March 21, 2024

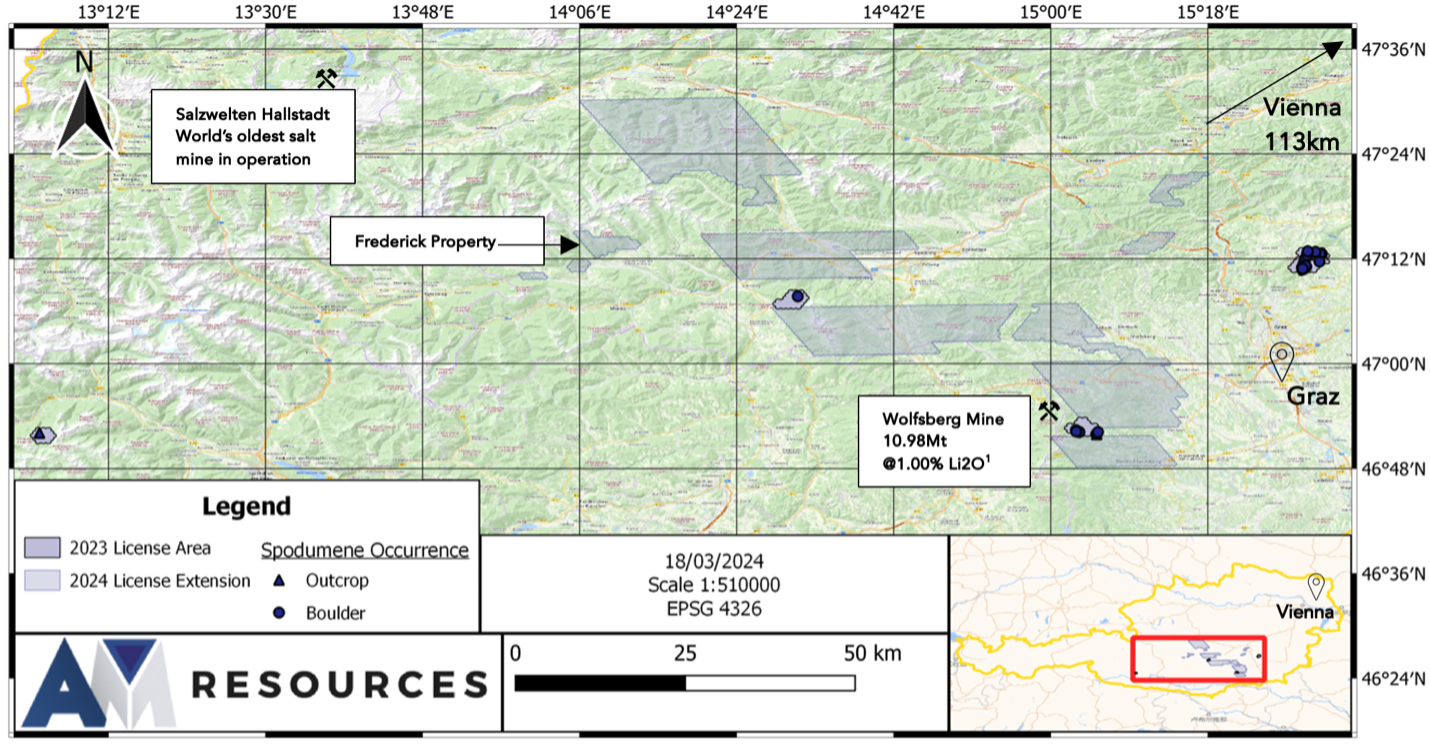

AM Resources Corporation (“AM Resources” or the “Company”) (TSXV: AMR) (Frankfurt: 76A), a dynamic junior mining company focused on the exploration and development of high-potential pegmatite deposits, is pleased to announce the acquisition of a significant land package totaling 1,500 km2 through map staking in Austria. The newly acquired land is located in the Austrian Pegmatite Belt within the Austroalpine Nappes, known for its geological diversity and rich mineral endowment.

- Newly acquired 1,500 km2 land package gives AM Resources control over a large area of the Austrian Pegmatite Belt.

- New land package includes the Frederick Property, where 112 pegmatites were identified over an area of 52.25 km2.

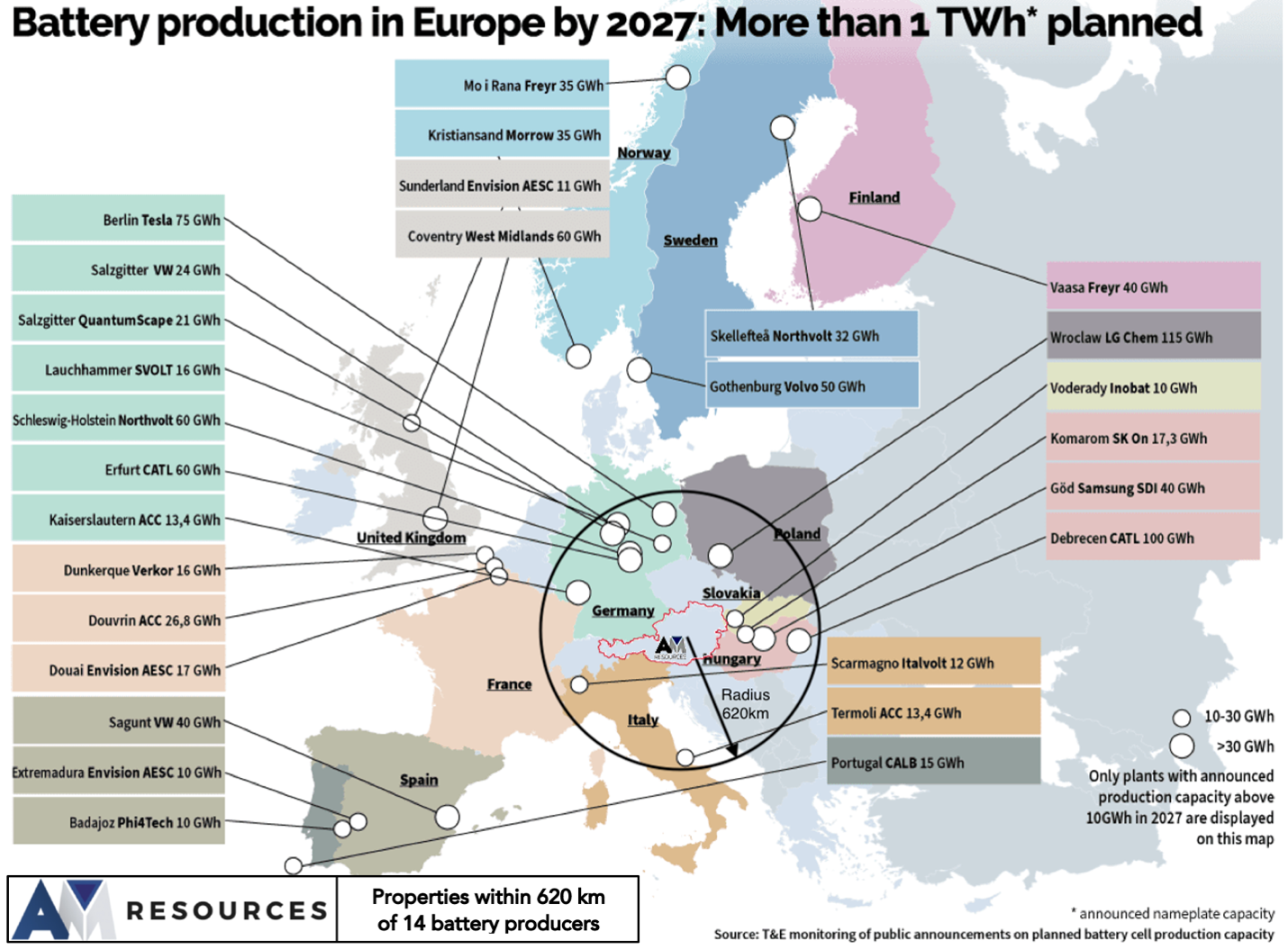

- AM Resources properties are located within a 620 km radius of 14 battery plants.

AM Resources extended 1,500 km2 land package

Lithium Exploration Country Play

AM Resources has positioned itself to become the only lithium exploration country play in a proven jurisdiction with an existing Tier 1 lithium mine project1 and located within 620 km of end users.

The AM Resources team has been actively assembling a massive prospective land package with four key elements at the core of its strategy: proven geology, proximity to key markets, historical expertise, and a clear, proven mining code. Of the few jurisdictions that qualified, Austria was the obvious choice. AM Resources’ properties are located within 620 km of 14 planned battery plants and have direct access to an extensive rail system. Mining in Austria predates the founding of the country with the world’s oldest salt mine in operation2. In addition, mining has a tradition of skilled labor and an extensive academic and geological service network. In its report on the mining industry, Minlex (commissioned by the European Union) concluded: “In Austria, operators have investment security and legal certainty”3. When we combine all these elements and add in the massive land package available, the Company believes it has a unique investment proposition for its shareholders.

David Grondin, CEO of AM Resources, commented: "Seizing this unique opportunity in a proven mining friendly jurisdiction was a no-brainer for us. We are very excited to have assembled such a large, high value prospective property. We were diligent in testing and proving our theory last summer when we acquired two properties based on geological probabilistic structures and went to the ground and found spodumene4 on each one of them. Following this confirmation, we have staked all currently available claims that we believe to be of geological interest in the proven Austrian Pegmatite Belt5.”

Within the new property acquisition, the Company is excited to add the Frederick property to its portfolio with 112 identified pegmatites6 in an area of 52.25 km2. The longest identified pegmatite measures over 750 metres in length. This property demonstrates the exceptional potential of the Austrian Pegmatite Belt. The combination of the number and size of the identified pegmatites makes this property one of the team's top priorities for the Company's next exploration campaign.

AM Resources New Frederick Property

"This strategic acquisition represents a pivotal moment in AM Resources' growth plan and strengthens its position in one of the most prospective mineral regions in Europe. This acquisition fits perfectly with our growth strategy and underscores our confidence in the mineral potential of Austria. The geological diversity for other minerals and the presence of extensive pegmatite systems provide exciting discovery opportunities. To do so in such an overlooked, regulatory stable mining jurisdiction makes it even more exhilarating,” added Mr. Grondin.

The Company has spent the last few months building long-lasting local relationships with the government, service providers and professionals and is looking forward to carrying out exploration activities, continuing to investigate new lithium discoveries made during the last summer campaign, as well as exploring new prospective ground. In addition, AM Resources is considering expanding its land position to further enhance its strategic position.

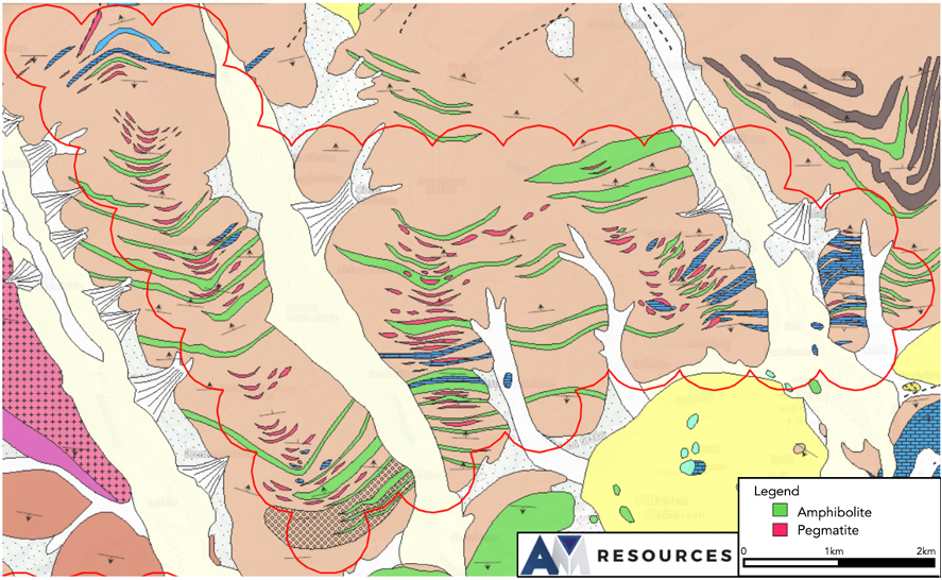

New Land-Package Geology

Geological surveys indicate the presence of several thousand pegmatites variably distributed throughout the area. These pegmatite-bearing units consist primarily of mica schist and paragneiss, often containing staurolite and/or aluminosilicate-rich layers, with protoliths expected to range in age from Neoproterozoic to Carboniferous.

The spodumene pegmatites typically occur as dykes ranging in length from a few tens of metres to over 1 km, with thicknesses varying from a few decimetres to several metres. These pegmatites, together with leucogranites, which occur as inhomogeneous bodies with pegmatitic and aplitic zones, cover extensive areas of up to 1,500 km2. Their sharp contact with host rocks, sometimes with narrow reaction zones, underscores their geological importance.

This geological area has led to the discovery of the Wolfsberg deposit with over 10 million tonnes grading in excess of 1% spodumene. AM Resources' business model is to explore for a deposit of this magnitude on its newly acquired properties.

Warrants Extension

The Company also announces that it has applied for the TSX Venture Exchange’s approval to extend the term of an aggregate of 13,155,000 common share purchase warrants (the “Warrants”). The Warrants were originally issued as part of a private placement that closed in two tranches dated April 6 and April 29, 2022, respectively. The expiry dates will be extended as follows:

| Number of warrants | Exercise Price | Original Expiry Date | New Expiry Date |

| 8,695,000 | $0.075 | April 6, 2024 | April 6, 2025 |

| 4,460,000 | $0.075 | April 29, 2024 | April 29, 2025 |

All other terms of the Warrants will remain unchanged.

Qualified Person

Technical information related in this news release has been reviewed and verified by Jean Lafleur, P. Geo., of PJLEXPL Inc., a registered geologist with the Ordre des Géologues du Québec (OGQ #833) and is a qualified person (QP) as defined by NI 43-101. Mr. Lafleur is independent from the Company and has reviewed and approved the disclosure of the AM Resources geological information.

About AM Resources

AM Resources Corporation (TSXV: AMR) is a dynamic junior mining company focused on the exploration and development of high-potential pegmatite deposits. With a strategic portfolio of assets and a commitment to responsible resource development, the Company is dedicated to creating long-term value for its stakeholders while adhering to the highest standards of corporate governance and sustainability.

Forward-Looking Statements

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of AM Resources to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “estimates”, “intends”, “anticipates” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Readers are cautioned that the foregoing list of factors is not exhaustive. The forward-looking statements contained in this news release are made as of the date of this release and, accordingly, are subject to change after such date. AM Resources does not assume any obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf, except as required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information:

David Grondin

AM Resources Corporation

President and Chief Executive Officer

1-514-360-0576

www.am-resources.ca

AMR:CA

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00