May 01, 2023

Coolabah Metals Limited (ASX:CBH) (“Coolabah” or “the Company”) is pleased to announce that it has entered into an agreement to acquire 100% of 4 highly prospective lithium exploration properties located within the prolific James Bay region of Quebec, Canada.

Highlights

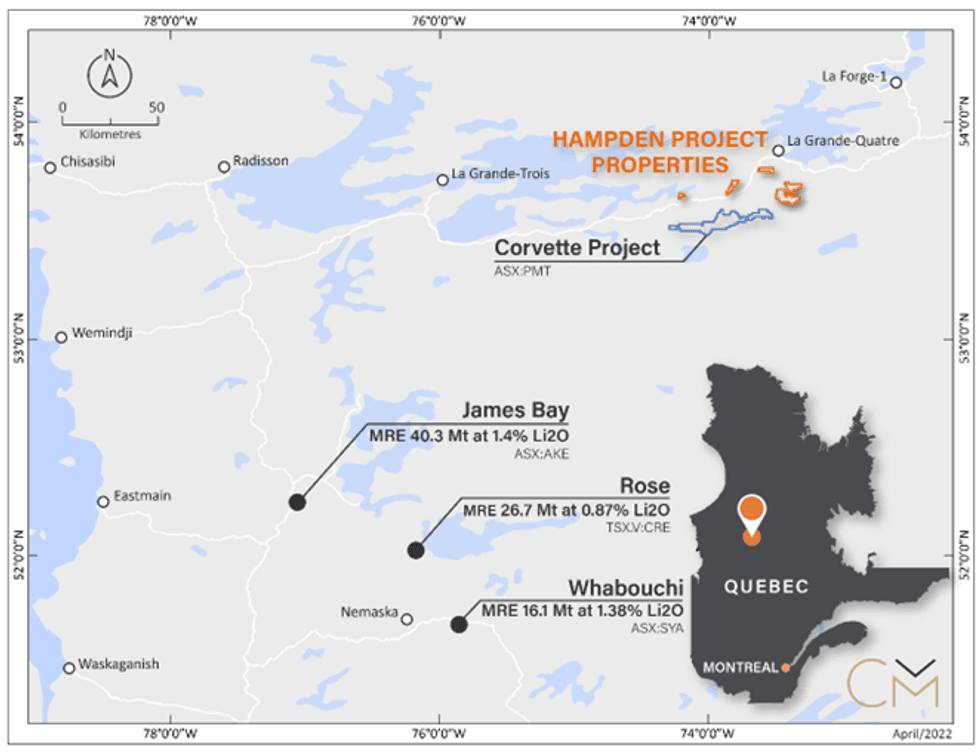

- CBH to acquire 113km2 of lithium exploration claims located within 20km of Patriot Battery Metals’ (Patriot) Corvette property in the James Bay region of Quebec and a 70km2 project in Northwestern Ontario near Frontier Lithium’s (Frontier) PAK and Spark properties

- The Quebec property consists of four areas: Carmoy, Taiga, La Grande and Mago North

- The Carmoy project targets interpreted dyke structures (identified from aerial photography), 15km along strike to the north-west of Patriot Battery Metals’ Corvette Project which has recently announced spectacular drilling results including: 156.9m @ 2.12% Li2O including 25m @ 5.04% Li2O1

- The Ontario project named McCoy Lake is a 70km2 property 75km east of the Frontier Lithium properties

- Well timed acquisition, leading into the Canadian 2023 field work season allowing the Company to quickly commence exploration of identified targets

- Coolabah have received firm commitments for a $1 million placement at $0.10, a premium to the last traded share price of $0.096

As part of the proposed acquisition CBH will acquire 100% of the share capital in Hampden Lithium Pty Ltd (“Hampden”) which in turn owns 100% of the James Bay and Ontario lithium properties. The properties are not subject to any existing royalties.

The four James Bay properties (totalling 113km2), are located in close proximity to Patriot Battery Metals’ (ASX:PMT) Corvette project, where recent drilling has identified a potentially world class spodumene deposit. The properties consist of:

Carmoy: located within 7km to the east of Patriot’s Corvette property and 5km west of Cosmos Exploration’s Corvette Far East project.

Taiga: Located approximately 9km north of Patriot’s Corvette property; Mago North: 12km to the north and La Grande 20km to the north-west.

Coolabah Managing Director Cameron Provost, stated:

“Lithium is becoming increasingly important as the world shifts towards renewable energy sources and electric transportation. As demand for these technologies grows, so too does demand for lithium.

The James Bay Region of Quebec, Canada is known for containing significant resources of lithium and this 100% acquisition positions Coolabah Metals as a player in the fast-growing lithium exploration market.

Quebec is a Tier 1 jurisdiction for mining and exploration. The Canadian government unveiled its Critical Minerals Strategy in 2019, which aims to position Canada as a leading global supplier of critical minerals. The strategy identifies 31 minerals, including lithium, as critical to the country’s economic growth and security, as well as to the global transition to a low-carbon economy.

We can already see in publicly available satellite images, structures that appear to be intrusive dykes about 10km along strike from Patriot’s Corvette Project. Early focus for Coolabah’s field work will be determining if these dykes contain lithium.

Timing of the acquisition is excellent, leading into the Canadian field season. Coolabah Metals looks forward to updating the market as testing of these structures unfolds.”

The James Bay Region is a prime investment opportunity for lithium exploration and production hosting several known spodumene bearing pegmatite projects. Québec’s advantageous resource development sector, abundance of skilled labor and close proximity to thriving electric vehicle markets in North America and Europe make it an attractive destination for investment. Furthermore, the Canadian Government’s recently unveiled Critical Minerals Strategy seeks to establish Canada as the leading supplier of sustainably and responsibly sourced critical minerals, including lithium.

Click here for the full ASX Release

This article includes content from Coolabah Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00