- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

The much-hyped cannabis beverage industry hasn’t exactly lived up to expectations. Even though it is finally showing significant signs of life, it still only represented about 2 percent of the industry last quarter. This brings it to about $100 million in California and probably about the same in Canada, the world’s two largest cannabis markets.

It turns out the problem is this: There’s never been anywhere to manufacture these drinks on a large scale, except for a couple of places in Canada backed by major liquor companies. Cannabis beverages in Canada have therefore enjoyed more market share than in the US, as American consumers have had to endure the challenges of high-priced drinks of varying quality, made on rudimentary bottling lines.

The Tinley Beverage Company (CSE:TNY, OTC:TNYBF) struggled with this problem for years, searching California for reliable options to manufacture its premium, scientifically advanced complex formulations, including Tinley’s #1 and #2 Emerald Cup award-winning drinks. Because major beverage alcohol companies have continued to steer clear of US cannabis manufacturing for legal reasons, the prospects for anyone building a major scaled cannabis bottling facility remained slim.

As a result, Tinley’s decided to take matters into its own hands: Tinley’s has built a world-class, scaled facility with the state’s most varied menu of product formulation, container type and packaging options for infused beverages. It intentionally built this facility far larger than it would need for its own Tinley’s-branded cannabis beverages, recognizing the greater opportunity in manufacturing third-party products.

This has proven to be the right move for investors: Manufacturing consistently delivers far higher gross margins than the branded products themselves, without the high marketing costs and inventory risks. Of the $100 million of cannabis drinks being purchased in California, a solid portion – if not majority – of this revenue is spent by the brands solely on manufacturing their products. Yet the margins are mostly going to the manufacturers, because co-packing is mostly a fixed cost business (i.e. the one-time cost to build the bottling lines). So who’s passing on that $100 million to investors – the brands or the manufacturers?

Until recently, Tinley’s Long Beach facility and one other scaled licensed facility in California were focused on manufacturing third-party brands. Following the acquisition of the other facility by a new majority owner, its third-party manufacturing operations were redirected to focus on the new majority owner’s brands. This provided an opportunity for Tinley’s to exclusively capture the market for third-party manufacturing of cannabis-infused beverages. Until such time as another scaled manufacturer decides to enter the industry — which is typically a multi-year effort — Tinley’s can continue to enjoy defensible gross margins.

In 2022, Tinley’s Long Beach facility added several co-packing clients, including Soma’s Hoppin’ High Ride High-PA, Highbridge Premium, Mary Y Juana and Green Monké. The company also conducted several facility enhancements, like tunnel pasteurizers that enable beverage production without preservatives, have more natural formulations, and allow micro-organisms to maintain safety for both products and containers in onestep.

Tinley’s team is no stranger to co-packing beverages. Its founding investors and many executive members hail from Cott Corporation, until recently the world’s largest beverage co-manufacturer. If you’ve ever bought a supermarket soda brand, or many other beverage brands and product types, chances are it was manufactured by Cott.

Tinley’s vision is the same: If you purchase a cannabis beverage in California, there’s an increasingly large chance it was manufactured at Tinley’s facility. Will Tinley’s grow into the world’s largest cannabis beverage co-packer, just as Cott did for mainstream beverages? This would take a bigger buildout because a separate bottling line would need to be built in each state until federal legalization occurs. However, California is the largest cannabis market in the US, so Tinley’s can become the USA’s largest cannabis beverage co-packing facility in the meantime — and based on their clients’ feedback, it already is. Several of its clients have said they’ve never seen a facility anywhere nearly as large or high-quality as Tinley’s anywhere in the US.

Tinley’s Long Beach facility can manufacture 12 million bottles, 10 million cans (imminently) and 7 million (and increasing) mini “shot” bottles per year, typically at $0.50 to $1.20 per unit. Gross margins can well exceed 50 percent given the fixed cost nature of the business, making Tinley’s increasingly a cash cow. The bottle and can lines offer the seamless option of running the drinks through a tunnel pasteurizer – the only such equipment for cannabis in the USA – which enables more naturally formulated, preservative-free beverages, for additional fees. The company also offers a licensed distribution space, which significantly improves economics for Tinley’s and its clients, as mandatory state testing and the first-mile distribution processes can be completed on site.

All this is run by an all-star leadership team. In addition to past Cott leadership, the team includes Richard Gillis, the former general manager of Coca-Cola’s US Southwest region. In this role, he oversaw 14 bottling lines, thousands of employees and more than US$2 billion in revenue.

It's been a long road. It took several years of struggling to manufacture its own drinks without any co-packers in the state, and then several years to build its own facility. All while burning cash and trying the patience of investors. This long road has proven to be a blessing in disguise for the company and those looking to invest. If it takes several years to build, commission, and optimize a bottling facility, this means it could be years until new entrants pop up, and Tinley’s will be operating with limited competition throughout this entire time.

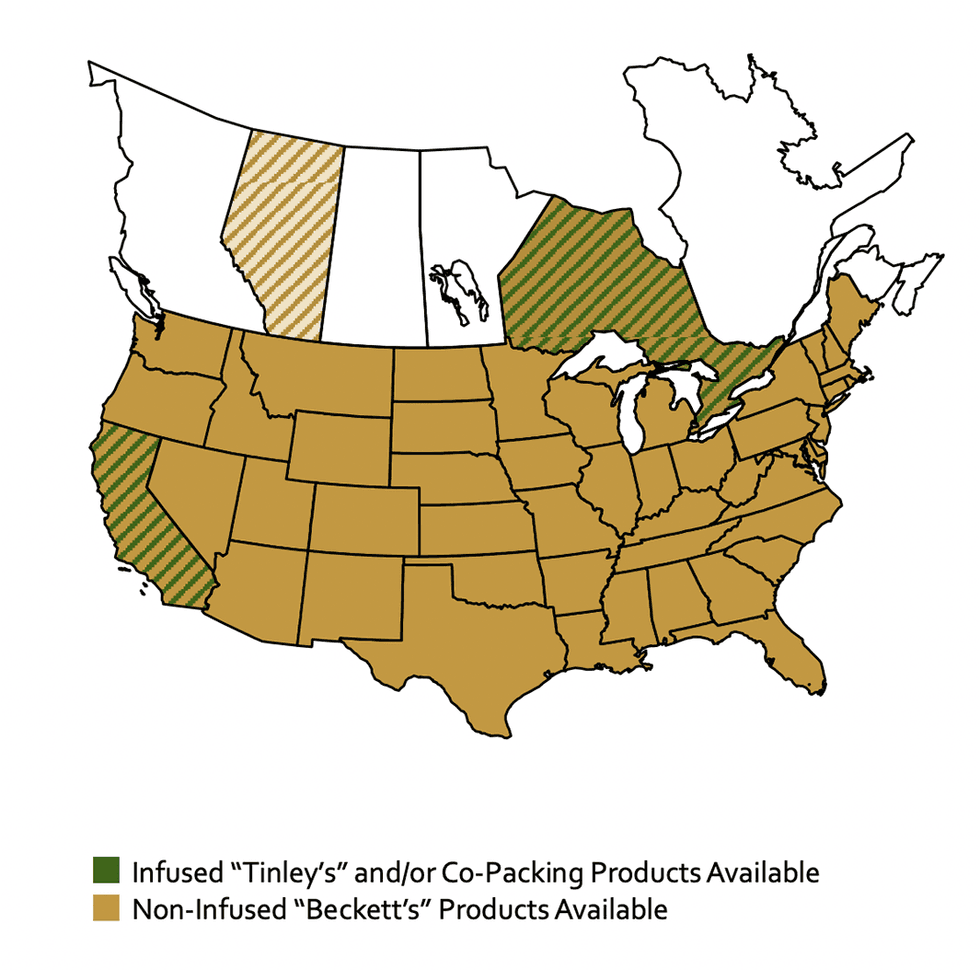

The company continues to sell its own Tinley’s-branded products, two of which won the #1 and #2 awards at California’s Emerald Cup, the largest cannabis competition in the world. The Tinley’s line-up was crafted by alcohol formulators using non-alcoholic botanicals, flavors and spices that are found in the country’s leading spirits. Tinleys '27 TM Smooth Coconut, the Canadian version of California's Emerald Cup-award winning Tinley's TM '27 Coconut Cask, were delivered to the Ontario Cannabis Store warehouse mid-March 2022 and was made available for Ontario dispensaries in April 2022.

Tinley’s represents the best vehicle for investing in this trend. Why? Because it offers investors perhaps the highest margin function in the cannabis beverage industry, and does so for a highly diversified portfolio of drinks. In fact it probably offers investors exposure to the largest portfolio of beverages of any cannabis beverage company on the planet, given it derives economics from its own drinks plus those of its countless co-packing clients. Plus it’s a pure-play – Tinley’s isn’t affected by margins or industry changes in cultivation, retail, extraction, vapes, edibles or topicals.

At barely a $20 million market cap, there is plenty of room to participate in upside as the cannabis category – and Tinley’s portion of it – continues to grow. The time is now as more and more co-packing clients sign up and the company is beginning to report growing revenue and margins. Plus, potentially there are some new directions for growth given the company, for the first-time, added references to mergers and acquisitions, business development and expansion to other states in its recent materials.

In June 2022, Tinley’s announced a US$3.5 million strategic investment by Blaze Life Holdings, LLC (BLH). Founded by brewing industry veterans and cannabis visionaries Scott Kim and Paul Burgis, BLH group is a vertically integrated cannabis business that parallels the operations of the craft breweries and brew pubs.. Tinley’s and BLH have entered into a management services agreement to improve efficiency and reduce costs through synergies, and accelerate revenue growth and profitability.

Company Highlights

- The Tinley Beverage Company is a pure-play cannabis beverage company that manufactures a significant portion of California’s cannabis beverage brands.

- The company operates California’s largest co-packing facility for cannabis-infused beverages, with three production lines, each with capacity to produce 7 to 12 million units per year.

- The Tinley Beverage Company also sells its own Emerald Cup award-winning line of cannabis beverages in cannabis dispensaries and via home delivery services throughout California.

- The company offers non-infused versions of its cocktail-inspired beverages through mainstream retail for the “sober curious” consumers. This includes grocery and restaurant chains and e-commerce channels.

- The company’s management team incorporates executives with unparalleled experience and expertise in the cannabis, regulated CPG and beverage sectors.

- In June 2022, Tinley’s received a US$3.5 million strategic investment from Blaze Life Holdings.

Get access to more exclusive Cannabis Investing Stock profiles here