Investor Insight

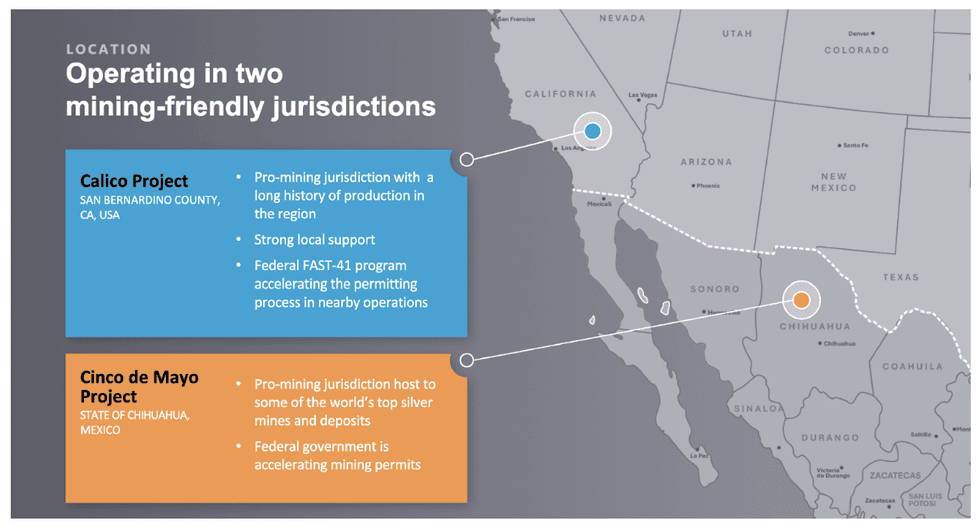

Apollo Silver is advancing two high-impact silver projects in premier North American jurisdictions—California and Chihuahua—offering investors a unique combination of scale, optionality, and leverage to silver and critical mineral demand.

Overview

Apollo Silver (TSXV:APGO,OTCQB:APGOF,FSE: 6ZF0) is a silver-focused company advancing a dual-asset strategy centered on two high-impact projects in North America: the Calico silver project in California, USA and the Cinco de Mayo project in Chihuahua, Mexico. Both are located in mining-friendly jurisdictions with strong infrastructure and significant historical work.

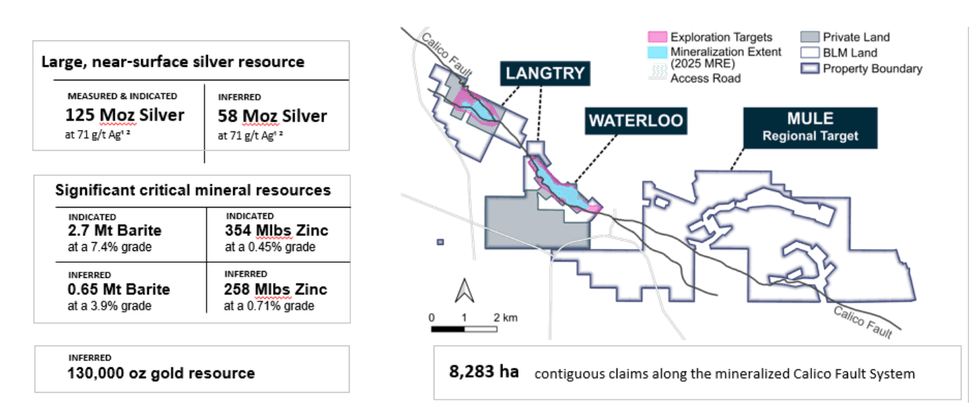

At Calico, Apollo Silver is advancing the Waterloo deposit toward development through geological modeling, barite resource definition, and engineering studies. Calico boasts 125 Moz of silver (measured and indicated) and 58 Moz of silver (inferred), and recent test work has produced a 94.6 percent barite concentrate, supporting the asset’s potential as a US critical minerals supplier.

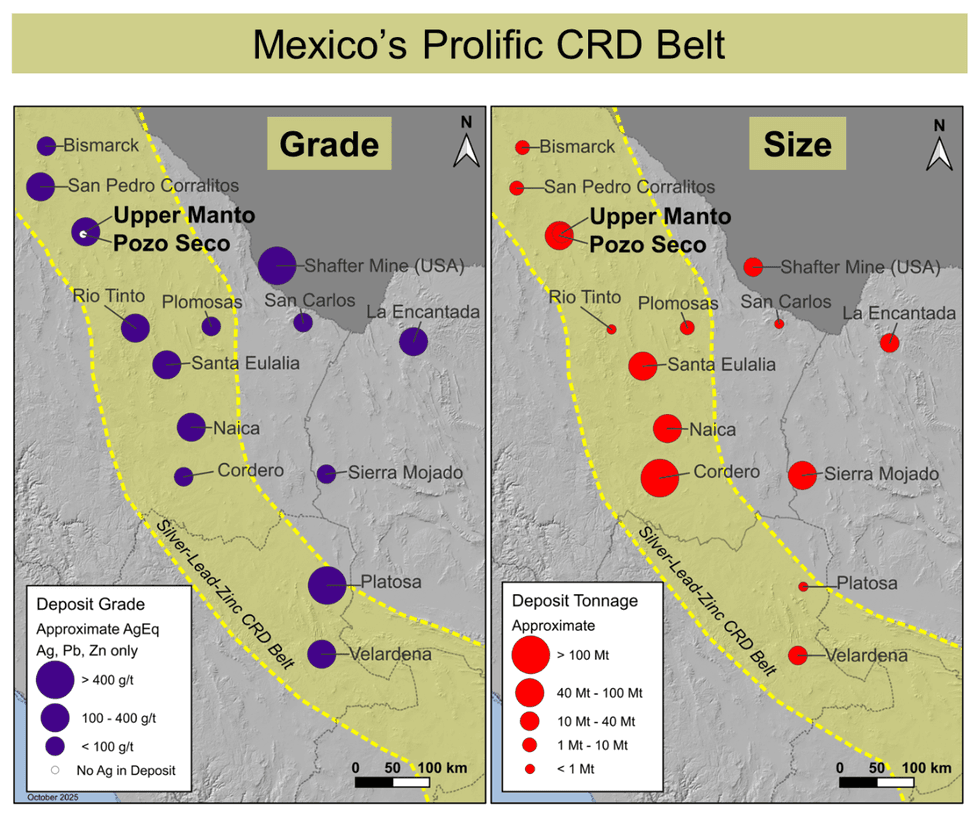

In Mexico, Cinco de Mayo offers rare optionality with a historical inferred resource of 154 Moz silver equivalent (385 g/t), and a potentially game-changing discovery at the Pegaso Zone. The project is under an option agreement between Apollo Silver and Pan American (previously MAG Silver), wherein Apollo Silver will complete a 20,000-meter drill program to convert the option to an acquisition of the Cinco de Mayo. Apollo Silver’s strategy is underpinned by disciplined capital allocation, high-impact exploration, and a proven ability to acquire and unlock value from high-quality assets—following a model similar to Prime Mining. With no debt, strong institutional backing, and an experienced team, Apollo Silver is well-positioned to deliver scalable, discovery-driven growth in a rising silver and

critical minerals market.

Company Highlights

- Tier-1 US Silver Asset – Calico Project: Hosts 125 Moz silver (Measured and Indicated) and 58 Moz silver (inferred), making it the largest undeveloped primary silver deposit in the US.

- Barite & Zinc Critical Minerals Exposure: Calico includes an Indicated resource estimate of 2.7 Mt of barite and 354M lbs of zinc and an Inferred resource estimate of 0.65Mt of barite and 258M lbs of zinc.

- High-grade Discovery Potential – Cinco de Mayo: An option to acquire a district-scale carbonate replacement deposit with a historical inferred resource of 154 Moz silver equivalent at 385 g/t, offering further upside from the Pegaso Zone discovery target.

- Strategic Shareholder Registry: Backed by Jupiter Asset Management, Eric Sprott, Terra Capital, Commodity Capital and Ninepoint.

- Experienced Leadership Team: Proven M&A, discovery and capital markets expertise with over $5 billion in past transactions and most applicable to Apollo Silver, the success at Prime Mining.

Key Projects

Calico Project

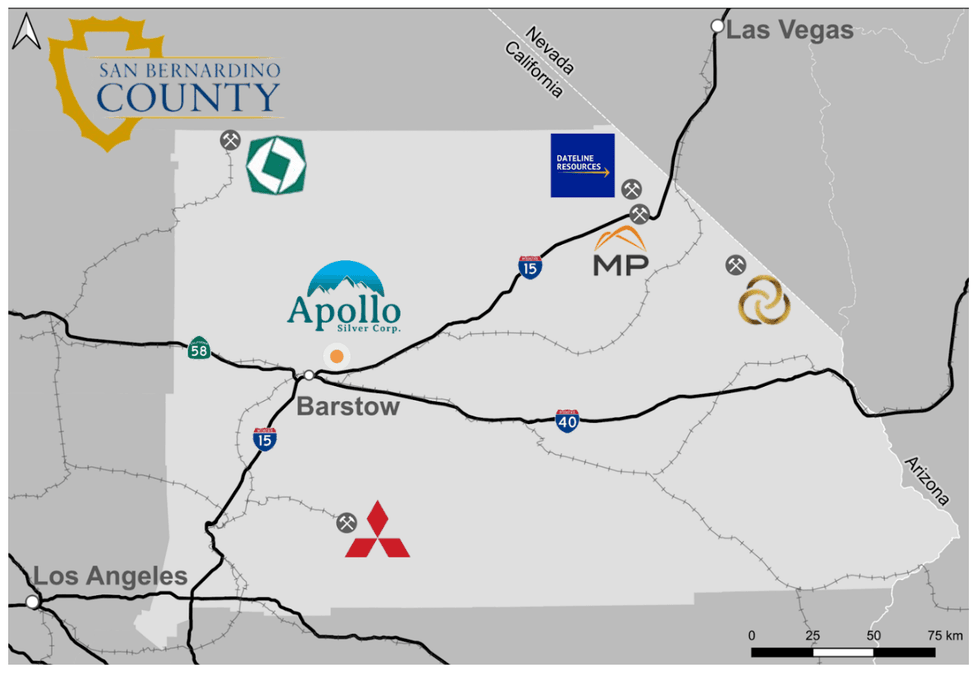

The Calico silver project comprises three adjacent properties—Waterloo, Langtry and Mule—located in mining-friendly San Bernardino County, 15 km from Barstow, California. Resources at Calico sit primarily on private land with vested mining rights, simplifying the path to permitting. Infrastructure is excellent: paved roads, power lines within 5 km, and proximity to the expanding Barstow rail terminal.

Using a 47 g/t silver equivalent cut-off grade, the Waterloo Deposit includes 125 M oz of silver in in 55Mt at an average grade of 71 g/t silver in the Measured and Indicated categories, and 0.51 Moz silver in 0.6 Mt at an average of 26 g/t silver in the Inferred category. The Langtry Deposit now contains 57 Moz silver in 24 Mt at an average grade of 73 g/t in the Inferred category, using a 43 g/t silver cut-off grade. The deposits are approximately 2 km apart, shallow, laterally extensive, and exhibit excellent geologic continuity. The mining concept would be a potential open-pit operation, with a minimal environmental footprint and where Waterloo would have a low strip ratio of 0.8:1.

Apollo Silver recently added critical mineral resources for both barite & zinc at the Calico project. Barite has shown recoveries above 94.6 percent in earlier test work. Waterloo includes an Indicated resource estimate of 2.7 Mt of barite and 354M lbs of zinc at an average grade of 7.4 percent barite and 0.45 percent zinc at a cut-off grade of 47 g/t silver equivalent. It also contains Inferred resource estimate of 0.65Mt of barite and 258M lbs of zinc, at an average grade of 3.9 percent barite and 0.71 percent zinc at a cut-off grade of 47 g/t silver equivalent.

The company has recently acquired 2,215 hectares of highly prospective claims contiguous to its Waterloo property at the Calico silver project referred to as the Mule claims comprising 418 lode mining claims. The Mule claims expand the Calico Project land package by over 285 percent, from 1,194 ha to 3,409 ha of contiguous claims.

Having recently announced its mineral resource estimate, ongoing 2025-26 programs are contemplated to include exploration for additional gold mineralization, with a subsequent targeted drill program contingent on positive early results, and metallurgical and geotechnical work program on Waterloo.

Cinco de Mayo Project

Cinco de Mayo is a district-scale carbonate replacement deposit (CRD) system located in Chihuahua, Mexico along the same NW-SE structural trend that hosts some of the country’s largest silver and base metal deposits. The project was historically MAG Silver’s flagship asset, hosting a 2012 historical mineral resource estimate prepared by RPA. At an NSR cut-off of US$100/t, the Inferred resources were estimated to total 12.45 Mt at 132 g/t silver, 0.24 g/t gold, 2.86 percent lead, and 6.47 percent zinc. The total contained metals in the resource were 52.7 Moz of silver, 785 Mlbs of lead, 1,777 Mlbs of zinc, and 96,000 ounces of gold. Notably, a significant mineralized intercept—including 61 meters of massive sulphides—was drilled by MAG Silver in the Pegaso Zone beneath the known resource but never followed up due to social access issues.

The site also includes the Pozo Seco deposit, which hosts an additional historical resource consisting of 29.1 Mt grading 0.147 percent molybdenum and 0.25 g/t gold, containing 94.0 Mlbs of molybdenum and 230,000 oz of gold, in the Indicated resource category. An Inferred Mineral Resources were estimated at 23.4 Mt grading 0.103 percent molybdenum and 0.17 g/t gold, containing 53.2 Mlbs of molybdenum and 129,000 oz of gold. Cut-off grade used in the 2010 technical report was 0.022 percent molybdenum.

Apollo Silver has secured an option to acquire the Cinco de Mayo property from Pan American (previously Mag Silver) and is re-engaging with the local community to secure surface access. A new, development-friendly ejido administration, elected in December 2024, has created an opportunity to negotiate a mutually beneficial agreement for access rights. Once secured, Apollo plans to launch a 20,000-meter drill campaign, with priority targets at Pegaso and expansion zones at Jose Manto.

Under the option agreement with Pan American, Apollo must secure surface access, complete the 20,000 meters of drilling, and issue 19.99 percent of its common shares to finalize the acquisition. The company is also evaluating metallurgical studies and engineering reviews to support a future resource update.

Management Team

Andrew Bowering – Chairman of the Board

A venture capitalist with over 30 years of operational experience, Andrew Bowering has raised over $500 million in value and capital for companies within the natural resources industry. He is the founder of Millennial Lithium and American Lithium, and he is a director and executive advisor to Prime Mining.

Ross McElroy – President and CEO

Ross McElroy is a professional geologist with over 38 years of experience in the mining industry, spanning operational and corporate roles with major, mid-tier, and junior companies worldwide. He played a pivotal role in the discoveries of several world-class uranium and gold deposits, many of which have advanced through development into mining operations. Most recently he was the CEO of Fission Uranium Corp, where he oversaw the sale of Fission for more than $1.14B to Paladin Energy.

Chris Cairns – Chief Financial Officer

Chris Cairns is a CPA, CA and brings more than 13 years of experience working in the finance and mining industries. He obtained his designation while at PwC, working with numerous Canadian and US-listed mining and exploration companies operating in North America, South America and Mongolia, before leaving to serve in roles as controller and CFO of two publicly listed mining exploration companies listed in Canada and the United States.

Rona Sellers – VP Commercial and Compliance and Corporate Secretary

Rona Sellers is an experienced governance professional with more than 13 years of experience in corporate and securities law. Previously, she was VP compliance and corporate secretary at Maple Gold Mines, and previous to that she held corporate secretarial roles at publicly traded companies listed in Canada and the United States.

Isabelle Lépine – Director, Mineral Resources

With over 25 years experience leading resource focused technical programs and teams, Isabelle Lépine brings extensive knowledge in mineral resource management to Apollo. Her significant experience ranges across the advanced stages of the resource development cycle through to mining. Most recently, she was director of mineral resources at Stornoway Diamonds.