- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

Overview

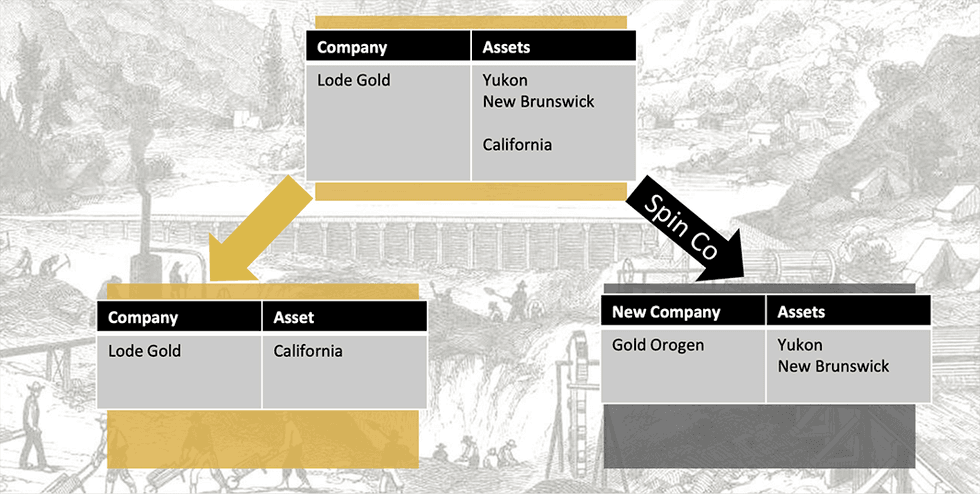

To unlock value for shareholders, Lode Gold (TSXV:LOD) is immediately spinning out its Canadian assets into a new company, Gold Orogen. Shareholders approved this transaction at the Annual General Meeting (AGM) on March 10, 2025. Upon approval by the Exchange, a Record Date will be set. After 10 days to complete court filings, the companies will trade as two separate entities. Each Lode Gold shareholder as of the Record Date will receive shares of Gold Orogen through a tax-efficient spin-out.

The new spin-off company, Gold Orogen, is funded with $3 million (raised in October 2024). Lode Gold is raising an additional $1.5 million, ensuring that both of the assets in Yukon and New Brunswick will be drilled in the upcoming 2025 exploration season.

Get access to more exclusive Gold Investing Stock profiles here