- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

Overview

While the copper market has been affected by overall economic conditions, the metal is necessary for the long-term decarbonization movement. In 2023, Fitch Solutions revised its 2023 copper price forecast from $8,400 per tonne to $8,500 due to higher demand and weaker supply. Copper prices will also continue to increase each year to $9,100 per tonne in 2024, $9,400 per tonne in 2025, $9,800 per tonne in 2026, and up to $11,500 per tonne in 2031.

Latin America is a dominant player in global mining, leading in copper, silver and iron ore production. Codelco, the major Chilean mining company, is the largest copper producer worldwide. Additionally, significant partnerships with automotive manufacturers, such as Ford, create even greater interest in the region. Major players in Brazil’s mining landscape include Ero Copper (TSX:ERO), a high-margin, high-growth green copper producer with fully funded operations in Para, Mato Grosso and Bahia.

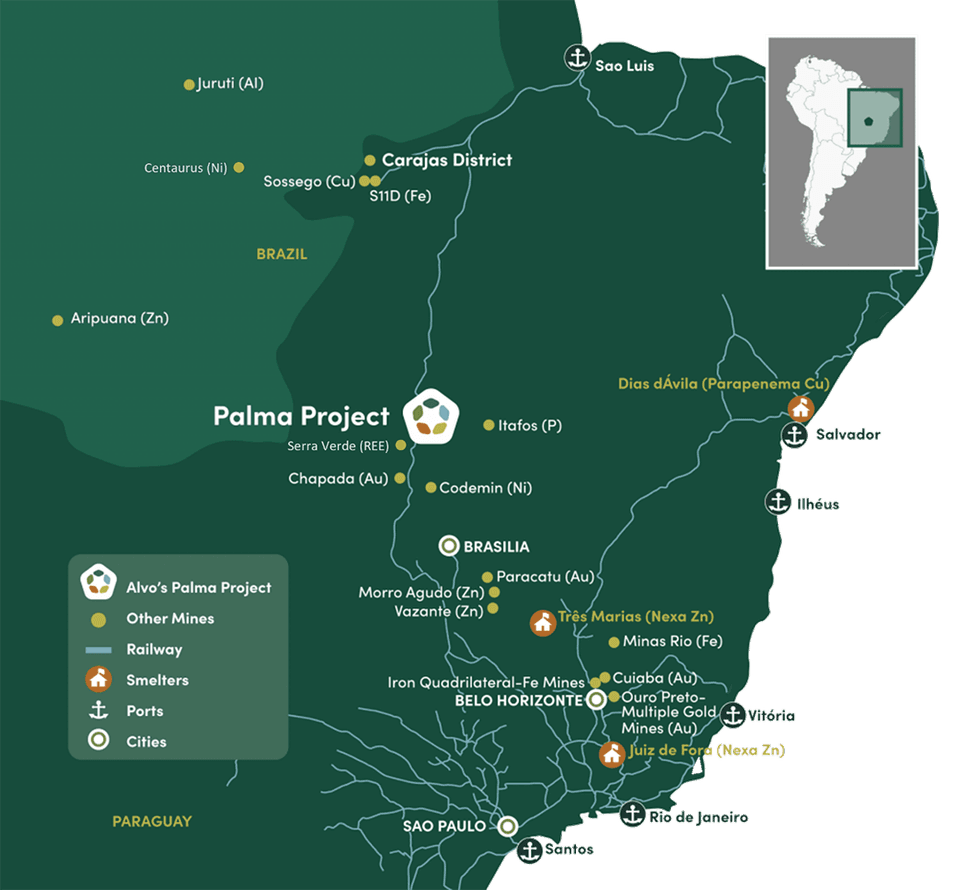

Alvo Minerals (ASX:ALV) is an exploration and development company focused on a district-scale opportunity in the underexplored Palmeiropolis region of central Brazil. The advanced-stage Palma project has produced exploration results that indicate high-grade copper-zinc deposits in a rich volcanogenic massive sulphide (VMS) district. The project is surrounded by active mines, including Lundin Mining’s Chapada copper-gold mine and Serra Verde’s REE project.

The Palma project was discovered in the 1970s, yet it has been idle for over 30 years. Once Alvo Minerals acquired the project, it became the first mining company to apply modern, systematic and aggressive exploration techniques to the project. A 2012 JORC inferred mineral resource estimate indicated 4.6 million tonnes at 1.0 percent copper, 3.9 percent zinc, 0.4 percent lead and 20 g/t silver. The company also recently released assays on the C3 deposit - with highlights including 7 meters @ 5.2 percent copper, 8 percent zinc and 7.4 meters @ 2.2 percent copper, and 23.1 percent zinc.

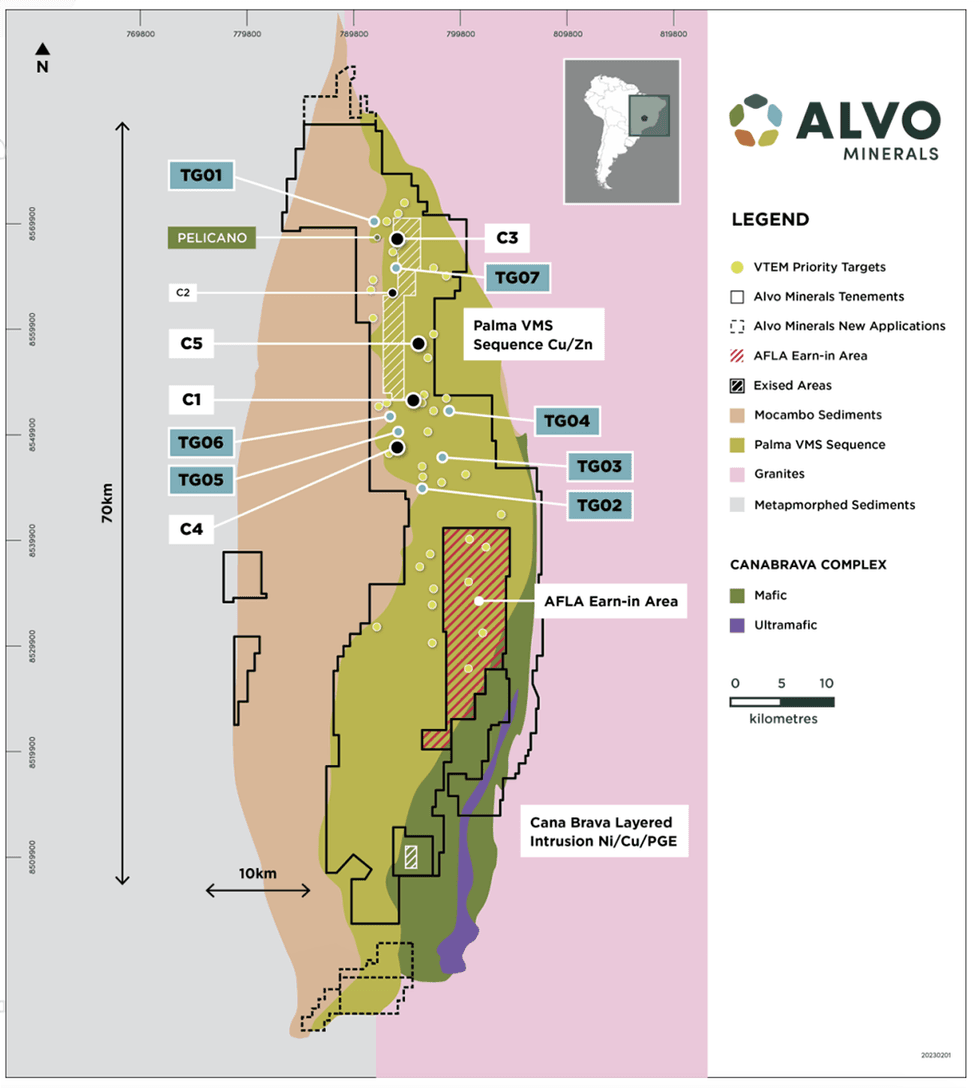

The district-scale project has identified two prospects with distinct characteristics: C3 and C1. The C3 prospect has completed phase 1 drilling, and assays indicate high-grade copper and zinc. The C1 prospect has undergone diamond drilling, and phase one intercepted significant polymetallic sulphides with higher quantities of high-grade zinc and lead than C3.

Phase 2 of the drilling campaign is ongoing, with approximately 16,000 meters of diamond drilling and 1,500 meters of reverse circulation (RC) drilling completed (at the end of 2022). Further testing will continue the program of drilling at C1 and C3, targeting significant extensions along strike and at depth to the high-grade VMS mineralization, with an updated MRE planned over these deposits for 2023. The company owns 80 percent of the district, which facilitates future exploration campaigns to discover additional deposits, with added support through a robust local infrastructure alongside strong political and community backing.

Drilling results identified 20 new prospects that will be systematically tested over the coming year, with the intention of confirming the Palma Project as a new VMS camp essential in global sources of copper, zinc, lead, silver and gold.

Regional geology and tenement holdings for Alvo's Palma project area - Afla Project area in red hash

Alvo has signed a binding earn-in agreement on the highly prospective Alfa Cu/Zn Project with Afla Investimentos E Participações Ltda. The agreement further consolidates the broader Palma VMS belt. The Afla Project was partially covered by a VTEM survey, and multiple conductors have been identified which appear similar to conductors that host significant VMS mineralization at Palma. The earn-in transaction has no upfront cash payments and will utilize Alvo’s existing exploration team to deliver 1,000 meters of diamond drilling within 18 months of the agreement to earn the initial 60 percent of the project. The company can earn up to 100 percent of the project depending on additional exploration and contract milestones.

Alvo Minerals is led by a management team with robust exploration and mining experience in Brazil and around the world. Graeme Slattery, Alvo’s non-executive chairman, has extensive experience dealing with foreign jurisdictions and regulatory issues. Managing director Rob Smakman is a geologist with over 25 years of international experience highlighted by having successfully founded and listed Crusader Resources and initiated the company’s Brazilian entry and operations.

Company Highlights

- Alvo Minerals is an exploration and development company with a district-scale project in Tocantins and Goias states, central Brazil.

- Historic exploration programs have indicated high-grade copper-zinc deposits containing lead and silver. These results were confirmed in the 2012 JORC resource estimate that indicated 4.6 million tonnes @ 1 percent copper, 3.9 percent zinc, 0.4 percent lead, 20 grams per ton (g/t) silver.

- Alvo has acquired mineral rights over multiple areas covering more than 850 square kilometers, including more than 70 kilometers of strike covering the prospective geological sequence.

- Alvo completed 15,697 meters of diamond drilling and 1,467 meters of reverse circulation drilling at the Palma project up to the end of 2022, with an updated MRE expected in 2023.

- Palma is surrounded by active mines, including Lundin Mining’s Chapada copper-gold mine and Serra Verde’s rare earth elements (REE) project. There are also major nickel (Anglo American), gold, bauxite and phosphate operating mines within the district.

- The Palma project has excellent infrastructure including abundant hydroelectric power and strong community and political support.

- An experienced management team leads the company with the right equipment and funding to fully capitalize on its promising district-scale opportunity.

Get access to more exclusive Resource Investing Stock profiles here