Silver47 Exploration Corp. (TSXV: AGA,OTC:AAGAF) (OTCQB: AAGAF) ("Silver47" or the "Company") is pleased to announce the 2025 exploration program is nearing completion at its wholly-owned Adams Plateau Project (the "Project") in southern British Columbia, a silver-zinc-copper-gold-lead SEDEX project.

Gary Thompson, CEO of Silver47, stated: "We are glad to continue our work on Adams Plateau toward defining drill targets on this road-accessible project. The abundance of surface mineralization on the Project is very encouraging for the potential of new and exciting discoveries. The Company has received a 5-year permit for drilling. This year is shaping up to be transformational for the Company with a full season of drilling at the flagship Red Mountain Project and the pending merger with Summa Silver."

Key Highlights:

- Extensive coverage: 5,008 soil samples were collected over an approximately 35 square kilometer ("km") area with a focus on infilling the historical soil geochemical grid. An additional 76 rock samples have been collected with on-going prospecting to support future drill targets.

- Approach to discovery: soil geochemistry, in conjunction with follow up rock sample prospecting, represents an important step in target development and maximizes discovery efficiency.

- Significantly underexplored: very limited drilling has occurred outside historic production sites on the project.

- Work just beginning: the completion of this prospecting and soil geochemical survey serves as an initial step toward pinpointing targets and unlocking a multi-km search space.

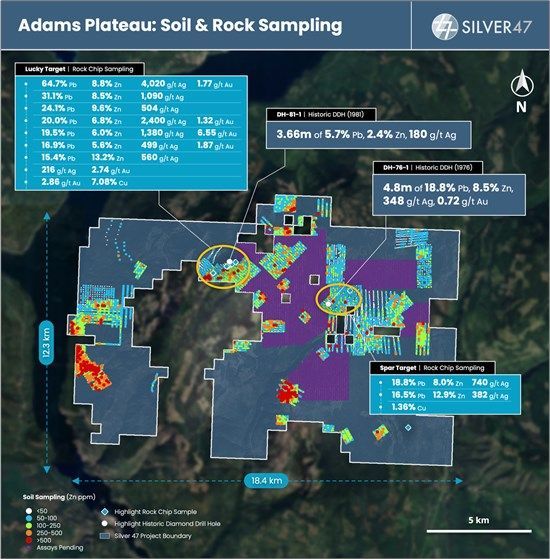

Adams Plateau Historic Drilling Highlights:

- A 1976 drill hole (DH 76-1) returned 4.8 metres ("m") of 348 grams per tonne ("g/t") silver, 0.72 g/t gold, 8.5% zinc, and 18.8% lead from the Spar Target. (BC Assessment Report 6645, 1977, Diamond Drilling Report on the Spar Group 1 - https://apps.nrs.gov.bc.ca/pub/aris/Detail/6645)

- A 1981 drill hole (DH81-1) returned 3.66 m of 180 g/t silver, 2.4% zinc, and 5.7% lead from the Lucky Target. (BC Assessment Report 11521, 1983, Geology of the Adams Plateau Property, Kamloops Mining Division - https://apps.nrs.gov.bc.ca/pub/aris/Detail/11521)

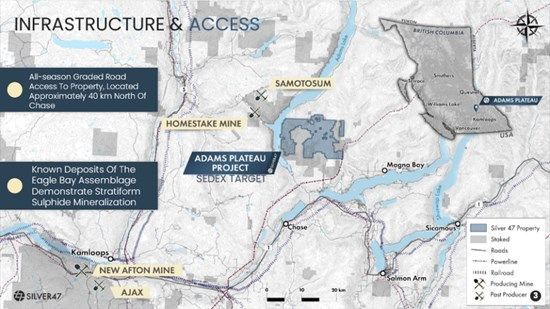

Figure 1. Location Map of the Adams Plateau Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/258342_c58951fbd4a219ec_002full.jpg

Historic surface rock grab samples (separate samples) from across the property returned up to 4000 g/t silver, 10.4 g/t gold, 7% copper, 30% zinc, and 64% lead. Recent rock samples collected by Silver47 have returned up to:

- 3503 g/t silver, 1.0 g/t gold, 9.17% zinc, and >20% lead

- 170 g/t silver, 2.8 g/t gold, 7.1% copper, 1.05% zinc, and 0.86% lead*

- 2,400 g/t silver, 1.3 g/t gold, 6.8% zinc, and 20% lead*

*(BC Assessment Report 40920, 2022, 2022 Assessment Report on the Adams Plateau - https://apps.nrs.gov.bc.ca/pub/aris/Detail/40920)

Figure 2. Plan Map of the Adams Plateau Project with Zinc in soil and select rock analysis.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/258342_c58951fbd4a219ec_003full.jpg

Despite the long history of exploration on the plateau, historical geochemical data has been limited to small grids focused around known mineralization. Since acquiring the property in 2022, Silver47 has worked towards building a soil geochemical database which covers the entirety of the prospective Eagle Bay Assemblage. The 2025 soil grid ties together multiple historic grids with anomalous concentrations of silver, zinc and copper, and will provide near-total coverage over the high-priority zones of the central and eastern portions of the property.

Concurrent with the soil sample program, follow-up prospecting of previous high-grade soil and rock anomalies is taking place across the property. Recent forest fire activity and extensive logging operations have provided additional road access and the potential for new mineralization exposure along road cuts in previously under-explored areas.

The results of the 2025 sampling program, along with the extensive historic database will be used to refine drill targets, particularly in areas with limited bedrock exposure. With the recently granted 5-year multi-year area-based ("MYAB") permit, the company will be poised to begin drill testing for high-grade sulfide mineralization at historic and new, un-drilled targets along the extent of the Eagle Bay assemblage.

Exploration for silver-lead-zinc mineralization at Adams Plateau has taken place from 1925 to the present day with 137 assessment reports dating back to 1949 that suggest a large mineralized system indicating significant potential for discoveries. This is the first time the mineral claims in the area have been consolidated under one banner. The property hosts over 25 MINFILE occurrences, including limited historical, small-scale production at Beca (1926), Lucky (1956 and 1975-1977) and Spar (1985). Mineralization is typical of SEDEX and VMS type deposits, comprised of semi-massive to massive sulphide layers with pyrrhotite-tetrahedrite-sphalerite-galena-pyrite and localized chalcopyrite

Historical sampling over the claim group includes 7,021 soil samples, 115 rock samples and 79 silt samples. Recent work in 2022-2024 included the collection of 2,547 soil samples and 140 rock samples. Property-wide LiDAR and orthophotos have been completed to refine exploration targets. Limited historical drilling has occurred on the project outside the historic production sites.

Figure 3. Select rock grab samples photographs from the Adams Plateau Project 2025.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/258342_c58951fbd4a219ec_004full.jpg

Note: EX-1 is also referred to as SPAR

Data Verification

Historic data disclosed in this news release relating to past production and drilling is historic in nature and sourced from documents filed with the British Columbia Assessment Report Database (ARIS - https://apps.nrs.gov.bc.ca/pub/aris), or the British Columbia MINFILE Mineral Inventory (https://minfile.gov.bc.ca/). Historic production records for the Property are incomplete and of unknown accuracy. The Company is unable to verify the historic drilling data as drill hole rock samples are unavailable, precise collar locations cannot be field-located, and down-hole survey data is incomplete. Neither the Company, nor the qualified person can verify historic production or drill data and therefore investors should not place undue reliance on such data. The Company's future exploration work will include verification of historic data where it is possible to do so.

Adams Plateau Project Overview

The wholly-owned 150 square km Adams Plateau Project is located approximately 100 km north-east of Kamloops, British Columbia with excellent road access, power and rail nearby.

SEDEX (Sedimentary Exhalative) deposits are known for their high-grade silver, lead, zinc, copper, mineralization. Exploration is primarily focused on sediment-hosted polymetallic massive sulphides within the prolific Eagle Bay Assemblage with silver, copper, gold zinc, lead being the primary commodities of interest with other critical minerals like graphite and antimony.

The nearby past-producing Samatosum mine, located about 15 km northwest of the project, operated from 1989 to 1992. Before production commenced in June 1989, reserves for the Samatosum open-pit deposit were reported to be estimated at 634 984 tonnes grading 1035 g/t silver, 1.9 g/t gold, 1.2% copper, 1.7% lead and 3.6% zinc. https://minfile.gov.bc.ca/summary.aspx?minfilno=082M%20%20244

QAQC

Quality assurance and quality control (QAQC) protocols for rock and soil samples collected in 2022, 2024, and 2025 at the Adams Plateau project followed industry standard practice. Samples were bagged on site and delivered to ALS Minerals Laboratories in Kamloops, British Columbia. ALS Kamloops / North Vancouver is certified with ISO/IEC 17025:2017 and ISO 9001:2015 accreditation from the Standards Council of Canada. The 2022 soil sample program inserted field duplicates at a rate of one duplicate per 20 samples. The 2024 soil sample program inserted one field duplicate per collector per day. Both 2022 and 2024 soil and rock samples relied on ALS Quality control procedures during preparation and analysis. All samples were weighed, pulverized and screened. The 2022 soil samples were analyzed by ALS method ME-ICP41 and Au-AA23. The 2022 rock samples were analyzed by ALS method ME-ICP61 and Au-AA23. Rock samples exceeding limits for Ag, Pb, Zn, and Cu were analyzed by OG62. 2024 soil samples. The 2024 soil samples were analyzed by ALS method ME-ICP41 and Au-ST43, with overlimit gold samples further analyzed by Au-AROR43. The 2024 rock samples were analyzed by ALS method ME-MS61 and Au-AA23.

Qualified Person

Mr. Alex S. Wallis, P.Geo., is Vice President of Exploration for Silver47 and a "qualified person" as defined by National Instrument 43-101. Mr. Wallis has verified the data disclosed in this press release, including the sampling, analytical and test data underlying the technical information and has approved the technical information in this press release.

About Silver47 Exploration

Silver47 Exploration Corp. wholly-owns three silver and critical metals (polymetallic) exploration projects in Canada and the US. These projects include the flagship Red Mountain Project in southcentral Alaska, a silver-gold-zinc-copper-lead-antimony-gallium VMS-SEDEX project. The Red Mountain Project hosts an inferred mineral resource estimate of 15.6 million tonnes at 7% zinc equivalent or 335.7 g/t silver equivalent, totaling 168.6 million ounces of silver equivalent, as reported in the NI 43-101 Technical Report dated January 12, 2024. The Company also owns the Adams Plateau Project in southern British Columbia, a silver-zinc-copper-gold-lead SEDEX-VMS project, and the Michelle Project in the Yukon Territory, a silver-lead-zinc-gallium-antimony MVT-SEDEX project. For detailed information regarding the resource estimates, assumptions, equivalency calculations, and technical reports, please refer to the NI 43-101 Technical Report and other filings available on SEDAR+ at www.sedarplus.ca. The Company trades on the TSXV under the ticker symbol AGA and OTCQB under the ticker symbol AAGAF.

For more information about the Company, please visit www.silver47.ca and see the Technical Report filed on SEDAR+ (www.sedarplus.ca) and titled "Technical Report on the Red Mountain VMS Property Bonnifield Mining District, Alaska, USA with an effective date January 12, 2024, and prepared by APEX Geoscience Ltd."

Silver47 Contact Information

Mr. Gary R. Thompson

Director and CEO

gthompson@silver47.ca

For investor relations

Kristina Pillon

info@silver47.ca

604.908.1695

X: @Silver47co

LinkedIn: Silver47

No securities regulatory authority has either approved or disapproved of the contents of this release. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This release contains certain "forward looking statements" and certain "forward-looking information" as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as "may", "will", "expect", "intend", "estimate", "upon" "anticipate", "believe", "continue", "plans" or similar terminology. Forward-looking statements and information include, but are not limited to: closing of the Offering, including the number of Units and FT Units issued in respect thereof; anticipated use of proceeds; expected closing date of the Offering; payment of finder's fees; ability to obtain all necessary regulatory approvals; insider participation in the Offering; the statements in regards to existing and future products of the Company; and the Company's plans and strategies. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict, that may cause the Company's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the ability to close the Offering, including the time and sizing thereof, the insider participation in the Offering and receipt of required regulatory approvals; the use of proceeds not being as anticipated; the Company's ability to implement its business strategies; risks associated with general economic conditions; adverse industry events; stakeholder engagement; marketing and transportation costs; loss of markets; volatility of commodity prices; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; industry and government regulation; changes in legislation, income tax and regulatory matters; competition; currency and interest rate fluctuations; and the additional risks identified in the Company's financial statements and the accompanying management's discussion and analysis and other public disclosures recently filed under its issuer profile on SEDAR+ and other reports and filings with the TSXV and applicable Canadian securities regulators. The forward-looking information are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws.

No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/258342