May 12, 2024

Horizon Minerals Limited (ASX: HRZ) (“Horizon” or “the Company”) is pleased to announce that it has entered into a binding Toll Milling Agreement (“TMA”) with FMR Investments Pty Ltd (“FMR”) to treat 200kt of Horizon ore from the Cannon underground project, or other deposit, commencing in the December 2024 Quarter.

HIGHLIGHTS

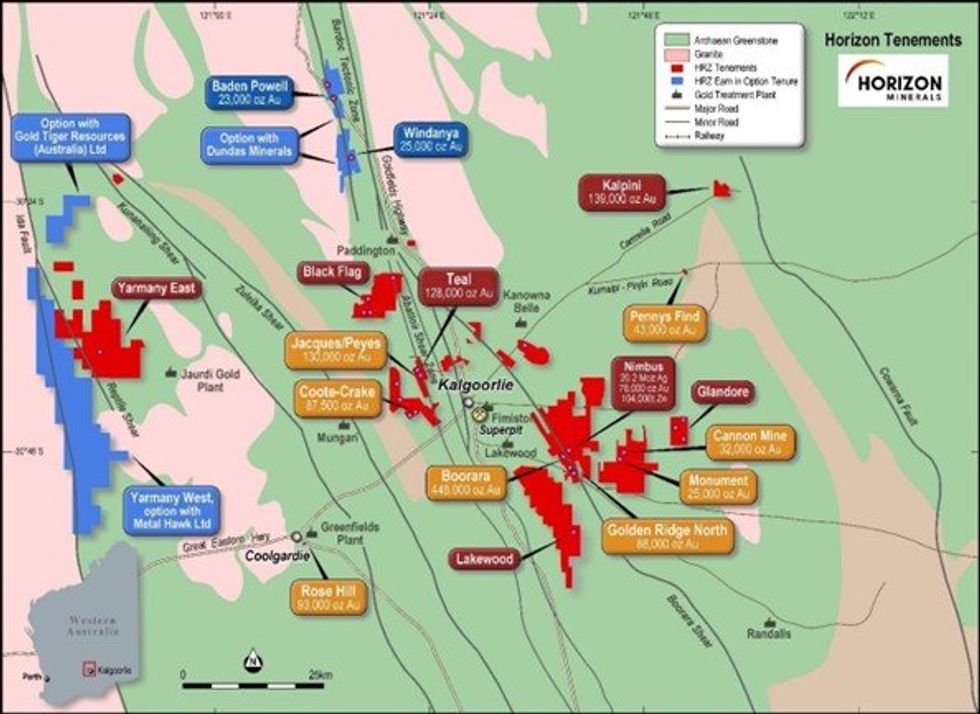

- Binding TMA has been executed with FMR, which owns the Greenfields Mill located northeast of Coolgardie and 30km southwest of Kalgoorlie-Boulder in WA

- Horizon will arrange contract mining and hauling of ore from Cannon for ore processing at FMR’s 1.0Mtpa Greenfields Mill, located ~67km by road from the Cannon Project

- An agreed 200kt of ore will be processed over a period of eight months, commencing in the December 2024 Quarter

- The TMA contains competitive ore treatment rates with the payment structure as follows:

- Horizon is responsible for delivery of each stockpile to the Greenfields Mill ROM near Coolgardie

- Payment of processing costs must be made before the value of the processed and refined gold at the Perth Mint is transferred from FMR’s metal account to Horizon

- If the delivery schedule is missed Horizon will forfeit its allocated tonnes for that month and from the overall 200kt allocation

- An Ore Reserve for Cannon has already been established including forecast economics for the ore to be processed via a Toll Milling Agreement 1

- Cannon is fully environmentally permitted (with last mining in 2017) with pre-production activities are already underway, including dewatering of the open pit in preparation for underground mining

- The TMA has flexibility that Horizon can treat Horizon ore other than Cannon, including Horizon’s own current resources or those acquired through the proposed merger with Greenstone Resources Limited, provided sufficient notice is provided to FMR

Commenting on the toll milling agreement, Chief Executive Officer Mr Grant Haywood said: 2

“We are very pleased to have converted our 200,000 tonne allocation with FMR into a formal Toll Milling Agreement, and look forward to working closely with them as ore deliveries will commence later this calendar year. This agreement is in addition to our 1.4Mt ore sale agreement with Paddington announced a week ago. Together this will see us generating cash flow from two fronts in this fantastic gold price environment before the end of 2024.”

Next Steps 1

- AMC Consultants has been engaged and undertaken a review of the Cannon Ore Reserve and will progress the revised key financial outcomes for the June 2024 Quarter

- Finalise engagement with underground mining and haulage contractors to finalise tenders for Cannon

- Complete the proposed merger with Greenstone Resources to enhance the long-term production profile with development ready high-grade projects

Click here for the full ASX Release

This article includes content from Horizon Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

21 August 2025

Horizon Minerals

Emerging stand-alone gold producer in Western Australia

Emerging stand-alone gold producer in Western Australia Keep Reading...

17h

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

23 February

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00