zone including the MR-6 and MR-3 dykes (see October 8, 2024 press release ) and has continued to intersect wide and well-mineralized intervals on their extension and at depth.

Highlights include:

- 37 meters at 1.14% Li2O in hole MR-24-87 and 1.15% Li2O over 23 meters in hole MR-24-89 extending mineralization at MR-3 down dip where it remains open.

- New interval at the MR-6 Dyke with 1.74% Li2O over 19.7 meters in hole MR-24-84 and 0.93% Li2O over 13.5 meters in hole MR-24-75 extending the dyke to the northwest.

- New multiple intervals in the stacked dyke area east of MR-6 with 1.39% Li2O over 12.9 meters and 1.99% Li2O over 10 meters in hole MR-24-78, 1.32% Li2O over 16.1 meters in hole MR-24-80 and 1.61% Li2O over 9.9 meters in hole MR-24-85

- Hole MR-24-91, drilled for forthcoming metallurgical results, reaffirms the thick, near-surface continuous mineralization at MR-6 with 56 meters at 1.40% Li2O .

Mr. Killian Charles, President and CEO of BRW, commented: "Once more, our drilling continues to expand the known mineralized zones at Mirage both along strike and down-dip. I'm particularly pleased to see the wide, well-mineralized intercept in MR-3 where the dyke appears to thicken at depth. This is something observed across many well-mineralized lithium systems globally and Mirage is no different. Our primary objective at Mirage and across our portfolio is focused on defining a resource of at least 50Mt within 50km from infrastructure and drilling to date continues to underscore this potential.

"While 2024 has been a challenging year for lithium markets, we have kept our focus on expanding Mirage and outlining new targets across our portfolio. We drilled approximately 12,000 meters just at Mirage, outlined several new significant dykes and substantially expanded the near-surface MR-6 dyke. Outside of Mirage, we also made the first greenfield lithium discovery in Greenland.

"As we look to 2025, we will build upon these successes with a major winter drill program at Mirage, which will target new zones that have never been drilled before and launch one of the largest grassroot exploration program ever in Greenland."

Mirage Project Drilling Overview

The Mirage Project comprises 427 claims located roughly 40 kilometers south of the Trans-Taiga Highway in Quebec's James Bay region and 34 kilometers northeast of Winsome Resources' Adina Project.

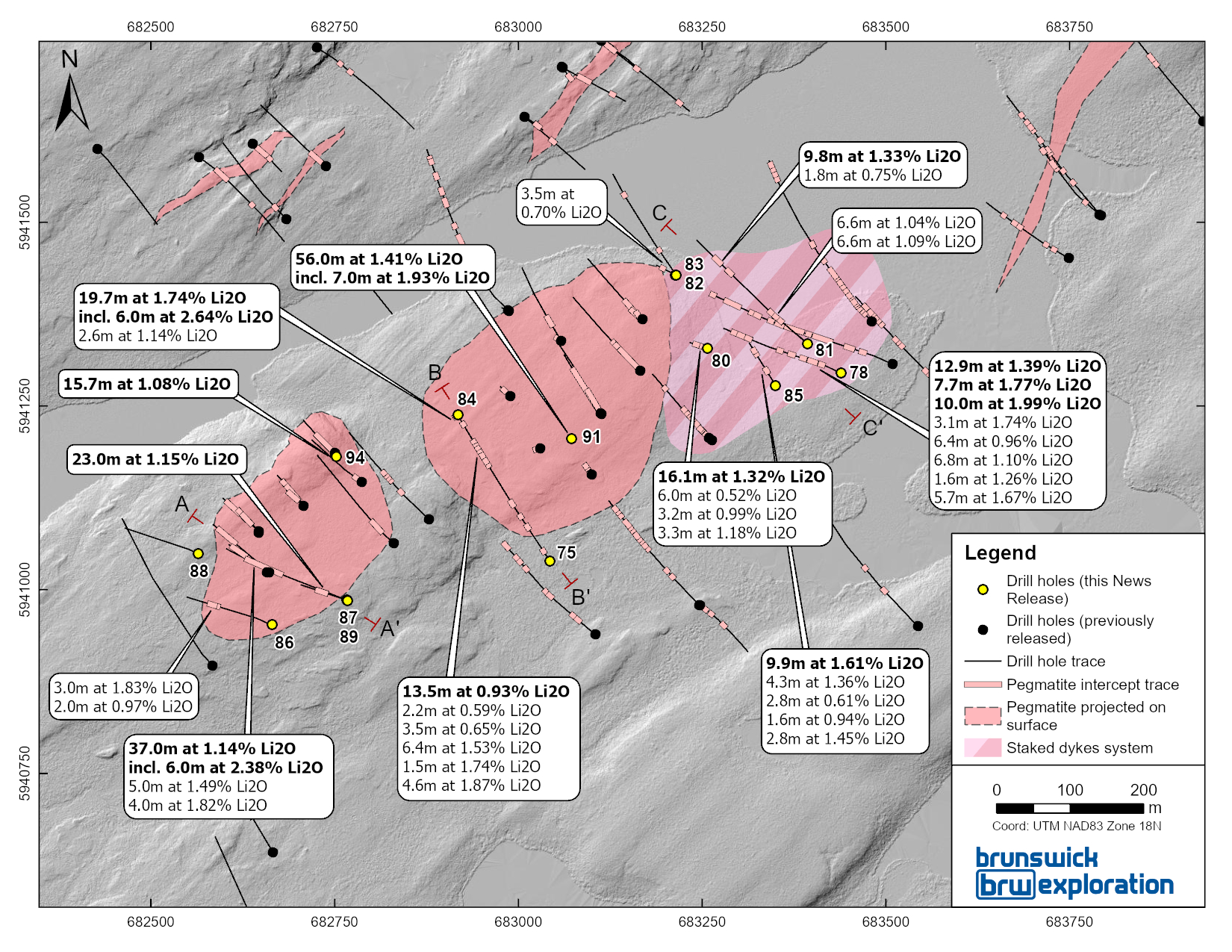

The summer drilling campaign focused on extending the mineralized dykes identified during the last two drilling campaigns. Highlights discussed in this release are shown in Table 1 and Figure 1.

Figure 1 : Central Zone of the Mirage Project

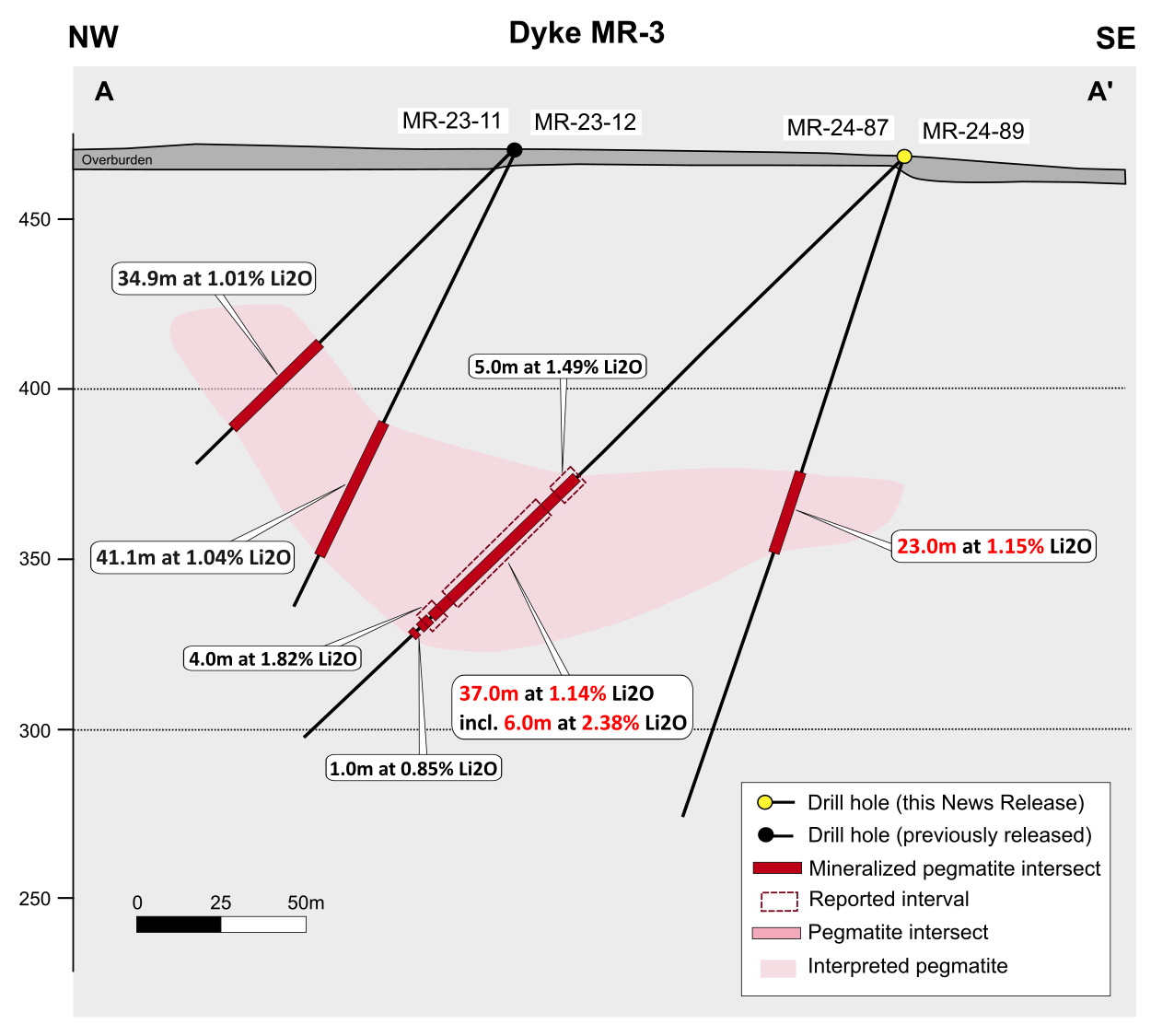

The holes MR-24-86, MR-24-87 and MR-24-89 extended the MR-3 dyke 150m to the South (Figure 2). MR-3 has been now drill traced over an area measuring over 250 meters by 250 meters as seen on Figure 2 with an average thickness of 25 meters. Identified at surface to the north, the dyke plunges to the South where it remains open with the last intercept at a depth of only 125 meters vertical.

Interestingly, hole MR-24-87 shows a significant thickening of the pegmatite where it reaches an overall size of 58 meters downhole. This is associated with a larger core of higher-grade lithium mineralization highlighted in the intercept of 37.0 meters at 1.14% Li2O.

Figure 2 : Cross Sections A to A'

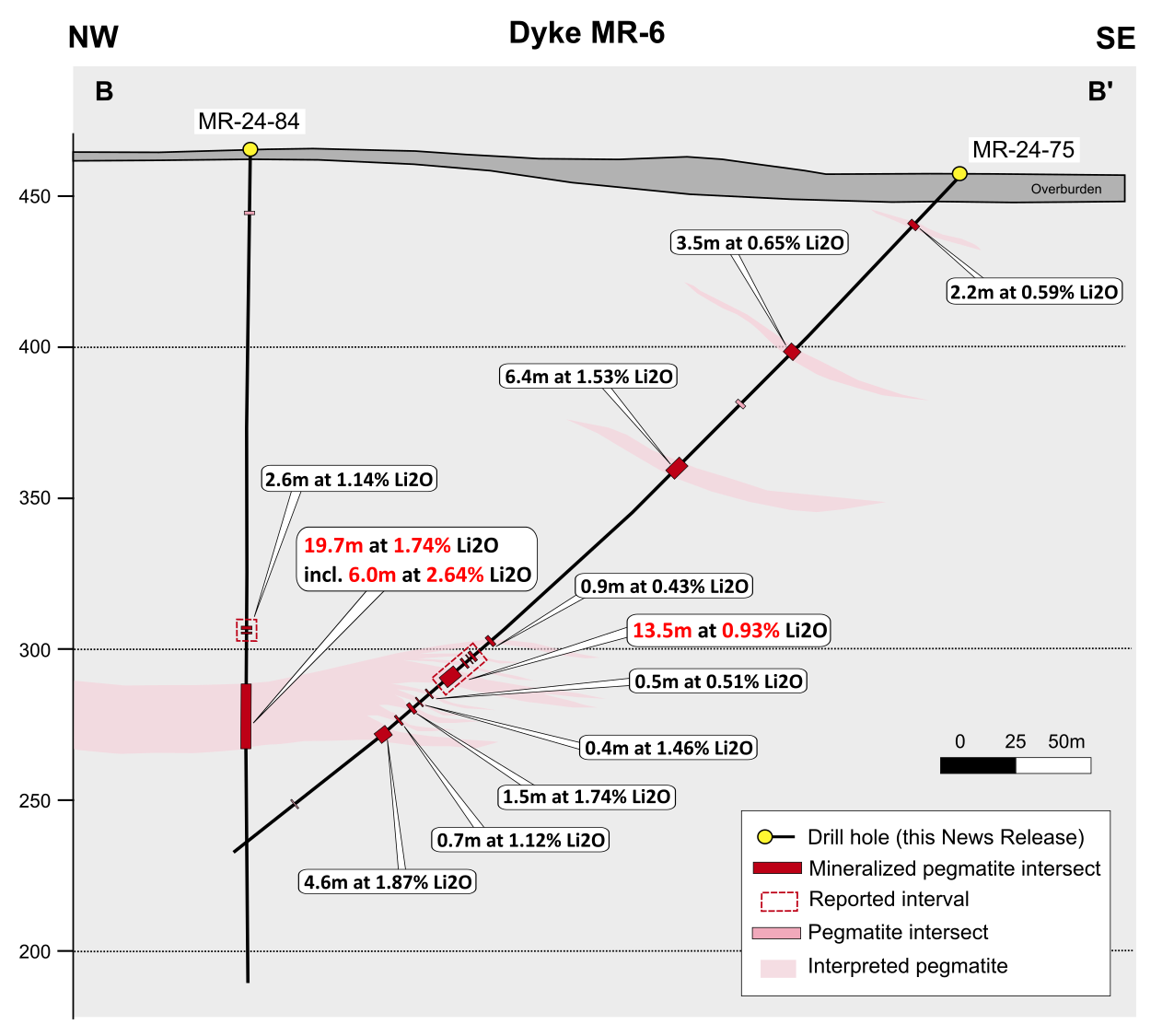

Holes MR-24-75 and MR-24-84 expanded the MR-6 dyke 100 meters to the Southwest. MR-6 has been now drill traced over an area measuring over 350 meters by 350 meters with an average thickness of 30 meters with a core zone where the average thickness increases to 50 meters. MR-6 continues to be open to the Northwest from surfaces to 170 meters vertical (Figure 3).

Figure 3 : Cross Sections B to B'

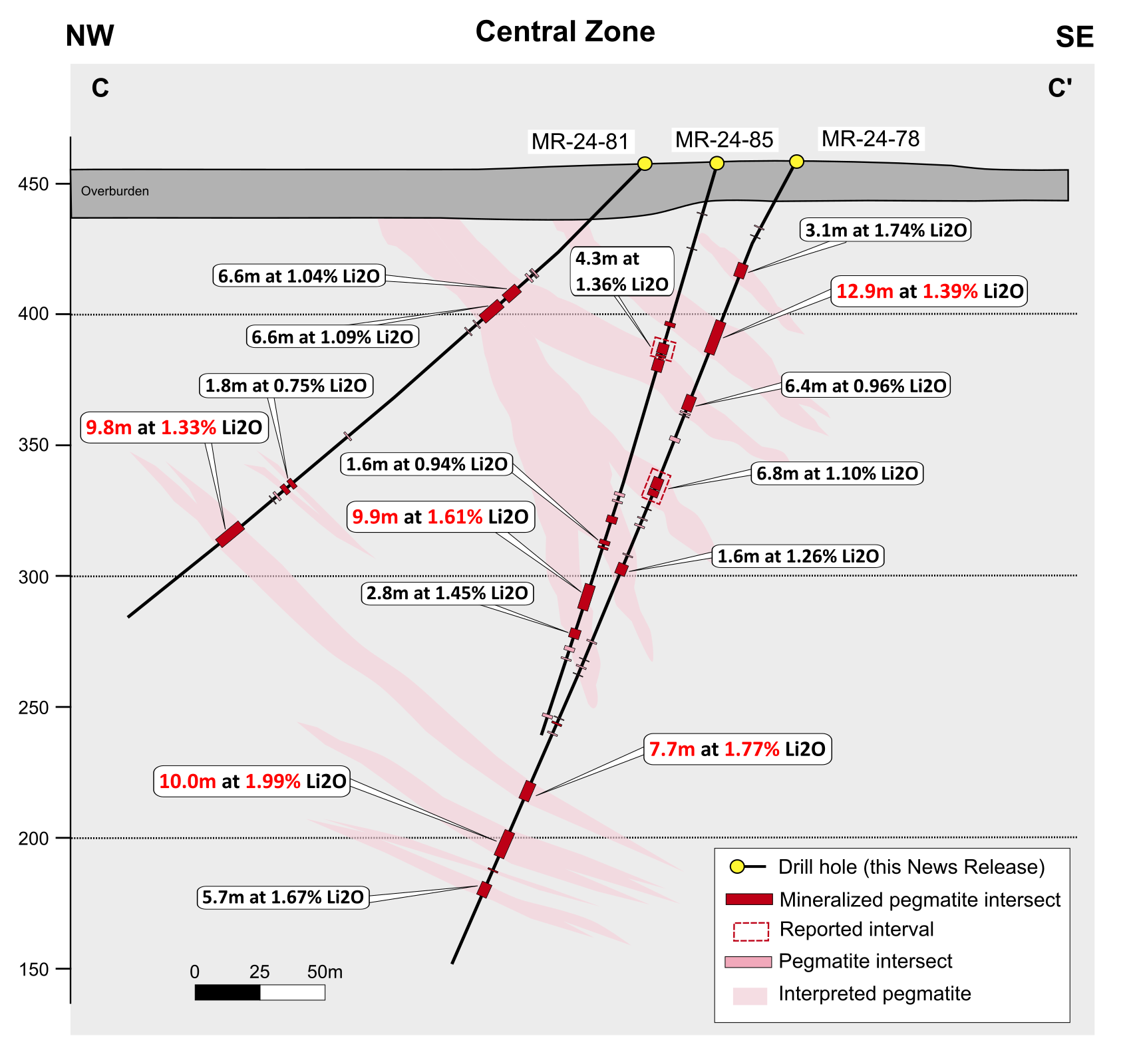

Holes MR-24-78, MR-24-81 and MR-24-85 were drilled in the stacked dyke zone located immediately to the East of MR-6. These new holes continue to confirm the potential of this zone with multiple wide high-grade lithium mineralization. Contained within an envelope of 250 meters by 300 meters, this zone remains open to the North, East and South. More drilling is needed to improve the interpretation of the geometry of each dyke in this zone.

Figure 4 : Cross Sections C to C'

Table 1 : 2024 Summer Drilling Program Mentioned in this Release

| Hole ID | From (m) | To (m) | Length (m) | Li2O (%) | Ta2O5 (ppm) |

| MR-24-75 | 21.55 | 23.75 | 2.2 | 0.6 | 190.4 |

| and | 78.55 | 82 | 3.5 | 0.7 | 235.9 |

| and | 131.7 | 138.1 | 6.4 | 1.5 | 133.0 |

| and | 226.55 | 240 | 13.5 | 0.9 | 93.8 |

| and | 252.8 | 254.3 | 1.5 | 1.7 | 441.3 |

| and | 264 | 268.55 | 4.6 | 1.9 | 277.3 |

| MR-24-78 | 49 | 52.1 | 3.1 | 1.7 | 670.1 |

| and | 72.7 | 85.55 | 12.9 | 1.4 | 233.0 |

| and | 103.85 | 110.2 | 6.4 | 1.0 | 189.1 |

| and | 139.5 | 146.25 | 6.8 | 1.1 | 228.7 |

| and | 178.75 | 180.35 | 1.6 | 1.3 | 209.2 |

| and | 271.65 | 279.3 | 7.7 | 1.8 | 233.7 |

| and | 294.1 | 304.1 | 10.0 | 2.0 | 221.3 |

| and | 309.7 | 310.3 | 0.6 | 1.1 | 99.3 |

| and | 315.65 | 321.3 | 5.7 | 1.7 | 143.6 |

| MR-24-80 | 114 | 120 | 6.0 | 0.5 | 237.0 |

| and | 146.55 | 149.75 | 3.2 | 1.0 | 184.3 |

| and | 157.8 | 173.85 | 16.1 | 1.3 | 188.8 |

| and | 182.05 | 185.35 | 3.3 | 1.2 | 326.5 |

| MR-24-81 | 70.5 | 77.05 | 6.6 | 1.0 | 154.5 |

| and | 82.5 | 89.1 | 6.6 | 1.1 | 210.5 |

| and | 186.45 | 188.2 | 1.75 | 0.7 | 161.9 |

| and | 212.85 | 222.6 | 9.75 | 1.3 | 153.3 |

| MR-24-82 | 3.8 | 4.14 | 0.3 | 0.8 | 203.9 |

| and | 166.8 | 170.3 | 3.50 | 0.7 | 195.0 |

| MR-24-83 | 161.15 | 161.5 | 0.35 | 0.0 | 512.9 |

| and | 173.8 | 174.4 | 0.55 | 0.6 | 192.9 |

| MR-24-84 | 20.35 | 21.6 | 1.25 | 0.0 | 314.4 |

| and | 157.75 | 160.4 | 2.60 | 1.1 | 119.1 |

| and | 178.7 | 198.4 | 19.70 | 1.7 | 148.9 |

| incl. | 179.75 | 185.8 | 6.00 | 2.6 | 162.3 |

| MR-24-85 | 19.5 | 19.8 | 0.30 | 0.0 | 456.7 |

| and | 33.4 | 33.7 | 0.25 | 0.1 | 363.9 |

| and | 62.9 | 63.9 | 1.00 | 0.5 | 305.3 |

| and | 72.25 | 76.5 | 4.3 | 1.4 | 285.5 |

| and | 79.5 | 82.25 | 2.8 | 0.6 | 157.4 |

| and | 141.1 | 141.9 | 0.8 | 0.4 | 255.2 |

| and | 149.75 | 151.35 | 1.6 | 0.9 | 250.7 |

| and | 152.25 | 153.15 | 0.9 | 0.6 | 211.9 |

| and | 167.65 | 177.55 | 9.9 | 1.6 | 248.7 |

| and | 185.4 | 188.2 | 2.8 | 1.4 | 246.4 |

| MR-24-86 | 161.45 | 162.9 | 1.5 | 0.1 | 812.1 |

| and | 166.8 | 169.8 | 3.0 | 1.8 | 152.0 |

| and | 173.45 | 175.45 | 2.0 | 1.0 | 70.2 |

| and | 237.2 | 237.45 | 0.3 | 0.0 | 2252.9 |

| MR-24-87 | 137.9 | 142.9 | 5.0 | 1.5 | 104.8 |

| and | 149 | 186 | 37.0 | 1.1 | 63.4 |

| incl. | 157 | 163 | 6.0 | 2.4 | 69.6 |

| and | 192 | 196 | 4.0 | 1.8 | 91.8 |

| and | 201.15 | 202.15 | 1.0 | 0.9 | 174.6 |

| MR-24-89 | 100 | 123 | 23.0 | 1.1 | 86.8 |

| MR-24-90 | 43 | 53.8 | 10.8 | 2.4 | 57.4 |

| MR-24-91 | 45 | 101 | 56.0 | 1.4 | 130.5 |

| MR-24-92 | 72.8 | 86.9 | 14.1 | 3.3 | 52.4 |

| MR-24-93 | 82.35 | 92.2 | 9.9 | 2.4 | 80.0 |

| MR-24-94 | 4.15 | 19.85 | 15.7 | 1.1 | 74.7 |

QAQC

All drill core samples were collected under the supervision of BRW employees and contractors. The drill core was transported by helicopter and by truck from the drill platform to the core logging facility in Val-d'Or. Each core was then logged, photographed, tagged, and split by diamond saw before being sampled. All pegmatite intervals were sampled at approximately 1-meter intervals to ensure representativity. Samples were bagged; duplicated on reject, blanks and certified reference materials for lithium were inserted every 20 samples. Samples were bagged and groups of samples were placed in larger bags, sealed with numbered tags, in order to maintain a chain of custody. The sample bags were transported from the BRW contractor facility to the ALS laboratory in Val-d'Or. All sample preparation and analytical work was performed by ALS using ICP-AES according to the ALS method ME-MS89L. All results passed the QA/QC screening at the lab and all inserted standard and blanks returned results that were within acceptable limits. All reported drill intersections are calculated based on a lower cutoff grade of 0.3% Li2O, with maximum internal dilution of 5 meters. Host basalts adjacent to the dykes may grade up to 0.3% Li2O but were excluded from the reported intersections.

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Mr. Simon T. Hébert, VP Development. He is a Professional Geologist registered in Quebec and is a Qualified Person as defined by National Instrument 43-101.

About Brunswick Exploration

Brunswick Exploration is a Montreal-based mineral exploration company listed on the TSX-V under symbol BRW. The Company is focused on grassroots exploration for lithium in Canada, a critical metal necessary to global decarbonization and energy transition. The company is rapidly advancing the most extensive grassroots lithium property portfolio in Canada and Greenland.

Investor Relations/information

Mr. Killian Charles, President and CEO ( info@brwexplo.ca )

Cautionary Statement on Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; the other risks involved in the mineral exploration and development industry; and those risks set out in the Corporation's public documents filed on SEDAR at www.sedar.com. Although the Corporation believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Corporation disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0276c271-a28f-482c-8ce9-7046ef8247f8

https://www.globenewswire.com/NewsRoom/AttachmentNg/eb06ae78-e34f-47f8-9cc2-2d6580942ad9

https://www.globenewswire.com/NewsRoom/AttachmentNg/f7b023fe-f494-4c3b-8f5b-c56000fde710

https://www.globenewswire.com/NewsRoom/AttachmentNg/1f7d9b6d-1ca5-46de-a0f0-c3d4fcd5fa67