Blue Lagoon Resources Inc. (the "Company") (CSE:BLLG); (FSE:7BL); (OTCQB:BLAGF) is pleased to announce significant mineralized intercepts from the last of the 2022 Phase One drill results on its all year-round and road accessible Dome Mountain Gold Project, located a short 50-minute drive from Smithers, British Columbia. Drill results include 124 gt Au and 36.7 gt Ag over 0.76 meters from the Argillite Vein in hole DM-22-233 and 31.67 gt Au and 473 gt Ag over 1.09 meters from the Boulder Vein in hole DM-22-229

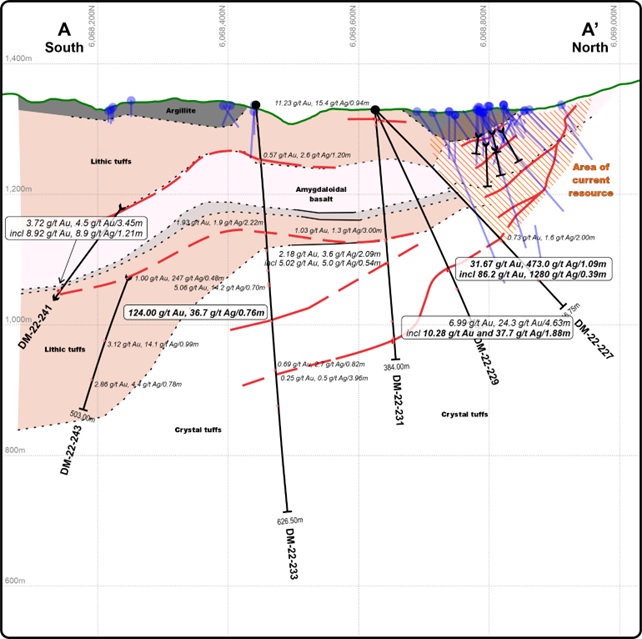

Drilling deep and on strike in the Boulder Vein encountered very significant mineralization which added over 200 m of strike length to the already deep intercepts 200 meters below the current 43-101 resource on the Boulder Vein System. Results include 31.67 g/t Au and 473.0 g/t Ag over 1.09 meters (including 86.20 g/t Au and 1280 g/t Ag over 0.39 meters) from DM-22-229 and 11.22 g/t Au and 15.4 g/t Ag over 0.94 meters and 6.99 g/t Au and 37.7 g/t Ag over 4.63 meters ( including 10.28 g/t Au and 37.7 g/t Ag over 1.88 meters) both from DM-22-231. True thicknesses of these intersections are estimated at 70% of the drill indicated length.

The 4.63 meter drill intercept (approximately 3.27 meter true thickness) in hole DM-22-231 is a thick intercept of the Boulder Vein that not only demonstrates that the Boulder Vein is robust at depth, it may in fact be swelling at depth.

Hole DM-22-233 intersected 124.4 g/t Au and 36.7 g/t Ag over 0.76 meters from the interpreted down-dip extension of the Argillite Vein. This intercept is 350 meters downdip of the current 43-101 resource. Insufficient structural data is available to determine true thickness. Table 1 summarizes the significant results from the Boulder Vein System drilling.

"Hole DM-22-229 provides a lot of confidence that mineralization on the Boulder Vein continues to depth", said Bill Cronk, Chief Geologist for Blue Lagoon Resources. "This hole was meant to step out along strike and target the Boulder Vein 200 meters along strike from the DM-20-139 intercept (17.69 g/t Au and 70.40 g/t Ag over 3.13 meters, see press release December 9, 2020). With this intercept we feel that drilling deep along strike will add significant value to the mineralized Boulder Vein System and, to the Dome Mountain Gold Project as a highly attractive regional gold development target," he added.

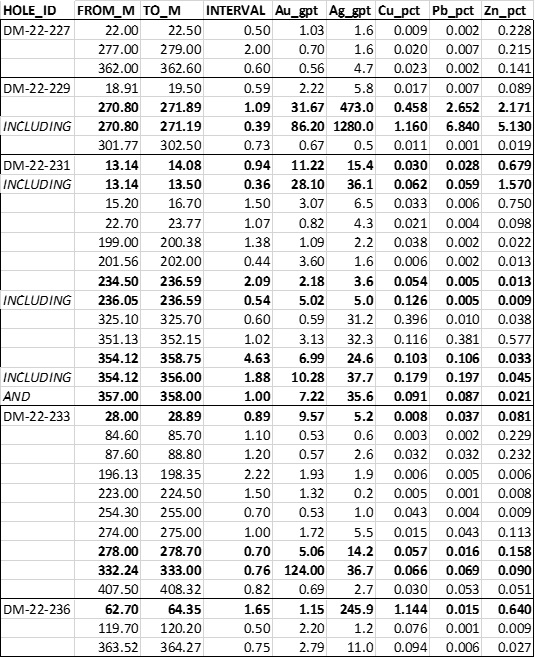

TABLE 1

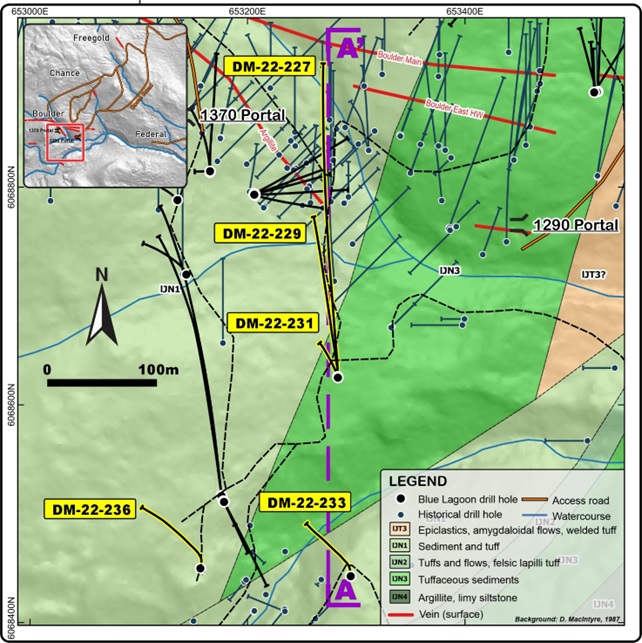

Figure 1: Drill Hole Plan Map, Boulder Vein System

Figure 2: Cross Section, 653275E, Boulder Vein System. Note hatched zone in upper right denotes current resource. All stated intersection lengths are drill indicated lengths.

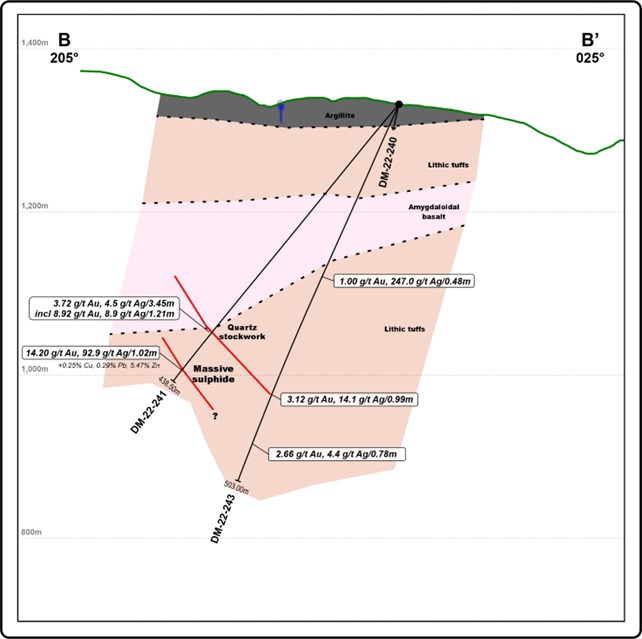

Further to the Boulder Vein System drilling, additional holes were drilled to the south into and around the historic 9800 Zone which features historic high grade surface exposure (see Figure 1)

Two holes were drilled into the area and both holes intersected high grade mineralization including 14.2 g/t Au, 92.9 g/t Ag and 5.4% Zn over 1.02 meters in hole DM-22-241. Table 2 highlights the significant results. This intercept is a new mineralized zone and will be followed up in the future. All intersection widths are drill indicated lengths as insufficient work has been done to determine orientations.

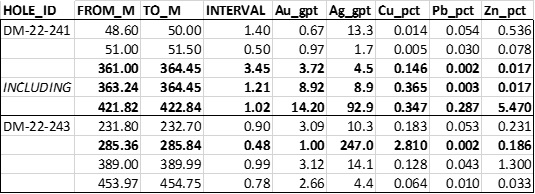

TABLE 2

Figure 3: Drill Hole Plan Map, 9800 Zone

Figure 4: Cross Section, 9800 Zone. All stated intersection lengths are drill indicated lengths.

QUALITY ASSURANCE AND CONTROL

Core selected for sampling was cut in half with a core saw or split with a hydraulic splitter with one half bagged for shipping. Strict chain of custody storing, and shipping protocol was maintained. All core preparation and analyses were completed by Activation Laboratories Ltd. located in Kamloops, BC. Core was crushed, split, and pulverized with 250 grams passing 200 mesh. Each sample was analyzed for gold by fire assay with ICP-OES finish (Act Labs Code 1A2-ICP) and for multi-elements by 4-acid total digestion ICP with OES finish.(Act Labs Code 1F2) Any gold overlimits (>30 ppm Au) were analyzed by gravimetricfire assay. Standards and blanks were inserted by Company staff. The sampling program was undertaken by Company personnel and under the direction of Ted Vanderwart, P.Geo.

The scientific and technical disclosure in this news release was approved by William Cronk, P.Geo, a Qualified Person as defined in NI 43-101 and a consultant to the Company.

For further information, please contact:

Rana Vig

President and Chief Executive Officer

Telephone: 604-218-4766

Email: rana@ranavig.com

The CSE has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Statement Regarding Forward-Looking Information: This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address events or developments that Blue Lagoon Resources Inc. (the "Company") expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include results of exploration activities may not show quality and quantity necessary for further exploration or future exploitation of minerals deposits, volatility of gold and silver prices, and continued availability of capital and financing, permitting and other approvals, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Blue Lagoon Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/707630/Blue-Lagoon-Encounters-Significant-Mineralization-on-the-Boulder-Vein--Adds-Over-200-Meters-of-Strike-Length-to-Previous-Deep-Intercept-200-Meters-Below-Current-Resource