Investor Insight

Metal Bank Limited (MBK) offers a compelling investment opportunity driven by its copper-focused growth strategy, targeting high-demand projects across the Middle Eastern region.

Overview

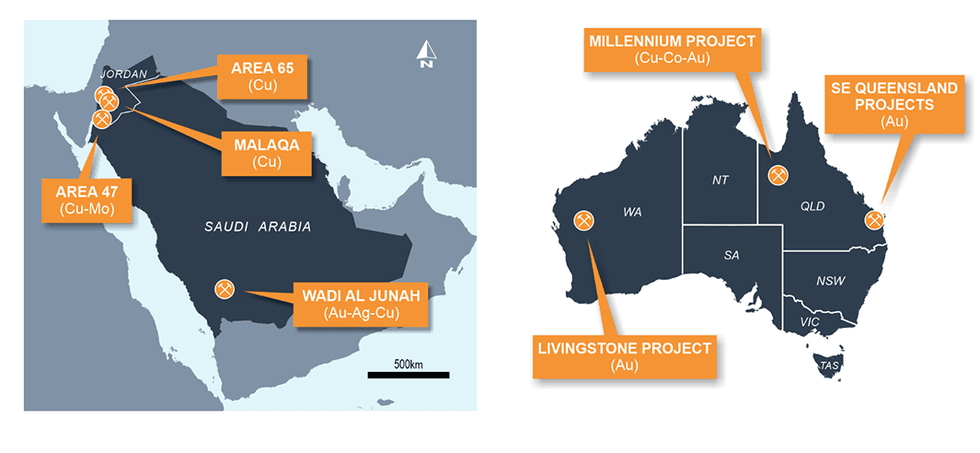

Metal Bank (ASX:MBK) is a growth-focused explorer engaged in copper and gold exploration and development across Australia, Saudi Arabia and Jordan.

The company’s near-term focus is on optimizing and divesting the Livingstone gold project to generate capital for expanding its copper projects in the Middle East. Metal Bank's strong regional presence, particularly in Saudi Arabia and Jordan, is underpinned by deep industry relationships and extensive operating experience.

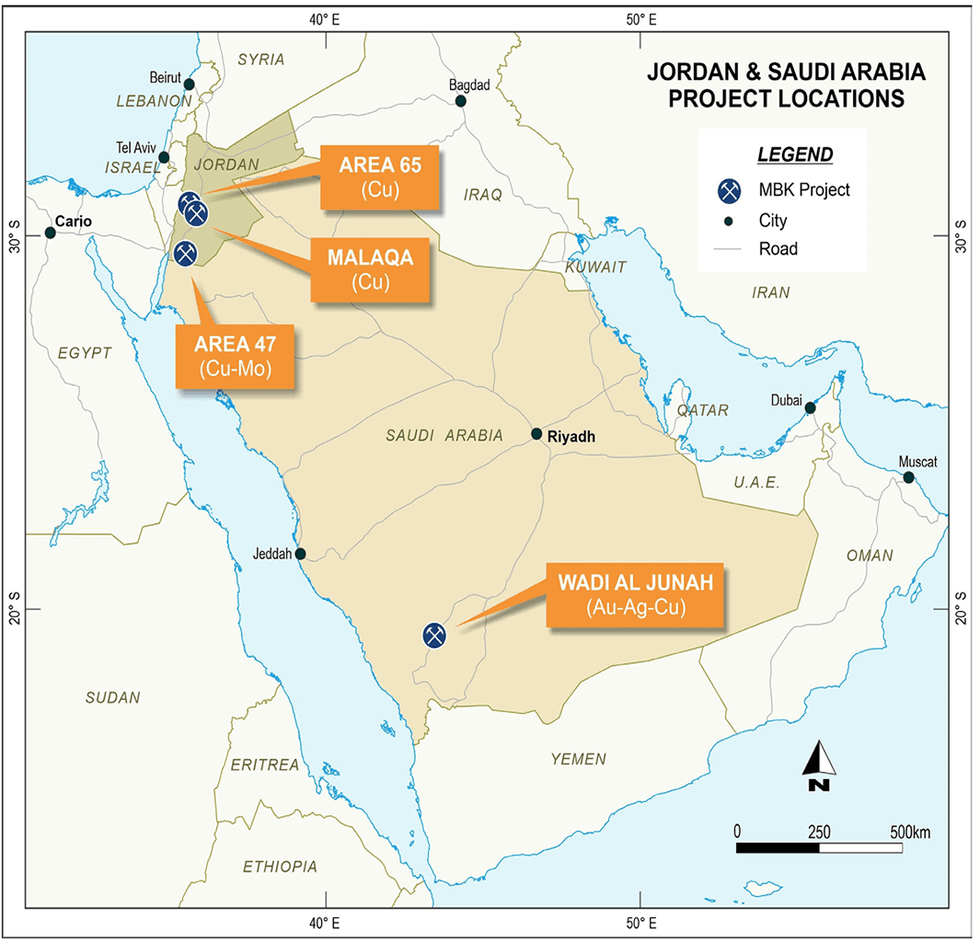

In the near term, MBK is executing its Middle East and North African (MENA) strategy focused on Saudi Arabia and Jordan. The strategy includes securing copper and other critical minerals projects in Saudi Arabia, through its joint venture company, Consolidated Mining Company (CMC). CMC is 60 percent owned by MBK and 40 percent by Central Mining Holding Company. Its first project, Wadi Al Junah, has been awarded exploration licences in November 2024. MBK has also identified several new areas of interest and exploration licence applications have already been submitted. MBK is also in discussions with third parties holding exploration licences for potential cooperation/joint ventures.

In Jordan, key agreements have been secured for copper exploration within historic mining areas. The three copper project areas granted in Jordan are Malaqa, Area 47 and Area 65. Two of these projects are in areas with historic mining activities, while the third is highly prospective for large-scale copper under cover.

The leadership team brings a proven track record of exploration success and project execution, positioning the company for long-term value creation in the critical minerals market.

Company Highlights

- Strategically focused on copper exploration and development, leveraging extensive experience and partnerships in the MENA region. Aiming for long-term growth from copper assets.

- Focused on the Livingstone gold project divestment, with ongoing JORC resource optimization, and strong corporate acquisition interest. If divested, proceeds are earmarked to fast-track exploration on the company’s copper projects.

- Expanding in Saudi Arabia by progressing the Wadi Al Junah copper project through a joint venture with Central Mining Holding Company.

- Disciplined capital allocation approach focused on low overheads and in-ground exploration investment.

- The company’s leadership team brings a proven track record in Saudi Arabia and Australia of exploration success and project execution, positioning the company for long-term value creation in the critical minerals market.

Key Projects

Livingstone Gold Project (Western Australia)

Multiple prospects at Livingstone gold project

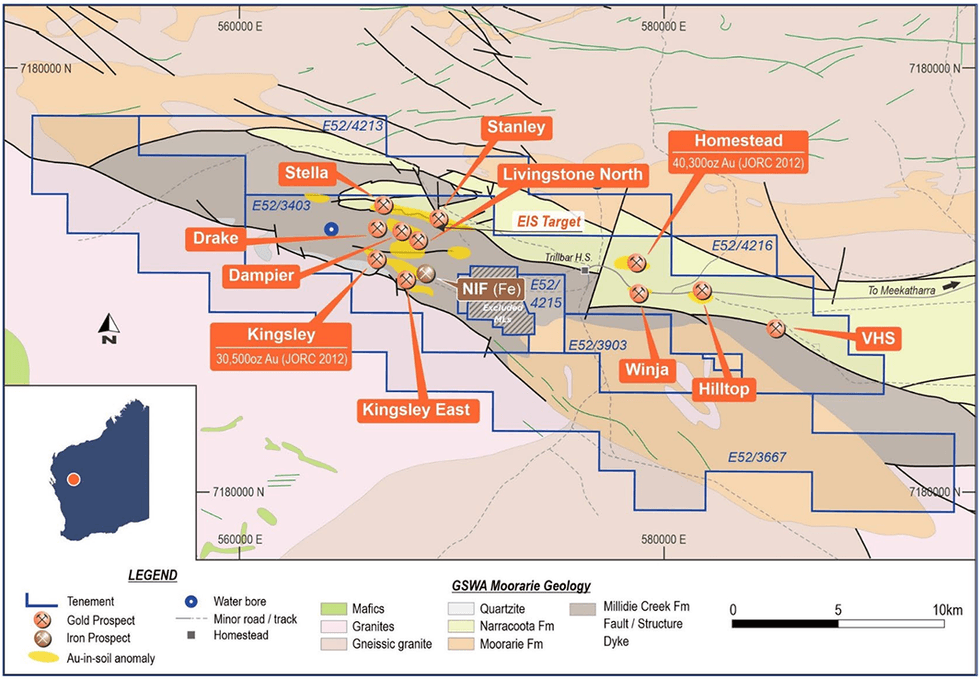

The Livingstone gold project is an advanced gold exploration project located 140 km northwest of Meekatharra in Western Australia. The project spans 395 sq km within the Bryah-Padbury Basin. The project hosts a JORC 2012 resource of 40,300 oz gold (Homestead) and 30,500 oz gold (Kingsley). Exploration efforts include geophysical mapping, RC drilling, and over 40 km of strike target assessments. The company is updating resource models and conducting pit optimization. Strong corporate interest has led to discussions to expedite divestment, with proceeds to fund MENA operations.

The project has multiple advanced gold targets, inadequately tested to date, including Hilltop, Stanley, Winja, Winja West, VHF and Kirba, Additionally, independent experts have identified more than 10 regional greenfields targets with 40km prospective strike length.

Wadi Al Junah Project (Saudi Arabia)

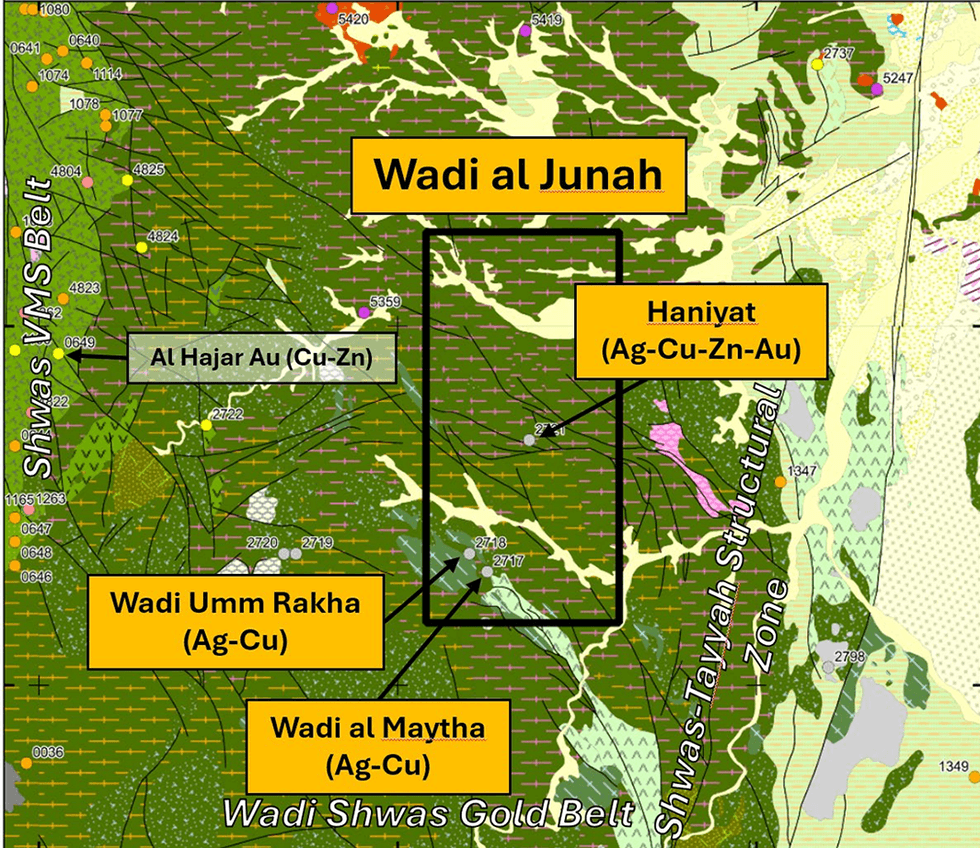

A 427 sq km VMS copper-zinc-gold-silver project, Wadi Al Junah is a joint venture through Consolidated Mining Company (CMC, MBK 60 percent). Exploration activities include regional geochemical surveys, surface mapping, and shear-zone anomaly identification. Phase 1 drilling is planned for Q2 2025.

The Wadi Al Junah project is 35 km east of the Al Hajar gold-silver (copper-zinc) deposit that was previously mined by Saudi’s state-owned mining company, Ma’aden, and is close to the major regional centre and airport of Bisha. The project has received very limited rock chip sampling as part of regional scale mapping work in the 1960s and 1970s. with results of up to 1.53 percent copper, 0.44 grams per ton (g/t) gold and 160 g/t silver. MBK aims to define drill targets in preparation for initial drill programs.

Metal Bank is leveraging its extensive history in Saudi Arabia, and pursuing additional tenement applications and joint venture partnerships. The country has enacted a new mining code in 2021, establishing mining-friendly regulations and a system of refunding exploration expenditure for approved projects.

Jordan Copper Projects – Malaqa, Area 47 and Area 65

This three-project portfolio is aimed at large-scale copper exploration. The Malaqa project has shown copper mineralization over an 800-meter strike through chip and channel sampling. Area 47 features a 4 sq km geochemical anomaly indicative of porphyry-style mineralization, while Area 65 is a bulk-tonnage copper-oxide target. Metal Bank is planning a drilling campaign during 2025 and also assessing local joint venture opportunities to progress these three projects.

Millennium Project (Queensland)

Rock sample from the Millennium project

This cobalt-copper-gold project holds a JORC 2012 Inferred Resource of 8.4 Mt at 0.09 percent cobalt, 0.29 percent copper, and 0.12 g/t gold. Recent reanalysis of historic cores revealed high-grade graphite intersections (e.g. 56 m at 18.29 percent graphite). Located on granted mining leases, the project offers polymetallic potential. Metal Bank is planning further metallurgical testing and drilling to expand both the copper and graphite resource base.

Management Team

Inés Scotland – Executive Chair

Inés Scotland has over 20 years of experience in the mining industry, having worked with major gold and copper companies across Australia, Papua New Guinea, the USA, and the Middle East. Her career includes roles with Rio Tinto companies such as Comalco, Lihir, and Kennecott Utah Copper. Notably, she was the managing director and CEO of Citadel Resource Group Limited, where she led the development of the Jabal Sayid Copper Project in Saudi Arabia. Under her leadership, Citadel grew to a market capitalization of $1.3 billion before its acquisition by Equinox Minerals in January 2011. She also served as the managing director and CEO of Ivanhoe Australia, an ASX-listed company with a market capitalization of $500 million. Scotland was appointed as chair of Metal Bank Limited on August 13, 2013.

Guy Robertson – Executive Director

Guy Robertson brings over 30 years of experience as a chief financial officer, company secretary, and director for both public and private companies in Australia and Hong Kong. His previous roles include serving as chief financial officer and general manager of finance for organizations such as Jardine Lloyd Thompson, Colliers International, and Franklins. He has over a decade of experience with ASX-listed mineral exploration companies and currently holds directorships with Hastings Technology Metals, GreenTech Metals, Artemis Resources, and Alien Metals. Robertson was appointed as an executive director of Metal Bank on September 17, 2012.

Sue-Ann Higgins – Company Secretary and Executive Director

Sue-Ann Higgins is an experienced company executive with over 25 years in the mining industry. She has held senior legal and commercial roles with companies including ARCO Coal Australia, WMC Resources, Oxiana, and Citadel Resource Group. Her expertise encompasses governance and compliance, mergers and acquisitions, equity capital markets, and mineral exploration, development, and operations. Higgins was appointed as company secretary on August 21, 2013, and became an executive director on February 24, 2020.