San Domingo Drilling Results Demonstrate Further Potential for an Extensive Lithium Pegmatite District in Arizona

Bradda Head Lithium Ltd. (AIM:BHL)(TSXV:BHLI)(OTCQB:BHLIF) ("Bradda Head", "Bradda", "BHL" or the "Company"), the North America-focused lithium development company, announces significant high grade lithium bearing minerals intercepted at multiple locations from the initial set of results from its first diamond core drilling programme at the Company's 23km2 San Domingo pegmatite district in Arizona. BHL has intersected 31.85 meters at 1.60% Li2O in drill hole SD22-024 which includes 3.21 meters at 3.74% Li2O[1]. This is the first extensive drilling campaign undertaken at San Domingo since the 1950's and is the maiden program under BHL

Highlights include:

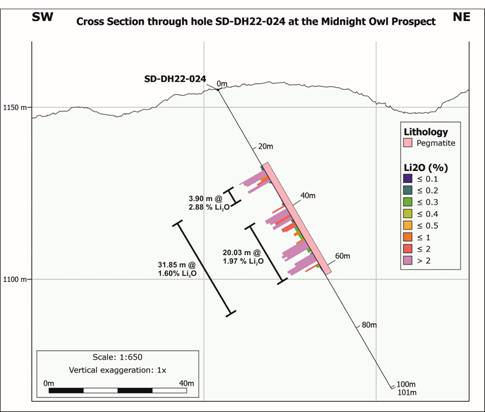

· 31.85m @ 1.60% Li2O (including 3.90m @ 2.88% Li2O, and 20.03m @ 1.97% Li2O (including 7.06m @ 1.92% Li2O, 3.21m @ 3.74% Li2O and 3.81m @ 3.25% Li2O)) in SD-DH22-024

· 9.75m @ 0.78% Li2O (including 5.36m @ 1.20% Li2O) in SD-DH22-003

· 4.27m @ 1.86% Li2O in SD-DH22-005

· 2.44m @ 1.63% Li2O in SD-DH22-001

Summary:

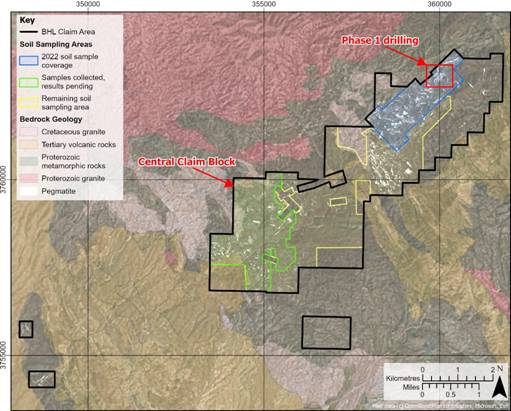

· Bradda Head commenced a 7,000m diamond core drilling programme at its San Domingo lithium pegmatite district in Arizona in Q3 2022 as a first pass exploration effort. Once completed, this programme (see map below) will have tested just over 1% of the 23km2 that Bradda holds in Arizona.

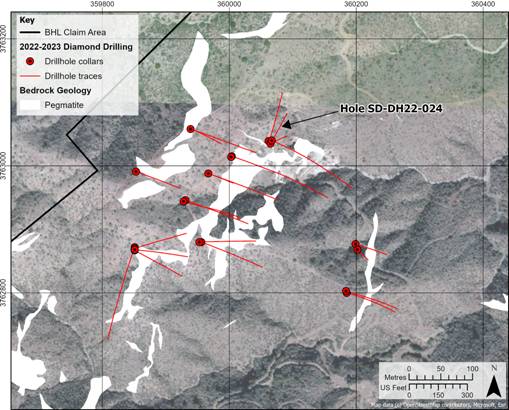

· Out of the 7,000m planned, 5,700m (36 holes completed so far) have been drilled with positive results, as set out in the table below. Partial assays have been received back with Lithium bearing minerals observed in c.75% of the holes drilled. This first pass phased drilling programme is expected to be completed by the end of February.

· Based on the success of Phase 1 at the Northern Claim block (see map) as highlighted by the results noted above, Bradda Head has already commenced a detailed soil survey over its entire 23km2 land package (see PR dated 21 November 2022). Remaining drilling results of the programme will be reported as and when received.

· The above detailed soil survey programme is scheduled to be completed by early March and along with an ongoing structural mapping programme, will be used to more accurately and efficiently target our Phase 3 drilling programme (due to start H2 2023) building on areas covered by Phase 1 and 2 (Central Claim block), and also to explore the potential at the c.99% of our claims at San Domingo that remain untested.

· It is Important to note that this first programme has been focussed on shallow drilling and with positive intersections of lithium mineralisation recorded at shallow depths (from surface in some holes) in multiple locations across an area in the Northern claim block at San Domingo (see map and hole 24 cross-section below), where partial assays have now been received. A shallow Open Pit Mining approach therefore seems the route to follow.

· Phase 2 of this programme at the Central Claim Block has commenced; assays are pending.

· North American assay laboratories are currently running at capacity and as a consequence turnaround times on assay reporting are excessive, +8 -12 weeks on occasions, as well as being subject to last minute delays and disruption. Bradda therefore expects all results to be received by the end of H1 2023.

· Assay results for c.50% of our 36 completed holes are pending.

Charles FitzRoy, CEO of Bradda Head Lithium, commented:

"These results are encouraging and set the scene for what we believe has the potential to define a world class lithium pegmatite district in Arizona, near vital infrastructure and battery end-users within the US and the wider developing North American battery hub. The US is investing US$135bn in its EV and critical minerals supply chain, all Bradda's assets are located in the US for the US market, these results are therefore extremely supportive of our business model. ESG is front and centre in our approach and we are working to develop these assets with as low a carbon footprint as possible.

"The initial results from this first drill programme at San Domingo highlights a distinct district scale potential. As a result, Bradda is in the process of designing a follow-up drilling programme in H2 of this year aimed at testing additional ground within the much wider 23km2 of lithium pegmatite claims held in Arizona. Funds are already in place for this work, and ongoing exploration work by our geologists suggests that we have only just scratched the surface of what we have at San Domingo with just over 1% of the area tested from this first programme. We intend to keep the market updated on our progress and we look forward to sharing further developments of this exciting project.

"As well as progressing its pegmatite projects, Bradda Head recently announced a 2nd resource update in less than 12 months at its lithium in clay Basin project in Arizona. Further drill programmes are planned to start at the Basin in H1 of this year, which we believe will likely lead to further resource growth at our flagship clay asset. With almost 0.4Mt of LCE already in compliant resources Bradda Head now has the largest publicly announced lithium resource in Arizona and 2023 is expected to be yet another resource growth year for the Company!

"The success of our current programmes at our San Domingo Pegmatites, and also at our Lithium in Clay Basin Project, both located in Arizona, USA, continue to highlight the risk diversification approach followed by Bradda that separates us from many of our peers in the 'Lithium' space."

San Domingo Overview map:

Phase 1 - Northern Claim Block:

Hole 24 Cross-section:

San Domingo Phase 1 drill highlights so far:

Phase | Drill Hole Number | From* (m) | To (m) | Interval (m) | Lithium Oxide (Li2O) % | Target Area |

SD-DH22-001 | 27.43 | 29.87 | 2.44 | 1.63 | Northern Claims | |

SD-DH22-001 | 59.31 | 68.28 | 8.96 | 0.48 | Northern Claims | |

SD-DH22-002 | 23.04 | 25.73 | 2.68 | 0.04 | Northern Claims | |

with | 34.67 | 35.27 | 0.58 | 0.06 | Northern Claims | |

SD-DH22-003 | 0 | 9.75 | 9.75 | 0.78 | Northern Claims | |

1 | with | 0 | 5.36 | 5.36 | 1.20 | Northern Claims |

and | 9.75 | 22.86 | 13.11 | 0.05 | Northern Claims | |

SD-DH22-004 | 44.93 | 50.23 | 5.3 | 0.07 | Northern Claims | |

SD-DH22-005 | 0 | 4.27 | 4.27 | 1.86 | Northern Claims | |

and | 40.84 | 53.49 | 11.8 | 0.04 | Northern Claims | |

SD-DH22-006 | 8.53 | 11.13 | 2.59 | 0.05 | Northern Claims | |

and | 11.89 | 28.35 | 16.15 | 0.02 | Northern Claims | |

SD-DH22-007 | 14.63 | 16.76 | 2.13 | 0.03 | Northern Claims | |

SD-DH22-008 | 106.34 | 112.78 | 6.43 | 0.04 | Northern Claims | |

SD-DH22-009 | No significant Intercepts | Northern Claims | ||||

SD-DH22-010 | 2.29 | 27.04 | 16.85 | 0.16 | Northern Claims | |

with | 4.08 | 20.33 | 8.36 | 0.21 | Northern Claims | |

and | 35.11 | 38.86 | 6.43 | 0.09 | Northern Claims | |

SD-DH22-011 | 2.74 | 6.71 | 3.96 | 0.44 | Northern Claims | |

and | 48.16 | 50.72 | 3.69 | 0.05 | Northern Claims | |

SD-DH22-012 | No significant Intercepts | Northern Claims | ||||

SD-DH22-013 | 175.26 | 178.19 | 2.93 | 0.13 | Northern Claims | |

SD-DH22-014 | 3.96 | 6.40 | 2.43 | 0.22 | Northern Claims | |

SD-DH22-015 | 8.53 | 10.67 | 2.13 | 0.29 | Northern Claims | |

SD-DH22-016 | No significant Intercepts | Northern Claims | ||||

1 | SD-DH22-017 | No significant Intercepts | Northern Claims | |||

SD-DH22-018 | Results Pending | Northern Claims | ||||

SD-DH22-019 | Results Pending | Northern Claims | ||||

SD-DH22-020 | Results Pending | Northern Claims | ||||

SD-DH22-021 | Results Pending | Northern Claims | ||||

SD-DH22-022 | Results Pending | Northern Claims | ||||

SD-DH22-023 | Results Pending | Northern Claims | ||||

SD-DH22-024 | 26.82 | 58.67 | 31.85 | 1.60 | Northern Claims | |

with | 26.82 | 30.72 | 3.90 | 2.88 | Northern Claims | |

with | 38.65 | 58.67 | 20.03 | 1.97 | Northern Claims | |

with | 38.65 | 45.72 | 7.06 | 1.92 | Northern Claims | |

with | 49.83 | 53.04 | 3.21 | 3.74 | Northern Claims | |

And | 54.86 | 58.67 | 3.81 | 3.25 | Northern Claims | |

SD-DH22-025 | Results Pending | Northern Claims | ||||

SD-DH22-026 | Results Pending | Northern Claims | ||||

SD-DH22-027 | Results Pending | Northern Claims | ||||

* All drill holes commenced at surface

Background

The Phase 1 and 2 7,000m diamond core drilling programme was designed to test the thesis that San Domingo is similar in structure to other well-known zoned pegmatites.

Following on from SRK's 3D remote mapping of the Company's whole San Domingo claims, and Bradda's geological fieldwork, the Company decided to increase its claims by 75% to cover 23km2 in 2022, thereby strengthening its position in what Bradda believes has the potential to be a world class lithium district[2].

In 2022 Bradda completed a soil sampling survey covering c.11% or just under 3km2 of its 23km2 of pegmatite ground in Arizona, yielding highly prospective follow-up drill targets and a 3km trend on the area covered by the soil sampling (see PR dated 21 November2022) with the same elemental signatures that have been seen at known lithium mineralisation locations globally. The programme is now being expanded to cover the remaining 20km2 not extensively soil sampled, with consultants currently in the field collecting samples.

The soil geochemistry suggests that the pegmatite swarm is largely of the LCT (lithium-caesium-tantalum) mineralisation type, the most significant for lithium deposits and what is commonly associated with economic occurrences of lithium and tantalum. LCT-type pegmatites are generally found in the Western Australian pegmatite district, like Tianqi and Albemarle's joint-venture Greenbushes lithium mine.

Bradda is proactively doing everything commercially possible to sample our entire pegmatite district to ensure follow-up drill programmes hit more high-priority targets and to continue to keep intersecting further lithium bearing pegmatites. Bradda has a 10,000m drill programme planned to start in the second half of 2023, using data from the wider soil sampling, current drilling, SRK pegmatite mapping and the upcoming structural mapping programme.

Previous surface sampling at named outcropping pegmatites in the San Domingo claim blocks returned individual sample grade highlights of:

· Midnight Owl: 1.44% Li2O

· Joker: 0.35% Li2O

· White Ridge: 2.49% Li2O

· Lower Jumbo: 1.62% Li2O

· Sunrise: 0.67% Li2O

· North Morning Star: 0.92% Li2O

For further information please visit the Company's website: www.braddaheadltd.com

Qualified Person (BHL)

Joey Wilkins, B.Sc., P.Geo., is Head of North America at BHL and the Qualified Person who reviewed and approved the technical disclosures in this news release. Mr. Wilkins is a graduate of the University of Arizona with a B.Sc. in Geology with more than 37 years of experience in mineral exploration and is a Qualified Person under the AIM Rules and a Qualified Person as defined under Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Core samples were split on site and bagged with sample tracking tags. Samples were shipped by the company directly to SGS Laboratories in Burnaby, B.C., Canada where SGS prepped then analysed all samples using sodium peroxide fusion combined ICP-AES and ICP-MS, method GE_ICM90A50. Certified standards were inserted into the sample stream and reviewed by the QP. Mr. Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

ENDS

For further information, please contact:

+44 (0) 1624 639 396 | |

| Charlie FitzRoy, CEO Denham Eke, Finance Director | |

| Beaumont Cornish (Nomad) James Biddle/Roland Cornish | +44 20 7220 1666 |

Peterhouse (Joint Broker) | +44 207 469 0930 |

| Charles Goodfellow Duncan Vasey Lucy Williams | |

Shard Capital (Joint Broker) | +44 207 186 9927 |

| Damon Heath Isabella Pierre | |

Red Cloud (North American Broker) | +1 416 803 3562 |

Joe Fars | |

Tavistock (PR) | + 44 20 7920 3150 |

| Nick Elwes Adam Baynes |

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium development group. The Company currently has interests in a variety of projects, the most advanced of which are in Central and Western Arizona: The Basin Project (Basin East Project, and the Basin West Project) and the Wikieup Project.

As previously announced in press release on 16 January 2022, the Basin East Project has an Indicated Mineral Resource of 21.2 Mt at an average grade of 891 ppm Li and 3.5% K for a total of 100 kt LCE and an Inferred Mineral Resource of 73.3 Mt at an average grade of 694 ppm Li and 3.2% K for a total of 271 kt LCE. In the rest of the Basin Project SRK has estimated an Exploration Target of between 300 to 1,300 Mt of material grading between 600 to 850 ppm Li which is equivalent to a range of between 1 to 6 Mt LCE.

The Group intends to continue to develop its three phase one projects in Arizona, whilst endeavouring to unlock value at its other prospective pegmatite and brine assets in Arizona, Nevada, and Pennsylvania. All of Bradda Head's licences are held on a 100% equity basis and are in close proximity to the required infrastructure.

Bradda Head is quoted on the AIM of the London Stock Exchange with the ticker of BHL, on the TSX Ventures exchange with a ticker of BHLI, and on the US OTCQB market with a ticker of BHLIF.

Competent Person SRK

The Mineral Resource statement for the Basin Project was authored by Martin Pittuck, CEng, MIMMM, FGS who works for SRK Consulting (UK) Ltd, an independent mining consultancy. Mr. Pittuck has over 25 years' experience undertaking and reviewing Mineral Resource estimates and has worked on lithium clay estimates for over 5 years. Mr. Pittuck consents to the inclusion of the resources information in this press release and context in which they appear. Martin Pittuck is a Qualified Person as defined under NI 43-101.

Reference is made to the report entitled "Independent technical report on the Basin and Wikieup Lithium clay projects, Arizona, USA" dated October 18, 2022 with an effective date of June 10, 2022 was prepared by Martin Pittuck, CEng, MIMMM, FGS, and Kirsty Reynolds MSci, PhD, FGS and reviewed by Nick Fox MSc, ACA, MIMMM. The Report is available for review on SEDAR (www.sedar.com) and the Company's website www.braddaheadltd.com.

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, following: The Company's objectives, goals or future plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; delays in obtaining or failures to obtain required regulatory, governmental, environmental or other project approvals; political risks; future operating and capital costs, timelines, permit timelines, the market and future price of and demand for lithium, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices; delays in the development of projects, capital and operating costs varying significantly from estimates; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

[1] Core length

[2] See PRs dated 21 November 2022, 13 September 2022, 08 August 2022, 18 July 2022, 21 June 2022 and 02 November 2021.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Bradda Head Lithium Limited

View source version on accesswire.com:

https://www.accesswire.com/738166/Bradda-Head-Lithium-Ltd-Announces-San-Domingo-Drilling-Results