July 26, 2022

Anson Resources Limited (ASX: ASN, ASNOC, ASNOD) (Anson or the Company) is pleased to announce that drilling of the targeted Mississippian Units at the Long Canyon No. 2 well at the Paradox Lithium Project (the Project) in Utah, USA, has delivered a further 87% increase in lithium grade over the most recent reported assays at the Project.

Highlights:

- Anson has delivered a further 87% increase in Lithium assay grade in drilling of the targeted Mississippian Unit at the Long Canyon No. 2 well at its Paradox Lithium Project

- Drilling returned an average assay grade of 187ppm Lithium and 3,793ppm Bromine through the entire drilled zone compared to recently reported 100ppm Li

- Lithium and bromine grades are also significantly higher than the maximum grade range used in the Project’s Exploration Target

- The assay results confirm the Mississippian Units’ massive, supersaturated brine aquifer is lithium and bromine rich

- The brines are similar to those of the previously sampled Clastic Zones where the Project’s existing Indicated and Inferred JORC Resource has been estimated

- Drilling is progressing on the Cane Creek 32-1 well to sample the Mississippian brines, which is designed to increase the JORC resource

- Mississippian Units within historic wells on the western side of the Project (‘western strategy”) are to be re-entered and drilled to further expand the Paradox Resource

Anson recently completed drilling at Long Canyon No. 2 as part of its ongoing resource expansion drilling program at the Project. First assay results from this targeted drilling were announced earlier this month, and returned an assay value of 100ppm lithium – collected at the top of the Mississippian unit (see ASX announcement 11 July, 2022).

The Company is now pleased to advise that results of all four brine samples from the recent drilling into the Mississippian units at Long Canyon No. 2 have been returned and have delivered an average assay value of 187ppm lithium (and 3,793ppm bromine).

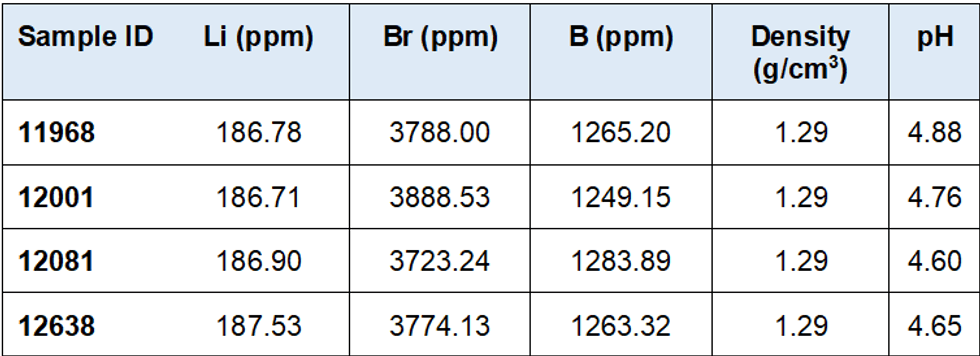

See Table 1 for sample assay results from the recent drilling at Long Canyon No. 2.

This assay grade represents an 87% increase on the first assay value from the recent drilling (100ppm lithium), and a 134% increase on the only historical lithium value recorded at the Project (80ppm lithium). They are also higher than the maximum lithium grade range used in the Exploration Target for the Mississippian Units (140ppm) (summarised in Table 2).

Table 1: Assay results from sampling the Mississippian Unit from the Long Canyon Unit 2 well.

The Mississippian Units host a massive brine aquifer with a thickness of between 70m to 170m. It is situated approximately 500m below the clastic zones that have been used to calculate the existing Indicated and Inferred JORC resource estimate.

The ability to now include assay results from the Mississippian Units provides the opportunity to significantly expand the Paradox resource in Anson’s planned upcoming resource upgrade for the Project.

Paradox Exploration Target

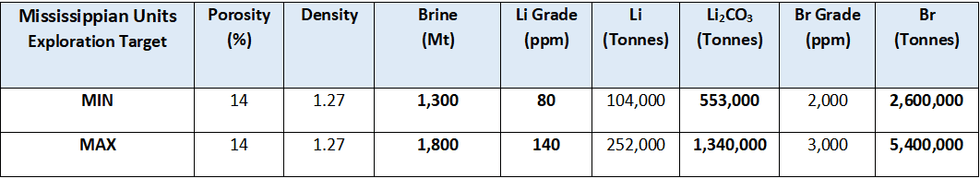

The Project has an Exploration Target for the Mississippian supersaturated brines of 1.3Bt – 1.8Bt of brine grading 80 – 140ppm Li and 2,000 – 3,000ppm Br (see ASX announcement April 6, 2021) (summarised in Table 2). The maximum assay ranges in the Exploration Target are 140ppm Li and 3,000ppm Br, which are significantly lower than the latest laboratory assay results reported in this announcement - average grade of 187ppm Li and 3793ppm Br.

The latest assay results may indicate a connectivity between the Mississippian and Paradox Formation Clastic zones due to the Robert’s Rupture geological feature, which has resulted in the Mississippian rocks being faulted against the Paradox salt beds near the Long Canyon No. 2 well.

Table 2: The Mississippian Units Exploration Target Range with brine & grade variables.

The Exploration Target figure is conceptual in nature as there has been insufficient exploration undertaken on the Project to define a mineral resource for the Mississippian Units. It is uncertain that future exploration will result in a mineral resource.

The Mississippian Units for the entire Project area are currently only included as an Exploration Target in the JORC estimate (See Announcement 6 April 2021).

This Exploration Target was calculated by an independent third party and used data generated during previous oil and gas-focused drilling programs. The review identified several wells within the Project area that have been drilled into the Mississippian Units. They included Long Canyon No1, Long Canyon Unit 2, Coors USA 1-10LC, White Cloud 1, Big Flat Unit 5 and Mineral Canyon Fed 1–3, see Figure 2.

In addition to these wells, numerous other wells that abut the project area have been drilled into or through this limestone unit. These include holes such as Big Flat 1, 2 and 3, the locations of which are shown in Figure 1.

Click here for the full ASX Release

This article includes content from Anson Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ASN:AU

The Conversation (0)

08 June 2022

Anson Resources

Developing a Near-Term Clean Energy Project in Utah

Developing a Near-Term Clean Energy Project in Utah Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00