Aclara Resources Inc. ("Aclara" or the "Company") (TSX:ARA) is pleased to announce an updated Mineral Resource Estimate ("Updated Mineral Resource Estimate" or "Updated MRE") for its Rare Earth Element ("REE") project, Penco Module ("Project"), located in the BioBio Region of Chile

Following drilling campaigns carried out during 2021 and 2022, a total of 5,298 m from 175 new drill holes have been completed and incorporated into the Updated MRE. This work has resulted in both the definition of a new resource area, Alexandra Poniente, as well as an increase in the Mineral Resources within the Project area.

Aclara is planning to incorporate these results into a Feasibility Study for the Project, to be developed during 2023.

The exploration and infill drilling program resulted in:

- The addition of Measured, Indicated, and Inferred Mineral Resources at Alexandra Poniente, a new area within the Project area to the north-west of Alexandra Oriente.

- The conversion of Inferred Mineral Resources from Luna, Victoria Norte, Alexandra Oriente, Victoria Sur, and Maite into Measured and Indicated Mineral Resources.

A comparison of the Updated Mineral Resource Estimate and the mineral resource estimate presented in the "Amended and Restated NI 43-101 Technical Report - Preliminary Economic Assessment for Penco Module Project - Penco, Biobio Region, Chile" with an effective date of September 15, 2021, as prepared by Ausenco Chile Limitada and filed on December 2, 2021 (the "Technical Report") (which is available under the Company's profile on SEDAR at www.sedar.com) is presented in Table 1, and highlights an increase of 32.6% in Measured and Indicated Resources and a decrease of 19.3% in Inferred Mineral Resources. Drilling success at the Project was tempered by a higher cut-off value at the Project, reflecting changes to some input prices. The Updated MRE (October 13, 2022) is presented in Table 2 and the Previous MRE (September 15, 2021) is presented in Table 3.

Table 1: Updated Mineral Resource Estimate Comparison to Previous Mineral Resource Estimate

Category | MRE (Sept 15, 2021) | MRE (Oct 13, 2022) | Variation | |||||

Tonnage | Contained TREO | Tonnage | Contained TREO | Tonnage | Contained TREO | |||

(Mt) | (kt) | (Mt) | (kt) | (Mt) | (%) | (kt) | (%) | |

Measured | 15.4 | 37.9 | 21.3 | 49.3 | 5.9 | 38.2% | 11.4 | 30.0% |

Indicated | 5.3 | 12.3 | 6.2 | 13.7 | 0.9 | 16.5% | 1.4 | 11.1% |

Measured + Indicated | 20.7 | 50.2 | 27.5 | 62.9 | 6.8 | 32.6% | 12.7 | 25.3% |

Inferred | 2.1 | 4.8 | 1.7 | 3.4 | -0.4 | -19.3% | -1.4 | -29.5% |

Notes:

- TREO = Total Rare Earth Oxides (La2O3, CeO2, Pr6O11, Nd2O3, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3) + Yttrium (Y2O3).

- Totals may not balance due to rounding of figures.

- NSR cut-off values: US$13/t (Oct 31, 2022) and US$ 9.79/t (Sept 15, 2021)

Table 2: Updated Mineral Resource Estimate (Effective October 13, 2022)

Category | Tonnage | NSR | TREO | TREY | TREY | TDYTB | TNDPR | TDY | TND |

(Mt) | (US$/t) | (ppm) | (ppm) | Recovery | (ppm) | (ppm) | Recovery | Recovery | |

Measured | 21.3 | 28.4 | 2,315 | 1,952 | 22.83% | 67 | 384 | 43.15% | 19.57% |

Indicated | 6.2 | 27.4 | 2,212 | 1,865 | 22.80% | 64 | 368 | 43.49% | 19.38% |

Measured + | 27.5 | 28.2 | 2,292 | 1,932 | 22.82% | 66 | 380 | 43.23% | 19.53% |

Inferred | 1.7 | 24.3 | 1,999 | 1,679 | 22.56% | 71 | 298 | 39.25% | 18.06% |

Table 3: Previous Mineral Resource Estimate (Effective September 15, 2021)

Category | Tonnage | NSR | TREO | TREY | TREY | TDYTB | TNDPR | TDY | TND |

(Mt) | (US$/t) | (ppm) | (ppm) | Recovery | (ppm) | (ppm) | Recovery | Recovery | |

Measured | 15.4 | 27.8 | 2,467 | 2,080 | 17.99% | 71 | 401 | 35.70% | 15.32% |

Indicated | 5.3 | 24.5 | 2,309 | 1,945 | 16.67% | 69 | 373 | 33.30% | 13.36% |

Measured + | 20.7 | 27.0 | 2,426 | 2,045 | 17.65% | 71 | 394 | 35.08% | 14.82% |

Inferred | 2.1 | 24.0 | 2,299 | 1,936 | 16.37% | 70 | 371 | 32.49% | 12.72% |

Notes:

- NSR = Net Smelter Return.

- NSR cut-off value = US$13/t

- TREY = Total Rare Earth Elements (La, Ce, Pr, Nd, Sm, Eu, Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu) plus Yttrium.

- TREO = Total Rare Earth Oxides (La2O3, CeO2, Pr6O11, Nd2O3, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3) + Yttrium (Y2O3).

- TDYTB = Total Dysprosium plus Total Terbium.

- TNDPR = Total Neodymium plus Total Praseodymium.

- TDY Recovery = Average metallurgical recovery for Dysprosium.

- TND Recovery = Average metallurgical recovery for Neodymium.

- Totals may not balance due to rounding of figures.

- Mineral Resources are not Mineral Reserves, as they do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant factors.

- The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resources.

- Mineral Resources are classified in accordance with the CIM (2014) Standards and Definitions of Mineral Resources.

- The results are presented in-situ and undiluted, are constrained within optimized open pit shells, and are considered to have reasonable prospects of economic viability.

The Updated MRE encompasses four mineralized zones, namely Luna, Maite, Victoria (Victoria Norte and Victoria Sur) and Alexandra (Alexandra Oriente and Alexandra Poniente). The Updated MRE figures by zone are presented in Table 4 and grade values for all 15 elements are shown in Table 5.

Updated Mineral Resource Estimate Details

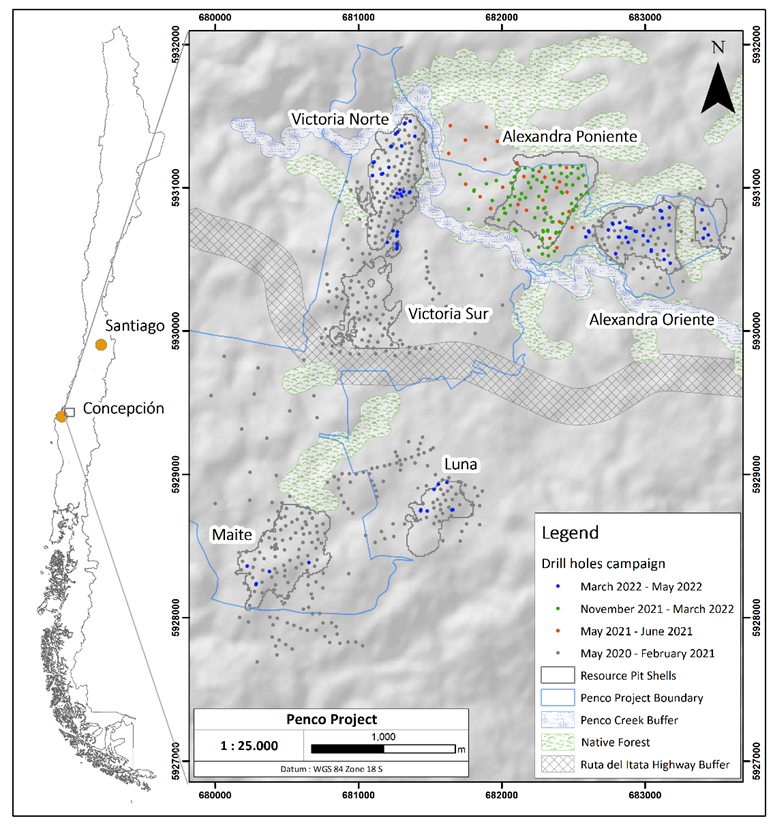

Figure 1 highlights the location of the new drill holes, the Mineral Resource pit shells, and the environmental buffers limiting the Mineral Resources. New drilling incorporated into the Updated MRE was completed between May 2021 to May 2022.

Figure 1: Location of New Drilling, Constraining Pit Shells, Environmental Constraints, and Project Boundary

Several restricted areas exist within the Project area viz. native forests, the Penco Creek, the Ruta del Itata highway servitude, and the Alexandra Creek. The Updated MRE does not include any mineralized material within these areas.

A geological overview for the Project is available the Technical Report under the Company's profile on SEDAR at www.sedar.com. The geology, sampling, assay protocols, and QA/QC for the Alexandra Poniente zone have been presented in Aclara's news release on brownfield exploration results, dated July 25, 2022, which is also available on SEDAR, stating that the total grades database shows good precision and accuracy, and all estimating protocols are in line with standard industry practices.

Estimation Methodology

High-grade capping supported by statistical analyses (Parrish criteria) were completed on raw assay data before compositing and applying to the Victoria, Alexandra, and Luna zones. No capping was applied to Maite samples, as the statistical analysis suggested.

The Updated MRE was completed using GEOVIA Surpac for four different block models (Luna, Maite, Victoria, Alexandra zones) each consisting of 10 m x 10 m x 2 m blocks. Grade interpolation for each of the 15 elements was obtained by Ordinary Kriging using hard boundaries.

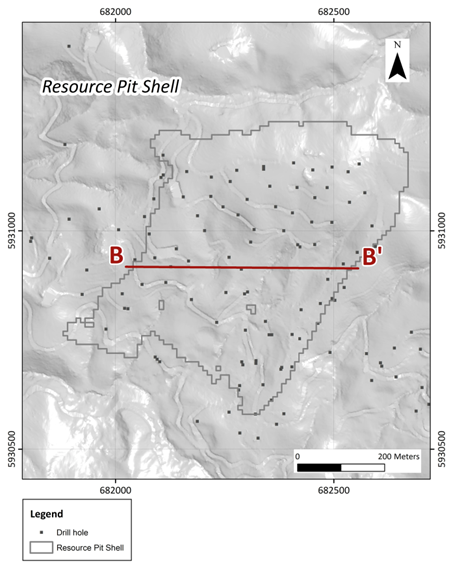

Variography was done for each of the four domains in the four different zones, for three groups of elements: Heavy Rare Earth elements plus Yttrium (Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu, Y), Light Rare Earth elements minus Europium (La, Ce, Pr, Nd, Sm), and Europium (Eu) which showed a poor correlation with the other two groups. Block estimation was validated visually, by global bias analysis and by trend analysis. Figure 2 shows a comparison between estimated blocks and composites for a vertical section at the Alexandra Poniente zone. Additionally, a Whittle pit outline is displayed in the section.

Figure 2: Comparison Between Estimated Blocks and Composites for a Vertical Section at Alejandra Poniente

Average bulk density values ranging from 1.25 to 2.0 t/m3 were assigned to each Geological Unit. In-situ trench tests were completed at surface (horizon A) and for the deeper horizons (horizons B, C, and D0), and density was calculated using Shelby tubes.

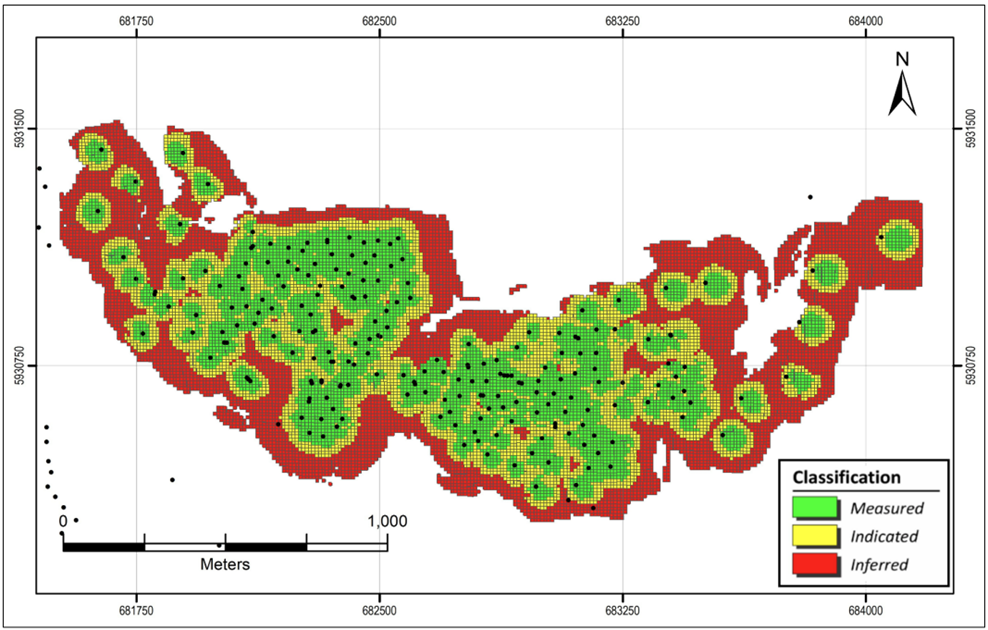

The Updated MRE is classified as Measured, Indicated, and Inferred Mineral Resources, respectively. For both Measured and Indicated Mineral Resources, the Kriging estimation error must be less than 15% in 90% of the cases, for a volume equivalent to three months of production for Measured and one year for Indicated.

The Measured Mineral Resource category is defined by three or more drill holes when the closest sample is located less than 40 m from the block being estimated, or with two drill holes if the closest sample is located less than of 24 m from the block being estimated.

The Indicated Mineral Resource category is defined with a minimum of two drill holes when the closest sample is be less than 65 m from the block being estimated.

The Inferred Mineral Resource category is defined with all blocks estimated with samples closer than 160 m.

Figure 3 presents a plan view of the Alejandra block model displaying the three block categories.

Figure 3: Plan View Displaying Block Categories at Alexandra

The Updated MRE is pit-constrained using GEOVIA Whittle 2022 software, with an overall slope angle of 23° and a mining cost of US$3/t. The Updated MRE is reported at a Net Smelter Return (NSR) marginal cut-off of US$13/t based on processing plus general and administrative cost estimates.

NSR was calculated for each block using the following parameters:

- Selling prices for rare earth oxides: Price estimates in US$/kg corresponds to those used in the Technical Report for pit optimization: La2O3 = 2.62, CeO2 = 1.88, Pr6O11 = 92.93, Nd2O3 = 96.34, Sm2O3 = 2.16, Eu2O3 = 41.40, Gd2O3 = 35.55, Tb4O7 = 1,344.82, Dy2O3 = 537.93, Ho2O3 = 106.65, Er2O3 = 31.76, Tm2O3 = 0.0, Yb2O3 = 6.78, Lu2O3 = 707.97, Y2O3 = 6.78.

- Metallurgical recoveries: Obtained from the 2021/22 laboratory test program performed by SGS Lakefield in Canada, consisting of 119 representative samples tested under conditions which carry out desorption at a pH of 3.0, plus a synthetic lixiviant solution designed to emulate the predicted concentrations of recycled salts generated in the closed-circuit process. For each Geological Unit, the median of the corresponding laboratory results was assigned. For some minor Geological Units with no available laboratory results, the 2021 PEA recovery values were used. See Table 6 at the end of this news release.

- Plant efficiency: Variable by element, ranging from 90.5 to 99.1% with an approximate average of 94%.

- Concentrate treatment and selling cost = $0.5034/kg of concentrate

- Concentrate purity = 83%

The Technical Report provides the basis for the assumptions used in the Updated MRE, unless otherwise stated. All technical and economic parameters will be subject to further consideration during the preparation of the Feasibility Study, which is expected to be developed during 2023.

Neither the authors of this news release nor the management of Aclara are aware of any environmental, permitting, legal, title-related, taxation, socio-political, marketing, or any other relevant issue not reported in the Technical Report that could materially affect the Updated MRE other than the information included in Aclara's news release, dated May 10, 2022, which is also available on SEDAR, where the Company provided an update on its corporate strategy.

Qualified Persons and Review of Technical Information

The Updated MRE has been prepared by Andres Beluzan (General Manager, ABelco Consulting SpA), an independent consultant for geostatistics and resource estimation with more than 12 years of relevant experience. Mr. Beluzan, who is responsible for the Updated MRE, and has reviewed and approved the scientific and technical information related to the Updated MRE contained in this news release, is registered under the Chilean Mining Commission and is an independent Qualified Person under NI 43-101.

The scientific and technical information related to geology, drilling, mineralization, and geological modeling in this news release has been reviewed and approved by Luis Oviedo (General Manager, Atticus Chile S.A.), an independent Consulting Geologist with more than 45 years' experience. Mr. Oviedo is a member of the Colegio de Geólogos de Chile and the Institute of Mining Engineers of Chile, is registered under the Chilean Mining Commission and is an independent Qualified Person under NI 43-101.

Manuel Arre (Head of Mine Engineering, Aclara), a mining engineer with 20 years' experience in economic modeling of mining projects, has produced pit shells to constrain the resources for reasonable prospects of eventual economic extraction. Mr. Arre is registered under the Chilean Mining Commission and is a Qualified Person under NI 43-101. He has led an internal peer review for the Updated MRE.

About Aclara

Aclara Resources is a Rare Earths company with a development project in Chile, and is listed on the TSX (TSX:ARA).

Aclara is initiating the development of its resources through a project called the Penco Module, which covers a surface area of approximately 600 hectares, and which hosts ionic clays rich in rare earth elements. Aclara is currently focused on the development and future construction and operation of the Penco Module, which will aim to produce a rare earth concentrate through a processing plant that will be fed by clays from nearby deposits. Aclara's extraction process offers several environmentally positive attributes such as: no blasting, crushing, or milling; no tailings facility; minimal water consumption due to a high level of water recirculation; is amenable to leaching with a fertilizer; and contains no radioactivity.

Contact Information

For further information, please visit www.aclara-re.com or contact: investorrelations@aclara-re.com or contacto@aclara-re.com

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to mineral continuity, grade and upside at the Alexandra Poniente zone and the Company's expectations in respect thereof, the Updated MRE in respect of the Project and the estimates contained therein, the Company's proposed Feasibility Study and the Expected timing and contents in respect thereof., Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to, the factors discussed under "Risk Factors" in the Company's annual information form dated as of March 30, 2022, filed on the Company's SEDAR profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward- looking information contained in this news release is provided as of the date of this news release and the Company does not undertake any obligation to update such forward-looking information, whether because of new information, future events or otherwise, except as expressly required under applicable securities laws.

Table 4: Updated Mineral Resource Estimate (Effective October 13, 2022), Detail by Zone

Zone | Category | Tonnage | NSR | TREO | TREY | TREY | TDYTB | TNDPR | TDY | TND |

(Mt) | (US$/t) | (ppm) | (ppm) | Recovery | (ppm) | (ppm) | Recovery | Recovery | ||

Alexandra O. | Measured | 4.01 | 27.8 | 2429 | 2044 | 20.09% | 78 | 383 | 41.88% | 10.16% |

Indicated | 1.11 | 25.5 | 2316 | 1951 | 18.96% | 71 | 375 | 41.66% | 10.07% | |

M + I | 5.12 | 27.3 | 2,404 | 2,024 | 19.84% | 76 | 381 | 41.83% | 10.14% | |

Inferred | 0.22 | 23.0 | 2,175 | 1,832 | 18.27% | 69 | 351 | 39.89% | 9.37% | |

Alexandra P. | Measured | 4.11 | 27.8 | 2065 | 1745 | 23.58% | 54 | 358 | 46.95% | 24.08% |

Indicated | 1.09 | 27.8 | 1911 | 1613 | 26.03% | 52 | 331 | 49.40% | 27.53% | |

M + I | 5.21 | 27.8 | 2,033 | 1,717 | 24.09% | 53 | 352 | 47.47% | 24.80% | |

Inferred | 0.38 | 22.8 | 1,420 | 1,199 | 28.21% | 38 | 247 | 53.02% | 32.48% | |

Luna | Measured | 1.68 | 25.1 | 1545 | 1295 | 29.27% | 66 | 211 | 42.38% | 20.20% |

Indicated | 0.47 | 24.8 | 1417 | 1185 | 33.87% | 64 | 184 | 44.24% | 23.60% | |

M + I | 2.15 | 25.1 | 1,517 | 1,270 | 30.28% | 66 | 205 | 42.79% | 20.95% | |

Inferred | 0.60 | 27.5 | 2,077 | 1,734 | 25.55% | 99 | 249 | 33.44% | 15.15% | |

Maite | Measured | 3.93 | 30.5 | 2501 | 2110 | 21.25% | 71 | 421 | 41.43% | 16.93% |

Indicated | 1.59 | 30.8 | 2510 | 2117 | 21.47% | 72 | 422 | 41.47% | 16.91% | |

M + I | 5.52 | 30.6 | 2,504 | 2,112 | 21.32% | 71 | 421 | 41.44% | 16.92% | |

Inferred | 0.02 | 35.3 | 2,893 | 2,439 | 21.78% | 82 | 481 | 41.50% | 16.90% | |

Victoria N. | Measured | 5.73 | 30.6 | 2695 | 2274 | 23.53% | 70 | 457 | 42.01% | 23.81% |

Indicated | 0.87 | 29.3 | 2566 | 2166 | 23.98% | 64 | 439 | 43.54% | 25.07% | |

M + I | 6.60 | 30.4 | 2,678 | 2,259 | 23.59% | 69 | 455 | 42.22% | 23.98% | |

Inferred | 0.14 | 20.4 | 2,364 | 1,993 | 17.30% | 65 | 379 | 31.20% | 18.32% | |

Victoria S. | Measured | 1.81 | 22.8 | 1741 | 1468 | 22.51% | 54 | 292 | 45.40% | 21.94% |

Indicated | 1.04 | 23.6 | 2027 | 1710 | 19.46% | 59 | 341 | 41.91% | 17.78% | |

M + I | 2.86 | 23.1 | 1,845 | 1,557 | 21.40% | 56 | 310 | 44.13% | 20.42% | |

Inferred | 0.34 | 22.2 | 2,195 | 1,852 | 15.88% | 62 | 364 | 36.81% | 12.65% |

Notes:

- NSR = Net Smelter Return

- NSR cut-off value = US$13/t

- TREY = Total Rare Earth Elements (La, Ce, Pr, Nd, Sm, Eu, Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu) plus Yttrium.

- TREO = Total Rare Earth Oxides (La2O3, CeO2, Pr6O11, Nd2O3, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3) + Yttrium (Y2O3).

- TDYTB = Total Dysprosium plus Total Terbium.

- TNDPR = Total Neodymium plus Total Praseodymium.

- Totals may not balance due to rounding of figures.

- Mineral Resources are not Mineral Reserves, as they do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resources.

- Mineral Resources are classified in accordance with the CIM (2014) Standards and Definitions of Mineral Resources.

- The results are presented in-situ and undiluted, are constrained within optimized open pit shells and are considered to have reasonable prospects of economic viability.

Table 5: Updated Mineral Resource Estimate (Effective October 13, 2022), Detail by REE

Category | Tonnage | TLA | TCE | TPR | TND | TSM | TEU | TGD | TTB | TDY | THO | TER | TTM | TYB | TLU | TY |

(Mt) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | (ppm) | |

Measured | 21.3 | 321 | 658 | 79 | 305 | 51 | 3 | 49 | 8 | 58 | 12 | 36 | 5 | 33 | 5 | 330 |

Indicated | 6.2 | 308 | 626 | 75 | 293 | 49 | 3 | 48 | 8 | 56 | 12 | 34 | 5 | 31 | 4 | 315 |

M + I | 27.5 | 318 | 650 | 78 | 302 | 50 | 3 | 49 | 8 | 58 | 12 | 36 | 5 | 32 | 5 | 326 |

Inferred | 1.7 | 249 | 510 | 61 | 237 | 41 | 2 | 46 | 9 | 63 | 14 | 40 | 6 | 36 | 5 | 363 |

Notes:

- NSR = Net Smelter Return

- NSR cut-off value = US$13/t

- TLA = Total Lanthanum

- TCE = Total Cerium

- TPR = Total Praseodymium

- TND = Total Neodymium

- TSM = Total Samarium

- TEU = Total Europium

- TGD = Total Gadolinium

- TTB = Total Terbium

- TDY = Total Dysprosium

- THO = Total Holmium

- TER = Total Erbium

- TTM = Total Thulium

- TYB = Total Ytterbium

- TLU = Total Lutecium

- TY = Yttrium

- Totals may not balance due to rounding of figures.

- Mineral resources are not mineral reserves, as they do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as Indicated or Measured Mineral Resources.

- Mineral Resources are classified in accordance with the CIM (2014) Standards and Definitions of Mineral Resources.

- The results are presented in-situ and undiluted, are constrained within optimized open pit shells, and are considered to have reasonable prospects of economic viability.

Table 6: Metallurgical Recoveries (%) used for NSR Calculation

Zone | Unit | R. Ce | R. La | R. Pr | R. Nd | R. Sm | R. Y | R. Eu | R. Gd | R. Tb | R. Dy | R. Ho | R. Er | R. Tm | R. Yb | R. Lu |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A. Oriente | GG_B | 1.7 | 6.3 | 7.7 | 8.6 | 12.1 | 49.9 | 33.5 | 25.2 | 31.9 | 37.0 | 36.6 | 39.1 | 39.0 | 37.7 | 37.0 |

| GG_C | 1.1 | 5.1 | 6.1 | 7.1 | 9.8 | 49.7 | 40.5 | 21.6 | 29.6 | 33.7 | 36.2 | 38.5 | 40.6 | 38.5 | 38.3 | |

| DRT_B | 3.5 | 9.8 | 15.9 | 18.8 | 32.8 | 89.3 | 45.0 | 57.2 | 60.7 | 67.6 | 69.1 | 68.6 | 76.3 | 69.5 | 65.9 | |

| DRT_C | 0.9 | 1.0 | 1.5 | 2.3 | 4.8 | 17.5 | 9.1 | 8.0 | 10.2 | 12.2 | 14.0 | 14.6 | 13.6 | 13.8 | 13.0 | |

| MP_B | 2.3 | 4.5 | 6.2 | 7.4 | 8.9 | 12.8 | 24.5 | 10.7 | 12.1 | 12.4 | 12.6 | 12.3 | 13.4 | 12.5 | 12.8 | |

| MP_C | 2.2 | 4.7 | 9.5 | 13.2 | 17.6 | 15.1 | 30.3 | 15.1 | 17.9 | 17.5 | 13.1 | 12.6 | 12.0 | 11.4 | 11.5 | |

| A. Poniente | GG_B | 1.8 | 16.0 | 18.9 | 20.6 | 23.3 | 68.8 | 46.3 | 34.0 | 41.6 | 44.5 | 49.4 | 52.5 | 45.7 | 48.7 | 51.3 |

| GG_C | 1.5 | 5.6 | 6.8 | 7.7 | 9.8 | 39.4 | 126.0 | 16.0 | 22.9 | 23.8 | 25.8 | 25.3 | 24.5 | 22.6 | 26.0 | |

| DRT_B | 4.4 | 26.7 | 34.2 | 36.9 | 41.0 | 65.0 | 57.0 | 55.0 | 58.3 | 56.3 | 60.9 | 57.7 | 55.1 | 55.4 | 53.8 | |

| DRT_C | 1.3 | 1.6 | 2.9 | 4.6 | 9.0 | 24.2 | 11.5 | 12.4 | 14.6 | 16.5 | 19.3 | 20.2 | 18.9 | 20.2 | 20.7 | |

| MP_B | 4.8 | 16.0 | 18.6 | 20.0 | 79.5 | 8.3 | 21.6 | 12.9 | 12.2 | 10.0 | 9.3 | 8.4 | 6.7 | 7.5 | 7.8 | |

| MP_C | 4.8 | 16.0 | 24.1 | 24.5 | 26.3 | 70.0 | 39.2 | 38.6 | 33.3 | 46.8 | 40.6 | 42.9 | 40.7 | 43.2 | 39.7 | |

| Luna | GG_B | 1.5 | 9.1 | 11.9 | 13.8 | 20.9 | 55.3 | 31.8 | 33.0 | 39.3 | 36.4 | 45.8 | 42.0 | 43.7 | 38.9 | 40.2 |

| GG_C | 2.2 | 5.4 | 8.2 | 10.3 | 12.2 | 39.9 | 25.1 | 23.1 | 24.5 | 25.1 | 28.6 | 28.3 | 26.5 | 23.6 | 22.9 | |

| DRT_B | 3.6 | 24.8 | 28.9 | 32.7 | 33.4 | 82.8 | 47.6 | 47.0 | 52.7 | 52.7 | 59.3 | 57.2 | 59.8 | 51.0 | 48.9 | |

| DRT_C | 4.6 | 7.1 | 6.7 | 7.4 | 12.7 | 20.5 | 24.8 | 14.6 | 17.6 | 17.3 | 17.4 | 17.1 | 15.5 | 12.4 | 13.5 | |

| MP_B | 3.0 | 23.1 | 26.0 | 28.8 | 34.6 | 60.8 | 42.5 | 37.4 | 55.5 | 61.5 | 58.1 | 57.2 | 67.0 | 58.0 | 58.5 | |

| MP_C | 2.5 | 3.1 | 4.3 | 5.2 | 7.5 | 8.8 | 25.1 | 7.2 | 9.3 | 9.5 | 8.7 | 7.6 | 6.9 | 6.3 | 6.8 | |

| Maite | GG_B | 2.2 | 10.6 | 16.0 | 16.9 | 16.6 | 66.2 | 24.8 | 30.3 | 36.1 | 41.5 | 48.3 | 49.5 | 50.4 | 48.4 | 49.1 |

| GG_C | 0.8 | 3.8 | 3.1 | 3.4 | 4.2 | 16.2 | 11.4 | 7.6 | 8.4 | 10.1 | 12.4 | 12.0 | 11.6 | 10.3 | 10.2 | |

| DRT_B | 0.2 | 0.3 | 1.4 | 0.9 | 4.5 | 24.3 | 3.0 | 7.2 | 14.3 | 14.1 | 13.1 | 15.7 | 23.9 | 13.3 | 22.0 | |

| DRT_C | 1.0 | 3.5 | 5.1 | 6.4 | 7.4 | 23.4 | 15.3 | 14.5 | 14.2 | 17.3 | 17.9 | 20.0 | 24.9 | 15.8 | 22.0 | |

| MP_B | 4.6 | 12.3 | 16.3 | 21.4 | 27.6 | 35.5 | 40.1 | 26.1 | 29.4 | 30.1 | 34.5 | 33.3 | 32.6 | 31.7 | 31.1 | |

| MP_C | 1.5 | 3.7 | 4.9 | 7.3 | 12.2 | 41.8 | 35.3 | 19.2 | 27.6 | 30.6 | 31.3 | 33.7 | 31.5 | 29.2 | 26.1 | |

| V. Norte | GG_B | 1.6 | 18.7 | 18.6 | 20.4 | 21.7 | 62.8 | 37.2 | 34.9 | 36.4 | 40.3 | 46.7 | 45.8 | 46.0 | 40.9 | 40.8 |

| GG_C | 2.4 | 8.5 | 9.7 | 11.5 | 10.9 | 26.0 | 18.1 | 18.9 | 20.1 | 21.1 | 21.4 | 21.5 | 21.5 | 18.5 | 21.7 | |

| DRT_B | 6.9 | 35.5 | 46.6 | 51.5 | 62.9 | 93.3 | 59.9 | 62.5 | 78.8 | 74.6 | 77.4 | 77.6 | 79.3 | 91.6 | 70.9 | |

| DRT_C | 2.5 | 4.4 | 4.6 | 5.4 | 6.6 | 14.8 | 13.4 | 8.1 | 9.2 | 9.9 | 11.5 | 11.1 | 10.1 | 9.7 | 10.4 | |

| MP_B | 5.2 | 36.0 | 37.8 | 44.1 | 55.1 | 69.4 | 37.8 | 53.5 | 53.5 | 54.9 | 54.5 | 53.9 | 52.6 | 58.5 | 53.7 | |

| MP_C | 1.7 | 1.9 | 2.5 | 3.3 | 4.4 | 14.0 | 7.2 | 5.9 | 8.5 | 10.4 | 10.5 | 10.5 | 7.9 | 6.9 | 5.8 | |

| V. Sur | GG_B | 2.7 | 10.7 | 12.3 | 14.6 | 17.2 | 45.7 | 45.5 | 31.9 | 37.7 | 40.2 | 41.9 | 46.7 | 50.1 | 46.7 | 45.4 |

| GG_C | 0.9 | 1.7 | 2.4 | 2.9 | 5.6 | 27.6 | 19.3 | 15.7 | 20.5 | 26.2 | 28.9 | 23.6 | 25.6 | 22.1 | 26.9 | |

| DRT_B | 3.3 | 11.3 | 14.6 | 16.6 | 20.9 | 81.5 | 36.9 | 47.2 | 49.0 | 53.7 | 59.6 | 54.2 | 55.2 | 62.9 | 61.8 | |

| DRT_C | 0.8 | 0.9 | 1.1 | 1.5 | 2.6 | 11.2 | 6.2 | 3.9 | 5.3 | 6.3 | 7.5 | 8.7 | 8.0 | 7.6 | 7.3 | |

| MP_B | 5.6 | 36.0 | 40.5 | 46.6 | 39.1 | 63.4 | 75.9 | 56.5 | 49.4 | 59.7 | 59.2 | 60.7 | 64.3 | 57.1 | 55.3 | |

| MP_C | 3.1 | 7.9 | 8.0 | 8.1 | 12.2 | 56.3 | 32.1 | 17.0 | 21.8 | 24.6 | 28.1 | 30.5 | 26.9 | 27.2 | 23.8 |

Notes:

- GG = Garnet Granitoid, DRT = Diorite, MP = Metapelite.

- _B and _C correspond to regolith horizons.

- The recoveries are based on the 2021/22 laboratory test program performed by SGS Lakefield in Canada, except for VNOR_ DRT_C, VNOR_MP_C, VSUR_ DRT_C, VSUR_MP_C, MAIT_MP_B, MAIT_MP_C, AORI_DRT_C, AORI_MP_C, APON_DRT_C, AORI_MP_B, LUNA_DRT_C, LUNA_MP_B, LUNA_MP_C where recovery values are based on the Technical Report (some units of MP and DRT were not tested by SGS because they account for approximately 10% of the Mineral Resource).

SOURCE: Aclara Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/729761/Aclara-Provides-an-Update-on-the-Mineral-Resource-Estimate-at-the-Penco-Module-Project