- WORLD EDITIONAustraliaNorth AmericaWorld

September 19, 2023

In accordance with Listing Rule 5.7 and the JORC Code, this amended announcement includes JORC Table 1 (sections 1 and 2), in reference to the helicopter reconnaissance rock chip sampling program that was completed.

Further, a visual estimate has been included as the announcement refers to ‘outcropping manganiferous material’ within the body of the announcement under the header ‘Highlights and exploration summary’ and refers to the photo at Figure 2. Accordingly, additional information has been included under this header and also below Figure 2 in accordance with ASX and AIG guidance. Lastly, a summary of the 91 samples is included at Annexure 0.1.

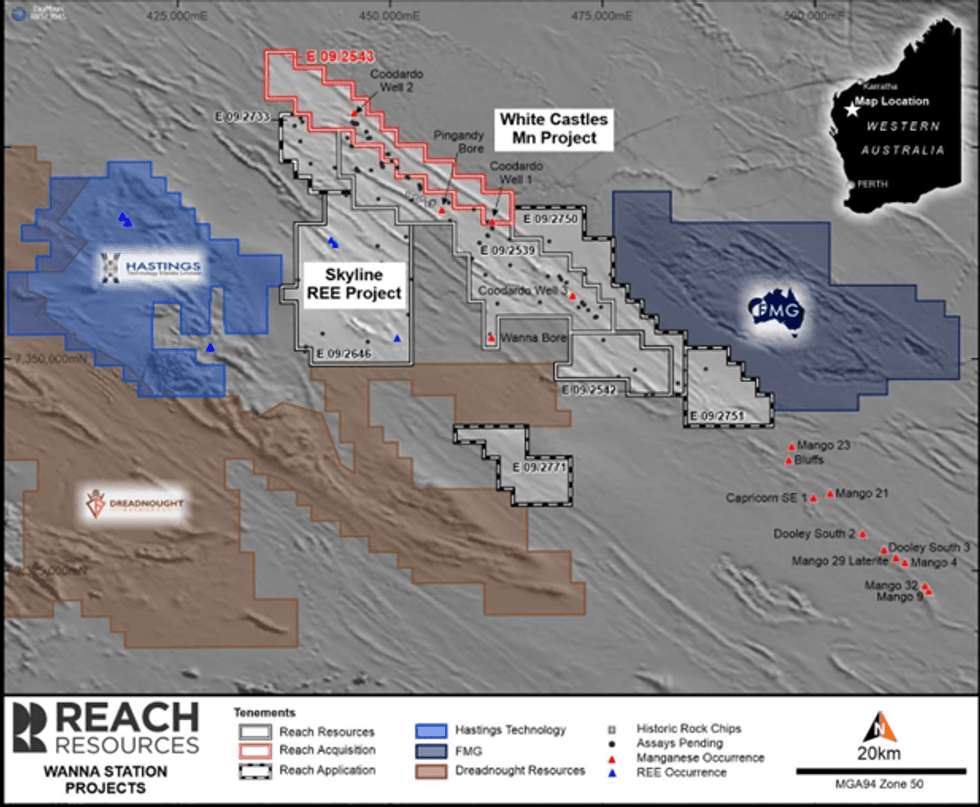

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce it has entered into a binding tenement sale agreement to acquire tenement E09/2543 from Firebird Metals (ASX: FRB). The tenement acquisition consolidates ground already held by Reach in an area highly prospective for manganese and rare earths. The low cost acquisition (A$110,000) is payable via the issue of ordinary shares in Reach Resources.

HIGHLIGHTS

- Reach acquires tenement E09/2543 from Firebird Metals (ASX: FRB).

- Tenement E09/2543 adjoins existing Reach tenure and expands the manganese and rare earth prospectivity of the Company’s assets by ~25%.

- Reach continues to acquire ground focused on the growing battery market.

- High-grade rock chips up to 18% MnO2 at neighbouring Reach tenement E09/25391.

- Significant land holding now held by Reach, right in the middle of Hastings and FMG.

- Low cost acquisition payable entirely in Reach shares (A$110k).

1 ASX Announcement 13 February 2023

Manganese is recognised as a critical mineral by the Office of the Chief Economist (Australian Government Department of Industry, Innovation and Science). Further, a White House document (June 2021) states that manganese use in battery cathodes may result in the metals preferred element emergence in next generation battery cells, due to its ‘relative safety’ and ‘having by far the most stability’.

Note 2:

1. The nature of the mineral occurrence: Massive stratiform/supergene manganese mineralisation hosted within sediments of the Ullawarra Formation.

2. Identify the minerals observed: The Manganese minerals observed are limited to a suite of manganese oxides, hydroxides, carbonates, and silicates. The outcrop as shown displays all of the characteristics which typify manganese mineralisation, i.e jet black in colour, surficial and concentric supergene coating/banding, massive stratiform layering, extremely fine grained with high specific gravity and likely contains iron in addition to manganese.

3. Estimate of abundance: Manganese is observed as per 2 above. Managanese ores are extremely fine-grained microscopic mixtures of several different manganese minerals. The manganese content of the material sampled based on visual examination ranges between 10% and 30% by volume.

4. Anticipated timing of assay results: Assay results are expected in October 2023.

Cautionary Statement: Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

Jeremy Bower CEO commented:

“Whilst primarily used in the steel industry as an alloying agent to improve hardness, strength and resitence to corrosion, the Electric Vehicle revolution is here and manganese is a key component in the production of lithium-ion batteries. The Company remains entirely focused on our Morrissey Hill lithium project, but it’s important that we continue to consolidate our tenure in highly prospective areas, with a focus on the EV market. This low cost acquisition is right in between some big players in Hastings and FMG and we are very interested in manganese generally and the role it will play over the coming years.”

Click here for the full ASX Release

This article includes content from Reach Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RR1:AU

The Conversation (0)

03 May 2022

Reach Resources Limited

Sourcing the Critical Minerals of the Future

Sourcing the Critical Minerals of the Future Keep Reading...

13 May 2025

Murchison South Increases to 67koz Gold Across Two Pits

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce the completion of a new Mineral Resource Estimate (MRE) for the Pansy Pit deposit at its Murchison South Gold Project. The estimate, prepared by independent consultants Mining Plus, reported above a... Keep Reading...

28 July 2023

Quarterly Activities/Appendix 5B Cash Flow Report

Reach Resources Limited (ASX: RR1) (“Reach” or “the Company”) provides its activities report for the quarter ended 30 June 2023. HIGHLIGHTS High-Grade Lithium Results at Yinnetharra (15 May 2023) Lithium mineralisation confirmed with rock chip samples reporting highly encouraging assays of up to... Keep Reading...

18 May 2023

Outcropping Copper Gossan Delivers 33% Cu Assays At Morrissey Hill Project, Yinnetharra

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce that it has received high grade copper, gold and silver results up to 33% copper, 0.2g/t gold and 142g/t silver from its recently completed rock chip sampling program at the Company’s Morrissey Hill... Keep Reading...

14 May 2023

Reach Resources’ Strategic Position Between Two of WA’s Mining Heavyweights

Reach Resources’ (ASX:RR1) strategic position with its Morrissey Hill project has placed the critical mineral explorer on the radar of two of Western Australia’s mining giants Delta Lithium (ASX:DLI) and Minerals 260 (ASX:MI6), according to an article published in The West Australian.“While... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00