October 29, 2023

SensOre Ltd (ASX: S3N) is pleased to announce that it has optioned its Leonora assets, consisting of the Christmas Well and 8 Mile Well projects, to Red Wolf Resources Pty Ltd.

Highlights

- SensOre has optioned its Leonora AI targets to Red Wolf Resources Pty Ltd (Red Wolf)

- SensOre to receive $250,000 in equity in Red Wolf on the assets becoming listed and a 1% Net Smelter Return (NSR) royalty on any gold production from the exploration licences

- The option and sale agreement is part of SensOre’s strategy to commercialise AI targets derived from SensOre’s proprietary assets

- Red Wolf has informed SensOre that it intends to combine the Christmas Well and 8 Mile Well Projects with other assets it holds in the area and explore an Initial Public Offering (IPO) in 2024

SensOre CEO, Richard Taylor, said “The option agreement provides Red Wolf with a strategic land package near the Genesis owned Gwalia operations. Our AI targeting shows there is more to be discovered in this highly prospective area. The agreement monetises SensOre’s targets following our project generator model.”

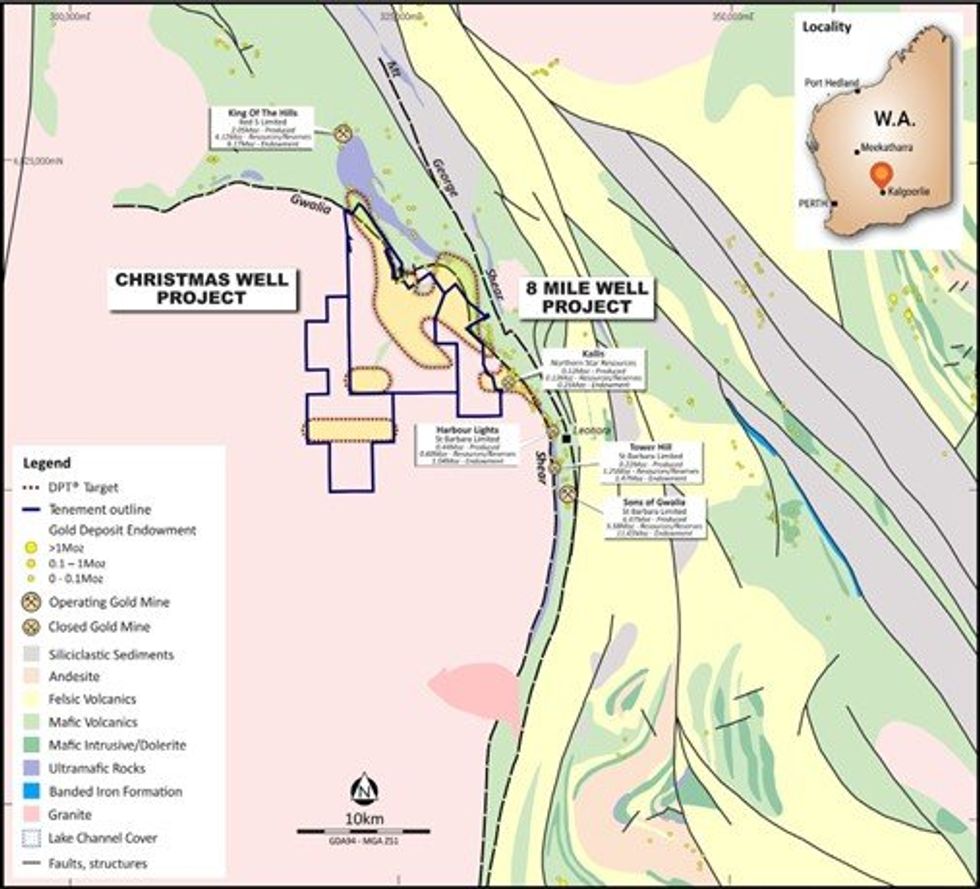

The Greater Christmas Well Project tenements are located in the Leonora district of the Boorara Domain in the Kalgoorlie Terrane, separated by the Ockerburry Fault (locally the Mt George Shear, Perseverance Fault) from the Gindalbie Domain of the Kurnalpi Terrane to the east (Figures 1 and 2).

SensOre has generated gold targets in the Yilgarn by applying its Discriminant Predictive Targeting (DPT) within its data cube to +2,500 layers of regional public data sets, including geological maps with enhanced geophysical data and existing geochemical sampling and gold deposit information. Numerous gold targets with a 400 x400m grid cell size were generated in the Yilgarn in this way and classified with an inferred grade, size, and depth, with a probability factor or chance of occurring. To date, a number of target areas have been predicted with untested, well defined mineral target system/s that could potentially deliver an economic gold deposit in the short to medium term.

The Leonora greenstone belt contains the Leonora Gold Operations from Genesis. Mining commenced in 1897 by Herbert Hoover and to date more than 6.7 Moz has been produced with additional resources at the Gwalia mine of 6.37Moz at 5.6 g/t Au (June 2021). The Leonora District contains an older 2.8Ga mafic- ultramafic sequence dominated by an early extensional fabric (Jones, AJES 2014), separated by the Gwalia Shear from the 2.75Ga Raeside granite dome on the west side and overlain by a younger 2.7Ga volcano metasedimentary sequence to the east. The early extensional foliation (2665Ma) is axial planar to the tightly folded gold lodes at Gwalia (G), Tower Hill (TH) and Harbour Lights (HL) deposits. The Tarmoola (King of the Hills) gold lodes crosscut this early foliation and therefore represent a second, later gold event. The Gwalia shear at the edge of the Raeside dome is inferred to be a primary control and fluid pathway for the gold mineralisation.

Click here for the full ASX Release

This article includes content from SensOre, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

S3N:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00